Widening Cracks In Private Credit: Insights From Credit Weekly

Table of Contents

Rising Default Rates in Private Credit

Default rates in the private credit market are climbing, signaling a potential crisis in this alternative lending sector. Credit Weekly's data reveals a concerning trend across various private debt segments, including leveraged loans and direct lending. This increase in credit defaults represents a significant shift from the historically low default rates seen in previous years. The implications are far-reaching, impacting investor confidence and the overall stability of the credit market.

-

Specific examples of high-profile defaults: Recent high-profile defaults in the private credit space include [Insert specific examples and links to reputable sources if available. If not, remove this bullet point.]. These cases highlight the vulnerability of certain borrowers to changing economic conditions.

-

Analysis of sectors most affected: The real estate and technology sectors appear particularly susceptible to increased private debt defaults. [Insert supporting data or analysis if available]. This vulnerability is linked to factors such as overleveraging, decreased valuations, and shifts in market demand.

-

Comparison of current default rates to historical averages: Current default rates are significantly higher than historical averages, surpassing [insert percentage if available from Credit Weekly or other reputable source]. This sharp increase suggests a more systemic issue within the private credit market.

-

Mention any projections for future default rates: Experts predict that [insert data or prediction on future default rates, citing sources if possible]. This projection underscores the need for cautious risk management in the private credit space.

Increased Competition and Pricing Pressure in the Private Credit Market

Intense competition is driving down returns and potentially encouraging riskier lending practices within the private credit market. The influx of new players, attracted by the seemingly high yields of private debt, has created a highly competitive environment. This pressure has led to yield compression, squeezing profit margins and potentially compromising lending standards.

-

Discussion of the influx of new players into the private credit market: The ease of entry into the private credit market has attracted a wave of new lenders, exacerbating the already intense competition.

-

Analysis of how competition has affected pricing and credit spreads: The competitive pressure has resulted in tighter credit spreads, reducing the returns for private credit lenders. This pressure to maintain market share can encourage lenders to take on more risk in order to maintain profitability.

-

Explain the relationship between compressed yields and increased risk: The pursuit of returns in a compressed yield environment incentivizes lenders to accept lower credit quality borrowers or relax lending standards, leading to elevated default risk.

-

Mention concerns about the sustainability of current pricing models: Many market analysts question the sustainability of current pricing models in the face of rising default rates and macroeconomic uncertainty.

The Impact of Macroeconomic Factors on Private Credit Risk

Macroeconomic headwinds are significantly increasing private credit risk. Rising interest rates, persistent inflation, and recessionary fears all contribute to a challenging environment for private credit borrowers. These factors strain the ability of borrowers to service their debt and increase the likelihood of defaults.

-

Explain how rising interest rates increase borrowing costs and strain borrowers' ability to repay: Higher interest rates directly translate into increased borrowing costs for private credit borrowers, reducing their capacity to repay loans.

-

Discuss the impact of inflation on profitability and debt servicing capacity: Inflation erodes purchasing power and can negatively impact the profitability of borrowers, decreasing their ability to meet their debt obligations.

-

Analyze the correlation between recessionary fears and increased credit risk: Recessionary fears heighten uncertainty and increase default risk as businesses face reduced revenue and potential layoffs.

-

Mention any potential policy responses to mitigate these risks: Government policy responses, such as interest rate adjustments, might aim to mitigate the impact of macroeconomic factors but are unlikely to fully offset the risks.

Liquidity Concerns in the Private Credit Market

Liquidity risk is an emerging concern in the private credit market. The illiquid nature of many private credit investments means that investors may struggle to access their capital quickly, particularly during times of market stress. This lack of liquidity can lead to significant challenges for investors seeking to redeem their investments.

-

Explain how illiquidity can impact investors' ability to access their capital: The illiquid nature of private credit makes it difficult for investors to sell their investments quickly, potentially locking up their capital for extended periods.

-

Discuss any concerns about the ability of private credit funds to meet redemption requests: Concerns exist that private credit funds may struggle to meet redemption requests from investors, especially if a large number of investors simultaneously demand their capital.

-

Mention the role of fund structures and investor behaviour in liquidity risk: The structure of private credit funds and investor behavior during periods of stress significantly influence liquidity risk.

Conclusion

Credit Weekly's insights reveal widening cracks in the private credit market. Rising default rates, increased competition leading to compressed yields, and the significant impact of macroeconomic factors all point towards a challenging environment for private credit investors. Liquidity concerns further amplify the risks inherent in this asset class. Investors must carefully assess the risks associated with private credit investments, remain informed through reputable sources like Credit Weekly, and diversify their portfolios to mitigate potential losses. Monitor your private credit investments closely and stay updated on the latest developments in the private credit market to proactively manage your exposure to these emerging risks.

Featured Posts

-

Paolini Y Pegula Sorpresa En Dubai Eliminadas De La Wta 1000

Apr 27, 2025

Paolini Y Pegula Sorpresa En Dubai Eliminadas De La Wta 1000

Apr 27, 2025 -

Cerundolo Avanza A Cuartos De Final En Indian Wells Ausencias De Fritz Y Gauff

Apr 27, 2025

Cerundolo Avanza A Cuartos De Final En Indian Wells Ausencias De Fritz Y Gauff

Apr 27, 2025 -

The China Factor Why Bmw Porsche And Others Struggle In The Worlds Largest Auto Market

Apr 27, 2025

The China Factor Why Bmw Porsche And Others Struggle In The Worlds Largest Auto Market

Apr 27, 2025 -

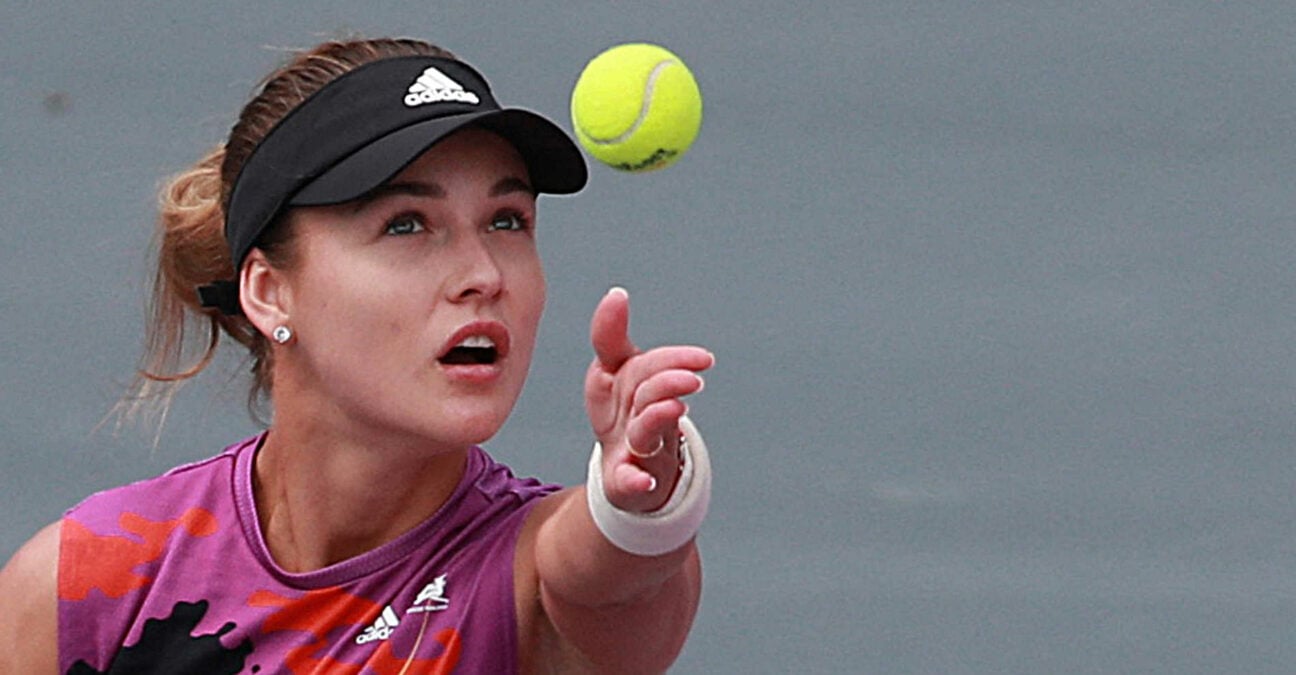

Wta Charleston Kalinskaya Scores Upset Victory Against Keys

Apr 27, 2025

Wta Charleston Kalinskaya Scores Upset Victory Against Keys

Apr 27, 2025 -

La Fire Victims Face Price Gouging A Selling Sunset Stars Allegation

Apr 27, 2025

La Fire Victims Face Price Gouging A Selling Sunset Stars Allegation

Apr 27, 2025