Record Canadian Investment In US Equities Amidst Trade War

Table of Contents

The Allure of US Equities for Canadian Investors

Several factors contribute to the attractiveness of US equities for Canadian investors, even amidst trade war anxieties.

Stronger US Dollar

A stronger US dollar significantly impacts returns for Canadian investors.

- Increased Purchasing Power: A stronger USD means Canadian investors can buy more US assets for each Canadian dollar.

- Higher Dividend Yields in USD: Dividends paid in USD translate to higher returns when the USD strengthens against the CAD.

- Potential for Capital Appreciation: Appreciation in the value of the USD further boosts returns when converting back to CAD.

Currency fluctuations are a critical aspect of international investing. Understanding these dynamics is crucial for optimizing investment strategies and managing risk effectively. For example, a weakening CAD can inflate returns on US investments when converting back to Canadian currency, even if the underlying US asset hasn't significantly appreciated.

Diversification Benefits

International diversification is paramount in mitigating risk. Investing in US equities offers significant diversification benefits for Canadian investors.

- Reduced Portfolio Volatility: Spreading investments across different markets reduces the impact of any single market's downturn.

- Exposure to Different Economic Cycles: The US and Canadian economies don't always move in sync, reducing the overall risk of portfolio losses.

- Access to a Wider Range of Investment Opportunities: The US market offers a far broader range of investment options than the Canadian market alone.

By diversifying into US equities, Canadian investors can create a more resilient portfolio less susceptible to the volatility inherent in any single market. This strategy is particularly valuable in times of economic uncertainty, like during a trade war.

Attractive Investment Opportunities

Specific sectors and companies within the US market are driving Canadian investment.

- Technology Sector Growth: The continued growth of the US tech sector presents compelling investment opportunities.

- Robust US Consumer Spending: Strong consumer spending in the US fuels growth in various sectors, creating attractive investment prospects.

- Strong Corporate Earnings in Certain Industries: Several US industries demonstrate strong and consistent earnings, making them attractive for long-term investment.

Companies like Apple, Microsoft, and Amazon, to name a few, consistently attract significant Canadian investment due to their strong performance and growth potential. This highlights the appeal of established, high-growth US companies within diversified portfolios.

Navigating Trade War Uncertainty

Canadian investors are employing sophisticated strategies to manage the risks associated with trade disputes.

Hedging Strategies

Various techniques help mitigate the risks of trade wars.

- Currency Hedging: Employing currency hedging strategies can protect against losses stemming from fluctuations in exchange rates.

- Diversification Across Sectors Less Vulnerable to Trade Wars: Investing across sectors less affected by trade disputes reduces overall portfolio vulnerability.

- Strategic Asset Allocation: Adjusting asset allocation based on trade war developments helps manage risk.

Currency hedging involves using financial instruments, such as forward contracts or options, to lock in exchange rates, thereby protecting against adverse currency movements.

Long-Term Investment Horizon

A long-term perspective is crucial for navigating short-term market fluctuations.

- Focus on Fundamental Analysis: Focusing on a company's fundamentals rather than daily market noise helps make informed investment decisions.

- Less Emphasis on Daily Market Movements: Short-term market volatility is often unrelated to long-term investment value.

- Patience in Riding Out Short-Term Volatility: A long-term approach allows investors to ride out temporary market dips.

Adopting a long-term investment strategy minimizes the impact of short-term market shocks caused by trade wars or other geopolitical events.

Government Policies and Incentives

Government policies play a role in shaping cross-border investment.

- Tax Treaties: Favorable tax treaties between Canada and the US can incentivize cross-border investment.

- Investment Promotion Initiatives: Government initiatives promoting foreign investment can encourage Canadian investment in US equities.

- Regulatory Frameworks Affecting Foreign Investment: Clear and predictable regulatory frameworks facilitate smoother cross-border investments.

These policies influence the investment landscape and impact the overall flow of capital between the two countries.

Implications and Future Outlook

Increased Canadian investment in US equities has significant implications.

Impact on Canadian Economy

The trend has several potential consequences:

- Capital Flows: Significant capital flows to the US can impact the Canadian economy's overall financial health.

- Potential for Job Creation in Canada: Investment returns can indirectly contribute to job creation in Canada.

- Impact on the Canadian Dollar: Significant capital outflows could potentially impact the value of the Canadian dollar.

The net effect on the Canadian economy is complex and depends on various interacting factors.

Future Investment Trends

Several trends are likely to shape future investment patterns:

- Continued Growth in Cross-Border Investment: The trend of increasing cross-border investment is likely to continue.

- Shifts in Investment Preferences Across Sectors: Investment preferences may shift based on economic developments and technological advancements.

- The Role of Technology in Shaping Investment Strategies: Technology will play an increasingly important role in shaping investment strategies and risk management.

The future of Canadian investment in US equities will be influenced by a dynamic interplay of economic, political, and technological forces.

Conclusion

The record-high Canadian investment in US equities reflects the resilience and strategic approach of Canadian investors navigating global economic uncertainty, particularly the US-China trade war. Factors such as the stronger US dollar, diversification benefits, and attractive investment opportunities in the US market have fuelled this trend. Sophisticated hedging strategies and a long-term perspective play crucial roles in mitigating trade war-related risks. Understanding the dynamics of Canadian investment in US equities is crucial for investors seeking to optimize their portfolios. Learn more about managing risk and maximizing returns through strategic cross-border investment in US equities. Consult a financial advisor to explore suitable strategies for your specific investment needs.

Featured Posts

-

Analysis Trumps Call For Powells Termination And Its Implications

Apr 23, 2025

Analysis Trumps Call For Powells Termination And Its Implications

Apr 23, 2025 -

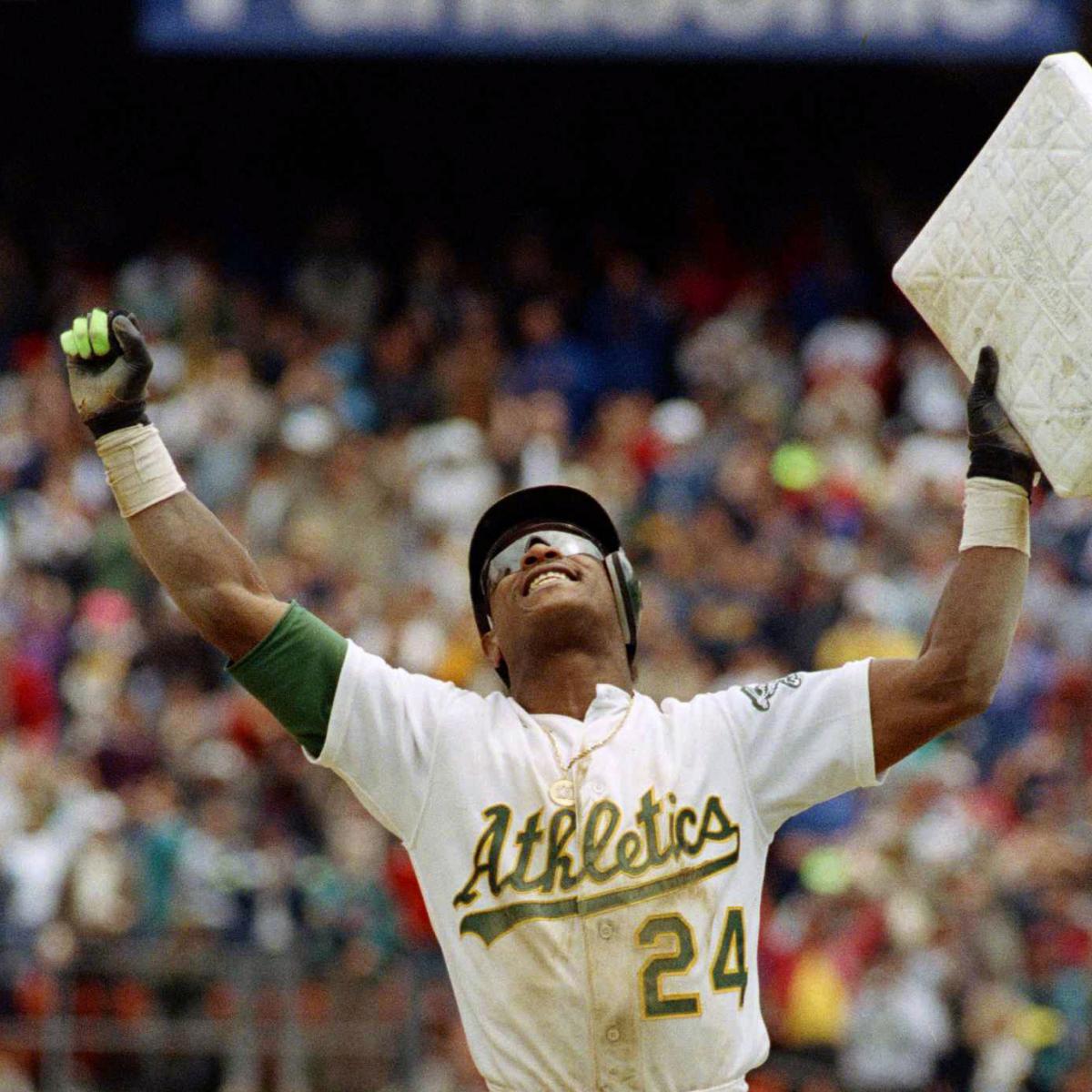

Nine Stolen Bases Power Brewers To Decisive Win Against Athletics

Apr 23, 2025

Nine Stolen Bases Power Brewers To Decisive Win Against Athletics

Apr 23, 2025 -

Yankees Opening Day Victory Analyzing The Winning Formula

Apr 23, 2025

Yankees Opening Day Victory Analyzing The Winning Formula

Apr 23, 2025 -

Yankees Historic Night 9 Home Runs Judges Triple Crown Performance

Apr 23, 2025

Yankees Historic Night 9 Home Runs Judges Triple Crown Performance

Apr 23, 2025 -

Keider Monteros Rough Outing In Tigers Series Finale Loss To Brewers

Apr 23, 2025

Keider Monteros Rough Outing In Tigers Series Finale Loss To Brewers

Apr 23, 2025