High Stock Market Valuations: A BofA Analyst's Reassuring View For Investors

Table of Contents

Understanding Current High Stock Market Valuations

Defining "High" Valuations

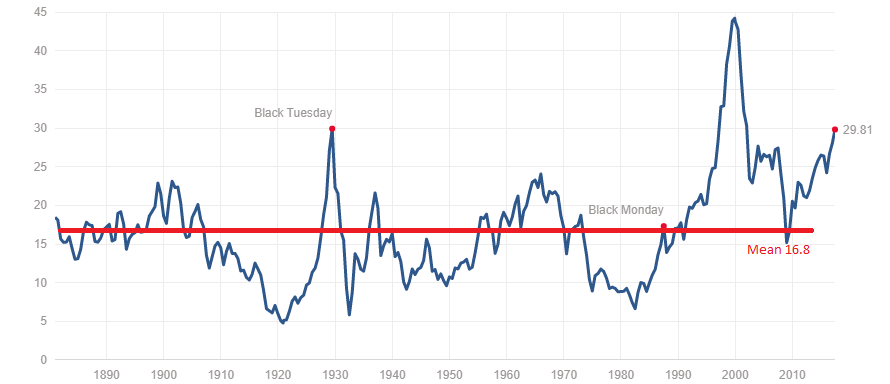

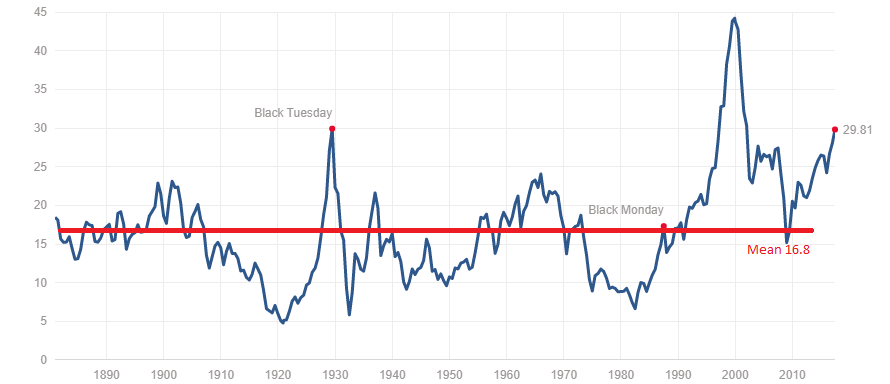

Determining whether current stock market valuations are truly "high" requires a careful examination of various metrics. Commonly used valuation ratios include the Price-to-Earnings ratio (P/E), and the cyclically adjusted price-to-earnings ratio (CAPE or Shiller PE).

- P/E Ratio: Currently, the S&P 500's P/E ratio is [insert current P/E ratio and source], which is [above/below/around] its historical average of [insert historical average and source].

- Shiller PE: The Shiller PE, which considers inflation-adjusted earnings over a ten-year period, is currently at [insert current Shiller PE and source], compared to its historical average of [insert historical average and source].

These metrics, however, have limitations. They don't account for factors like:

- Interest Rates: Low interest rates can inflate valuations as investors seek higher returns in the stock market.

- Inflation: High inflation can erode the purchasing power of future earnings, affecting valuation calculations.

- Market Sentiment: Investor optimism or pessimism significantly influences stock prices, irrespective of fundamental value.

The Role of Low Interest Rates

The prevailing low-interest-rate environment plays a crucial role in sustaining high stock market valuations.

- Attractiveness of Stocks: Low bond yields make stocks a relatively more attractive investment, pushing up demand and prices.

- Increased Corporate Borrowing: Low borrowing costs allow companies to invest more, potentially boosting earnings and further supporting stock valuations.

However, low interest rates also pose risks:

- Potential for Inflation: Sustained low rates can fuel inflation, eroding returns and potentially leading to market corrections.

- Increased Vulnerability: Low rates can mask underlying economic weaknesses, creating vulnerabilities when interest rates eventually rise.

BofA Analyst's Perspective: Key Arguments for Maintaining a Positive Outlook

The BofA analyst's report emphasizes several factors supporting a positive outlook, despite the high valuations.

Strong Corporate Earnings and Profitability

BofA highlights robust corporate earnings growth as a key justification for a positive market outlook.

- Strong Performing Sectors: The report likely points to specific sectors like technology, healthcare, or consumer staples demonstrating significant earnings growth (insert specific sectors and data from BofA report if available).

- Sustainability of Earnings: The analyst's assessment should consider the sustainability of these earnings, taking into account factors such as economic growth, competition, and potential disruptions.

Long-Term Growth Potential and Technological Innovation

BofA's positive outlook is further bolstered by its assessment of long-term economic growth drivers, particularly technological innovation.

- Technological Advancements: The report likely emphasizes the transformative impact of technological advancements (e.g., AI, cloud computing, biotechnology) on market performance.

- Key Growth Sectors: BofA might identify specific technology sectors (e.g., artificial intelligence, renewable energy) as key areas for future growth.

Addressing the Risks

While acknowledging the potential risks associated with high valuations, BofA likely incorporates these concerns into its analysis.

- Market Corrections: The report probably acknowledges the possibility of short-term market corrections, but emphasizes the importance of a long-term perspective.

- Inflationary Pressures: The analyst's assessment likely addresses the potential impact of inflation and suggests strategies to mitigate its effects.

- Diversification Strategies: The report may advise investors to diversify their portfolios across different asset classes to reduce risk.

Practical Implications for Investors

Investment Strategies in a High-Valuation Market

Based on BofA's analysis, investors can adopt several strategies:

- Long-Term Perspective: Maintaining a long-term investment horizon is crucial, allowing investors to ride out short-term market volatility.

- Strategic Asset Allocation: Investors should adjust their portfolio allocation based on their risk tolerance, potentially shifting towards less volatile assets if concerned about high valuations.

The Importance of Diversification

Diversification remains paramount in managing risk in any market environment, especially one characterized by high valuations.

- Asset Class Diversification: Investors should consider diversifying across different asset classes, such as stocks, bonds, real estate, and commodities.

- Professional Advice: Seeking guidance from a qualified financial advisor is essential for developing a personalized investment strategy tailored to individual circumstances and risk tolerance.

Conclusion: Navigating High Stock Market Valuations with Confidence

While high stock market valuations are a legitimate concern, the BofA analyst's perspective offers a reassuring counterpoint. Strong corporate earnings, the potential for long-term growth driven by technological innovation, and careful risk management strategies all contribute to a more optimistic outlook. However, it's crucial to understand the risks involved. By carefully assessing high stock market valuations, adopting a long-term perspective, and diversifying your portfolio, you can confidently navigate this market environment. Remember to conduct thorough research and consult with a financial advisor to develop a well-informed investment strategy that aligns with your personal goals and risk tolerance. Managing high stock market valuations effectively requires careful planning and a proactive approach to investing.

Featured Posts

-

Private Credit Jobs 5 Dos And Don Ts For Career Success

Apr 26, 2025

Private Credit Jobs 5 Dos And Don Ts For Career Success

Apr 26, 2025 -

Tariffs And The Economy Ceos Express Deep Concerns

Apr 26, 2025

Tariffs And The Economy Ceos Express Deep Concerns

Apr 26, 2025 -

Navigating The Transatlantic Divide Ai Regulation And The Trump Administration

Apr 26, 2025

Navigating The Transatlantic Divide Ai Regulation And The Trump Administration

Apr 26, 2025 -

Trumps Legacy A Herculean Task For The Next Federal Reserve Chair

Apr 26, 2025

Trumps Legacy A Herculean Task For The Next Federal Reserve Chair

Apr 26, 2025 -

Are High Stock Valuations A Concern Bof A Says No Heres Why

Apr 26, 2025

Are High Stock Valuations A Concern Bof A Says No Heres Why

Apr 26, 2025