The Private Credit Job Market: 5 Do's And Don'ts For Applicants

Table of Contents

Do's for Success in the Private Credit Job Market

1. Network Strategically

Building a strong network is paramount in the private credit industry. Private credit networking is less about cold emailing and more about building genuine relationships.

- Attend Industry Events: Conferences, workshops, and industry-specific seminars offer invaluable opportunities to meet professionals and learn about current trends in private debt. Private equity networking events often overlap and can provide valuable connections.

- Leverage LinkedIn: Use LinkedIn to connect with recruiters specializing in private credit placements and individuals working at firms you admire. Engage with their content and participate in relevant discussions.

- Informational Interviews: Reach out to professionals for informational interviews. These conversations provide valuable insights into the industry and can open doors to potential opportunities. Don't underestimate the power of a simple conversation.

- Target Your Networking: Focus your efforts on networking within specific niches of private credit that align with your career goals (e.g., distressed debt, real estate lending).

2. Tailor Your Resume and Cover Letter

Your resume and cover letter are your first impression. A generic application won't cut it in the competitive private credit job market. A well-crafted private credit resume and cover letter should highlight your relevant skills and experience.

- Quantify Achievements: Use metrics to demonstrate the impact of your work. Instead of saying "improved efficiency," say "increased ROI by 15% through streamlined processes."

- Highlight Transferable Skills: Even if your background isn't directly in private credit, highlight skills like financial analysis, accounting, or risk management. These are highly valued in private debt roles.

- Customize for Each Application: Don't use a generic template. Carefully tailor your resume and cover letter to each specific job description and the firm's investment strategy.

- Showcase Understanding: Demonstrate a clear understanding of key private credit strategies like direct lending, mezzanine financing, and distressed debt investing.

3. Master the Private Credit Interview

The private credit interview is rigorous. Preparation is crucial to succeed. Mastering the private credit interview requires more than just technical knowledge.

- Practice Common Questions: Prepare for common interview questions focusing on your experience with financial modeling, valuation techniques, and specific private credit strategies. Anticipate questions about distressed debt, credit analysis, and risk assessment.

- Demonstrate Financial Acumen: Show proficiency in financial modeling and valuation techniques. Be ready to discuss your experience with LBO modeling, discounted cash flow (DCF) analysis, and other relevant methods.

- Research the Firm: Thoroughly research the firm's investment strategy, recent transactions, and team members. Showing genuine interest and knowledge impresses interviewers.

- Prepare Thoughtful Questions: Asking insightful questions demonstrates your engagement and interest. Prepare questions about the firm's investment thesis, current market challenges, and future opportunities.

Don'ts to Avoid in the Private Credit Job Market

1. Neglecting Due Diligence

Failing to research firms and their investment strategies is a major mistake. Private credit due diligence extends beyond simply reviewing a job description.

- Thorough Research: Don't apply for jobs without thoroughly understanding the firm's investment focus, target markets, and recent activities. Research their portfolio companies and their performance.

- Understand the Fund: Understand the specific fund or strategy you're applying to. Each fund has unique investment parameters and risk profiles.

- Targeted Applications: Avoid submitting generic applications. Tailor each application to the specific requirements of the role and the firm's investment style.

2. Underestimating the Importance of Financial Modeling

Financial modeling is fundamental to private credit. Proficiency in this area is non-negotiable. Private credit financial modeling skills separate the successful candidates from the rest.

- Showcase Modeling Skills: Highlight your financial modeling skills prominently in your resume and be prepared to discuss your experience in detail during the interview.

- Demonstrate Proficiency: Be prepared to discuss your experience with various modeling techniques, including LBO modeling, DCF analysis, and sensitivity analysis. Walk interviewers through your process.

3. Lacking Enthusiasm and Passion

Genuine enthusiasm for the private credit industry is highly valued. Passion for private debt is contagious.

- Show Genuine Interest: Demonstrate genuine interest in the industry during the interview. Discuss current market trends and actively engage in discussions about the industry's challenges and opportunities.

- Be Knowledgeable: Stay up-to-date on industry news and demonstrate a deep understanding of current market conditions and trends. Discuss relevant articles or publications.

Conclusion

Securing a position in the competitive private credit job market requires a strategic and well-prepared approach. By following these do's and don'ts – from networking effectively to mastering the interview – you can significantly increase your chances of success. Remember to tailor your application materials, demonstrate a deep understanding of private credit principles, and showcase your passion for the industry. Start building your career in the lucrative private credit job market today!

Featured Posts

-

Post Roe America How Over The Counter Birth Control Reshapes Reproductive Healthcare

Apr 26, 2025

Post Roe America How Over The Counter Birth Control Reshapes Reproductive Healthcare

Apr 26, 2025 -

American Battleground A David Vs Goliath Showdown

Apr 26, 2025

American Battleground A David Vs Goliath Showdown

Apr 26, 2025 -

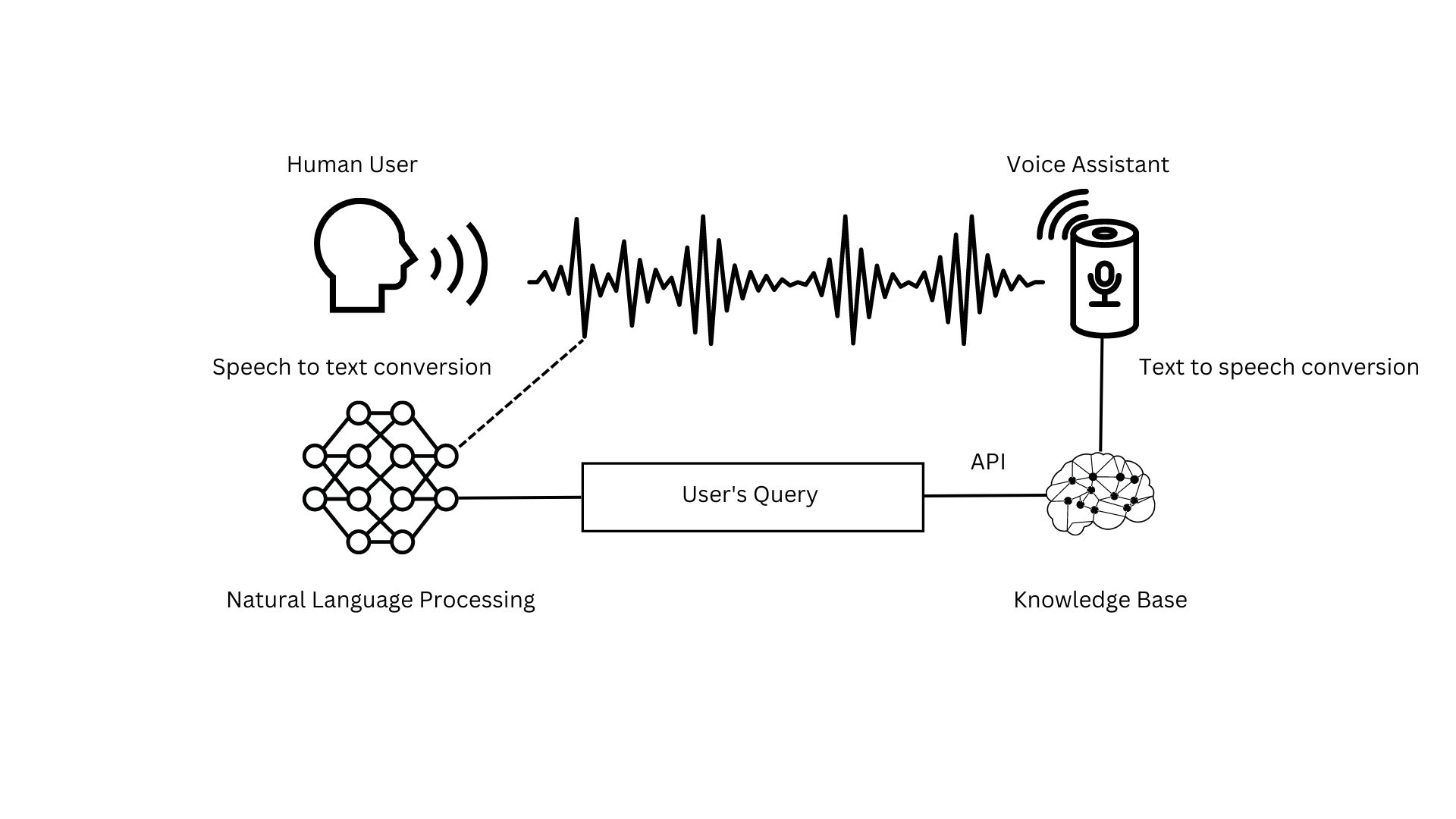

Building Voice Assistants Made Easy Open Ais 2024 Announcement

Apr 26, 2025

Building Voice Assistants Made Easy Open Ais 2024 Announcement

Apr 26, 2025 -

Ahmed Hassanein Poised To Make Nfl Draft History

Apr 26, 2025

Ahmed Hassanein Poised To Make Nfl Draft History

Apr 26, 2025 -

Harvards Turnaround A Conservative Professors Perspective

Apr 26, 2025

Harvards Turnaround A Conservative Professors Perspective

Apr 26, 2025