BofA's View: Why Investors Should Remain Calm Despite High Stock Market Valuations

Table of Contents

BofA's Positive Long-Term Outlook for the Stock Market

BofA maintains a positive long-term outlook for the stock market, grounded in several key factors. Their analysis points towards continued growth, despite the current high valuations.

Strong Corporate Earnings and Revenue Growth

BofA's research indicates robust corporate performance, with many companies exceeding earnings expectations and projecting strong revenue growth. This positive trend fuels their optimistic outlook.

- Examples of strong performing sectors: Technology (particularly AI-related companies), healthcare, and certain segments of the consumer discretionary sector have shown remarkable resilience.

- Specific company examples: While individual stock performance varies, companies like Apple (AAPL), Microsoft (MSFT), and Johnson & Johnson (JNJ) have demonstrated consistent growth, reflecting broader market strength. (Note: These are examples, and specific recommendations require individual investment analysis.)

- Projected growth rates: BofA's analysts project continued, albeit potentially moderating, growth rates in corporate earnings over the next few years, indicating a sustainable market trajectory. Specific figures are available in their latest research reports. (Link to BofA report would be inserted here)

Interest Rate Predictions and Their Impact

BofA's interest rate predictions are crucial for understanding the market outlook. While interest rate hikes are anticipated, BofA analysts believe these increases will be managed, avoiding a dramatic market slowdown.

- Explanation of BofA's rationale: BofA's predictions are based on an assessment of inflation, economic growth, and the Federal Reserve's likely policy responses. They project a measured approach, balancing inflation control with economic stability.

- Potential scenarios and their likelihood: BofA outlines several possible scenarios, including the probability of a soft landing, a mild recession, and other less likely outcomes. Their analysis suggests a moderate scenario as the most probable. (Link to relevant BofA research reports would be inserted here).

- Impact on different sectors: Different sectors will be affected differently by interest rate changes. For example, interest-sensitive sectors like real estate may experience a temporary slowdown, while others may remain relatively unaffected.

Inflationary Pressures and Their Mitigation

Inflation remains a significant concern. However, BofA's analysis suggests that inflationary pressures are gradually easing, and the measures taken to mitigate them are having an impact.

- Factors contributing to inflation: Supply chain disruptions, increased energy prices, and strong consumer demand have all contributed to inflationary pressures.

- BofA's predicted trajectory: BofA predicts a gradual decline in inflation rates over the coming quarters, although the path might not be perfectly linear.

- Potential impact on investor portfolios: While inflation erodes purchasing power, BofA suggests strategies to mitigate its impact on investor portfolios, including investments in inflation-hedged assets. (Specific strategies require individual consultation with a financial advisor).

Addressing Investor Concerns about High Stock Market Valuations

High stock market valuations are naturally causing apprehension. However, BofA provides context and reassures investors by addressing these concerns directly.

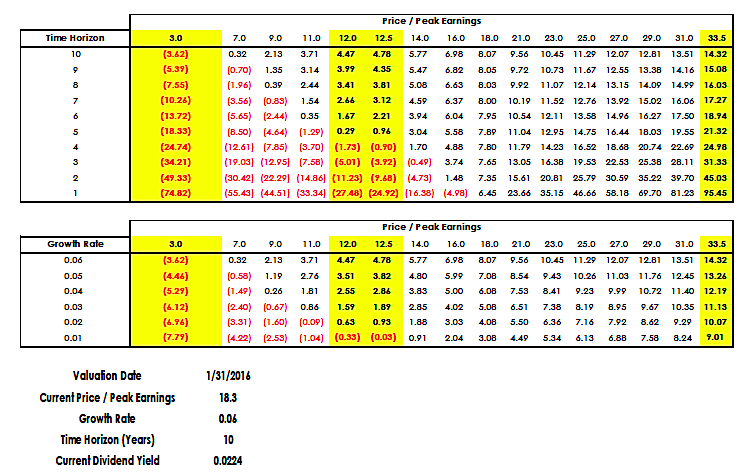

Understanding Valuation Metrics

Various valuation metrics, such as the Price-to-Earnings (P/E) ratio, are used to assess the market's value. BofA acknowledges the elevated valuations but argues that a comprehensive analysis is needed.

- Definition and explanation of key valuation metrics: The P/E ratio compares a company's stock price to its earnings per share. Other metrics include Price-to-Sales (P/S) and Price-to-Book (P/B) ratios.

- How they are used to assess market value: These metrics provide a relative measure of how expensive or cheap a stock or the overall market is compared to historical levels and to its peers.

- Why current valuations might not be as alarming as they seem: BofA argues that current valuations need to be viewed in the context of strong corporate earnings growth and low interest rates (historically speaking).

The Importance of a Long-Term Investment Horizon

BofA stresses the crucial role of a long-term investment strategy in mitigating the impact of short-term market fluctuations.

- Advantages of long-term investing: Long-term investing allows investors to ride out market cycles, benefiting from the compounding effect of returns.

- Strategies to mitigate risk: Diversification, regular contributions, and a disciplined approach to investing help to mitigate risk.

- The importance of historical context: Looking back at previous market corrections and recoveries reinforces the long-term perspective.

Opportunities Within the Current Market

Despite the high valuations, BofA analysts identify attractive investment opportunities in several sectors.

- Specific sector recommendations: While specific recommendations should come from personalized financial advice, some sectors showing potential include technology (particularly AI), renewable energy, and healthcare.

- Rationale behind the recommendations: These sectors offer attractive growth potential, and their valuations, while elevated in some cases, are supported by strong fundamentals.

- Potential risk vs. reward: All investments involve risk, and it's crucial to understand the potential risks before making any investment decisions.

Conclusion

BofA maintains a positive long-term outlook for the stock market, acknowledging the current high stock market valuations but emphasizing that a calm, strategic approach is advisable. Their analysis highlights strong corporate performance, manageable inflation pressures, and the importance of a well-diversified long-term investment strategy. By understanding these factors and employing a rational approach, investors can navigate the current market environment effectively.

To develop a well-informed investment strategy based on a long-term perspective, consult with a financial advisor and review BofA's research reports. Navigating High Stock Market Valuations with BofA requires careful consideration, but the outlook, based on their analysis, remains cautiously optimistic. Understanding the Stock Market Outlook with BofA empowers you to make informed investment decisions. [Link to relevant BofA resources would be inserted here].

Featured Posts

-

Saudi India Oil Refinery Partnership A Boost For Energy Security

Apr 24, 2025

Saudi India Oil Refinery Partnership A Boost For Energy Security

Apr 24, 2025 -

Bof A On Stretched Stock Market Valuations A Reason For Investor Calm

Apr 24, 2025

Bof A On Stretched Stock Market Valuations A Reason For Investor Calm

Apr 24, 2025 -

John Travolta Reassures Fans Following Controversial Bedroom Photo Post

Apr 24, 2025

John Travolta Reassures Fans Following Controversial Bedroom Photo Post

Apr 24, 2025 -

Quentin Tarantino Zasto Odbija Gledati Ovaj Film S Johnom Travoltom

Apr 24, 2025

Quentin Tarantino Zasto Odbija Gledati Ovaj Film S Johnom Travoltom

Apr 24, 2025 -

Understanding The Value Of Middle Management In Todays Workplace

Apr 24, 2025

Understanding The Value Of Middle Management In Todays Workplace

Apr 24, 2025