The Trump-Powell Conflict: A Deep Dive Into The Ongoing Dispute

Table of Contents

The Roots of the Conflict

The Trump-Powell conflict stemmed from a fundamental disagreement over economic policy and the role of the Federal Reserve.

Trump's Expectations and Economic Policies

Trump's economic agenda prioritized rapid economic growth and low interest rates. He frequently criticized the Fed for what he perceived as a slow response to stimulate the economy and for not adequately supporting his policies.

- Emphasis on tax cuts and deregulation: Trump's administration implemented significant tax cuts and deregulation, aiming to boost economic activity. However, these policies also fueled concerns about potential inflationary pressures.

- Belief in a strong dollar: While a strong dollar can benefit consumers through lower import prices, it can hurt American exporters. Trump often expressed his desire for a strong dollar, potentially conflicting with the Fed's monetary policy goals.

- Public criticism of Powell's actions: Trump frequently voiced his disapproval of the Fed's actions through public statements, tweets, and interviews, creating significant uncertainty in the markets. He openly called for interest rate cuts, even when economic indicators didn't necessarily warrant them.

Powell's Independent Stance and Mandate

The Federal Reserve, under Powell's leadership, maintained its commitment to its dual mandate: price stability and maximum employment. This mandate necessitates an independent approach, free from undue political influence.

- Data-driven approach to monetary policy: The Fed's decisions are based on economic data analysis, aiming to ensure long-term stability rather than reacting to short-term political pressures.

- Defense of the Fed's independence: Powell consistently defended the Fed's independence, emphasizing the importance of avoiding political interference in monetary policy decisions. This stance directly countered Trump's attempts to influence the Fed's actions.

- Historical context of Fed independence: The historical context of the Fed’s independence underscores the importance of protecting it from political manipulation to maintain credibility and effectiveness in managing the economy.

Key Events and Turning Points

Several key events escalated the Trump-Powell conflict.

Interest Rate Hikes and Market Reactions

The Fed's decision to raise interest rates in 2018 and 2019 directly clashed with Trump's preference for lower rates. These hikes triggered significant market reactions.

- Specific interest rate increases: Each interest rate increase by the Fed was met with strong criticism from Trump, highlighting the growing tension between the two.

- Trump's public criticism: Trump's public criticism following each rate hike fueled market uncertainty and volatility.

- Stock market reactions and economic consequences: The market reacted negatively to Trump's attacks on the Fed, adding to the existing anxieties surrounding interest rate adjustments.

Trump's Attempts to Influence the Fed

Trump employed various methods to pressure the Fed, raising serious concerns about the erosion of the central bank's independence.

- Public statements and tweets: Trump's frequent public statements and tweets criticizing the Fed directly undermined its credibility and independence.

- Calls for lower interest rates: His repeated calls for lower interest rates, often irrespective of economic data, demonstrated his willingness to override the Fed's professional judgment.

- Potential legal and ethical implications: The ethical and legal implications of a president attempting to influence the Fed's decision-making process remain a subject of debate and scrutiny.

Consequences and Long-Term Implications

The Trump-Powell conflict had significant consequences for the US economy and the broader political landscape.

Impact on Financial Markets

The conflict introduced considerable uncertainty into financial markets, affecting investor confidence and overall economic stability.

- Increased uncertainty: Trump's unpredictable attacks on the Fed increased uncertainty among investors, leading to market volatility.

- Fluctuations in the stock market: The stock market experienced significant fluctuations in response to the ongoing tension between Trump and Powell.

- Impact on bond yields and currency exchange rates: The conflict also impacted bond yields and currency exchange rates, reflecting the uncertainty surrounding economic policy.

Political Ramifications and Erosion of Trust

The conflict damaged the reputation of the Fed and raised concerns about the broader erosion of trust in key institutions.

- Damage to the reputation of the Fed: Trump's attacks on the Fed's independence undermined public trust in its ability to manage the economy effectively.

- Debates on the independence of central banks: The conflict reignited debates on the importance of maintaining the independence of central banks worldwide.

- Potential for future political interference: The episode served as a cautionary tale, highlighting the potential for future political interference in monetary policy decisions in the US and other countries.

Conclusion

The Trump-Powell conflict serves as a significant case study in the intricate interplay between politics and economics. The dispute highlighted the crucial importance of maintaining the independence of central banks and the potential ramifications of political interference in monetary policy. Understanding the dynamics of this conflict is crucial for navigating future economic challenges and appreciating the delicate balance between economic policy and political influence. Further research into the Trump-Powell conflict and the broader topic of central bank independence is encouraged to gain a deeper understanding of these critical issues. To delve deeper into this fascinating and impactful relationship, continue exploring resources on the Trump-Powell conflict and its lasting legacy.

Featured Posts

-

Yankees Record Breaking Night Judges 3 Home Runs Lead To 9 Total

Apr 23, 2025

Yankees Record Breaking Night Judges 3 Home Runs Lead To 9 Total

Apr 23, 2025 -

Best And Worst Uk Diy Stores A Consumer Report

Apr 23, 2025

Best And Worst Uk Diy Stores A Consumer Report

Apr 23, 2025 -

Record Setting Night Yankees Hit 9 Home Runs Judge With A Historic Performance

Apr 23, 2025

Record Setting Night Yankees Hit 9 Home Runs Judge With A Historic Performance

Apr 23, 2025 -

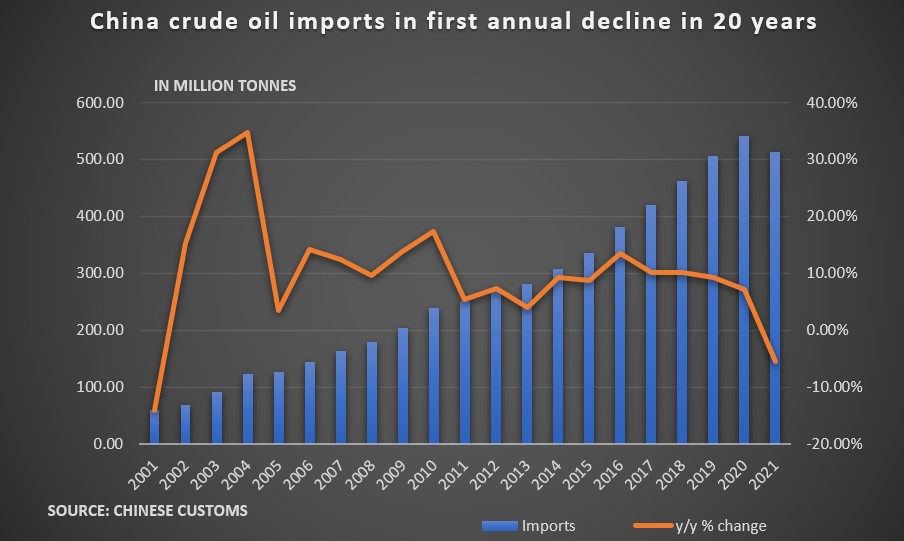

Shifting Sands Chinas Oil Imports And The Canada Us Dynamic

Apr 23, 2025

Shifting Sands Chinas Oil Imports And The Canada Us Dynamic

Apr 23, 2025 -

Du Dry January A La Tournee Minerale Bienfaits Pour La Sante Et L Industrie Du Sans Alcool

Apr 23, 2025

Du Dry January A La Tournee Minerale Bienfaits Pour La Sante Et L Industrie Du Sans Alcool

Apr 23, 2025