The Trump Tariff Effect: CEO Warnings And Market Volatility

Table of Contents

CEO Warnings and Their Justifications

Numerous CEOs publicly voiced concerns about the detrimental effects of Trump tariffs. These warnings weren't simply expressions of displeasure; they reflected tangible impacts on their businesses and the broader economy. The justifications were consistent across various sectors, highlighting the far-reaching consequences of these protectionist measures.

-

Increased Costs: Tariffs directly increased input costs for many companies, squeezing profit margins and forcing difficult decisions about pricing and production.

-

Reduced Competitiveness: American companies faced challenges competing against foreign rivals who were not subject to the same tariffs, leading to reduced market share and potential job losses.

-

Potential Job Losses: The fear of job losses due to decreased competitiveness and reduced production was a major concern voiced by numerous CEOs. Companies worried about relocating production to avoid tariffs or facing closures altogether.

Specific Examples:

- Manufacturing: Steel and aluminum producers initially benefitted, but downstream manufacturers reliant on these materials faced significant cost increases. CEOs in the automotive and construction industries voiced strong concerns about the price hikes.

- Agriculture: The agricultural sector suffered greatly from retaliatory tariffs imposed by China, impacting exports of soybeans, pork, and other agricultural products. Numerous agricultural CEOs warned of farm closures and rural economic hardship.

- Technology: The tech industry was affected by tariffs on components and finished goods, leading to increased costs for consumers and impacting innovation. CEOs in this sector expressed anxieties about supply chain disruptions and lost opportunities.

The uncertainty created by the Trump tariffs significantly impacted investment decisions and business strategies. Companies delayed expansion plans, reduced capital expenditures, and prioritized risk mitigation over growth. This uncertainty created a chilling effect on the overall business environment, hindering economic progress. Keywords: CEO statements, tariff impact, business decisions, investment uncertainty

Market Volatility and its Correlation to Tariff Announcements

The relationship between tariff announcements and stock market fluctuations was undeniable. Periods of heightened tariff activity were consistently followed by increased market volatility. This volatility reflected investor uncertainty and the ongoing reassessment of risk in the global economy.

(Insert chart/graph here illustrating market volatility correlated with tariff announcements)

Market Reactions to Specific Tariff Announcements:

- Announcement of Steel and Aluminum Tariffs: Initial positive reaction in the steel and aluminum sectors, followed by negative reactions in related downstream industries.

- Escalation of Trade War with China: Significant market sell-off as investors anticipated negative global economic consequences.

- Tariff Exemptions and Renegotiations: Periods of relative stability and market recovery, often short-lived.

Sectors Most Affected by Volatility:

- Trade-sensitive sectors (e.g., manufacturing, agriculture, technology) showed the greatest volatility.

- Financials and other sectors with global exposure were significantly impacted.

The volatility shook investor confidence, influencing capital flows and investment strategies. Investors became more risk-averse, seeking safe haven assets and reducing exposure to trade-sensitive sectors. Keywords: Market volatility, stock market reaction, investor confidence, tariff announcements

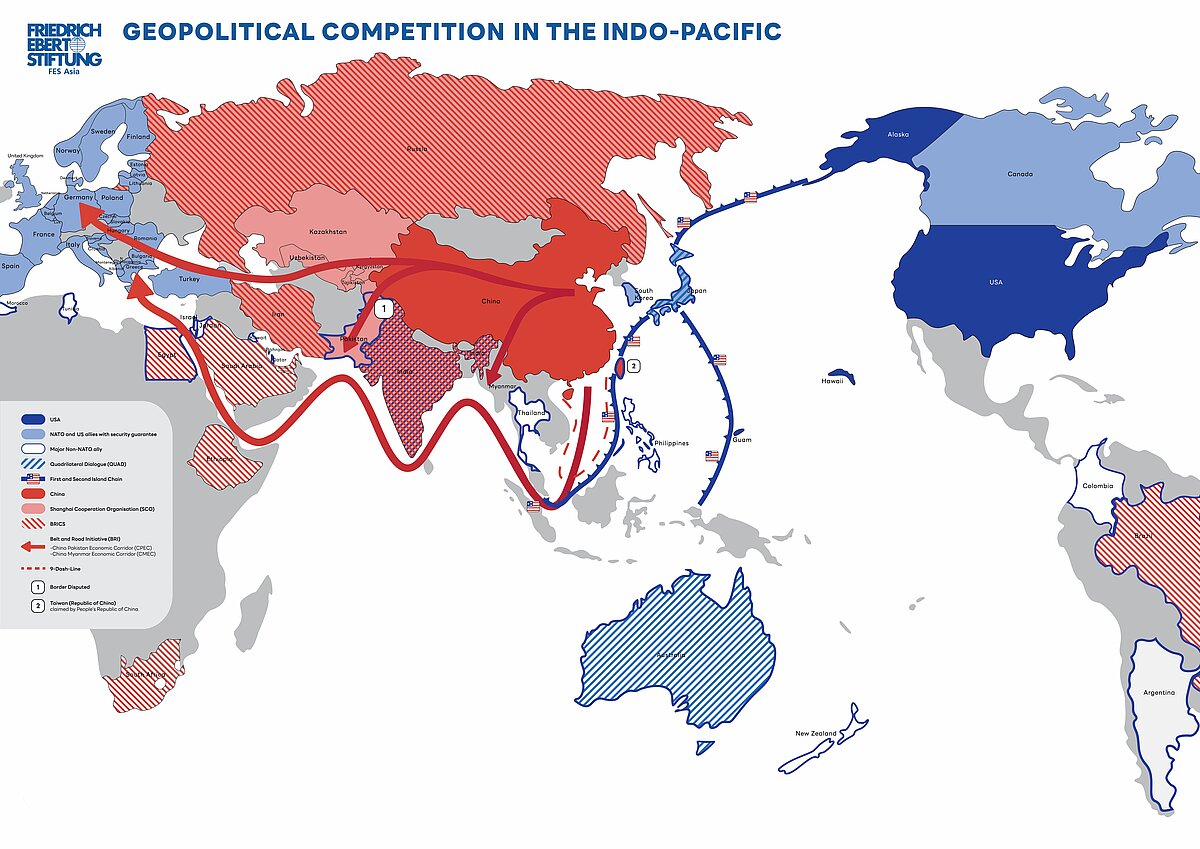

The Ripple Effect: Global Economic Consequences of Trump Tariffs

The Trump tariffs had far-reaching global economic implications, extending beyond the initial target sectors and countries. Disruptions to established trade relationships, supply chains, and international cooperation were significant.

Global Trade Disruptions:

- Retaliatory tariffs: Other countries retaliated with their own tariffs, creating a tit-for-tat trade war that harmed multiple economies.

- Supply chain disruptions: Companies struggled to adapt to shifting trade patterns, leading to increased costs and delays.

- Reduced global trade: Overall global trade volumes slowed as a result of the trade tensions.

Effects on Specific Countries and Regions:

- China: Suffered significantly from tariffs on agricultural exports and other goods.

- European Union: Experienced retaliatory tariffs on various products, impacting businesses and consumers.

- Developing countries: Experienced disruptions in export markets and supply chains.

The Trump tariffs significantly damaged international cooperation and trust, undermining efforts to create a stable and predictable global trading system. Keywords: Global trade, supply chain disruptions, international trade relations, retaliatory tariffs

Long-Term Effects and Lasting Impacts of Trade Wars

The long-term effects of the Trump tariffs continue to unfold, but certain impacts are already evident. Changes in supply chains, manufacturing locations, and consumer behavior are significant.

Lasting Changes:

- Reshoring and nearshoring: Some companies relocated production closer to home to mitigate tariff risks, though this process was often costly and complex.

- Diversification of supply chains: Businesses sought to reduce their dependence on single suppliers and diversify their sources of raw materials and components.

- Increased prices for consumers: Tariffs ultimately led to higher prices for many consumer goods, impacting household budgets.

Ongoing Impact:

- Inflationary pressures: The increased cost of imported goods contributed to inflationary pressures in several countries.

- Geopolitical tensions: The trade war exacerbated existing geopolitical tensions and undermined multilateral efforts to promote free trade.

- Uncertainty in international trade: The legacy of the Trump tariffs created uncertainty and volatility in global trade relations.

The full economic consequences of the Trump tariffs will likely be felt for years to come. Keywords: Long-term effects, trade war consequences, economic recovery, inflation

Conclusion: Understanding the Trump Tariff Effect and Future Implications

The Trump tariffs had profound and multifaceted consequences. CEO warnings accurately reflected the significant challenges faced by businesses due to increased costs, reduced competitiveness, and supply chain disruptions. Market volatility directly correlated with tariff announcements, reflecting investor uncertainty and fear. Finally, the global economic consequences, including retaliatory tariffs and supply chain issues, underscore the far-reaching impact of protectionist policies.

The long-term effects of these policies continue to unfold, impacting business strategies, consumer behavior, and global economic stability. Understanding the complexities of the Trump tariff effect and its lasting impact is crucial for navigating future trade disputes and formulating effective economic policy. Further research into the intricacies of Trump tariffs and their influence on market volatility is essential. Explore additional resources to gain a deeper understanding of international trade and the consequences of protectionist measures. The consequences of poorly considered trade policy serve as a valuable lesson in the interconnectedness of the global economy.

Featured Posts

-

The Closing Of Anchor Brewing Company What Happens Next

Apr 26, 2025

The Closing Of Anchor Brewing Company What Happens Next

Apr 26, 2025 -

Turning Poop Into Prose An Ai Powered Podcast Revolution

Apr 26, 2025

Turning Poop Into Prose An Ai Powered Podcast Revolution

Apr 26, 2025 -

Us China Geopolitical Competition A Focus On A Key Military Base

Apr 26, 2025

Us China Geopolitical Competition A Focus On A Key Military Base

Apr 26, 2025 -

Chronology Of The Legal Battles In The Karen Read Murder Case

Apr 26, 2025

Chronology Of The Legal Battles In The Karen Read Murder Case

Apr 26, 2025 -

Strategic Military Base A Focal Point In The Us China Power Struggle

Apr 26, 2025

Strategic Military Base A Focal Point In The Us China Power Struggle

Apr 26, 2025