Why Investors Shouldn't Fear High Stock Market Valuations: BofA's Perspective

Table of Contents

BofA's Rationale: Understanding the Nuances of High Valuations

BofA's analysis suggests that panicking over high stock market valuations is premature and potentially counterproductive. Their perspective emphasizes a long-term view, considering several crucial factors often overlooked in short-term market analyses. Instead of focusing solely on current price-to-earnings ratios (P/E ratios) or other valuation metrics, BofA encourages investors to consider the broader economic landscape and the potential for future earnings growth.

-

Focus on long-term growth potential: BofA likely argues that focusing on short-term market fluctuations is detrimental to long-term investment success. The long-term growth trajectory of companies and the overall economy should be the primary consideration. High valuations, in this context, may simply reflect the market's expectation of strong future performance.

-

The role of low interest rates: Low interest rates can significantly influence stock valuations. When interest rates are low, investors often seek higher returns in the stock market, potentially driving up valuations. This doesn't automatically signal an overvalued market; rather, it reflects the overall investment environment. Understanding this relationship is key to interpreting valuation data correctly.

-

Earnings growth and future prospects: BofA's analysis likely emphasizes the importance of considering a company's earnings growth trajectory. Strong earnings growth can justify higher valuations, even if current P/E ratios appear elevated compared to historical averages. Analyzing future growth prospects is crucial for discerning whether high valuations are justified.

-

Sector-specific resilience: BofA's research probably highlights specific sectors demonstrating resilience despite high valuations. Identifying these sectors can offer investors opportunities to allocate capital strategically, focusing on companies with sustainable growth potential, even within a seemingly overvalued market. Understanding which sectors are most likely to withstand potential market corrections is a valuable part of risk management.

Addressing the Concerns: Debunking Common Myths about High Valuations

Many investors fear high valuations, associating them with market bubbles and impending crashes. However, BofA's perspective challenges these common misconceptions.

-

High valuations don't automatically equate to a crash: Historically, periods of high valuations have not always been followed by immediate market crashes. While a correction is always possible, it's not inevitable. A thorough understanding of the underlying economic fundamentals and company-specific factors is crucial.

-

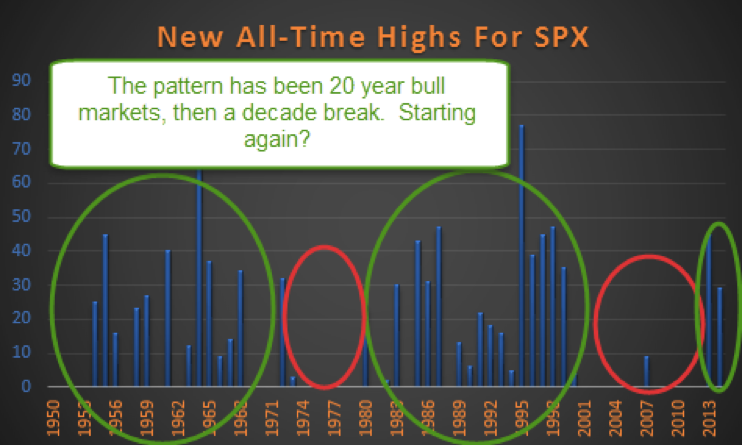

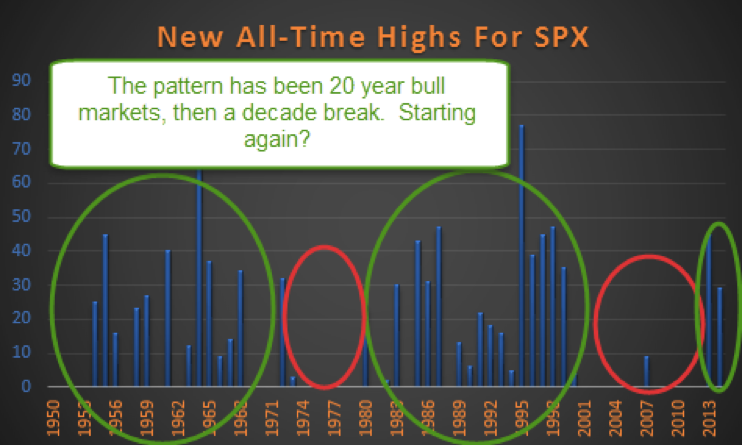

Historical context: Examining historical market data reveals numerous instances where high valuations were followed by sustained periods of growth. These examples illustrate that high valuations, in and of themselves, aren't a reliable predictor of market crashes. Understanding this historical context helps investors to maintain a more rational and balanced perspective.

-

Multiple valuation metrics: Relying on a single metric like the P/E ratio can be misleading. BofA likely advises using a range of valuation metrics, such as the Shiller PE (cyclically adjusted price-to-earnings ratio), to get a more holistic view. This approach minimizes the risk of drawing inaccurate conclusions based on limited data.

-

Limitations of valuation metrics: Valuation metrics are just one piece of the puzzle. Other factors, such as economic growth, interest rates, and geopolitical events, also significantly impact market performance. Over-reliance on valuation metrics without considering these broader factors can lead to poor investment decisions.

A Strategic Approach: How Investors Can Navigate High Valuations

BofA's perspective likely translates into a specific set of recommended strategies for managing portfolios in a high-valuation environment.

-

Diversification: A well-diversified portfolio across various asset classes (stocks, bonds, real estate, commodities) helps mitigate risk. Diversification reduces the impact of any single asset's poor performance.

-

Focus on quality: Investing in high-quality companies with strong fundamentals and proven growth potential is crucial. These companies are better positioned to weather market downturns and deliver long-term returns.

-

Long-term investment horizon: A long-term investment horizon allows investors to ride out short-term market volatility. Focusing on long-term growth reduces the impact of short-term fluctuations.

-

Portfolio rebalancing: Regularly rebalancing your portfolio to maintain your desired asset allocation helps manage risk and capitalize on market opportunities. This strategy ensures you aren't overly exposed to any single asset class.

-

Dollar-cost averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This helps mitigate the risk of investing a lump sum at a market peak.

The Importance of Professional Financial Advice

Navigating complex market situations like high stock market valuations requires expertise.

-

Personalized portfolio management: A financial advisor can create a personalized portfolio strategy tailored to your risk tolerance and financial goals.

-

Market analysis and insights: Advisors have access to in-depth market analysis and expert insights that individual investors may not have.

-

Informed decision-making: Guidance from a professional ensures you make informed investment decisions, even in volatile market conditions.

Conclusion

High stock market valuations, while seemingly daunting, don't necessarily signal an impending crash. BofA's perspective emphasizes the importance of focusing on long-term growth, understanding the nuances of valuation metrics, and employing a strategic investment approach. By considering these factors and potentially seeking professional advice, investors can navigate this environment effectively.

Call to Action: Don't let fear of high stock market valuations paralyze your investment decisions. Learn more about BofA's perspective and develop a sound investment strategy to achieve your long-term financial goals. Take control of your financial future and understand why high stock market valuations may not be as scary as they seem.

Featured Posts

-

How Tik Tok Ads Are Helping Businesses Avoid Trump Era Tariffs

Apr 22, 2025

How Tik Tok Ads Are Helping Businesses Avoid Trump Era Tariffs

Apr 22, 2025 -

Sweden And Finland Complementary Military Strengths In A Pan Nordic Defense

Apr 22, 2025

Sweden And Finland Complementary Military Strengths In A Pan Nordic Defense

Apr 22, 2025 -

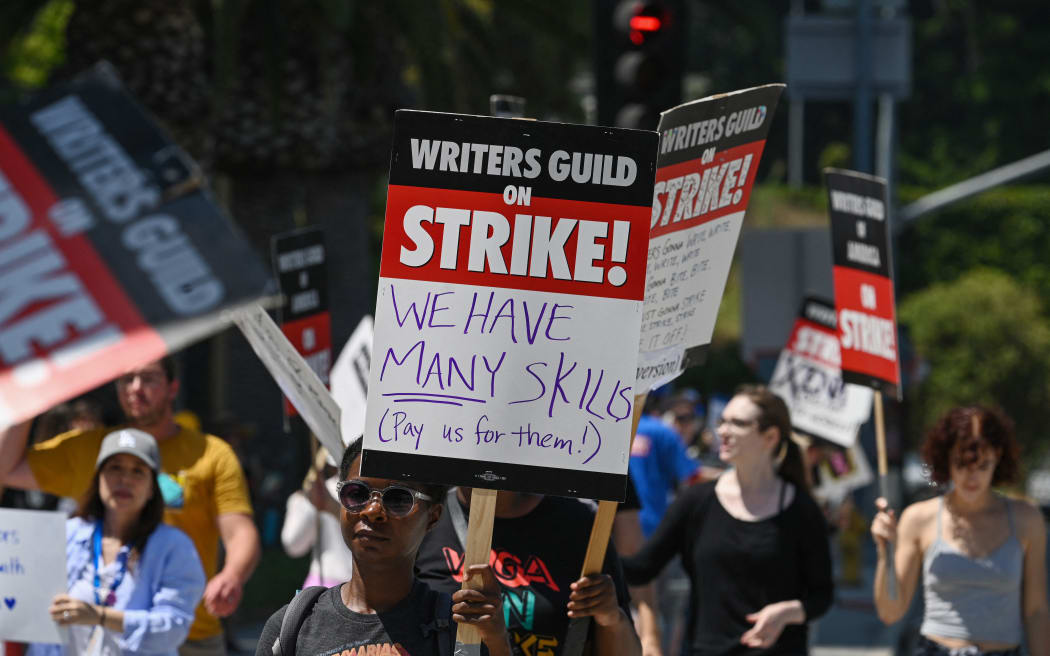

Hollywood At A Standstill The Impact Of The Writers And Actors Strike

Apr 22, 2025

Hollywood At A Standstill The Impact Of The Writers And Actors Strike

Apr 22, 2025 -

The Karen Read Case A Year By Year Timeline Of Legal Proceedings

Apr 22, 2025

The Karen Read Case A Year By Year Timeline Of Legal Proceedings

Apr 22, 2025 -

Antitrust Scrutiny Intensifies Could Google Be Broken Up

Apr 22, 2025

Antitrust Scrutiny Intensifies Could Google Be Broken Up

Apr 22, 2025