The Need For Fiscal Responsibility In Canada's Economic Plan

Table of Contents

The Current State of Canada's Finances

Understanding Canada's current financial landscape is crucial to appreciating the urgency of fiscal responsibility. Our debt-to-GDP ratio, a key indicator of a nation's fiscal health, has been steadily climbing in recent years. While the pandemic undeniably exacerbated the situation, pre-existing trends of increasing government spending and persistent budget deficits contributed significantly to this precarious position. Recent economic downturns, coupled with increased social program spending, have further strained government finances.

- Current national debt level: As of [Insert most recent data from a reputable source, e.g., Statistics Canada], Canada's national debt stands at [Insert figure].

- Projected deficit for the next fiscal year: The projected deficit for the upcoming fiscal year is estimated at [Insert figure, citing source].

- Major spending areas: Significant portions of the budget are allocated to healthcare, education, and various social programs, all essential yet demanding careful resource allocation.

- Sources of government revenue: Government revenue primarily comes from various taxes, including personal and corporate income taxes, GST/HST, and excise taxes. The effectiveness of the current tax system in generating sufficient revenue needs ongoing evaluation.

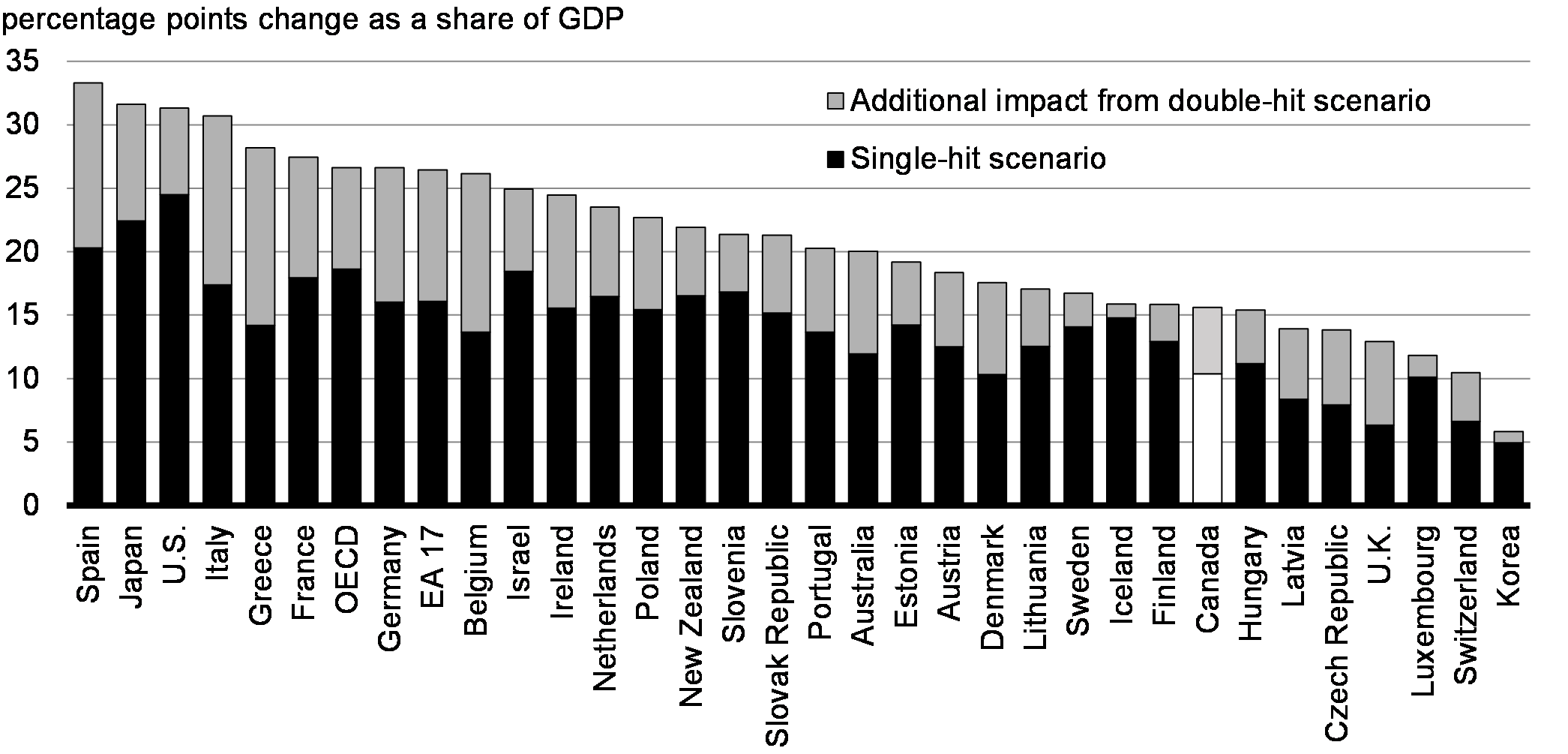

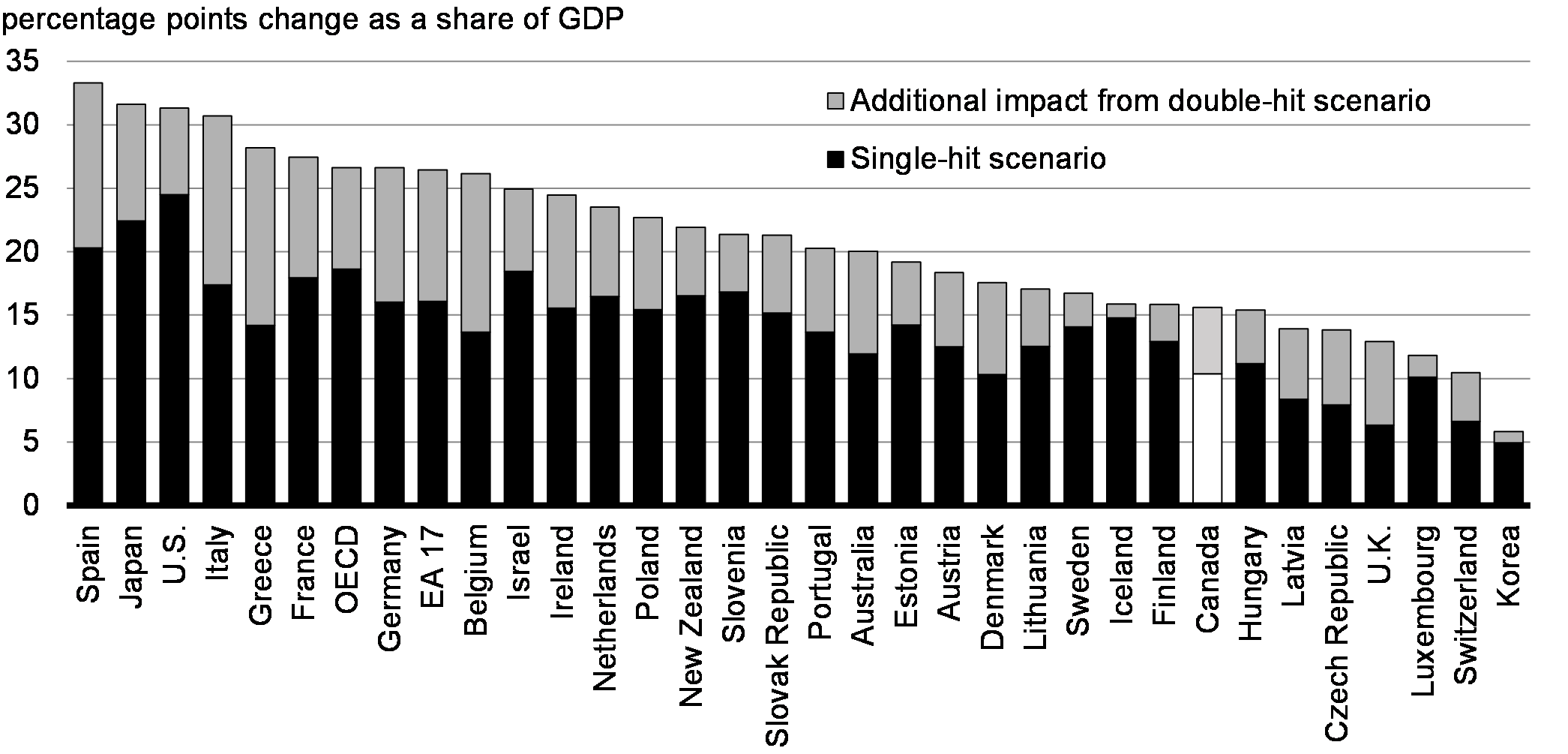

Analyzing these figures, it becomes evident that Canada needs a more sustainable approach to managing its finances. A simple comparison with other G7 nations regarding debt-to-GDP ratios provides valuable context. (Insert chart or graph comparing Canada's debt-to-GDP ratio with other G7 countries).

The Consequences of Fiscal Irresponsibility

Continuing on the path of fiscal irresponsibility carries severe consequences. Excessive government debt leads to increased interest payments, crowding out private investment, and ultimately hindering economic growth. This can manifest in several ways:

- Increased interest payments on national debt: A larger debt necessitates higher interest payments, diverting funds from essential public services and social programs.

- Crowding out of private investment: Increased government borrowing can push up interest rates, making it more expensive for businesses to invest and expand, stifling job creation and economic dynamism.

- Reduced government capacity to invest in essential services: A significant portion of government revenue is consumed by debt servicing, limiting the ability to invest in critical infrastructure, education, and healthcare.

- Potential for economic instability: Uncontrolled debt accumulation can lead to economic instability, potentially resulting in currency devaluation and inflationary pressures.

- Risk of a credit rating downgrade: A downgraded credit rating increases borrowing costs, further exacerbating the fiscal situation and potentially triggering a vicious cycle of debt.

Strategies for Achieving Fiscal Responsibility

Addressing Canada's fiscal challenges requires a multifaceted approach involving both revenue enhancement and expenditure management. While difficult choices are inevitable, a strategic and responsible plan can lead to a healthier financial future.

- Tax Reforms: Reforming the tax system to enhance revenue generation while ensuring fairness and competitiveness is crucial. This could involve addressing tax loopholes, streamlining tax administration, or adjusting tax rates. (Provide specific examples of potential tax reforms, e.g., carbon tax adjustments, corporate tax rate adjustments).

- Spending Efficiencies: Identifying areas for spending efficiencies without compromising essential services is paramount. This could involve streamlining government operations, leveraging technology, and optimizing procurement processes. (Provide specific examples, e.g., improved healthcare delivery models, optimizing education spending).

- Boosting Economic Growth: Stimulating economic growth through strategic investments in infrastructure, innovation, and human capital is vital for increasing tax revenue and reducing the debt-to-GDP ratio. (Provide specific examples of investment strategies).

- Public-Private Partnerships: Exploring the potential of public-private partnerships for infrastructure development can help share the financial burden and leverage private sector expertise.

The Importance of Transparency and Accountability

Transparency and accountability are not mere buzzwords; they are cornerstones of responsible governance. Canadians deserve clear and accessible information about government spending and financial decisions.

- Transparent Budgeting Practices: Implementing transparent budgeting practices, including clear explanations of revenue sources and expenditure allocations, fosters public trust and informed debate.

- Strengthening Accountability Mechanisms: Establishing robust mechanisms for auditing government spending and holding officials accountable for financial mismanagement is essential.

- Independent Oversight Bodies: Strengthening the role of independent oversight bodies, such as the Auditor General, is crucial for ensuring objective scrutiny of government finances.

- Increased Public Participation: Encouraging public participation in budget discussions and fostering open dialogue on fiscal policy is crucial for building consensus and fostering a shared commitment to fiscal responsibility.

Building a Sustainable Future Through Fiscal Responsibility in Canada

In conclusion, the need for fiscal responsibility in Canada is undeniable. Failing to address this issue will have far-reaching consequences, impacting our economic stability, social programs, and future generations. We must demand fiscal responsibility from our elected officials, support responsible economic policies, and advocate for a fiscally responsible Canada. Contact your elected officials, participate in informed discussions about fiscal policy, and demand greater transparency and accountability from the government. Let us work together to build a sustainable and prosperous future for Canada.

Featured Posts

-

Hield And Payton Key Contributors In Warriors Win Over Blazers

Apr 24, 2025

Hield And Payton Key Contributors In Warriors Win Over Blazers

Apr 24, 2025 -

Hisd Mariachi Groups Viral Whataburger Video Sends Them To Uil State

Apr 24, 2025

Hisd Mariachi Groups Viral Whataburger Video Sends Them To Uil State

Apr 24, 2025 -

Joint Venture Saudi Arabia India Plan Two Large Scale Oil Refineries

Apr 24, 2025

Joint Venture Saudi Arabia India Plan Two Large Scale Oil Refineries

Apr 24, 2025 -

Cocaine At The White House Secret Service Completes Investigation

Apr 24, 2025

Cocaine At The White House Secret Service Completes Investigation

Apr 24, 2025 -

Guilty Plea Lab Owner Falsified Covid 19 Test Results During Pandemic

Apr 24, 2025

Guilty Plea Lab Owner Falsified Covid 19 Test Results During Pandemic

Apr 24, 2025