Restoring Fiscal Responsibility In Canada: An Urgent Need

Table of Contents

The Current State of Canada's Finances

Canada's fiscal health is deteriorating. The national debt continues to climb, placing a significant burden on future generations. The budget deficit, the difference between government spending and revenue, remains stubbornly high, despite periods of economic growth. This unsustainable trend necessitates immediate action to prevent a potential fiscal crisis.

-

Increasing National Debt Burden: The national debt has reached alarming levels, representing a substantial percentage of Canada's GDP. This high level of debt limits the government's ability to invest in crucial areas such as infrastructure, education, and healthcare. The interest payments alone consume a significant portion of the annual budget, leaving less money for essential services.

-

The Impact of Increased Interest Payments: As interest rates rise, the cost of servicing the national debt increases exponentially, further straining the budget and potentially leading to spending cuts in other vital areas. This creates a vicious cycle of debt accumulation and reduced government capacity.

-

Long-Term Economic Consequences: Unchecked spending and a continuously growing national debt can lead to lower credit ratings, higher borrowing costs, and reduced investor confidence. This can stifle economic growth and hinder Canada's ability to compete on the global stage. The long-term consequences for future generations are particularly concerning.

-

The Pandemic's Impact: The COVID-19 pandemic significantly exacerbated Canada's fiscal challenges, requiring substantial government intervention and increasing the national debt. While necessary, these measures highlighted the vulnerability of the Canadian economy to unforeseen shocks and the importance of prudent fiscal management during times of stability.

Factors Contributing to Fiscal Irresponsibility

Several interconnected factors have contributed to Canada's current fiscal challenges. Understanding these root causes is crucial for developing effective solutions.

-

Growth of Social Programs: While essential, the ever-increasing costs associated with social programs like healthcare and pensions place a significant strain on government finances. The aging population is putting further pressure on these already substantial expenditures.

-

Impact of an Aging Population: Canada's aging population is driving up healthcare and pension costs at an alarming rate. This demographic shift demands innovative solutions to ensure the long-term sustainability of these vital programs without crippling the national budget.

-

Inefficient Government Spending: There's a need for a comprehensive review of government spending to identify inefficiencies and areas for potential savings. Streamlining processes and reducing bureaucratic overhead can free up valuable resources for essential services.

-

Adequacy of Tax Revenue: The current tax system may require reform to ensure adequate revenue generation. This could involve closing tax loopholes, broadening the tax base, or exploring alternative revenue streams. A balanced approach is needed to ensure fairness and sustainability.

Strategies for Restoring Fiscal Responsibility

Restoring fiscal responsibility in Canada requires a multi-pronged approach involving significant fiscal reform and a commitment to long-term sustainability.

-

Reducing Government Spending: This involves identifying inefficiencies, prioritizing programs based on their impact and cost-effectiveness, and implementing measures to control costs. A thorough review of all government programs is necessary to ensure optimal resource allocation.

-

Tax Reform: Reforming the tax system to ensure fairness and adequacy is crucial. This could involve closing tax loopholes often exploited by corporations and high-income earners, while also considering broader tax base expansion to generate more revenue.

-

Stimulating Economic Growth: A strong economy is essential for increasing tax revenues and reducing the debt-to-GDP ratio. Investing in infrastructure, education, and innovation can boost productivity and generate long-term economic growth.

-

Transparency and Accountability: Greater transparency and accountability in government finances are crucial to fostering public trust and ensuring responsible spending. Regular, accessible reporting on government finances is essential.

The Role of Citizens in Promoting Fiscal Responsibility

Citizens play a crucial role in demanding and achieving fiscal responsibility from their elected officials.

-

Fiscal Literacy: Promoting fiscal literacy is crucial to empowering citizens to understand government finances and hold their elected officials accountable. Increased public awareness is key to informed decision-making.

-

Informed Political Participation: Active participation in the political process through voting, contacting elected officials, and engaging in public discourse is essential to ensuring that fiscal responsibility remains a top priority.

-

Citizen Engagement: Initiatives promoting fiscal literacy and encouraging citizen engagement in budgetary matters can help create a more informed and engaged electorate.

Conclusion

Canada's fiscal challenges are urgent and demand immediate and decisive action. The unsustainable trajectory of rising national debt and budget deficits necessitates a fundamental shift towards fiscal responsibility. We must embrace a multifaceted approach, involving strategic spending cuts, responsible tax reforms, economic growth initiatives, and a commitment to transparency and accountability. Most importantly, citizens must engage actively to demand fiscal responsibility from their elected officials and participate in shaping a more financially secure future for Canada. Securing Canada's economic future demands urgent attention to restoring fiscal responsibility – and everyone has a role to play.

Featured Posts

-

Trumps Immigration Policies A Wave Of Legal Obstacles

Apr 24, 2025

Trumps Immigration Policies A Wave Of Legal Obstacles

Apr 24, 2025 -

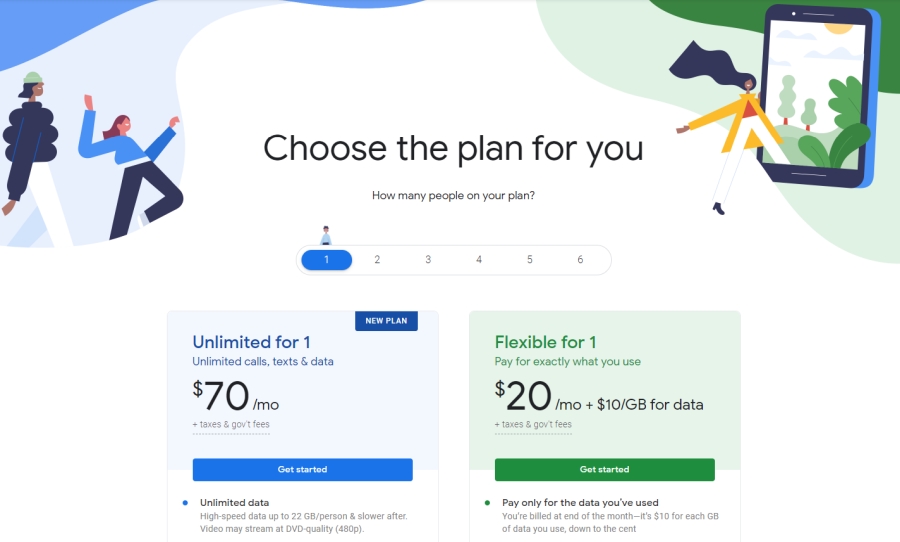

35 Unlimited Google Fis Latest Mobile Plan Explained

Apr 24, 2025

35 Unlimited Google Fis Latest Mobile Plan Explained

Apr 24, 2025 -

Rethinking Middle Management Their Vital Contribution To Companies

Apr 24, 2025

Rethinking Middle Management Their Vital Contribution To Companies

Apr 24, 2025 -

O Thanatos Toy Tzin Xakman I Sygkinitiki Anartisi Toy Tzon Travolta

Apr 24, 2025

O Thanatos Toy Tzin Xakman I Sygkinitiki Anartisi Toy Tzon Travolta

Apr 24, 2025 -

Fiscal Responsibility A Missing Element In Canadas Vision

Apr 24, 2025

Fiscal Responsibility A Missing Element In Canadas Vision

Apr 24, 2025