The Canadian Dollar: A Complex Picture In The Global Currency Market

Table of Contents

Factors Influencing the Canadian Dollar's Value

The Canadian dollar's exchange rate against other currencies, particularly the US dollar (USD), is a dynamic reflection of various interwoven factors. Understanding these factors is crucial for anyone involved in international trade, investment, or simply keeping abreast of the global financial landscape.

Commodity Prices (Oil, Natural Gas)

Canada is a major exporter of oil and natural gas, making commodity prices a significant driver of the CAD's value. The strong correlation between these prices and the Canadian currency is well-established.

- Increased oil prices boost CAD value: Higher global demand for oil translates into increased Canadian export revenue, strengthening the Canadian dollar.

- Decreased natural gas exports weaken CAD: Conversely, a slump in natural gas prices negatively impacts the Canadian economy and weakens the CAD's exchange rate.

- Price volatility creates uncertainty: Fluctuations in oil and natural gas prices introduce significant volatility into the Canadian dollar's performance, making it challenging to predict its future movements. This volatility is a key consideration for investors dealing with CAD-denominated assets.

Interest Rates and Monetary Policy

The Bank of Canada's monetary policy, particularly its interest rate decisions, significantly impacts the Canadian dollar. Interest rates influence investment flows and, consequently, the CAD's value.

- Higher interest rates attract foreign investment, strengthening the CAD: Higher interest rates make Canadian investments more attractive to foreign investors, increasing demand for the Canadian dollar and pushing its value upward.

- Lower interest rates can weaken the CAD: Conversely, lower interest rates can make the Canadian dollar less appealing to foreign investors, leading to a decrease in its value.

- Monetary policy adjustments: The Bank of Canada carefully considers economic indicators like inflation and employment when adjusting interest rates, aiming to maintain a stable and competitive CAD.

US Dollar Performance

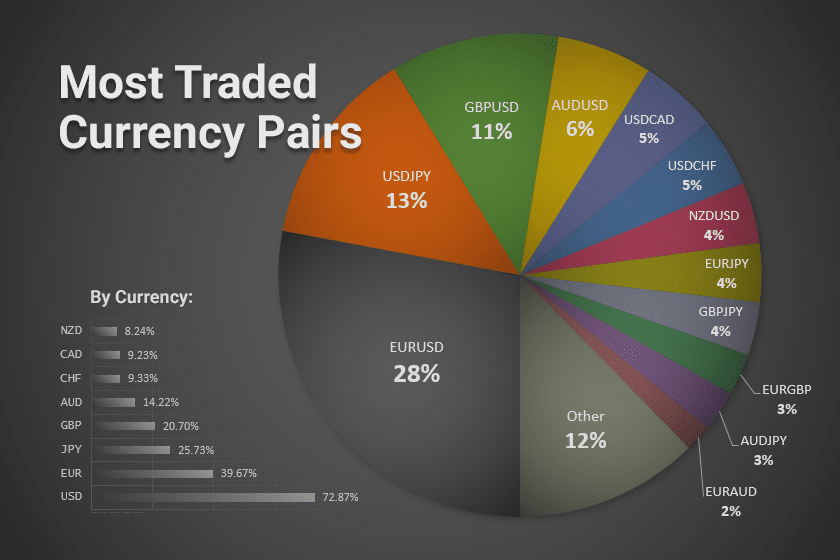

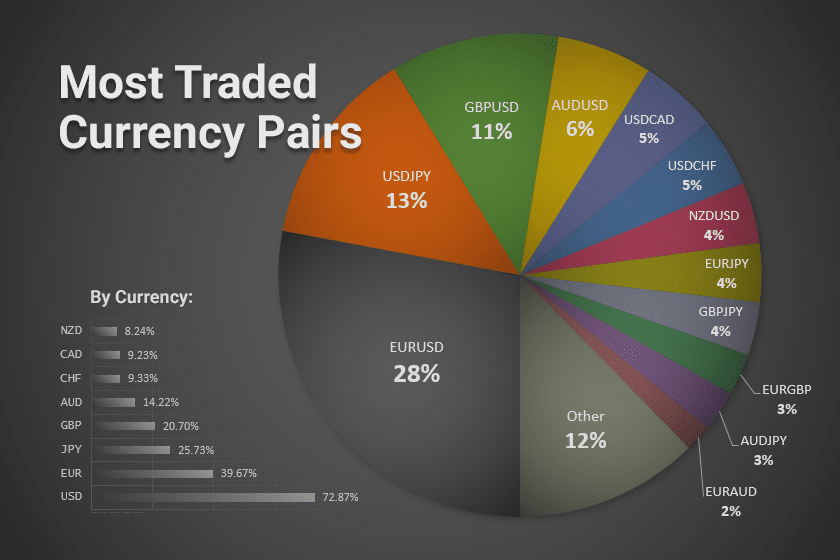

Given Canada's close economic ties with the United States, the performance of the US dollar is a major determinant of the CAD's value. The CAD/USD exchange rate is highly sensitive to USD movements.

- A strong USD typically weakens the CAD: When the US dollar strengthens against other major currencies, the Canadian dollar often weakens against it.

- A weak USD can strengthen the CAD: Conversely, a weakening US dollar generally results in a strengthening Canadian dollar.

- Trade relations and economic interdependence: The deep trade relationship between Canada and the US means that USD fluctuations directly impact the Canadian economy and, consequently, its currency.

Geopolitical Factors and Global Events

Global events, from trade wars and political instability to natural disasters, significantly influence investor confidence and the value of the Canadian dollar.

- Global uncertainty often leads to CAD volatility: Periods of global uncertainty often lead to increased volatility in the CAD's exchange rate as investors seek safe haven assets.

- Specific examples of geopolitical events impacting the CAD: For example, international trade disputes can negatively impact Canadian exports and weaken the CAD, while global crises may lead to increased demand for safe-haven currencies, potentially affecting the CAD's value.

- Risk aversion and investor sentiment: Global events significantly influence investor sentiment, which, in turn, directly impacts the demand for, and thus the value of, the Canadian dollar.

Canadian Economic Performance

The overall health of the Canadian economy plays a crucial role in determining the CAD's value. Strong economic indicators generally lead to a stronger currency, while weak performance can weaken it.

- Strong economic data strengthens the CAD: Positive indicators like robust GDP growth, low unemployment rates, and strong consumer confidence signal a healthy economy, leading to increased investor confidence and a stronger CAD.

- Weak economic data weakens the CAD: Conversely, indicators such as slow GDP growth, rising unemployment, or declining consumer confidence can lead to decreased investor confidence and a weaker CAD.

- Government policies and economic forecasts: Government policies and economic forecasts also significantly influence investor sentiment and impact the value of the Canadian dollar.

Conclusion

The Canadian dollar's value is determined by a complex interplay of commodity prices (especially oil and natural gas), interest rate policies set by the Bank of Canada, the performance of the US dollar, global geopolitical factors, and the overall health of the Canadian economy. Predicting the CAD's future movements requires careful consideration of all these interconnected elements. Understanding the intricate dynamics of the Canadian dollar is crucial for investors and businesses alike. Stay informed about the latest news and analysis to navigate the complexities of the global currency market and make informed decisions regarding the Canadian dollar and its exchange rate.

Featured Posts

-

Building Voice Assistants Made Easy Open Ais 2024 Developer Announcements

Apr 24, 2025

Building Voice Assistants Made Easy Open Ais 2024 Developer Announcements

Apr 24, 2025 -

E Bay Listings For Banned Chemicals Section 230 Protection Challenged

Apr 24, 2025

E Bay Listings For Banned Chemicals Section 230 Protection Challenged

Apr 24, 2025 -

Are We Normalizing Disaster The Case Of Betting On La Wildfires

Apr 24, 2025

Are We Normalizing Disaster The Case Of Betting On La Wildfires

Apr 24, 2025 -

Building A Fiscally Responsible Future For Canada

Apr 24, 2025

Building A Fiscally Responsible Future For Canada

Apr 24, 2025 -

Nba All Star Weekend Recap Herros 3 Point Win And Cavs Skills Challenge Domination

Apr 24, 2025

Nba All Star Weekend Recap Herros 3 Point Win And Cavs Skills Challenge Domination

Apr 24, 2025