The Market Crash And The Shift In Investor Behavior: Pros Out, Individuals In

Table of Contents

H2: The Retreat of Professional Investors

The market crash and subsequent volatility have significantly impacted the strategies of professional investors. Their retreat isn't a sign of panic, but rather a calculated response to a dramatically changed economic environment.

H3: Risk Aversion and Increased Uncertainty

Increased market volatility and economic uncertainty are the primary drivers behind the cautious approach adopted by many professional investors. The unprecedented levels of inflation, rising interest rates, and ongoing geopolitical instability have created a climate of heightened risk aversion.

- Increased market volatility: Sharp price swings and unpredictable market movements make it difficult for professional investors to accurately forecast returns.

- Wait-and-see approach: Many are adopting a more conservative strategy, reducing their exposure to riskier assets like stocks and focusing on safer investments such as government bonds.

- Concerns about inflation: Inflation erodes the purchasing power of investments, making it crucial for professional investors to protect their capital.

- Rising interest rates: Higher interest rates impact borrowing costs and reduce the attractiveness of certain investment strategies.

- Geopolitical instability: Uncertainties stemming from global conflicts and political tensions create further market unpredictability.

Bullet points: Decreased trading volume, higher cash holdings, reduced portfolio diversification, increased allocation to defensive assets.

H3: Performance Pressure and Fee Concerns

Professional investors, particularly fund managers, face intense pressure to deliver consistent returns to their clients. A market crash intensifies this pressure, leading to a more defensive investment strategy.

- Performance pressure: Underperforming funds often experience significant withdrawals, leading to reputational damage and potentially fund closures.

- Defensive posture: To avoid further losses, professional investors are prioritizing capital preservation over aggressive growth strategies.

- High management fees: In periods of low market growth, the high fees associated with professional investment services become less justifiable to clients, leading to reduced inflows.

Bullet points: Fund closures, decreased inflows into actively managed funds, increased scrutiny from regulators, heightened focus on risk management.

H2: The Rise of Individual Investors

The retreat of professional investors has been accompanied by a notable surge in participation from individual investors, driven by several key factors.

H3: Accessibility of Online Trading Platforms

The democratization of investing has been fueled by the proliferation of user-friendly online brokerage platforms. These platforms offer tools and resources that were previously inaccessible to the average investor.

- Zero-commission trading: The elimination of brokerage fees has significantly lowered the cost of investing, making it more appealing to individuals.

- Fractional share purchases: Investors can now buy fractions of shares, allowing them to participate in high-priced stocks even with limited capital.

- Mobile trading apps: The ease and convenience of mobile trading apps allow investors to monitor their portfolios and execute trades from anywhere, at any time.

Bullet points: Increased downloads of investment apps, growth in online brokerage accounts, younger demographics entering the market, increased use of robo-advisors.

H3: "FOMO" and the Search for Higher Returns

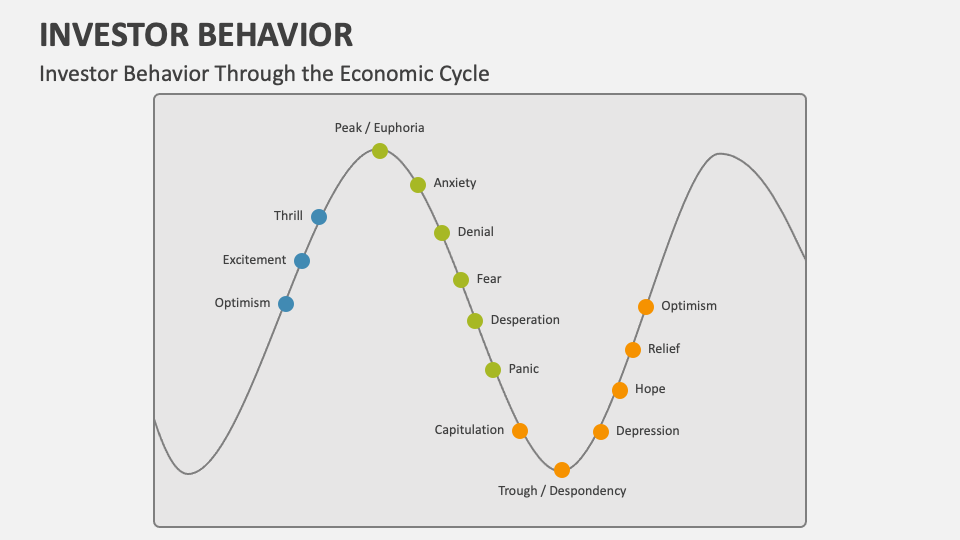

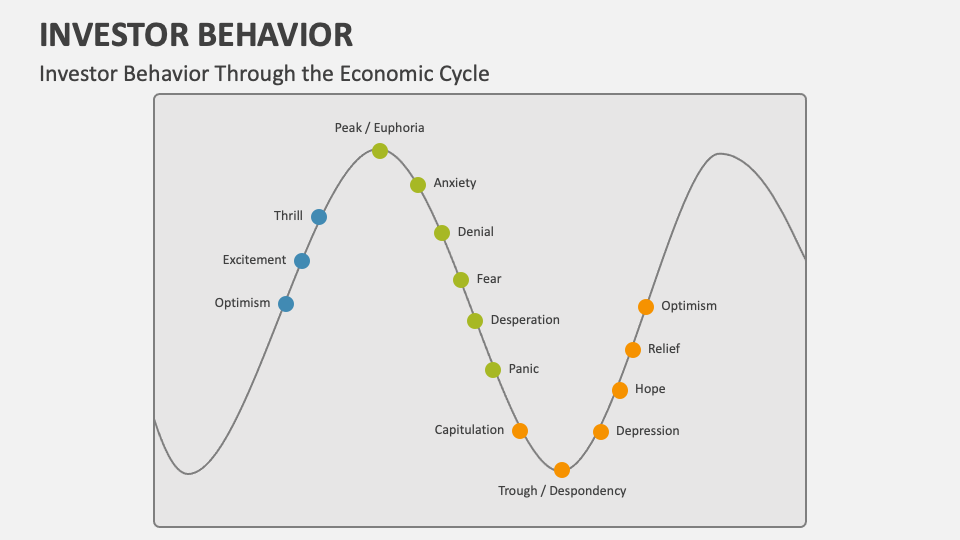

Fear of missing out (FOMO) is a powerful psychological factor driving some individual investors into the market despite the risks. Market dips are sometimes viewed as buying opportunities.

- Potential for higher returns: Investors believe that buying during a market downturn can lead to substantial gains once the market recovers.

- Contrarian investing: Some individuals actively seek out undervalued assets, believing that the market has overreacted negatively to certain events.

- Social media influence: Social media platforms can amplify investment trends, leading to both positive and negative consequences.

Bullet points: Increased social media discussions about investing, higher retail investor participation in IPOs and secondary offerings, increased engagement in meme stocks.

H3: Increased Financial Literacy and Education

The increased availability of online resources, educational courses, and financial advice has contributed to a rise in financial literacy among individual investors.

- Online resources: Numerous websites, blogs, and educational platforms provide valuable information about investing strategies and market analysis.

- Financial education: Online courses and workshops make it easier for individuals to gain the knowledge and skills necessary for successful investing.

- Robo-advisors: Automated investment platforms offer personalized investment advice and portfolio management based on individual risk tolerance and financial goals.

Bullet points: Growth in online finance courses, increased usage of financial news and analysis websites, rising interest in robo-advisors, increased demand for financial advisors.

H2: Implications of this Shift

The shift in investor behavior presents both opportunities and challenges. The increased involvement of individual investors can bring greater dynamism to the market but also carries risks.

- Increased market volatility: Individual investors may be more susceptible to emotional decision-making, leading to potentially erratic trading patterns and increased market fluctuations.

- Potential for market bubbles: Speculative trading and herd behavior can create unsustainable market bubbles, posing systemic risks.

- Democratization of investing: Greater access to the market empowers a broader range of people to participate in the economy.

- Regulatory challenges: Regulators face the challenge of protecting individual investors from risks while maintaining market integrity.

3. Conclusion:

The shift in investor behavior following the market crash, with professional investors exhibiting more caution and individual investors showing increased participation, presents a complex and evolving landscape. Understanding the motivations and potential consequences of this trend—the interplay of market crash and investor behavior—is critical. While increased participation can enhance market dynamism, the potential for emotional decision-making and less sophisticated strategies requires vigilance. This new era necessitates a careful approach to investment, whether you're a seasoned professional adapting to changing market conditions or an individual investor navigating the complexities of the market for the first time. Learn more about effectively managing your investments during times of market volatility and successfully navigating the changing landscape of market crash and investor behavior.

Featured Posts

-

Fn Abwzby Rhlt Fnyt Mmyzt Tbda Fy 19 Nwfmbr

Apr 28, 2025

Fn Abwzby Rhlt Fnyt Mmyzt Tbda Fy 19 Nwfmbr

Apr 28, 2025 -

Mets Fall To Twins 6 3 In Tuesday Night Matchup

Apr 28, 2025

Mets Fall To Twins 6 3 In Tuesday Night Matchup

Apr 28, 2025 -

Final Mets Rotation Spot What The Young Starter Must Prove

Apr 28, 2025

Final Mets Rotation Spot What The Young Starter Must Prove

Apr 28, 2025 -

Abwzby Tstdyf Asatyr Mwsyqyt Ealmyt Fy Mhrjanha Al 22

Apr 28, 2025

Abwzby Tstdyf Asatyr Mwsyqyt Ealmyt Fy Mhrjanha Al 22

Apr 28, 2025 -

Slight Lineup Change For Red Sox Doubleheader Game 1

Apr 28, 2025

Slight Lineup Change For Red Sox Doubleheader Game 1

Apr 28, 2025