Assessing The Risks: Trump's Trade Policies And US Financial Stability

Table of Contents

The Tariffs and Their Economic Ripple Effects

Trump's administration implemented significant tariffs on a range of imported goods, significantly impacting the US economy and financial stability. These tariffs, intended to protect domestic industries, created a complex web of economic repercussions.

Impact on Inflation

The imposition of tariffs directly increased the cost of imported goods, contributing significantly to inflationary pressures. This inflationary effect eroded consumer purchasing power, as the prices of everyday goods and services rose.

- Steel and Aluminum Tariffs: Tariffs on steel and aluminum, imposed in 2018, increased the cost of these crucial materials for numerous industries, leading to higher prices for automobiles, construction materials, and consumer goods. Studies estimated these tariffs contributed to a 0.3% increase in inflation.

- Impact on Low-Income Households: Low-income households were disproportionately affected by the rise in prices, as a larger portion of their income is dedicated to essential goods and services. This exacerbated existing income inequality.

- Reduced Consumer Spending: Rising prices led to reduced consumer spending, impacting overall economic growth and potentially hindering long-term financial stability.

Disruption to Supply Chains

Trump's trade wars and protectionist measures severely disrupted global supply chains, leading to shortages and increased production costs across various sectors. This uncertainty undermined the efficiency and reliability of established supply networks.

- Impact on Manufacturing: The automotive, electronics, and agricultural sectors experienced significant supply chain disruptions, leading to production delays and increased costs.

- Increased Input Costs: Businesses faced increased costs for raw materials and intermediate goods, forcing them to either absorb these costs or pass them on to consumers in the form of higher prices.

- Globalization's Role: The reliance on globally integrated supply chains, while offering benefits in terms of efficiency and lower costs, also heightened vulnerability to disruptions caused by trade disputes.

Uncertainty and Investor Sentiment

The unpredictable nature of Trump's trade policies fostered significant market volatility and uncertainty, undermining investor confidence and impacting investment decisions. This erratic policy environment created significant risk for investors.

Market Volatility

Announcements regarding new tariffs or trade negotiations often triggered sharp fluctuations in stock prices and other financial markets. This volatility created uncertainty and discouraged long-term investment.

- Market Reactions: Each major trade announcement – from the initial tariffs on steel and aluminum to the ongoing trade war with China – caused significant market reactions, often leading to short-term declines in stock prices.

- Impact on Investment Decisions: Investors became hesitant to make long-term investment decisions, as the constantly shifting trade landscape created an environment of heightened risk.

- Media Influence: The media's coverage of trade disputes further amplified investor sentiment, contributing to market volatility and influencing investment decisions.

Impact on Foreign Direct Investment (FDI)

The trade disputes significantly affected foreign direct investment (FDI) in the US, potentially hindering long-term economic growth and development. Uncertainty surrounding trade policy discouraged foreign investors.

- Decreased FDI Flows: Studies show a decline in FDI flows into the US during periods of heightened trade tensions, reflecting investor concerns about the predictability and stability of the US economic environment.

- Reasons for Decline: Foreign investors were hesitant to commit capital to a market characterized by unpredictable trade policies and the risk of retaliatory tariffs from other countries.

- Long-Term Consequences: Reduced FDI can lead to slower economic growth, reduced innovation, and a diminished capacity for job creation.

The Role of the US Dollar and Global Trade

Trump's trade policies also significantly impacted the value of the US dollar and its role in global trade, creating further complexities for the US economy.

Currency Fluctuations

Trade disputes and the resulting uncertainty influenced the value of the US dollar against other major currencies. This fluctuation had implications for both US exports and imports.

- Trade Policy and Exchange Rates: Tariffs and trade wars can lead to currency appreciation or depreciation, depending on the specific circumstances and market dynamics.

- US Dollar Fluctuations: The value of the US dollar fluctuated significantly during this period, reflecting the ongoing uncertainty surrounding trade policy.

- Impact on Exports and Imports: Currency fluctuations can make US exports more or less competitive in the global market and similarly affect the prices of imported goods.

International Trade Relations

Trump's protectionist policies significantly damaged international trade relations and the collaborative environment crucial for multilateral trade agreements. This damaged relationships with key trading partners.

- Strained Relationships: The trade disputes strained relationships with key trading partners, including China, the European Union, and Canada, leading to retaliatory tariffs and trade restrictions.

- Impact on Multilateral Agreements: The withdrawal from the Trans-Pacific Partnership (TPP) and the renegotiation of NAFTA (now USMCA) signaled a shift away from multilateral trade agreements and towards bilateral deals.

- Global Economic Cooperation: The decline in global cooperation on trade issues raised concerns about the future of the multilateral trading system and its ability to manage global economic challenges.

Conclusion

Trump's trade policies presented significant risks to US financial stability, impacting inflation, supply chains, investor sentiment, and international trade relations. The increased tariffs led to higher prices, disrupted supply chains, and created an environment of uncertainty that negatively impacted investment and economic growth. The damage to international relationships further complicated the global economic landscape. Understanding the lasting effects of Trump's trade policies on US financial stability requires ongoing analysis. Continue your research to gain a deeper understanding of this crucial aspect of the American economy, and to better assess the long-term consequences of protectionist trade policies on the stability of the US financial system.

Featured Posts

-

The Impact Of Over The Counter Birth Control On Reproductive Rights

Apr 22, 2025

The Impact Of Over The Counter Birth Control On Reproductive Rights

Apr 22, 2025 -

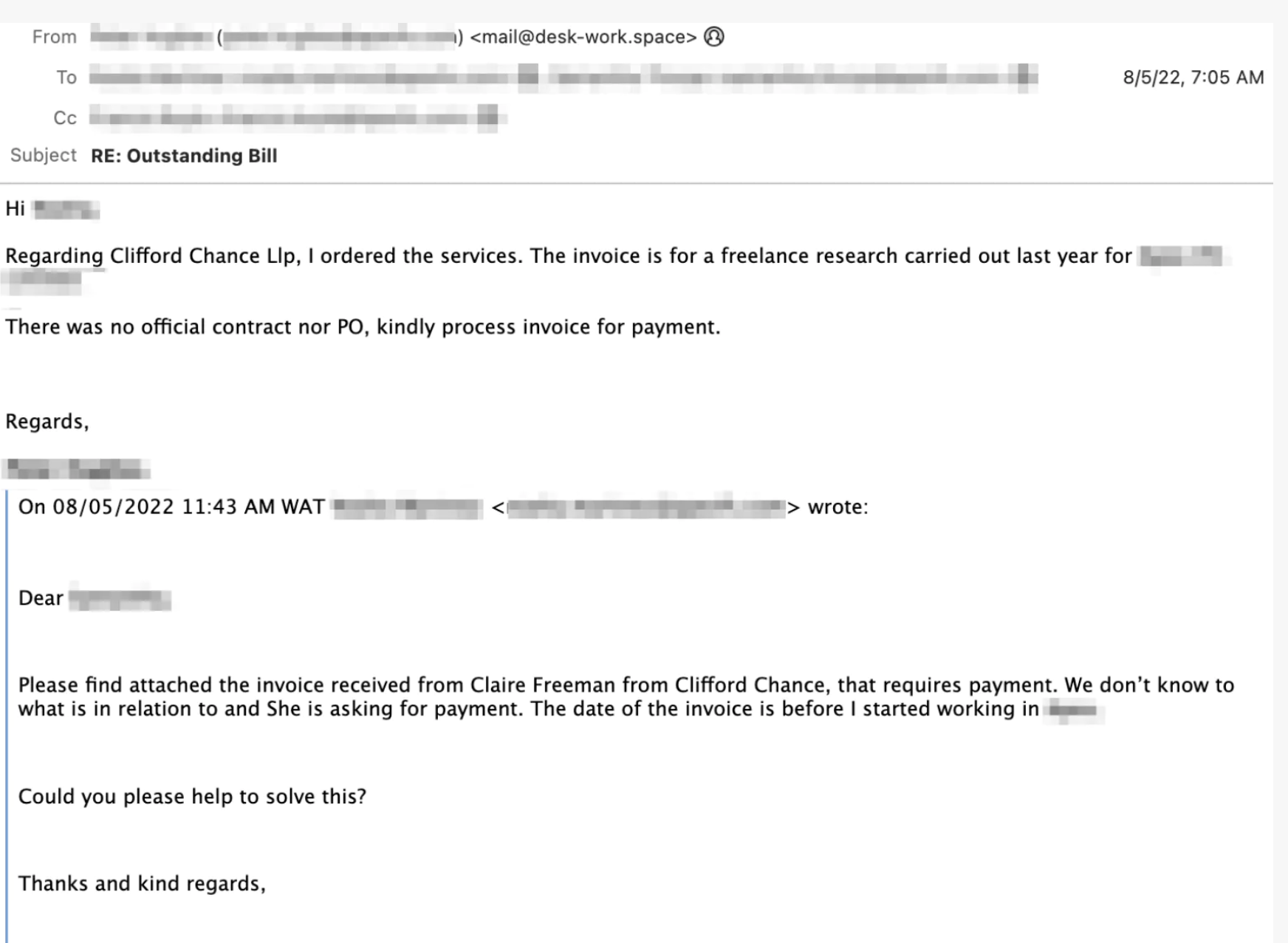

Millions Stolen Insider Reveals Massive Office365 Executive Email Compromise

Apr 22, 2025

Millions Stolen Insider Reveals Massive Office365 Executive Email Compromise

Apr 22, 2025 -

The Perilous Rise Of Disaster Betting The Case Of The Los Angeles Wildfires

Apr 22, 2025

The Perilous Rise Of Disaster Betting The Case Of The Los Angeles Wildfires

Apr 22, 2025 -

January 6th Falsehoods Ray Epps Defamation Case Against Fox News

Apr 22, 2025

January 6th Falsehoods Ray Epps Defamation Case Against Fox News

Apr 22, 2025 -

The Growing Threat Of Googles Demise A Breakup On The Horizon

Apr 22, 2025

The Growing Threat Of Googles Demise A Breakup On The Horizon

Apr 22, 2025