The Impact Of Reduced Non-Essential Spending On The Credit Card Industry

Table of Contents

Decreased Credit Card Transaction Volume and Revenue

Reduced discretionary spending directly translates to a decline in credit card transactions. Consumers are tightening their belts, prioritizing essential expenses over non-essential purchases. This directly impacts credit card companies' primary revenue streams: transaction fees and interest income.

- Lower average transaction values: As consumers buy less, the average value of each transaction decreases, reducing the overall revenue generated per card.

- Reduced frequency of purchases: Fewer purchases mean fewer transaction fees for credit card companies. This is especially true for impulse buys and luxury items, which often rely on credit.

- Impact on merchant fees: Merchants, who pay a percentage of each transaction as a fee to credit card processors, also experience reduced income, potentially leading to further economic downturn.

- Potential for decreased profitability: The combined effect of lower transaction volumes, reduced average transaction values, and decreased merchant fees directly impacts the profitability of credit card companies. Industry reports are already showing a slight decline in profits for major players. For example, a recent report from [Insert credible source and data here] indicates a [percentage]% decrease in Q[quarter] profits compared to the same period last year.

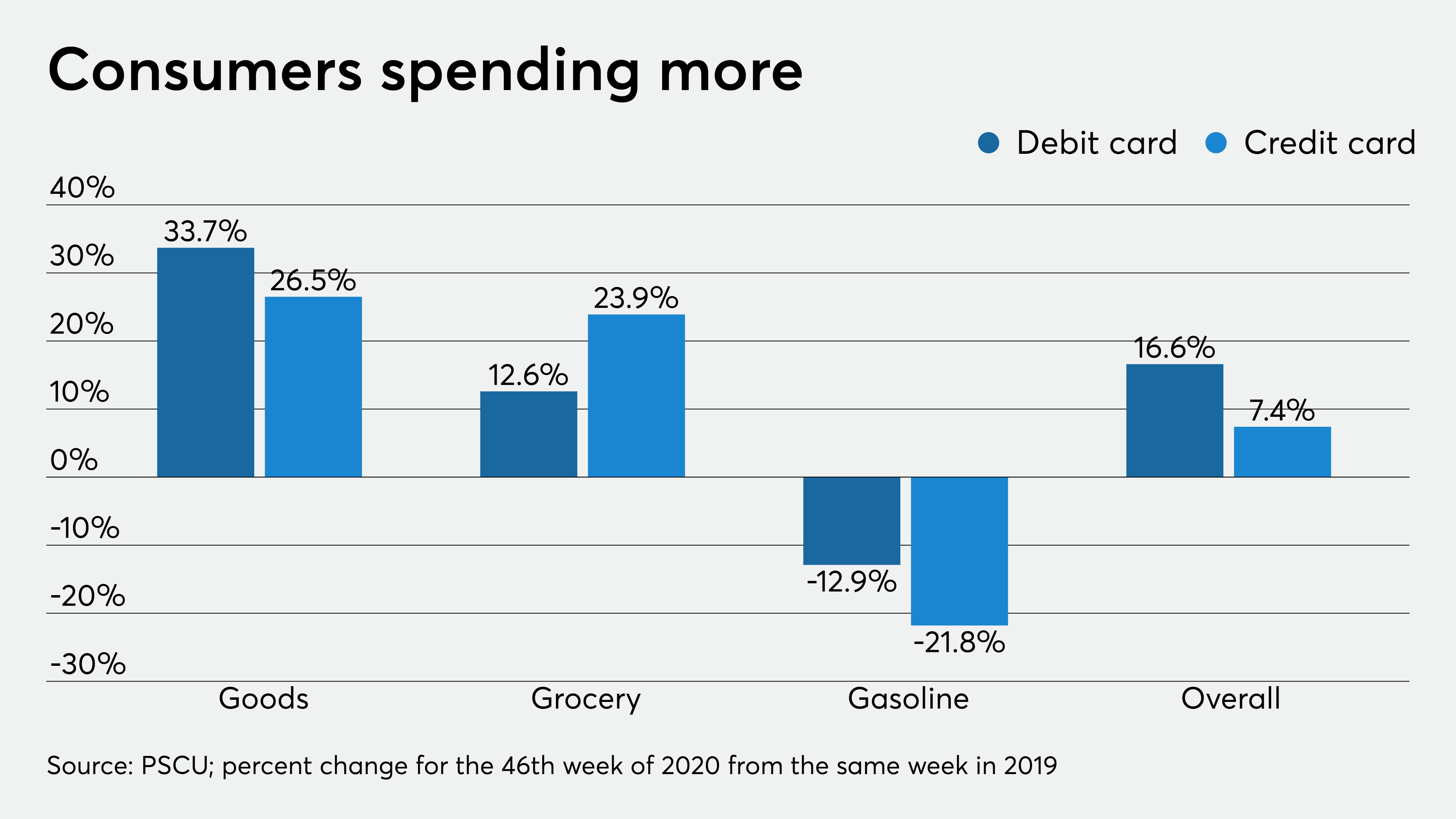

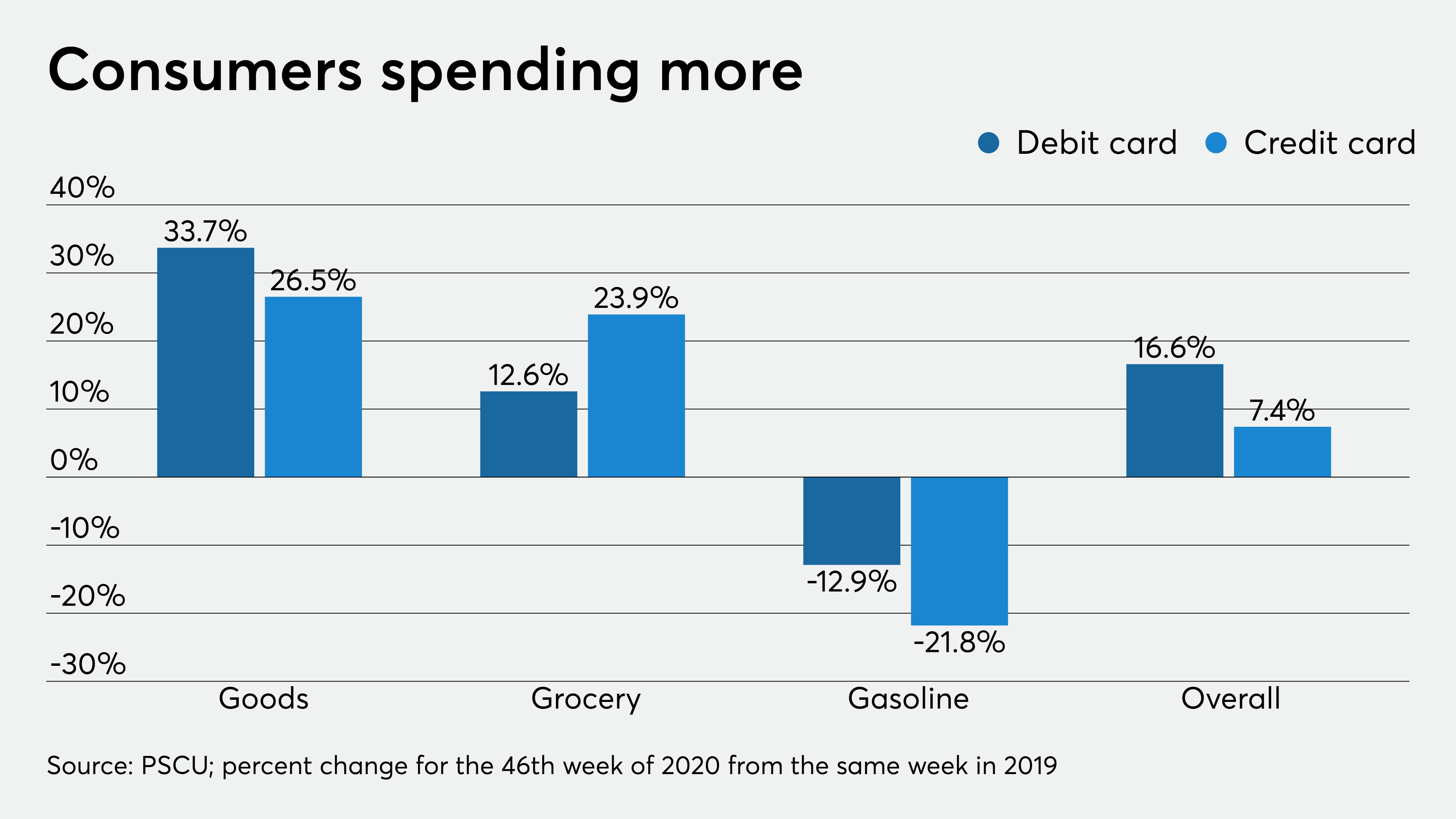

Shifting Consumer Behavior and Payment Preferences

The decline in non-essential spending has spurred significant changes in consumer behavior. Consumers are increasingly prioritizing savings and essential expenses, leading to a shift in payment preferences. The rise of alternative payment methods further challenges the credit card industry's dominance.

- Increased use of debit cards for everyday purchases: Debit cards, offering direct access to funds, are becoming increasingly popular for everyday transactions, reducing reliance on credit.

- Growth of digital payment platforms: Mobile payment apps and digital wallets are gaining traction, providing convenient and often fee-free alternatives to credit cards.

- Impact of BNPL services on credit card usage: Buy Now Pay Later (BNPL) services offer another compelling alternative, potentially diverting spending away from traditional credit cards.

- Changes in consumer debt levels: While some consumers are reducing debt, others may be turning to higher-interest BNPL options, leading to potential long-term financial concerns. This requires careful analysis and monitoring.

Strategies of Credit Card Companies to Adapt and Mitigate Losses

Faced with these challenges, credit card companies are actively adapting their strategies to retain customers and mitigate losses. They are focusing on innovative approaches to stimulate spending and attract new customers.

- Increased focus on rewards programs: Enhanced cashback offers, loyalty programs, and points systems incentivize card usage, aiming to offset the decline in spending.

- Development of new financial products and services: Credit card companies are investing in new products, such as personalized financial management tools and budgeting apps, to add value to their offerings.

- Targeted marketing campaigns: Companies are refining their marketing strategies to focus on specific demographics and spending habits, promoting relevant offers and services.

- Strategic partnerships with retailers: Collaborations with retailers provide opportunities for exclusive promotions and deals, boosting card usage.

- Emphasis on responsible lending practices: Addressing concerns around consumer debt, credit card companies are promoting responsible spending habits and offering financial literacy resources. This builds trust and encourages long-term customer relationships.

The Long-Term Implications for the Credit Card Industry

The long-term effects of reduced non-essential spending on the credit card industry are still unfolding, but several key trends are emerging. The industry faces potential consolidation, increased competition, and significant shifts in consumer expectations.

- Potential for industry consolidation: Mergers and acquisitions may become more frequent as companies seek economies of scale and increased market share.

- Increased competition from fintech companies: Fintech companies continue to disrupt the financial landscape, offering innovative payment solutions and financial products.

- Long-term impact on credit card debt: The shift in consumer spending habits and the rise of alternative payment options could significantly influence credit card debt levels in the long run.

- Potential for regulatory changes: Changes in consumer behavior and the evolving financial landscape may prompt regulatory adjustments affecting the credit card industry.

Navigating the New Normal: The Future of Reduced Non-Essential Spending and the Credit Card Industry

Reduced non-essential spending is significantly impacting the credit card industry, leading to decreased transaction volumes, shifting consumer behavior, and prompting adaptive strategies from credit card companies. Understanding these trends is crucial for both consumers and businesses alike. The long-term implications are complex and require ongoing observation. Understanding the impact of reduced non-essential spending on your credit card usage is crucial. Learn more about managing your finances effectively during these economic shifts by [link to relevant resource].

Featured Posts

-

South Carolina Voter Confronts Rep Nancy Mace A Heated Exchange

Apr 24, 2025

South Carolina Voter Confronts Rep Nancy Mace A Heated Exchange

Apr 24, 2025 -

Ella Bleu Travoltas Stunning Makeover John Travoltas Daughter Graces Magazine Cover At 24

Apr 24, 2025

Ella Bleu Travoltas Stunning Makeover John Travoltas Daughter Graces Magazine Cover At 24

Apr 24, 2025 -

Instagrams New Video Editing App A Threat To Tik Tok

Apr 24, 2025

Instagrams New Video Editing App A Threat To Tik Tok

Apr 24, 2025 -

Ohio Train Disaster Persistent Toxic Chemicals Contaminate Buildings

Apr 24, 2025

Ohio Train Disaster Persistent Toxic Chemicals Contaminate Buildings

Apr 24, 2025 -

Bold And The Beautiful Recap April 9 Steffys Blame Finns Icu Visit And Liams Demand For Discretion

Apr 24, 2025

Bold And The Beautiful Recap April 9 Steffys Blame Finns Icu Visit And Liams Demand For Discretion

Apr 24, 2025