Bitcoin Price Surge: Trump's Trade Moves And Fed Policy Impact

Table of Contents

Trump's Trade Policies and Their Impact on Bitcoin

Trump's trade policies, characterized by tariffs and trade disputes, created significant uncertainty in global markets, inadvertently fueling the Bitcoin price surge.

Uncertainty in Global Markets

The imposition of tariffs and the resulting trade wars introduced considerable volatility into traditional financial markets. This uncertainty pushed investors to seek alternative assets perceived as safer havens.

- Increased volatility in stock markets: The unpredictability of trade relations led to significant fluctuations in stock market indices, making investors nervous.

- Safe-haven asset appeal of Bitcoin: Bitcoin, often considered a hedge against economic uncertainty, saw increased demand as investors sought to diversify their portfolios and protect their assets.

- Decline in investor confidence in fiat currencies: The instability created by trade disputes eroded confidence in traditional fiat currencies, making Bitcoin a more attractive alternative.

Impact of the US Dollar

The strength and weakness of the US dollar are closely correlated with Bitcoin's price. Trump's trade policies directly affected the dollar's value.

- Weakening dollar can boost Bitcoin demand: A weaker dollar often increases the demand for Bitcoin as investors seek assets that may appreciate in value relative to the declining dollar.

- Trade wars affecting the dollar's value: The uncertainty surrounding trade wars significantly impacted the US dollar's strength, influencing its relationship with Bitcoin.

- Correlation between USD and Bitcoin price fluctuations: Historical data shows a notable correlation between the US dollar's performance and Bitcoin's price movements. A weakening dollar often coincides with a rising Bitcoin price, and vice versa.

Federal Reserve Policy and Bitcoin's Price Movement

The Federal Reserve's monetary policy decisions also played a crucial role in influencing the Bitcoin price surge.

Interest Rate Decisions

The Fed's interest rate decisions significantly impact investor behavior and, consequently, Bitcoin's price.

- Low interest rates can stimulate Bitcoin investment: Low interest rates reduce the returns on traditional savings accounts and bonds, encouraging investors to seek higher returns in alternative assets like Bitcoin.

- Investors seeking higher returns outside traditional markets: With low interest rates, the potential for higher returns from Bitcoin becomes more appealing to risk-tolerant investors.

- Impact of quantitative easing on Bitcoin's value: The Fed's quantitative easing (QE) programs inject liquidity into the market, potentially increasing the demand for alternative assets like Bitcoin.

Monetary Policy Uncertainty

Uncertainty surrounding the Fed's policy decisions can also drive investors towards Bitcoin as a hedge against risk.

- Unpredictable policy shifts increase Bitcoin's appeal: Uncertain economic conditions and unpredictable policy shifts increase the attractiveness of Bitcoin as a less regulated, decentralized asset.

- Investors seeking refuge in less regulated assets: Investors may seek refuge in less regulated assets like Bitcoin when uncertainty surrounding traditional markets is high.

- Influence of market sentiment on Bitcoin's price: Market sentiment, heavily influenced by the Fed's actions, can significantly impact Bitcoin's price, leading to rapid price increases or decreases.

The Interplay Between Trade and Monetary Policy on Bitcoin

The synergistic effect of both trade policy uncertainty and fluctuating monetary policy amplified the Bitcoin price surge.

- Combined impact of market instability and search for alternative investments: The combination of market instability stemming from trade disputes and the search for higher returns due to low interest rates created a perfect storm for Bitcoin investment.

- Increased demand for Bitcoin as a hedge against both economic and geopolitical risks: Bitcoin's appeal as a hedge against both economic and geopolitical risks was magnified by the confluence of these factors.

- Amplification of price movements due to the interaction of these two factors: The interaction between trade policy and monetary policy created a feedback loop, amplifying Bitcoin's price movements.

Conclusion

In conclusion, the recent Bitcoin price surge wasn't a singular event but rather a complex outcome driven by the interplay of former President Trump's trade actions and the Federal Reserve's monetary policies. The uncertainty created by trade disputes, coupled with the low-interest-rate environment, pushed investors towards alternative assets like Bitcoin, increasing its demand and driving up its price. Understanding the relationship between global trade dynamics, Federal Reserve policies, and the Bitcoin price surge is crucial for navigating the volatile cryptocurrency market. Stay informed to make informed decisions about your Bitcoin investments and stay ahead of future Bitcoin price surges.

Featured Posts

-

O Thanatos Toy Tzin Xakman I Sygkinitiki Anartisi Toy Tzon Travolta

Apr 24, 2025

O Thanatos Toy Tzin Xakman I Sygkinitiki Anartisi Toy Tzon Travolta

Apr 24, 2025 -

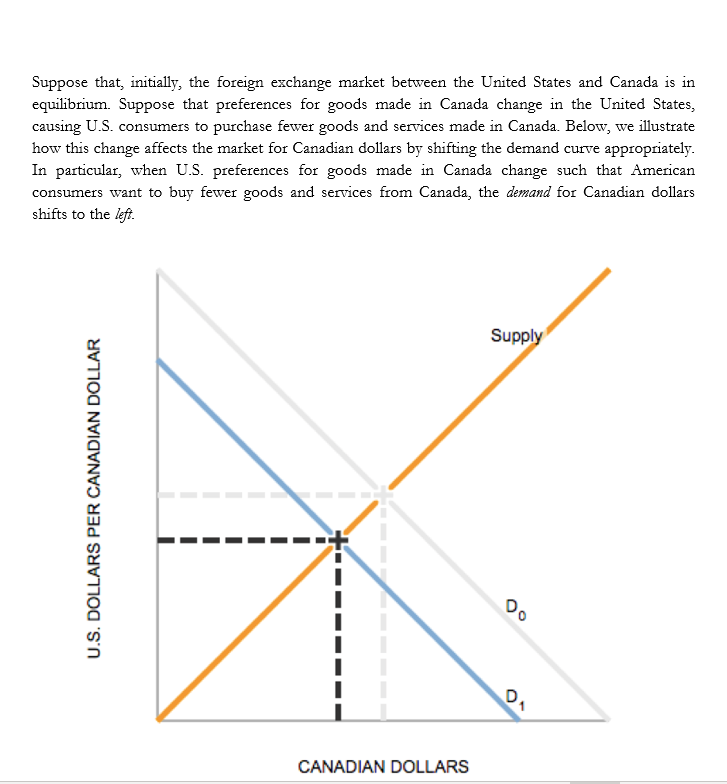

Analyzing The Canadian Dollars Performance Against Major Currencies

Apr 24, 2025

Analyzing The Canadian Dollars Performance Against Major Currencies

Apr 24, 2025 -

From Scatological Data To Engaging Podcast Ais Role In Document Digest

Apr 24, 2025

From Scatological Data To Engaging Podcast Ais Role In Document Digest

Apr 24, 2025 -

Harvard Trump Administration Negotiations Possible After Lawsuit

Apr 24, 2025

Harvard Trump Administration Negotiations Possible After Lawsuit

Apr 24, 2025 -

Tzon Travolta Mnimi Gia Ton Tzin Xakman

Apr 24, 2025

Tzon Travolta Mnimi Gia Ton Tzin Xakman

Apr 24, 2025