Trump Demands Powell's Termination: A Critical Analysis

Table of Contents

The Political Context of Trump's Demands

Trump's Economic Ideology and its Conflict with Powell's Approach

Trump's economic ideology favored lower interest rates and robust economic growth, often prioritizing short-term gains over long-term stability. This clashed sharply with Powell's approach, which focused on maintaining price stability and managing inflation according to the Fed's dual mandate. Trump believed lower rates would boost economic activity and the stock market, fueling his "America First" agenda. Powell, however, adhered to a more cautious approach, raising interest rates to combat inflation and prevent overheating of the economy.

- Specific examples of Trump's criticisms:

- Publicly criticizing rate hikes as "too fast" and harming economic growth.

- Accusing Powell of trying to sabotage his presidency.

- Suggesting the Fed was artificially suppressing the dollar.

The Independence of the Federal Reserve and its Importance

The Federal Reserve's independence from direct political pressure is a cornerstone of the US economic system. Established to insulate monetary policy from short-term political considerations, this independence is crucial for maintaining confidence in the currency and the financial system. Undermining this independence could have severe consequences, leading to unpredictable monetary policy shifts and damaging investor confidence.

- Arguments for maintaining the Fed's independence:

- Protects monetary policy from partisan politics.

- Enhances credibility and stability of the US dollar.

- Promotes long-term economic health over short-term political expediency.

Economic Implications of Trump's Actions

Impact on Market Volatility and Investor Confidence

Trump's repeated attacks on Powell directly impacted market volatility and investor confidence. Every statement questioning Powell's competence or suggesting his removal triggered significant market fluctuations, reflecting uncertainty about the future direction of monetary policy. The lack of predictability increased risk aversion, affecting investment decisions and potentially stifling economic growth.

- Examples of market fluctuations:

- Stock market drops following particularly harsh criticisms of Powell.

- Increased volatility in the bond market reflecting uncertainty about interest rate policy.

- Strengthening of the dollar following periods of market uncertainty.

Potential Effects on Inflation and Economic Growth

Prematurely lowering interest rates, as advocated by Trump, could have fueled inflation, potentially eroding purchasing power and harming long-term economic growth. Disrupting the Fed's carefully calibrated monetary policy risks jeopardizing the balance between economic growth and price stability.

- Potential scenarios and their likely outcomes:

- Rapid inflation: A sudden increase in the money supply could lead to a surge in inflation, eroding savings and potentially causing social unrest.

- Economic slowdown: Uncertain monetary policy could stifle investment and decrease economic growth.

- Currency devaluation: A loss of confidence in the Fed's ability to manage the economy could lead to a devaluation of the US dollar.

Legal and Constitutional Aspects of Removing the Fed Chair

The Process for Removing a Federal Reserve Chair

Removing a Federal Reserve Chair is not a simple process. While the President can appoint the Chair, removing them requires a demonstrable reason of incompetence or malfeasance, and even then, the process is complex and fraught with challenges.

- Steps involved in the removal process:

- The President would need to demonstrate substantial cause for removal.

- The process would likely involve legal challenges and scrutiny.

- Congressional involvement could further complicate the process.

Constitutional Concerns and Separation of Powers

Trump's demands raised significant constitutional concerns regarding the separation of powers. The Federal Reserve's independence is designed to protect monetary policy from political interference, ensuring that decisions are based on economic principles rather than partisan considerations. Attempts to remove a Chair for purely political reasons would constitute a serious breach of this principle.

- Constitutional arguments against presidential interference:

- Violation of the principle of independent central banking.

- Undermining the separation of powers between the executive and the Federal Reserve.

- Risk of politicizing monetary policy for short-term political gains.

Analyzing Trump Demands Powell's Termination – A Critical Summation

This analysis reveals the multifaceted nature of Trump's demands for Powell's termination. The controversy highlighted the tension between political pressures and the necessity of an independent central bank, showcasing significant economic and constitutional implications. The potential for market volatility, inflation, and damage to the US dollar’s credibility underscored the gravity of the situation. The legal and constitutional complexities surrounding the removal process further demonstrate the importance of maintaining the Fed's independence.

The implications of “Trump Demands Powell's Termination” extend far beyond the immediate political context. It serves as a crucial case study in the ongoing debate about the appropriate balance between political influence and the independence of institutions essential to a stable and functioning economy. We encourage readers to further research this critical topic and its ramifications for the future of US economic policy and global financial stability. What are your thoughts on the implications of this unprecedented demand? Let's discuss!

Featured Posts

-

Washington Nationals Reliever Jorge Lopezs Three Game Suspension For Hitting Andrew Mc Cutchen

Apr 23, 2025

Washington Nationals Reliever Jorge Lopezs Three Game Suspension For Hitting Andrew Mc Cutchen

Apr 23, 2025 -

Francona Misses Brewers Game Because Of Illness

Apr 23, 2025

Francona Misses Brewers Game Because Of Illness

Apr 23, 2025 -

Analyzing The Reds Unprecedented 1 0 Losing Streak

Apr 23, 2025

Analyzing The Reds Unprecedented 1 0 Losing Streak

Apr 23, 2025 -

Detroit Tigers Suffer 5 1 Loss To Brewers Drop Series

Apr 23, 2025

Detroit Tigers Suffer 5 1 Loss To Brewers Drop Series

Apr 23, 2025 -

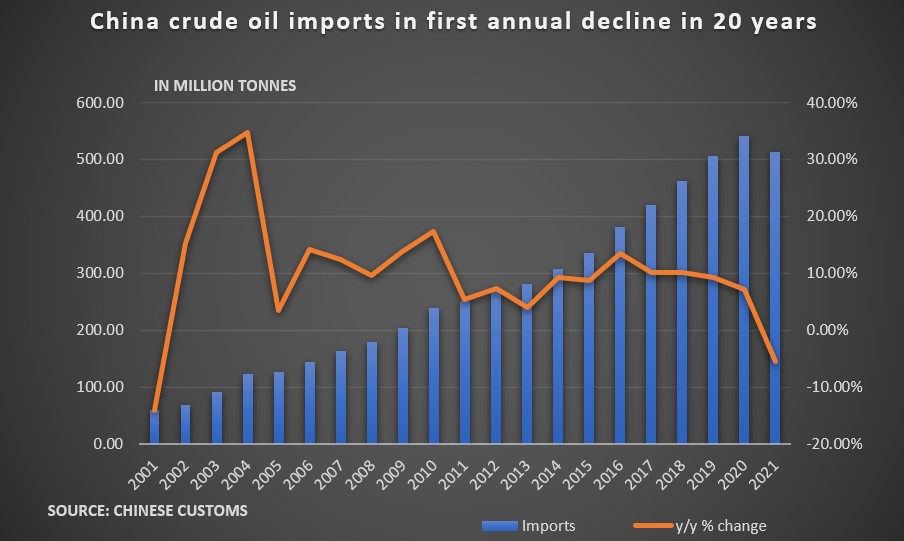

Shifting Sands Chinas Oil Imports And The Canada Us Dynamic

Apr 23, 2025

Shifting Sands Chinas Oil Imports And The Canada Us Dynamic

Apr 23, 2025