Weak Retail Numbers: Pressure Mounts On Bank Of Canada To Cut Rates

Table of Contents

Declining Retail Sales: A Deeper Dive

The recent decline in retail sales paints a concerning picture of the Canadian economy's health. Understanding the reasons behind this weakening trend is crucial for predicting future economic activity and the potential policy responses.

Impact of High Interest Rates

Rising interest rates are a primary culprit behind the decline in consumer spending. The increased cost of borrowing has made significant purchases, particularly those financed through loans, considerably more expensive.

- Housing sector: The housing market has been particularly hard hit, with sales significantly down due to higher mortgage rates.

- Durable goods: Purchases of big-ticket items like appliances and vehicles have also experienced a substantial drop.

- Consumer Confidence Index: The consumer confidence index has fallen sharply, reflecting decreased optimism about the future economic outlook and a reluctance to spend.

- Sales decline: Preliminary estimates suggest a decline in retail sales of X% compared to the previous quarter (replace X with actual data).

This weakening retail sales trend, driven largely by high-interest rate impact, is a significant cause for concern.

Inflation's Persistent Grip

Persistent inflation continues to erode consumer purchasing power, further contributing to declining retail sales. High inflation rates mean that each dollar buys less, leaving consumers with less disposable income for discretionary spending.

- Current inflation rate: The current inflation rate in Canada stands at Y% (replace Y with actual data), significantly higher than the Bank of Canada's target.

- Year-on-year comparison: Inflation is up Z% compared to last year (replace Z with actual data), squeezing household budgets.

- Impact on disposable income: The combination of high inflation and stagnant wages has dramatically reduced the disposable income available to Canadian households, directly impacting their ability to engage in retail spending.

The inflationary pressure continues to significantly constrain consumer spending and amplify the impact of already weakening retail sales.

Bank of Canada's Dilemma: To Cut or Not to Cut?

Faced with weakening retail numbers and other troubling economic indicators, the Bank of Canada is in a difficult position. The decision to cut interest rates or maintain the current policy carries significant implications.

Economic Indicators Pointing Towards a Rate Cut

Beyond the concerning retail sales figures, other economic indicators point towards a potential recession and the need for a rate cut to stimulate the economy.

- GDP growth rate: The recent GDP growth rate has slowed considerably, signaling a potential economic slowdown.

- Unemployment figures: While unemployment remains relatively low, there are signs of softening in the labor market.

- Housing market indicators: The continued decline in the housing market, further fueled by high interest rates, adds pressure for intervention.

These economic indicators, combined with the weak retail numbers, paint a picture that suggests a significant economic slowdown is underway.

Risks of Rate Cuts

While a rate cut might stimulate the economy in the short term, it also carries risks, notably the potential to further fuel inflation.

- Potential inflationary risks: Lowering interest rates could increase borrowing and spending, potentially exacerbating existing inflationary pressures.

- Impact on the Canadian dollar: A rate cut could weaken the Canadian dollar, increasing the cost of imports and potentially further driving up inflation.

The Bank of Canada needs to carefully weigh the benefits of stimulating the economy through rate cuts against the risks of further fueling inflation, a critical component in navigating the challenges presented by these weak retail numbers.

Market Reactions and Expert Opinions

The weak retail sales data has already generated significant market reaction and prompted diverse opinions among economists.

Stock Market Response

The stock market has reacted negatively to the weak retail sales data, reflecting investor concerns about the economic outlook.

- Stock market indices performance: Major Canadian stock market indices have experienced declines following the release of the retail sales figures.

- Analyst comments: Many analysts are expressing concerns about the potential for a recession and the need for the Bank of Canada to intervene. Market volatility is expected to continue in the short term.

The negative market response to these weak retail numbers highlights the severity of the situation and emphasizes the importance of the Bank of Canada's decision.

Economist Predictions

Economists hold differing views on the Bank of Canada's likely response and the timing and magnitude of any potential rate cut.

- Diverse predictions: Some economists predict an immediate rate cut, while others advocate for a wait-and-see approach to assess the situation further.

- Expert analysis: Many leading economists believe that the Bank of Canada will eventually need to cut rates to counter the economic slowdown and support consumer spending. However, the timing of this intervention remains a subject of debate.

The economic forecasts highlight the uncertainty surrounding the Bank of Canada's response, adding to the already volatile market conditions driven by these weak retail numbers.

Conclusion

In conclusion, weak retail numbers are putting significant pressure on the Bank of Canada to consider a rate cut to stimulate the economy. However, such a move carries the risk of exacerbating inflation. The Bank of Canada faces a complex dilemma, needing to balance the need to support economic growth with the risk of further inflationary pressures. The market is reacting negatively to these weak retail numbers, reflecting the uncertainty and concern surrounding the potential recession. Keep an eye on the Bank of Canada's announcements regarding interest rates to see how they respond to these weak retail numbers and the growing economic uncertainty. Understanding the impact of weak retail numbers on monetary policy is crucial for navigating the current economic climate. The implications of these weak retail numbers remain significant and require close monitoring in the coming months.

Featured Posts

-

Starbucks Unionization Wage Increase Proposal Rejected

Apr 28, 2025

Starbucks Unionization Wage Increase Proposal Rejected

Apr 28, 2025 -

Stock Market Valuation Concerns Bof As Perspective And Reassurance For Investors

Apr 28, 2025

Stock Market Valuation Concerns Bof As Perspective And Reassurance For Investors

Apr 28, 2025 -

Aaron Judge And Paul Goldschmidt The Driving Force Behind Yankees Win

Apr 28, 2025

Aaron Judge And Paul Goldschmidt The Driving Force Behind Yankees Win

Apr 28, 2025 -

International Figures Attend Pope Francis Funeral Service

Apr 28, 2025

International Figures Attend Pope Francis Funeral Service

Apr 28, 2025 -

The Reality Of Relocating Laid Off Federal Employees Seeking State And Local Positions

Apr 28, 2025

The Reality Of Relocating Laid Off Federal Employees Seeking State And Local Positions

Apr 28, 2025

Latest Posts

-

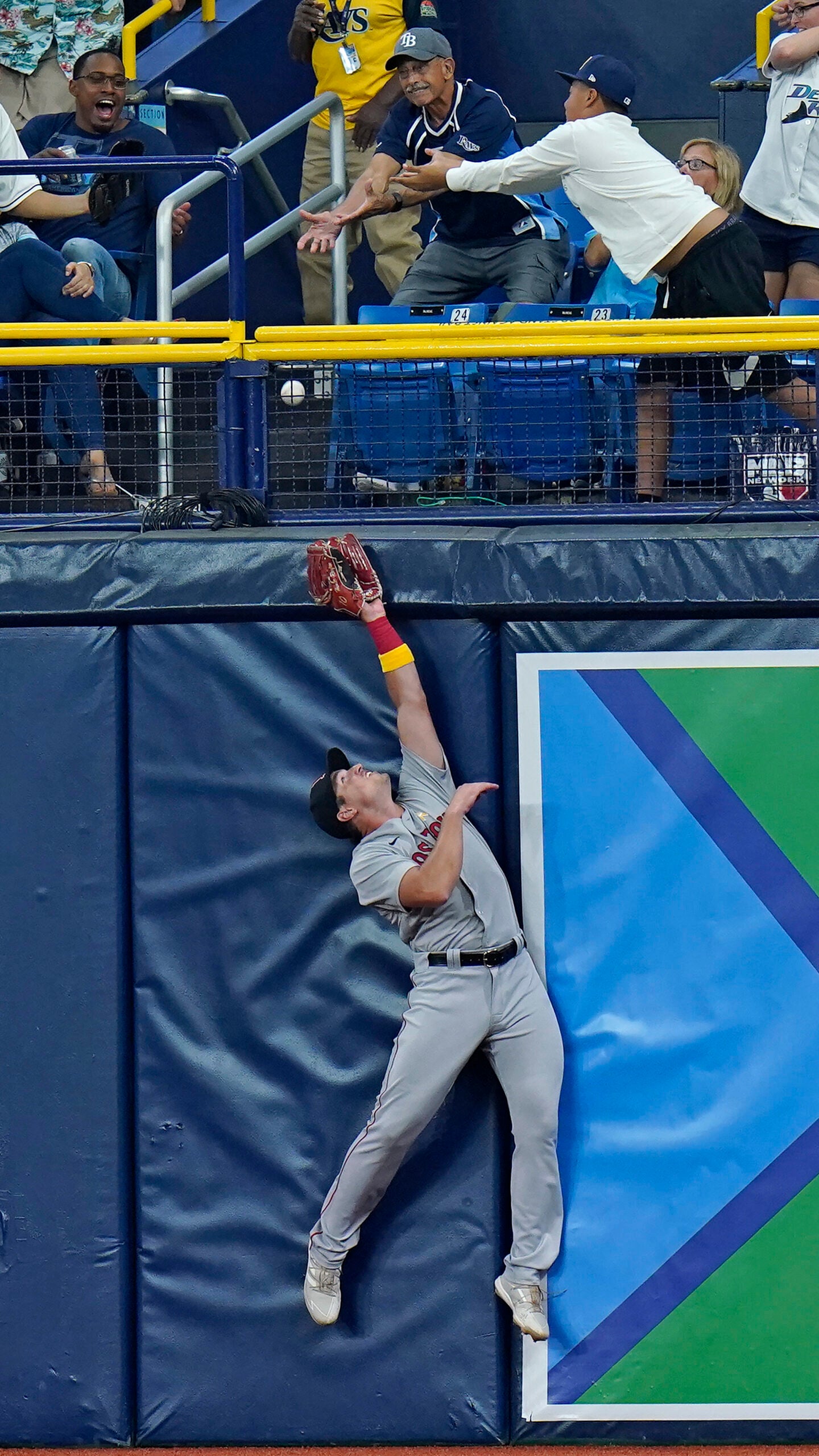

Red Sox Roster Update Outfielder Returns Casas Moves Down In Batting Order

Apr 28, 2025

Red Sox Roster Update Outfielder Returns Casas Moves Down In Batting Order

Apr 28, 2025 -

Red Sox Lineup Changes Casas Slide And Outfielders Return

Apr 28, 2025

Red Sox Lineup Changes Casas Slide And Outfielders Return

Apr 28, 2025 -

Red Sox Lineup Shuffle Casas Demoted Struggling Outfielder Returns

Apr 28, 2025

Red Sox Lineup Shuffle Casas Demoted Struggling Outfielder Returns

Apr 28, 2025 -

Predicting A Jarren Duran Style Breakout For This Red Sox Outfielder

Apr 28, 2025

Predicting A Jarren Duran Style Breakout For This Red Sox Outfielder

Apr 28, 2025 -

Is This Red Sox Outfielder The Next Jarren Duran A Breakout Season Prediction

Apr 28, 2025

Is This Red Sox Outfielder The Next Jarren Duran A Breakout Season Prediction

Apr 28, 2025