Understanding Tesla's Q1 2024 Earnings: 71% Net Income Decrease And Market Reaction

Table of Contents

Tesla's Q1 2024 Financial Performance: A Deep Dive

Significant Drop in Net Income

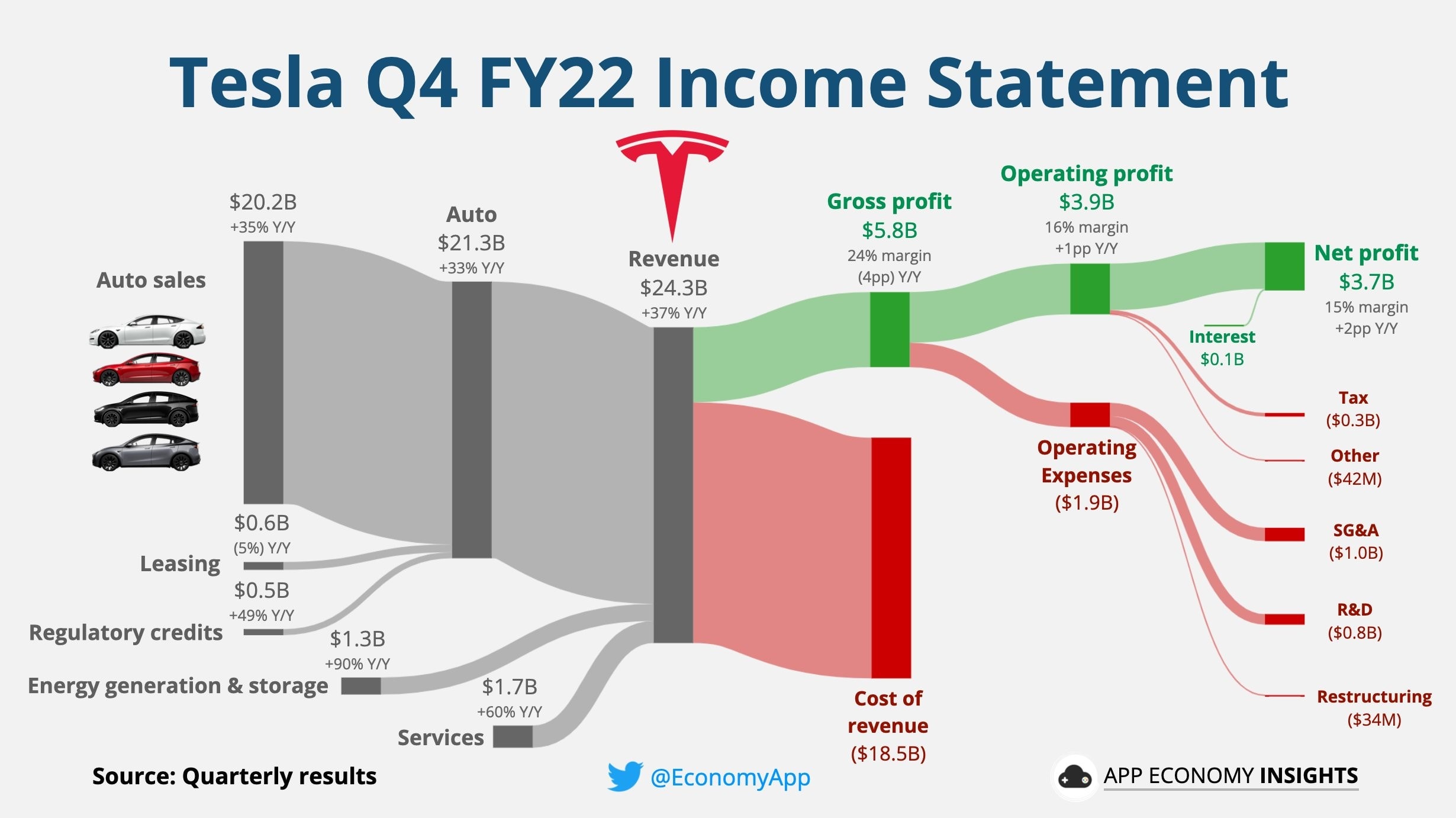

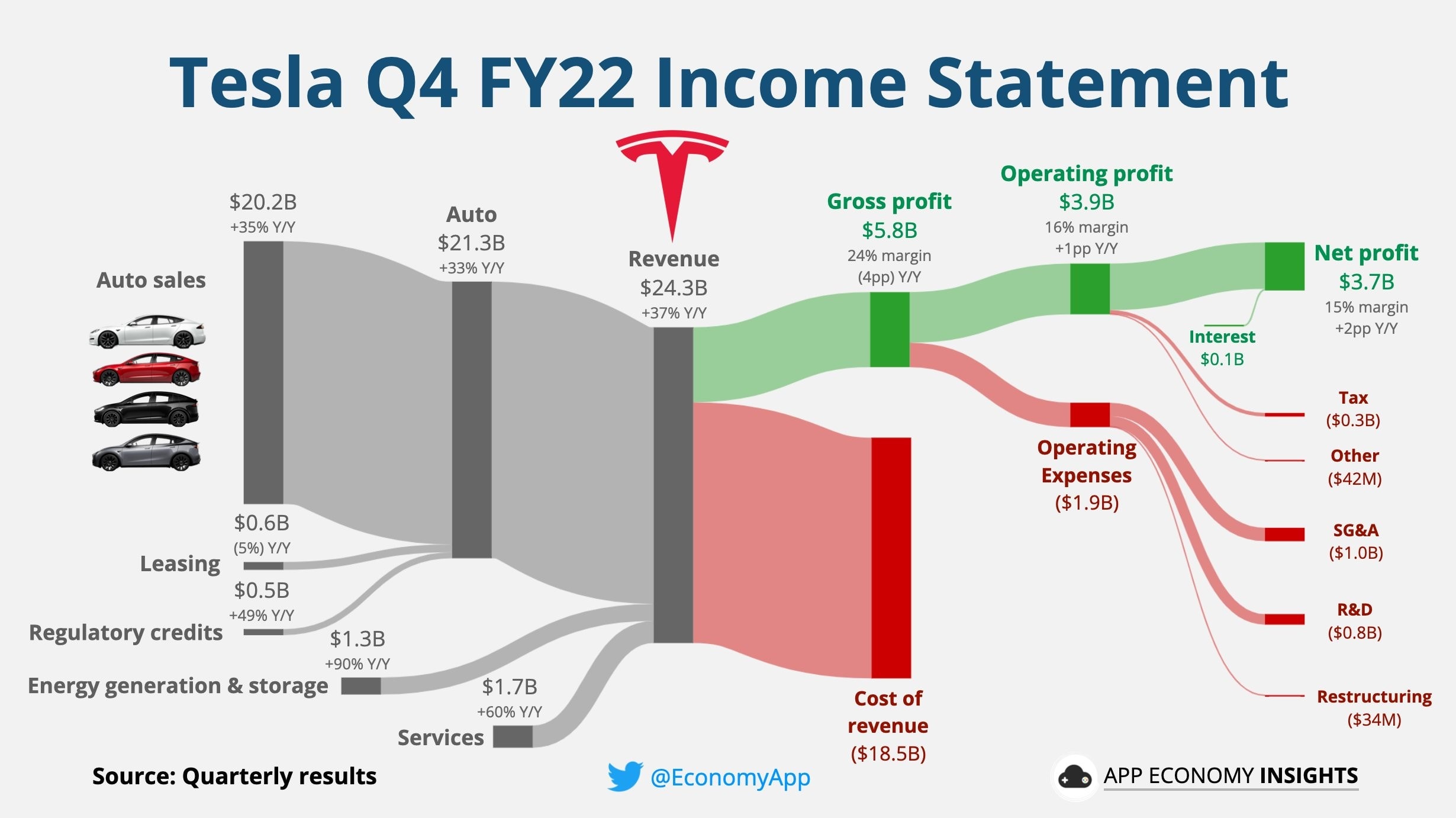

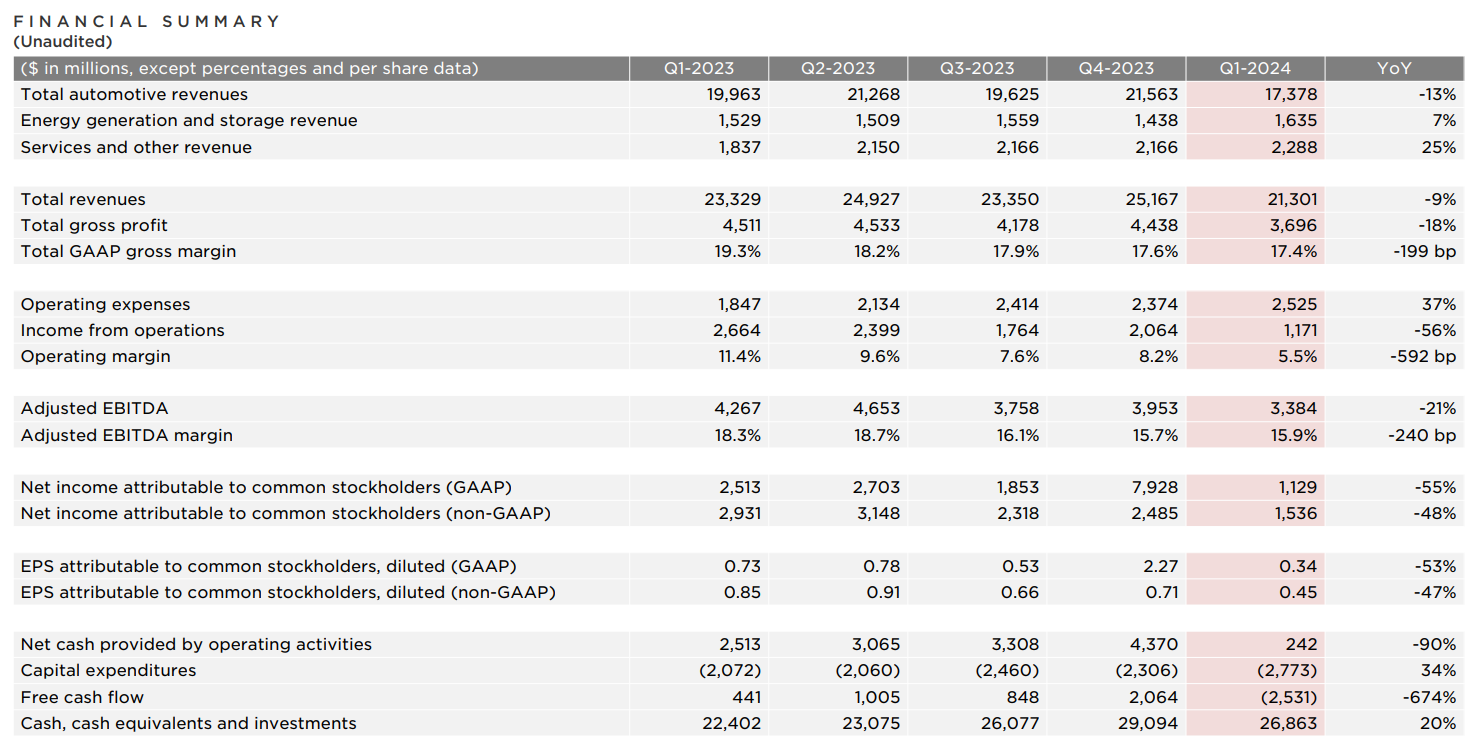

Tesla's Q1 2024 earnings report unveiled a drastic 71% decline in net income compared to the same period last year. While the exact figures will be available in the official release, the magnitude of this decrease is unprecedented for a company of Tesla's stature. This sharp reduction in profitability stands in stark contrast to previous quarters, highlighting a significant shift in the company's financial performance.

- Key Financial Metrics (Q1 2024 vs. Q1 2023): (Insert actual figures once released. Examples below)

- Revenue: (Example: $18B vs. $25B - a 28% decrease)

- Cost of Revenue: (Example: $15B vs. $18B - a 16% increase)

- Gross Margin: (Example: 15% vs. 25% - a 10% decrease)

- Operating Expenses: (Example: $3B vs. $2.5B - a 20% increase)

[Insert a chart or graph here visually illustrating the net income decline year-over-year.]

Price Reductions and Their Impact

Tesla's aggressive price reductions across its vehicle lineup played a significant role in the diminished profitability. While these cuts aimed to boost sales volume and maintain market share in the face of intensifying competition, they directly impacted the company's bottom line.

- Rationale for Price Cuts:

- Increased competition from established and emerging EV manufacturers.

- Stimulating demand in a potentially slowing market.

- Maintaining market leadership and brand dominance.

[Insert a chart or graph demonstrating the correlation between price reductions and sales volume.]

Supply Chain Challenges and Production Bottlenecks

Lingering supply chain disruptions and production bottlenecks continued to hamper Tesla's operations during Q1 2024, adding further pressure on profitability.

- Examples of Supply Chain Disruptions: (Insert specific examples if available. Examples below)

- Shortages of specific raw materials used in battery production.

- Delays in the delivery of crucial components.

- Logistical challenges affecting transportation and delivery times.

External macroeconomic factors, such as inflation and global economic uncertainty, likely exacerbated these existing challenges, contributing to the overall decline in profitability.

Market Reaction to Tesla's Q1 2024 Earnings Report

Stock Price Volatility

The announcement of Tesla's Q1 2024 earnings immediately triggered significant volatility in the company's stock price.

- Specific Dates and Price Fluctuations: (Insert specific dates and price movements once available. Example below)

- Pre-earnings announcement: (Example: Stock price at $X)

- Post-earnings announcement: (Example: Immediate drop of Y%, followed by further fluctuations)

- Analyst Ratings and Comments: (Include quotes and summaries of analyst opinions.)

[Include a chart showing stock price movements around the earnings announcement date.]

Investor Sentiment and Analyst Opinions

Investor sentiment turned cautious following the release of the disappointing earnings report. Analyst opinions were divided, with some expressing concerns about the sustainability of Tesla's growth strategy, while others remained optimistic about the company's long-term prospects.

- Quotes from Key Analysts and Financial News Sources: (Insert relevant quotes from analysts and news articles.)

- Diverse Perspectives: (Highlight both bullish and bearish perspectives on the future of Tesla.)

Long-Term Implications for Tesla's Valuation

The Q1 2024 results undoubtedly cast a shadow on Tesla's short-term valuation. However, the long-term implications remain uncertain. The company's ability to address the underlying challenges – improving production efficiency, navigating supply chain issues, and managing pricing strategies – will significantly impact its future growth and market valuation.

- Potential for Future Growth: (Discuss Tesla’s potential growth strategies, new products, market expansion, etc.)

- Strategies to Address Challenges: (Discuss Tesla's plans to overcome the challenges identified above)

Conclusion: Understanding Tesla's Q1 2024 Earnings and the Path Forward

Tesla's Q1 2024 earnings report revealed a substantial drop in net income, driven by a combination of price reductions, persistent supply chain issues, and macroeconomic headwinds. The market reacted with significant stock price volatility and a range of analyst opinions, reflecting the uncertainty surrounding the company's near-term outlook. Understanding these factors is crucial for investors and stakeholders alike. The key takeaway is the complexity of Tesla's financial performance and the unpredictable nature of the market. To stay informed about Tesla's financial performance and future developments, continue following our coverage of Tesla's Q1 2024 earnings and related topics. Subscribe to our newsletter or follow us on social media for the latest updates.

Featured Posts

-

A More Global Church Pope Francis Impact And The Challenges Ahead

Apr 24, 2025

A More Global Church Pope Francis Impact And The Challenges Ahead

Apr 24, 2025 -

Recent Tragedy At Israeli Beach Years Of Shark Activity Ends In Death

Apr 24, 2025

Recent Tragedy At Israeli Beach Years Of Shark Activity Ends In Death

Apr 24, 2025 -

South Carolina Voter Confronts Rep Nancy Mace A Heated Exchange

Apr 24, 2025

South Carolina Voter Confronts Rep Nancy Mace A Heated Exchange

Apr 24, 2025 -

The Bold And The Beautiful Spoilers Steffy Comforts Liam Poppy Warns Finn February 20

Apr 24, 2025

The Bold And The Beautiful Spoilers Steffy Comforts Liam Poppy Warns Finn February 20

Apr 24, 2025 -

Tesla Profit Decline In Q1 2024 The Role Of Musks Political Associations

Apr 24, 2025

Tesla Profit Decline In Q1 2024 The Role Of Musks Political Associations

Apr 24, 2025