The Impact Of US-China Trade War On Oil Markets: Canada's Gain

Table of Contents

H2: Disruption of Global Supply Chains and Increased Demand for Canadian Oil

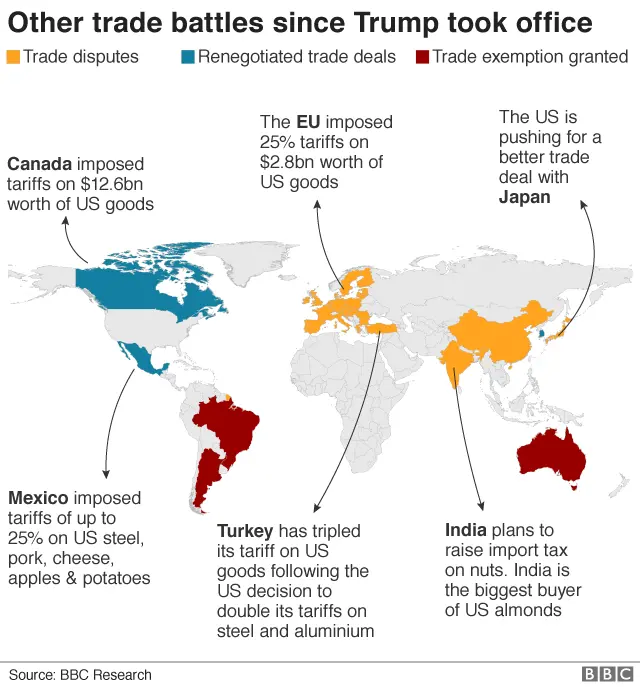

The US-China trade war significantly disrupted global supply chains, creating ripples throughout the energy sector. The imposition of tariffs on US goods by China led to a reassessment of energy import strategies.

H3: Reduced Chinese Imports from the US:

The trade war's impact on oil markets was immediate. China, a major consumer of oil, significantly reduced its imports from the US due to the tariffs. This created a void in the global oil market.

- Reduced reliance on US oil forced China to seek alternative suppliers, opening doors for other oil-producing nations.

- Canada, with its stable political environment, robust energy infrastructure, and established trade relationships, became a more attractive and reliable option.

- This resulted in increased Canadian oil exports to Asia, particularly to China, helping to offset the reduced US exports and demonstrating the impact of the US-China trade war on oil markets Canada.

H3: Shifting Global Energy Dynamics:

The trade war underscored the vulnerabilities inherent in overly concentrated global supply chains. Countries recognized the need for energy diversification to mitigate future risks.

- Countries actively sought more reliable and diverse sources of energy to reduce their dependence on any single supplier.

- Canada's reputation for a stable political climate and consistent energy production strengthened its position in this newly diversified international market.

- This diversification significantly benefited Canadian oil producers, who secured new contracts and gained access to previously untapped markets, highlighting the positive impact of the US-China trade war on oil markets Canada.

H2: Impact on Oil Prices and Canada's Competitive Advantage

The trade war's impact on oil prices was multifaceted, characterized by volatility. While volatility can be disruptive, it also presented opportunities for strategic players.

H3: Fluctuating Oil Prices:

The trade war contributed to fluctuating oil prices, creating both challenges and opportunities for Canadian producers.

- While price volatility can be detrimental, it also opened doors for Canadian producers to secure favorable contracts by strategically hedging against price fluctuations.

- Robust risk management strategies and hedging practices helped Canadian companies mitigate the impact of price swings, showcasing their adaptability.

- Canada's relatively low production costs compared to some competitors provided a significant competitive edge in the fluctuating market, further benefiting from the impact of the US-China trade war on oil markets Canada.

H3: Strengthened Canadian Dollar:

The increased demand for Canadian oil and other resource commodities had a positive knock-on effect on the Canadian dollar.

- A stronger Canadian dollar further enhanced Canada's export competitiveness in the global oil market, making Canadian oil more affordable for international buyers.

- This boost in competitiveness significantly improved the profitability of Canadian oil producers.

- The improved economic outlook attracted further foreign investment in the Canadian energy sector, further solidifying its position influenced by the US-China trade war impact on oil markets Canada.

H2: Long-Term Implications for Canada's Oil Industry

The increased demand and improved market position resulting from the US-China trade war had lasting implications for Canada's oil industry.

H3: Investment and Infrastructure Development:

The surge in demand spurred significant investments in Canadian oil infrastructure.

- New pipelines and export terminals were planned and constructed to meet the growing demand for Canadian oil.

- This investment generated numerous jobs and stimulated substantial economic growth across various sectors in Canada.

- The resulting infrastructural improvements further cemented Canada's position as a reliable and efficient energy supplier, strengthening its position in light of the US-China trade war impact on oil markets Canada.

H3: Geopolitical Considerations:

Canada's enhanced role as a stable and reliable oil supplier increased its geopolitical influence.

- This strengthened Canada's relationships with key Asian markets, particularly China.

- It successfully diversified its export markets, reducing reliance on the traditional US market.

- This strategic diversification positioned Canada as a key player in the complex global energy landscape, leveraging the US-China trade war impact on oil markets Canada to its advantage.

3. Conclusion:

The US-China trade war, while globally disruptive, unexpectedly presented a significant opportunity for Canada’s oil industry. By capitalizing on the shift in global energy dynamics, Canada increased its oil exports, secured new markets, and attracted substantial investment, ultimately strengthening its position in the international energy sector. Understanding the impact of the US-China trade war on oil markets and Canada's gain is crucial for navigating the complexities of the global energy landscape. For further insights into global energy market dynamics and Canada’s evolving role, continue researching the US-China trade war impact on oil markets Canada to stay ahead of the curve.

Featured Posts

-

Milwaukee Brewers Steal Nine Bases In First Four Innings Setting New Record

Apr 23, 2025

Milwaukee Brewers Steal Nine Bases In First Four Innings Setting New Record

Apr 23, 2025 -

William Contreras A Valuable Asset To The Milwaukee Brewers

Apr 23, 2025

William Contreras A Valuable Asset To The Milwaukee Brewers

Apr 23, 2025 -

Is William Contreras A Key Player For The Brewers Success

Apr 23, 2025

Is William Contreras A Key Player For The Brewers Success

Apr 23, 2025 -

Detroit Tigers Suffer 5 1 Loss To Brewers Drop Series

Apr 23, 2025

Detroit Tigers Suffer 5 1 Loss To Brewers Drop Series

Apr 23, 2025 -

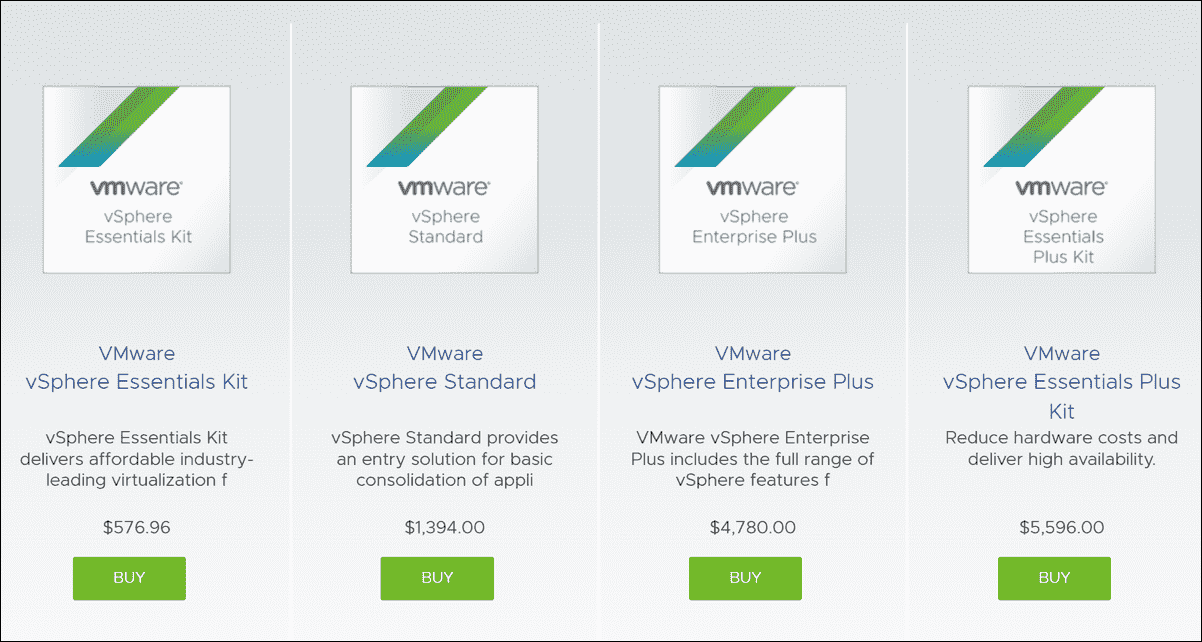

1 050 V Mware Price Hike At And T Highlights Broadcoms Extreme Pricing Proposal

Apr 23, 2025

1 050 V Mware Price Hike At And T Highlights Broadcoms Extreme Pricing Proposal

Apr 23, 2025