Tariffs Delay Dow's $9B Alberta Megaproject: Economic Fallout Analyzed

Table of Contents

H2: The Direct Impact of Tariffs on the Dow Project

The imposition of tariffs has a direct and substantial impact on the feasibility and timeline of the Dow Alberta megaproject. Increased costs and uncertainty are major obstacles.

H3: Increased Material Costs

Tariffs on imported materials crucial for the project significantly inflate its overall cost. These materials include, but are not limited to:

- Specialized Steel: Tariffs on specific types of steel required for the construction of the petrochemical plant have increased costs by an estimated 15-20%, according to industry sources.

- High-Tech Equipment: Import duties on advanced manufacturing equipment from key suppliers in the US and Europe add millions of dollars to the project's budget.

- Specialty Chemicals: The project requires numerous specialty chemicals in its production process; tariffs on these inputs further exacerbate the cost increase.

This surge in material costs forces Dow Chemical to reassess the project's financial viability, potentially delaying or even jeopardizing its completion. Dow's response includes exploring alternative suppliers and materials, but this process is time-consuming and may not fully offset the tariff-related price increases.

H3: Financing Challenges

The increased project costs and the uncertainty surrounding future tariff policies create significant financing challenges. This uncertainty makes it difficult to secure the necessary funding:

- Investor Pullback: Potential investors are hesitant to commit capital to a project facing substantial cost overruns and a volatile trade environment.

- Loan Approvals: Financial institutions are less likely to approve loans for a project with an increased risk profile due to tariff-related uncertainties.

- Alternative Financing: Dow is exploring alternative financing strategies, such as project financing and public-private partnerships, to offset the impact of increased costs. However, these options require additional time and negotiations.

These financing hurdles further complicate the already challenging situation, pushing the project's completion date further into the future.

H3: Project Timeline Delays and Associated Costs

The direct correlation between tariffs and project delays is undeniable. Delays translate into substantial financial and operational penalties:

- Estimated Time Delays: Industry experts estimate a delay of at least 12-18 months, potentially extending to several years depending on tariff resolutions.

- Delay-Related Cost Overruns: These delays lead to significant cost overruns due to extended labor costs, financing charges, and potential penalties for missed deadlines.

- Job Losses During Delay: The delay directly impacts the initial phase of job creation, resulting in temporary job losses for construction workers and related professionals.

H2: Wider Economic Ripple Effects Beyond the Dow Project

The ramifications of the Dow project delays extend far beyond the immediate project itself, impacting Alberta's economy and Canada's overall economic competitiveness.

H3: Impact on Alberta's Economy

The project's delay has significant implications for Alberta's economy:

- Projected Job Losses: The delay impacts not only the direct jobs at the plant but also indirect jobs across the value chain – in construction, manufacturing, transportation, and service sectors.

- GDP Impact: The reduced economic activity significantly affects Alberta's GDP growth, reducing overall economic output and potentially impacting provincial revenue.

- Knock-on Effects: The delay creates a ripple effect, negatively impacting other industries reliant on the petrochemical sector or related infrastructure development.

H3: National Economic Consequences for Canada

The Dow project's predicament reflects broader concerns about Canada's economic competitiveness:

- Impact on Foreign Direct Investment (FDI): The delays signal to potential foreign investors a volatile investment climate in Canada, potentially deterring future FDI.

- Trade Relations: The tariff-related delays highlight vulnerabilities in Canada's trade relationships with key partners and the need for a more robust trade policy framework.

- Decreased Export Competitiveness: The increased costs associated with the project may lead to a less competitive Canadian petrochemical sector in global markets.

H3: Supply Chain Disruptions

The tariffs also disrupt global supply chains, creating bottlenecks and increased costs for downstream industries:

- Specific Supply Chain Disruptions: Delays in procuring materials create cascading effects, impacting the production schedules of companies relying on Dow's products.

- Knock-on Effects: Downstream industries dependent on Dow's output experience production delays and increased input costs.

- Alternative Sourcing Strategies: Companies are forced to explore alternative sourcing strategies, but this may prove costly and time-consuming.

3. Conclusion

The imposition of tariffs significantly hampers the progress of Dow's $9 billion Alberta megaproject, triggering a cascade of negative economic consequences for Alberta and Canada. Increased material costs, financing challenges, project delays, and widespread supply chain disruptions all contribute to a concerning economic outlook.

Addressing the negative impact of tariffs on major projects like the Dow initiative is crucial for Canada's economic stability. It's imperative that policymakers actively pursue strategies to mitigate the impact of tariffs and foster a stable and predictable trade environment to attract future investment in the petrochemical industry and beyond. Understanding the full economic fallout of tariff-related delays is paramount for informed policymaking and strategic investment decisions related to large-scale projects like the Dow Alberta megaproject. A proactive approach to trade policy is necessary to prevent further delays and economic setbacks associated with large-scale projects in Canada.

Featured Posts

-

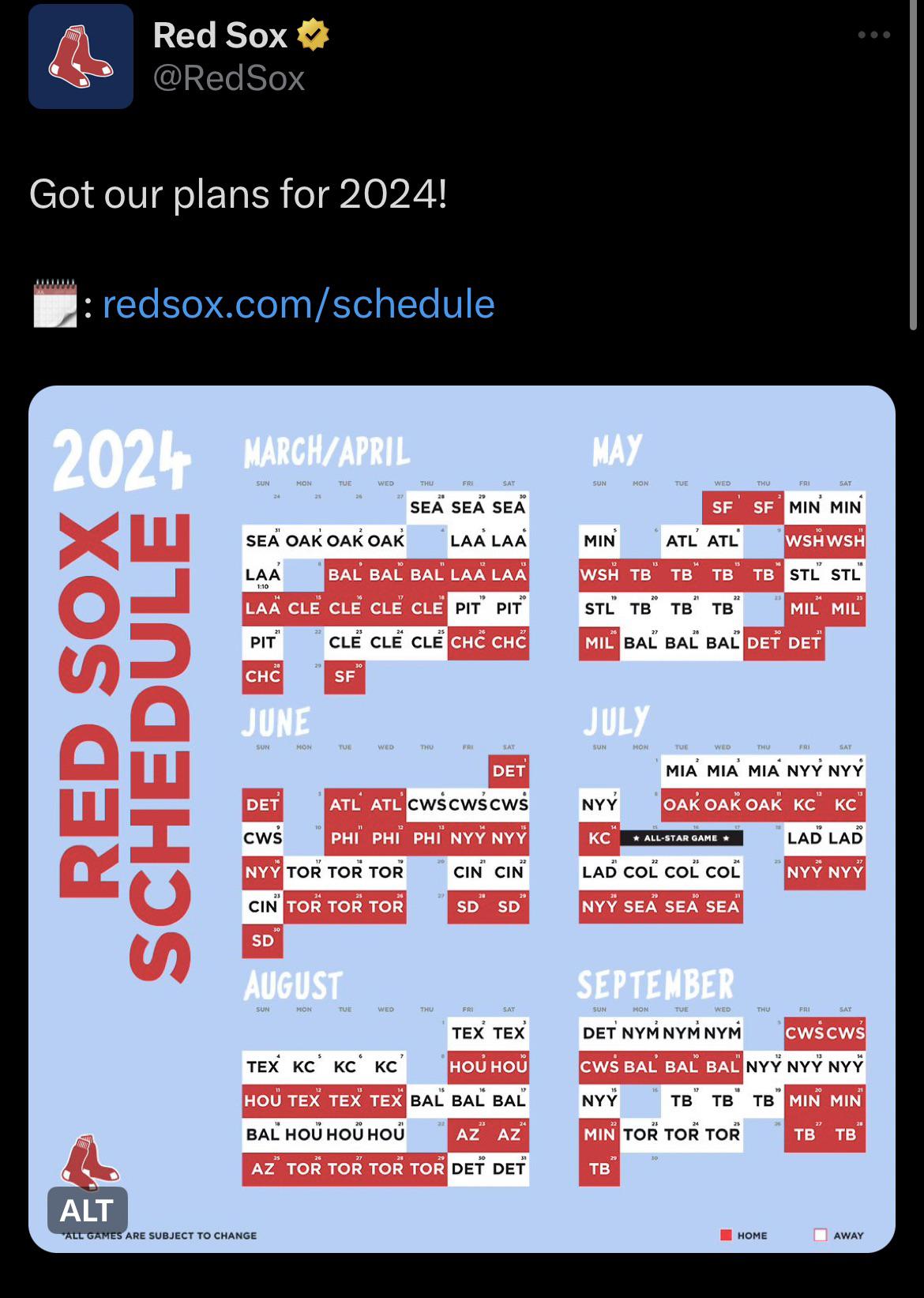

Red Sox 2025 Season Espns Controversial Prediction Analyzed

Apr 28, 2025

Red Sox 2025 Season Espns Controversial Prediction Analyzed

Apr 28, 2025 -

Remembering 2000 Joe Torres Strategic Decisions And Pettittes Shutout

Apr 28, 2025

Remembering 2000 Joe Torres Strategic Decisions And Pettittes Shutout

Apr 28, 2025 -

Mike Breen Names Marv Albert The Greatest Basketball Announcer

Apr 28, 2025

Mike Breen Names Marv Albert The Greatest Basketball Announcer

Apr 28, 2025 -

Mets Rivals Ace A Career Best Season

Apr 28, 2025

Mets Rivals Ace A Career Best Season

Apr 28, 2025 -

Auto Dealers Double Down On Opposition To Electric Vehicle Regulations

Apr 28, 2025

Auto Dealers Double Down On Opposition To Electric Vehicle Regulations

Apr 28, 2025