When Professionals Sold, Individuals Bought: Understanding Recent Market Swings

Table of Contents

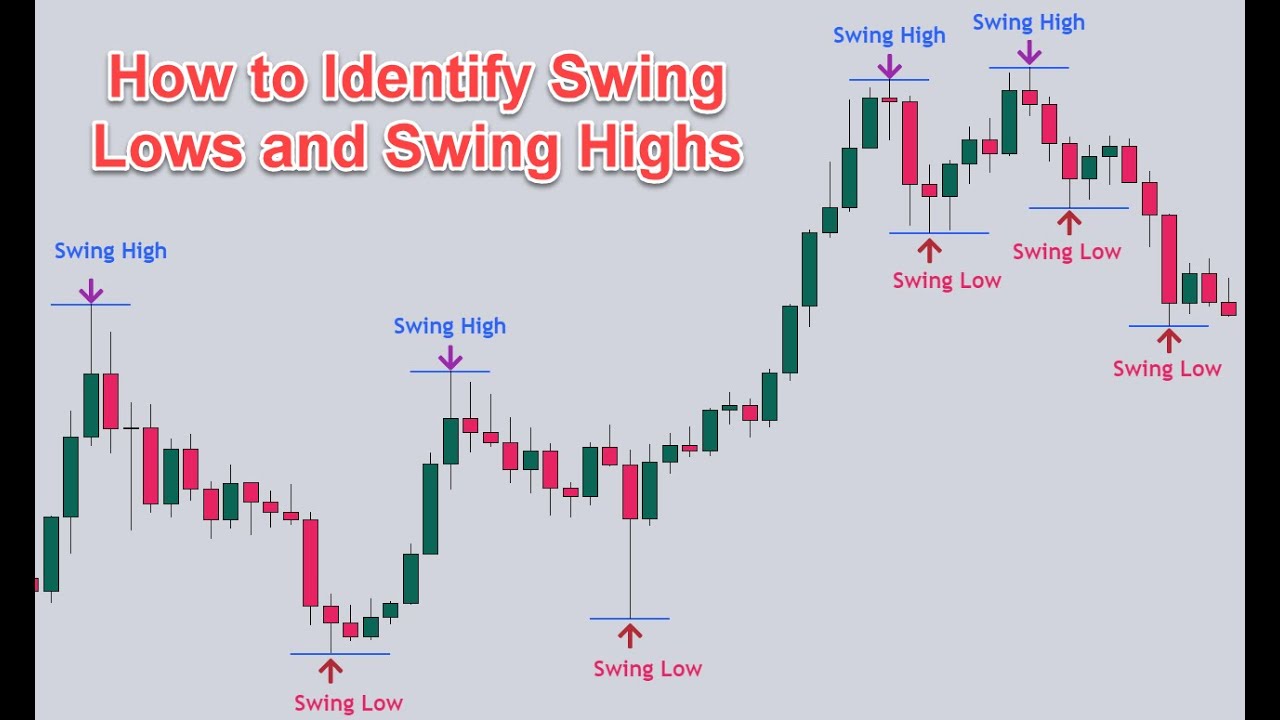

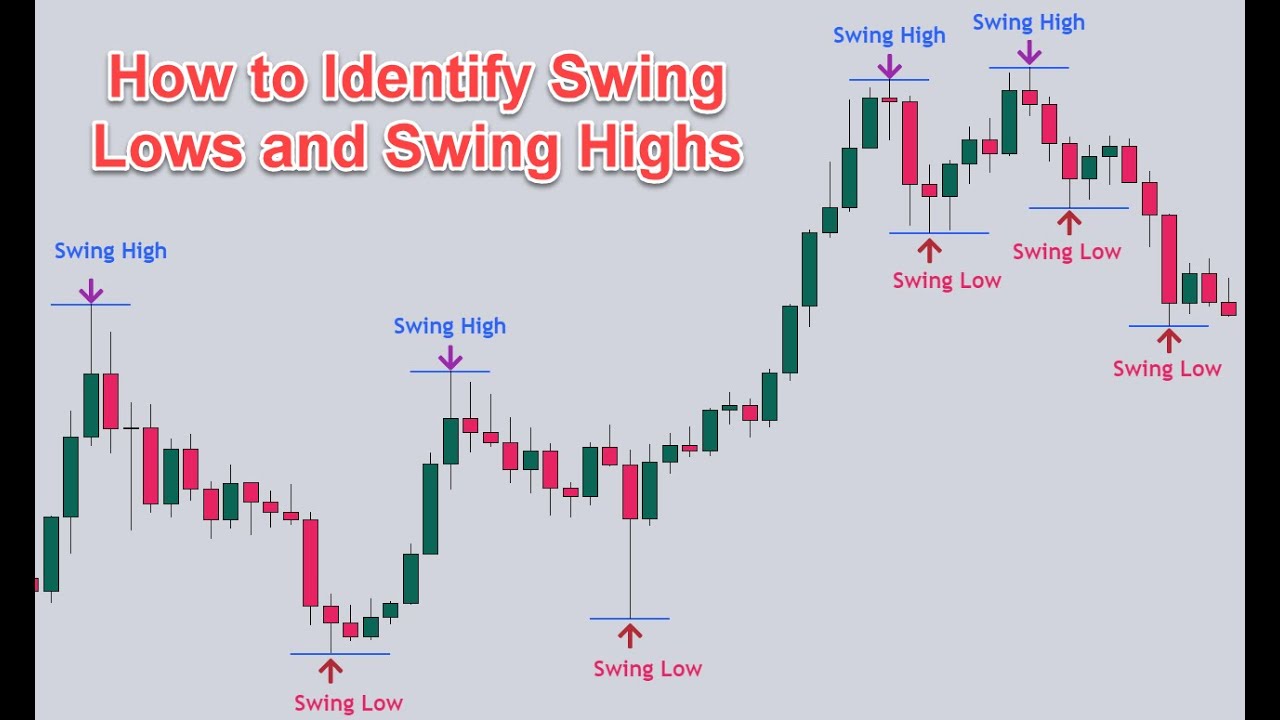

The recent real estate market has witnessed a fascinating shift: a noticeable drop in sales by professional investors and a corresponding surge in purchases by individual buyers. This article delves into the reasons behind this intriguing trend and its implications for the future. We'll explore the factors driving this change, examining shifts in market sentiment, economic conditions, and investor strategies related to real estate market swings.

<h2>The Retreat of Professional Investors</h2>

The decreased presence of professional investors in the current market is a significant factor shaping recent real estate market swings. This retreat can be largely attributed to two key elements: increased financing costs and a shift in market sentiment.

<h3>Increased Interest Rates and Financing Costs</h3>

Rising interest rates have significantly impacted the profitability of large-scale real estate investments. The cost of borrowing has increased dramatically, making it more expensive for professional investors to acquire and maintain substantial property portfolios.

- Reduced access to favorable financing options: Banks and lenders are becoming more cautious, tightening lending criteria and making it harder for investors to secure loans at competitive rates.

- Increased cost of debt servicing: Existing mortgage payments for large portfolios have become significantly more burdensome, squeezing profit margins and impacting cash flow.

- Lower projected returns on investment: With higher borrowing costs and potentially lower rental yields due to economic uncertainty, the overall return on investment for large-scale property acquisitions has diminished. This makes real estate investment less attractive compared to other asset classes.

<h3>Shifting Market Sentiment and Predictions</h3>

A growing concern about a potential market correction is another key reason for the retreat of professional investors. Many are taking a more conservative approach, prioritizing capital preservation over aggressive expansion.

- Risk aversion among institutional investors: Large institutional investors are particularly sensitive to market volatility and are more likely to reduce exposure in anticipation of a downturn.

- Concerns about future market volatility: Predictions of slowing rental demand and potential price drops are prompting many professional investors to sell properties and secure profits before a potential market correction.

- Capital preservation strategies taking precedence: With economic uncertainty looming, many investors are shifting towards more conservative investment strategies, focusing on protecting existing capital rather than making new acquisitions. This is evident in the recent real estate market swings.

<h2>The Rise of the Individual Buyer</h2>

While professional investors are pulling back, individual buyers are stepping up, creating a dynamic shift in the real estate market. This surge in individual homeownership can be attributed to two main drivers: the enduring desire for homeownership and evolving lifestyle preferences.

<h3>Desire for Homeownership and Long-Term Stability</h3>

Despite market uncertainty, the fundamental human desire for homeownership remains strong. Many individuals see the current market conditions as an opportunity to acquire property at potentially more favorable prices than in recent years.

- Increased affordability in certain market segments: While interest rates are higher, prices in some areas have softened, making homeownership more accessible to individual buyers than it was at the peak of the market.

- Long-term investment strategy for personal wealth building: Real estate is still viewed by many as a long-term investment, providing a tangible asset and potential for wealth generation.

- Desire for security and stability amidst economic uncertainty: In times of economic uncertainty, owning a home provides a sense of security and stability that appeals to many individual buyers.

<h3>Remote Work and Changing Lifestyle Preferences</h3>

The widespread adoption of remote work has significantly altered lifestyle preferences and housing demands, particularly benefitting individual buyers.

- Increased demand for larger homes outside urban centers: Remote work has allowed many to relocate to suburban or rural areas, seeking more space and a better quality of life. This has led to increased competition and higher prices in these areas, yet it is still individual buyers driving this change, in contrast to professional investors.

- Focus on lifestyle features and amenities: Individual buyers are increasingly prioritizing properties with features that support a work-from-home lifestyle, such as home offices, outdoor spaces, and access to nature.

- Geographic diversification of buyer demand: The shift to remote work has geographically diversified buyer demand, creating new opportunities in areas previously overlooked by professional investors focusing on dense urban centers.

<h2>Implications for the Future Market</h2>

The shift in buyer demographics has significant implications for the future real estate market, potentially leading to a period of stabilization or a more moderate correction.

<h3>Potential for a Market Correction or Stabilization</h3>

The reduced presence of professional investors coupled with the increased demand from individual buyers could signal a market correction or stabilization. However, the overall market trajectory will depend on several interconnected factors.

- Market volatility expected in the short term: We can expect some continued volatility as the market adjusts to these changes.

- Long-term outlook depends on various macro-economic factors: Interest rate policy, inflation rates, and overall economic growth will significantly influence the long-term direction of the real estate market.

- Potential for sustained growth in certain segments: Specific segments, like suburban or rural areas benefiting from remote work trends, might experience continued growth despite overall market fluctuations.

<h3>Changes in Investment Strategies</h3>

The recent market shifts are forcing both professional and individual investors to re-evaluate their strategies. A more cautious and nuanced approach is likely to become prevalent.

- Diversification of investment portfolios: Investors are likely to diversify their investments across different asset classes to mitigate risk.

- Increased focus on risk management: Risk assessment and management will play an even more crucial role in investment decisions.

- Exploration of alternative investment strategies: The changing market conditions may lead to the exploration of alternative real estate investment strategies or other asset classes.

<h2>Conclusion</h2>

The recent shift from professional to individual buyers in the real estate market signifies a significant change in market dynamics. Understanding the reasons behind this trend—from rising interest rates to shifting lifestyle preferences—is crucial for navigating the current climate. Whether you’re a seasoned investor or a first-time homebuyer, staying informed about these real estate market swings and adapting your strategies accordingly is key to success. Keep abreast of the latest trends in the real estate market to make informed decisions about your property investments. Understanding the dynamics of when professionals sold and individuals bought is paramount to navigating the ever-changing landscape of real estate.

Featured Posts

-

Bubba Wallace Speaks Out Against The Nascar Status Quo

Apr 28, 2025

Bubba Wallace Speaks Out Against The Nascar Status Quo

Apr 28, 2025 -

Devin Williams Struggles Continue Leading To Yankees Defeat

Apr 28, 2025

Devin Williams Struggles Continue Leading To Yankees Defeat

Apr 28, 2025 -

Yankees Aaron Judge And The 2025 Prediction A Push Up Enigma

Apr 28, 2025

Yankees Aaron Judge And The 2025 Prediction A Push Up Enigma

Apr 28, 2025 -

Profitable Prop Bets For The Nascar Jack Link 500 At Talladega 2025

Apr 28, 2025

Profitable Prop Bets For The Nascar Jack Link 500 At Talladega 2025

Apr 28, 2025 -

Hollywood Production Halted Wga And Sag Aftra Strike Impacts Film And Television

Apr 28, 2025

Hollywood Production Halted Wga And Sag Aftra Strike Impacts Film And Television

Apr 28, 2025