The Pre-Crisis Cracks In The Private Credit Market: A Credit Weekly Perspective

Table of Contents

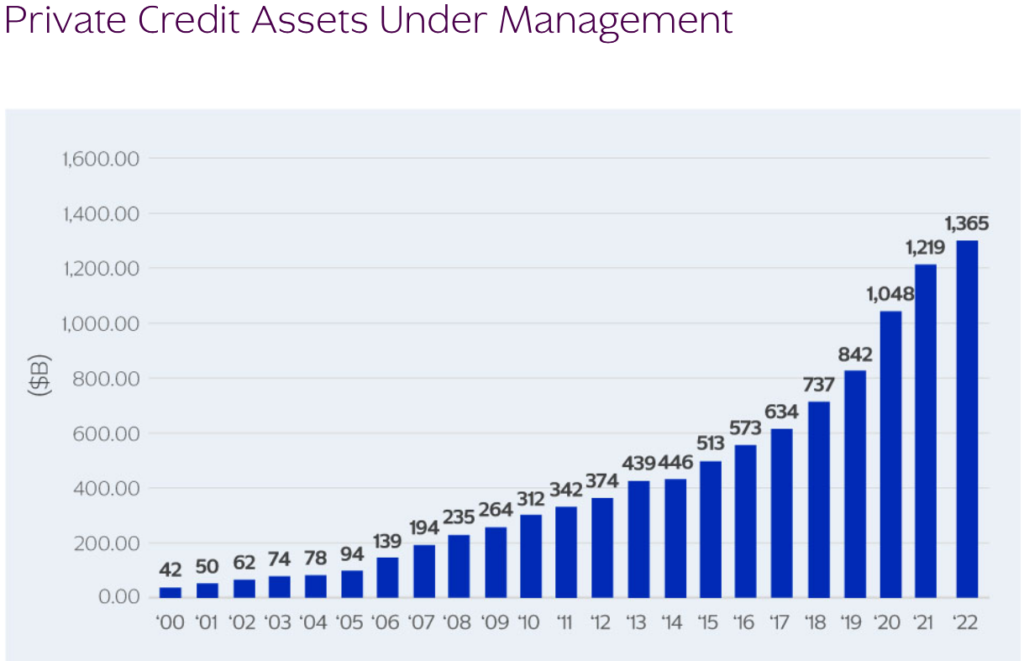

Rising Leverage and Risk Appetite in the Private Credit Market

Before major crises in the private credit market, a common thread is the significant increase in leverage and risk appetite. Low interest rates and abundant liquidity often fuel this behavior, encouraging lenders to pursue higher returns with less regard for underlying risk. This creates a dangerous feedback loop, where increased competition drives down lending standards and further inflates leverage.

Examples of this include the significant expansion of leveraged buyouts in the years leading up to the 2008 financial crisis, characterized by increasingly aggressive financial engineering and high levels of debt.

- Increased use of covenant-lite loans: These loans offer borrowers greater flexibility but expose lenders to increased risk.

- Growth of subordinated debt structures: The proliferation of complex debt structures obscures true risk and can lead to significant losses for junior creditors.

- Higher loan-to-value ratios: Lending more against the value of an asset increases the potential for losses in case of a downturn.

- Relaxation of underwriting standards: A rush to deploy capital can lead to a decline in the thoroughness of credit assessments.

Weakening Due Diligence and Underwriting Standards

The pressure to originate loans quickly and competitively often leads to a decline in the quality of due diligence and underwriting standards. This is particularly true in the private credit market, where the speed of deal execution is often prioritized over thorough risk assessment. Inexperienced personnel or insufficient expertise in evaluating complex financial structures can exacerbate this problem.

- Shorter due diligence periods: Less time for thorough investigation increases the likelihood of overlooking critical risks.

- Reduced emphasis on fundamental analysis: A focus on speed can lead to a reliance on superficial indicators rather than a deep dive into the borrower's financial health.

- Increased reliance on financial models: While models are useful tools, an over-reliance on them, without adequate scrutiny of underlying assumptions, can lead to inaccurate risk assessments.

- Lack of independent validation of financial information: Independent verification of financial data is crucial to mitigate the risk of fraud or misrepresentation.

Opaque Deal Structures and Lack of Transparency

Many private credit deals are characterized by complex structures and a lack of transparency. This opacity makes it difficult to accurately assess the true risk associated with these investments and compare them to other asset classes. Aggregating and analyzing data across this sector poses significant challenges, hindering comprehensive risk assessments and market analysis.

- Difficulty in obtaining accurate market data: The lack of centralized data repositories makes it challenging to track performance and identify trends.

- Limited standardization of reporting practices: Inconsistent reporting practices make it difficult to compare the performance of different private credit investments.

- Lack of public disclosure requirements: Unlike publicly traded debt, private debt often lacks the transparency of public disclosure requirements.

- Challenges in benchmarking performance: The lack of standardized data makes it challenging to benchmark the performance of private credit investments against other asset classes.

Early Warning Signals and Indicators to Watch

A "Credit Weekly" perspective is invaluable for identifying early warning signals of stress in the private credit market. By closely monitoring key metrics and indicators, investors and lenders can gain valuable insights into potential problems before they escalate into a crisis.

- Changes in credit spreads: Widening credit spreads can indicate increasing risk aversion in the market.

- Increased default rates: A rise in default rates is a clear sign of distress within the market.

- Decline in asset values: Falling asset values can trigger margin calls and exacerbate liquidity problems.

- Shifting investor sentiment: Changes in investor sentiment, as reflected in market pricing and trading activity, can provide early warnings.

- Changes in the regulatory environment: New regulations or enforcement actions can impact the credit market.

Navigating the Private Credit Market and Avoiding Future Crises

The pre-crisis cracks in the private credit market—rising leverage, weakening due diligence, opaque structures, and the difficulty of identifying early warning signals—pose significant risks. Rigorous due diligence, transparency, and robust risk management are essential to navigate this complex landscape. Investors and lenders should diversify their portfolios, carefully assess counterparty risk, and maintain sufficient liquidity buffers.

To avoid the pitfalls of these pre-crisis cracks in the private credit market, stay informed. Regular review of a comprehensive "Credit Weekly" analysis providing updates on early warning signals is crucial. Subscribe to our newsletter for a weekly perspective on private credit market trends and insights to help you make informed decisions and protect your investments.

Featured Posts

-

Impresionante Eliminacion En Indian Wells El Torneo Da Una Vuelca

Apr 27, 2025

Impresionante Eliminacion En Indian Wells El Torneo Da Una Vuelca

Apr 27, 2025 -

Pegula Defeats Collins To Win Charleston Title

Apr 27, 2025

Pegula Defeats Collins To Win Charleston Title

Apr 27, 2025 -

Napoleon Grills Ceos Commitment To Canadian Sourcing

Apr 27, 2025

Napoleon Grills Ceos Commitment To Canadian Sourcing

Apr 27, 2025 -

Pago De Licencia De Maternidad Para Tenistas Wta Un Ano De Salario Garantizado

Apr 27, 2025

Pago De Licencia De Maternidad Para Tenistas Wta Un Ano De Salario Garantizado

Apr 27, 2025 -

Celebrity Style Professional Take On Ariana Grandes Hair And Tattoo Debut

Apr 27, 2025

Celebrity Style Professional Take On Ariana Grandes Hair And Tattoo Debut

Apr 27, 2025