Bullion's Rise: Examining The Correlation Between Gold Prices And Trade Wars

Table of Contents

Understanding the Safe Haven Status of Gold

Gold's enduring appeal lies in its status as a safe haven asset—a store of value sought during times of economic uncertainty and geopolitical instability. This is rooted in several key factors:

- Historical Store of Value: For millennia, gold has served as a reliable store of value, transcending currency fluctuations and political upheavals. Its inherent value remains relatively constant, making it a dependable hedge against inflation and economic downturns.

- Limited Supply: Unlike fiat currencies, gold's supply is finite. This scarcity contributes to its inherent value and makes it resistant to artificial manipulation.

- Lack of Counterparty Risk: Gold's value isn't dependent on the solvency of any institution or government. Unlike stocks or bonds, it's not subject to counterparty risk—the risk that the issuer might default.

Bullet Points:

- Throughout history, periods of geopolitical instability, such as wars and political crises, have consistently witnessed a rise in gold prices.

- Gold exhibits a low correlation with other major asset classes, making it a valuable diversifier in an investment portfolio.

- Central banks worldwide hold significant gold reserves, further underscoring its role as a reliable store of value and a crucial component of global financial stability. These reserves act as a buffer against economic shocks.

The Impact of Trade Wars on Global Economic Uncertainty

Trade wars introduce significant uncertainty into the global economy. These disputes disrupt established supply chains, leading to increased production costs, reduced consumer confidence, and slower economic growth. The consequences ripple through various aspects of the economy:

- Supply Chain Disruptions: Tariffs and trade restrictions hinder the smooth flow of goods and services across borders, increasing costs for businesses and consumers.

- Currency Volatility: Trade disputes often result in significant volatility in currency markets, as investors react to the uncertain economic outlook. This instability can erode purchasing power and increase investment risks.

- Inflationary Pressures: Tariffs can contribute to inflation, as the cost of imported goods increases. This can further erode consumer purchasing power and fuel economic uncertainty.

Bullet Points:

- The trade wars of the late 1920s and early 1930s are a stark example of how trade disputes can negatively impact global economic growth and exacerbate existing uncertainties.

- Investor sentiment plays a vital role. Negative news regarding trade negotiations can trigger a sell-off in riskier assets, driving investors towards the perceived safety of gold.

- Specific sectors, such as agriculture and manufacturing, are particularly vulnerable to the negative effects of trade wars, leading to job losses and reduced economic activity.

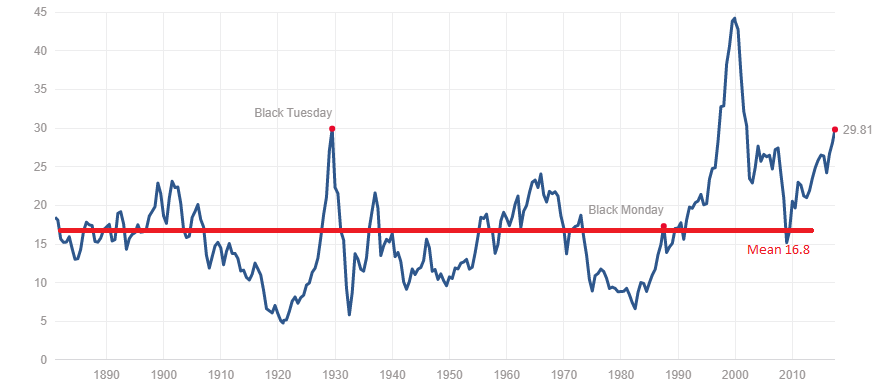

Analyzing the Correlation: Gold Prices and Trade War Intensification

A strong correlation exists between escalating trade tensions and rising gold prices. Historical data clearly illustrates this relationship:

- Data & Charts: (Include a relevant chart or graph here showing the correlation between gold prices and major trade war events. Sources should be cited). This visual representation will powerfully demonstrate the relationship between the two variables.

- Specific Examples: The imposition of tariffs on specific goods or the escalation of rhetoric during trade negotiations often precedes a noticeable increase in gold prices.

- Time Lag Analysis: While not instantaneous, the impact of trade war announcements on gold prices is usually observable within a relatively short timeframe, often within days or weeks.

Bullet Points:

- The gold price spikes observed during the US-China trade disputes of 2018-2020 provide compelling evidence of this correlation.

- Key economic indicators like the Consumer Price Index (CPI) and the Purchasing Managers' Index (PMI) can also shed light on the relationship between trade wars, economic uncertainty, and gold price fluctuations.

- It's crucial to remember that other factors—such as inflation, interest rates, and global monetary policy—also influence gold prices. The relationship between gold prices and trade wars needs to be viewed within a broader economic context.

Diversification Strategies in a Trade War Environment

In a climate of heightened trade uncertainty, gold plays a vital role in a diversified investment portfolio. Its low correlation with other asset classes makes it an effective hedge against potential losses in stocks and bonds during trade disputes.

- Hedging Trade War Risks: Investors can utilize gold to mitigate the risks associated with trade wars by reducing overall portfolio volatility.

- Gold Investment Options: Several avenues exist for investing in gold, each with its own advantages and disadvantages:

- Physical Gold: Offers tangible ownership but requires secure storage.

- Gold ETFs: Provide convenient and cost-effective access to gold markets.

- Gold Mining Stocks: Offer leveraged exposure to gold prices but carry higher risk.

Bullet Points:

- Consider the liquidity of different gold investments when making your decision. ETFs generally offer greater liquidity than physical gold.

- Understand the risks associated with leveraged investments such as gold mining stocks before investing. These investments can magnify both gains and losses.

- It's essential to consult a qualified financial advisor before making any investment decisions. A personalized strategy can help manage your risk profile and achieve your financial goals.

Conclusion

The relationship between gold prices and trade wars is undeniable. Escalating trade tensions often lead to increased investor demand for gold as a safe haven asset, driving up prices. Understanding this correlation is crucial for navigating today's volatile markets. Investors and policymakers alike must recognize the impact of trade disputes on global economic stability and the role of gold in mitigating these risks. Understanding the relationship between gold prices and trade wars is crucial for navigating today's volatile markets. Stay informed and build a robust investment strategy that incorporates this vital asset.

Featured Posts

-

Bmw And Porsches China Challenges A Growing Trend In The Automotive Industry

Apr 26, 2025

Bmw And Porsches China Challenges A Growing Trend In The Automotive Industry

Apr 26, 2025 -

Trumps Stance On Ukraines Nato Membership A Deep Dive

Apr 26, 2025

Trumps Stance On Ukraines Nato Membership A Deep Dive

Apr 26, 2025 -

Sinners Cinematography And The Expansive Mississippi Delta Landscape

Apr 26, 2025

Sinners Cinematography And The Expansive Mississippi Delta Landscape

Apr 26, 2025 -

Middle Managers Bridging The Gap Between Leadership And Workforce

Apr 26, 2025

Middle Managers Bridging The Gap Between Leadership And Workforce

Apr 26, 2025 -

High Stock Market Valuations A Bof A Analysts Reassuring View For Investors

Apr 26, 2025

High Stock Market Valuations A Bof A Analysts Reassuring View For Investors

Apr 26, 2025

Latest Posts

-

Assessing The Economic Fallout The Canadian Travel Boycotts Impact On The Us

Apr 28, 2025

Assessing The Economic Fallout The Canadian Travel Boycotts Impact On The Us

Apr 28, 2025 -

Canadian Travel Restrictions Immediate Effects On The American Economy

Apr 28, 2025

Canadian Travel Restrictions Immediate Effects On The American Economy

Apr 28, 2025 -

Car Dealerships Intensify Opposition To Mandatory Ev Sales

Apr 28, 2025

Car Dealerships Intensify Opposition To Mandatory Ev Sales

Apr 28, 2025 -

Increased Opposition From Car Dealers To Electric Vehicle Requirements

Apr 28, 2025

Increased Opposition From Car Dealers To Electric Vehicle Requirements

Apr 28, 2025 -

Resistance To Ev Mandates Grows Among Car Dealerships

Apr 28, 2025

Resistance To Ev Mandates Grows Among Car Dealerships

Apr 28, 2025