Stock Market Today: Dow Futures Decline, Dollar Weakens Amid Trade Tensions

Table of Contents

Dow Futures Decline: A Deeper Dive

Dow futures experienced a significant decline this morning, dropping by 150 points or 0.6%. This represents a considerable dip, signaling potential anxieties within the market. Several factors are likely contributing to this downturn:

- Increased Trade Tensions: The ongoing trade disputes between major global economies are creating uncertainty and impacting investor confidence. The threat of further tariffs and retaliatory measures is a significant concern.

- Concerns about Global Economic Growth: Slowing growth in several key economies is fueling fears of a potential global recession, leading to risk aversion among investors. This is reflected in the performance of other major stock market indices.

- Negative Corporate Earnings Reports: Disappointing earnings reports from several major corporations have added to the negative sentiment, contributing to selling pressure. This highlights the vulnerability of the market to company-specific news.

- Impact of Rising Interest Rates: While not a primary driver today, the ongoing increase in interest rates by central banks worldwide continues to exert pressure on market valuations, making borrowing more expensive for businesses.

Predicting short-term market movements is inherently difficult. While the current trends suggest potential further decline, the market's direction remains uncertain and subject to rapid shifts. The Dow Jones Industrial Average, a key indicator, reflects this volatility.

Weakening Dollar: Implications for Global Markets

The US dollar is weakening against other major currencies, including the Euro and the Yen. This decline can be attributed to several factors:

- Trade Tensions and Currency Exchange Rates: Trade disputes often impact currency exchange rates. Uncertainty about future trade policies can lead to a flight from the dollar.

- Monetary Policy Decisions by the Federal Reserve: The Federal Reserve's monetary policy decisions, including interest rate adjustments, play a crucial role in influencing the dollar's value.

- Global Economic Uncertainty: Global economic uncertainty always impacts currency markets. Investors often seek safe havens during times of instability, often affecting the dollar's value.

A weaker dollar can benefit US exporters by making their goods more competitive internationally. However, it can also lead to higher import prices, potentially contributing to inflation. Analyzing the US dollar index provides a comprehensive understanding of its performance against a basket of other major currencies. Fluctuations in forex trading reflect the dynamic nature of global currency markets.

Escalating Trade Tensions: The Primary Driver

The current market downturn is significantly driven by escalating trade tensions, particularly between the US and China. The ongoing dispute over tariffs and intellectual property rights is creating significant uncertainty for businesses and investors. This uncertainty is affecting investor sentiment and market confidence.

- Specific Trade Disputes: The ongoing trade war between the US and China, as well as other bilateral trade disputes, significantly impacts global trade and market stability.

- Impact on Investor Sentiment: The uncertainty surrounding trade policies creates significant risk aversion, leading investors to reduce their exposure to equities.

- Potential Outcomes: The potential outcomes of these trade disputes are wide-ranging and unpredictable. A prolonged trade war could lead to significant economic damage. Several leading financial analysts predict a negative impact on global economic growth.

Investor Sentiment and Market Reactions

Investor sentiment is currently characterized by a significant degree of fear and uncertainty. Many investors are adopting a risk-averse approach, leading to increased selling pressure. The market is exhibiting signs of increased volatility, with sharp intraday price swings becoming more frequent.

- Investor Behavior: Investors are primarily selling, with a noticeable decrease in buying activity. This reflects a cautious approach to risk management.

- Changes in Market Sentiment: The prevailing sentiment can be described as negative, with investors showing reduced confidence in the short-term outlook. This contributes to increased risk aversion.

Conclusion: Understanding Today's Stock Market – A Call to Action

In conclusion, today's stock market decline is primarily driven by a confluence of factors: a weakening dollar, declining Dow futures, and escalating trade tensions. These factors are creating significant uncertainty and impacting investor sentiment. While the short-term outlook remains uncertain, understanding these dynamics is crucial for navigating the current market volatility. To effectively manage your investments in light of current stock market volatility and Dow Jones fluctuations, stay informed about the stock market today by subscribing to reputable financial newsletters, following financial news closely, and consulting with a qualified financial advisor. Further research into the ongoing trade tensions and their potential impact on various sectors is highly recommended.

Featured Posts

-

A Pan Nordic Defense Strategy Combining Swedish And Finnish Military Assets

Apr 22, 2025

A Pan Nordic Defense Strategy Combining Swedish And Finnish Military Assets

Apr 22, 2025 -

Section 230 And Online Marketplaces The Implications Of The E Bay Case

Apr 22, 2025

Section 230 And Online Marketplaces The Implications Of The E Bay Case

Apr 22, 2025 -

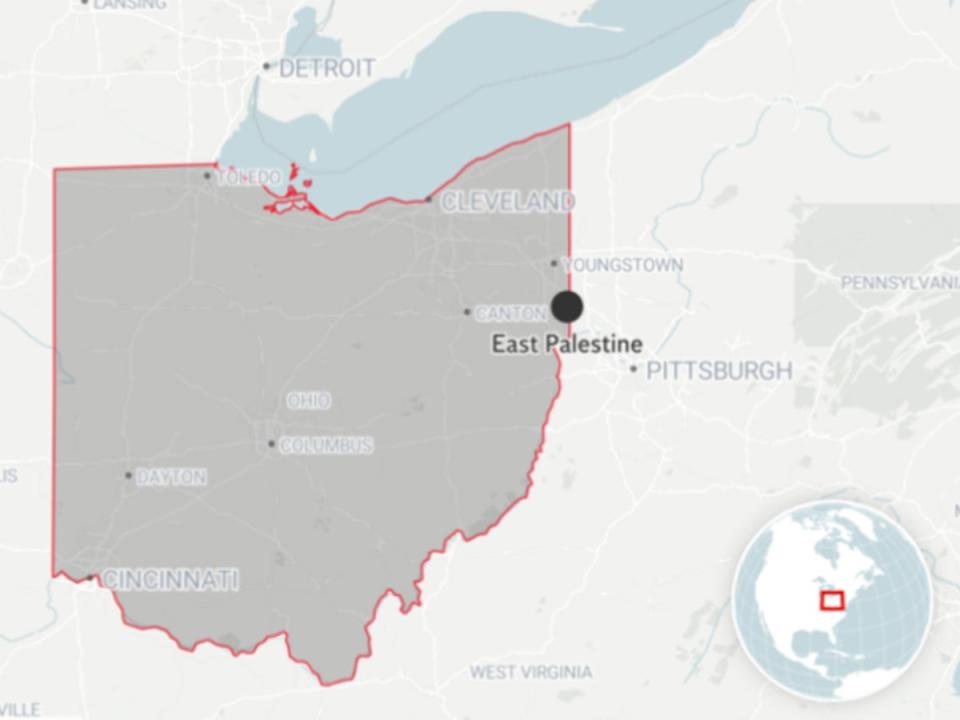

Ohio Train Derailment Toxic Chemical Lingering In Buildings

Apr 22, 2025

Ohio Train Derailment Toxic Chemical Lingering In Buildings

Apr 22, 2025 -

The Fracturing Relationship Understanding The Breakdown Between The U S And China

Apr 22, 2025

The Fracturing Relationship Understanding The Breakdown Between The U S And China

Apr 22, 2025 -

Updated Doj Vs Google Court Battle Reignites Over Search Dominance

Apr 22, 2025

Updated Doj Vs Google Court Battle Reignites Over Search Dominance

Apr 22, 2025