CAD Exchange Rate Fluctuations: A Comprehensive Analysis

Table of Contents

Macroeconomic Factors Influencing the CAD Exchange Rate

Several key macroeconomic indicators significantly influence the value of the Canadian dollar. These indicators provide a strong understanding of the Canadian economy's health and its impact on the CAD exchange rate. Analyzing these factors is crucial for businesses and investors seeking to understand and predict CAD fluctuations.

-

Interest Rate Differentials: The Bank of Canada's monetary policy plays a crucial role. Higher interest rates in Canada compared to other major economies (like the US or Eurozone) make CAD-denominated assets more attractive to foreign investors. This increased demand for CAD strengthens the currency. Conversely, lower interest rates can weaken the CAD as investors seek higher returns elsewhere. This impacts CAD trading significantly.

-

Inflation Rates: High inflation erodes the purchasing power of the Canadian dollar. When inflation in Canada outpaces that of other countries, the CAD tends to depreciate. Conversely, lower inflation relative to trading partners can bolster the CAD's value. Monitoring inflation is key to understanding CAD fluctuations.

-

Economic Growth: Strong economic growth, reflected in a robust Gross Domestic Product (GDP), typically strengthens the CAD. Positive economic indicators signal a healthy and attractive investment environment. Conversely, slow economic growth or recessionary fears tend to weaken the currency. This is a major driver of currency exchange rate movements for the CAD.

-

Government Debt: High levels of government debt can raise concerns about the country's long-term economic stability. This can lead to a weaker CAD as investors become less confident in the Canadian economy. Managing government debt is crucial for maintaining a strong Canadian dollar.

-

Bank of Canada Policies: The Bank of Canada's actions directly impact the CAD exchange rate. Announcements regarding interest rate changes, quantitative easing, or other monetary policy adjustments can cause significant short-term volatility in the CAD. Understanding the Bank of Canada’s stance is vital for navigating the forex market and CAD trading.

Commodity Prices and Their Impact on the CAD

Canada's economy is heavily reliant on the export of natural resources. The price of these commodities, especially oil, has a direct and significant impact on the CAD. This relationship underscores the importance of monitoring commodity prices to understand CAD fluctuations.

-

Oil Price Volatility: As a major oil producer, Canada's economy is highly sensitive to oil price fluctuations. Higher oil prices generally strengthen the CAD, while lower oil prices weaken it. This volatility directly impacts the energy sector and the overall Canadian economy. Tracking oil prices is crucial for understanding the Canadian dollar exchange rate.

-

Other Commodity Prices: While oil is dominant, other commodity prices also affect the CAD. Fluctuations in the prices of lumber, metals (potassium, nickel), and agricultural products contribute to overall CAD exchange rate volatility. This is especially important for investors in the natural resource sector.

-

Global Demand for Commodities: Global economic growth and demand for commodities directly influence the CAD. Strong global demand boosts commodity prices, strengthening the CAD. Conversely, weak global demand can lead to lower commodity prices and a weaker CAD. Understanding this global context is important for effective CAD trading.

Geopolitical Events and CAD Volatility

Global events and uncertainties significantly impact the Canadian dollar exchange rate. These external factors can introduce volatility and require careful consideration by businesses and investors.

-

Trade Wars and Protectionism: Trade disputes and protectionist policies, such as tariffs or trade restrictions, can negatively impact the Canadian economy and consequently weaken the CAD. Navigating these geopolitical risks is essential.

-

Political Instability: Political instability within Canada or in major trading partners can create uncertainty and negatively affect the CAD. Investors tend to favor stability, so political risk can lead to CAD fluctuations.

-

Global Economic Shocks: Unexpected global events, such as pandemics, natural disasters, or financial crises, can create significant volatility in the currency market, affecting the CAD along with other global currencies.

Strategies for Managing CAD Exchange Rate Risk

Businesses and investors exposed to CAD exchange rate fluctuations need effective strategies to manage this risk. Several tools and techniques can mitigate potential losses.

-

Forward Contracts: Forward contracts allow businesses to lock in a specific exchange rate for a future transaction. This eliminates the uncertainty of future CAD exchange rate movements.

-

Futures Contracts: Similar to forward contracts, futures contracts can be used to hedge against CAD exchange rate risks. They offer standardized contracts traded on exchanges.

-

Options Contracts: Options contracts provide flexibility. They allow businesses to buy the right, but not the obligation, to buy or sell CAD at a specific exchange rate within a certain timeframe. This offers protection against adverse CAD exchange rate movements without the rigidity of forward contracts.

-

Currency Hedging Strategies: A combination of the above strategies, along with other techniques, can be used to create a comprehensive currency hedging strategy tailored to specific risk profiles and business needs. This helps manage the volatility associated with the Canadian dollar exchange rate.

Conclusion

The CAD exchange rate is a complex interplay of macroeconomic, commodity-related, and geopolitical forces. Understanding these factors is crucial for informed decision-making and effective risk management. By employing suitable hedging strategies and closely monitoring market developments, businesses and investors can mitigate their exposure to CAD exchange rate fluctuations and optimize their financial outcomes. For continued analysis and in-depth insights into managing your exposure to CAD exchange rate volatility, explore our resources and contact our experts today.

Featured Posts

-

5 Key Actions To Secure A Private Credit Role

Apr 24, 2025

5 Key Actions To Secure A Private Credit Role

Apr 24, 2025 -

Legal Roadblocks Slow Trump Administrations Immigration Efforts

Apr 24, 2025

Legal Roadblocks Slow Trump Administrations Immigration Efforts

Apr 24, 2025 -

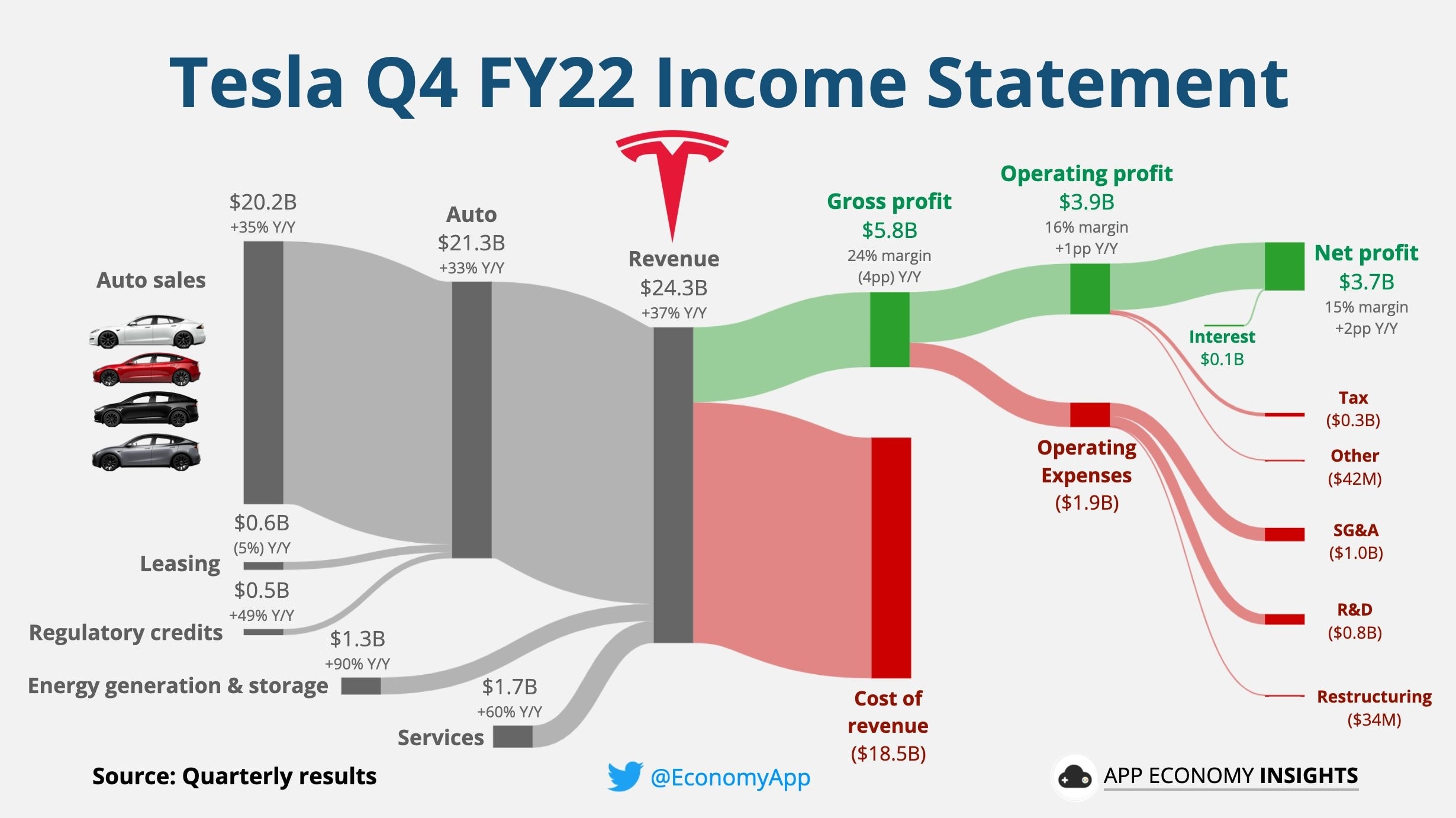

Understanding Teslas Q1 2024 Earnings 71 Net Income Decrease And Market Reaction

Apr 24, 2025

Understanding Teslas Q1 2024 Earnings 71 Net Income Decrease And Market Reaction

Apr 24, 2025 -

Increased Interest In 65 Hudsons Bay Company Leases

Apr 24, 2025

Increased Interest In 65 Hudsons Bay Company Leases

Apr 24, 2025 -

Chinese Stocks In Hong Kong Surge Trade Tension Easing Fuels Rally

Apr 24, 2025

Chinese Stocks In Hong Kong Surge Trade Tension Easing Fuels Rally

Apr 24, 2025