Power Finance Corporation FY25 Dividend: Expecting 4th Cash Reward On March 12

Table of Contents

Understanding the Power Finance Corporation (PFC) Dividend History

Power Finance Corporation boasts a consistent history of dividend payments, fostering investor confidence and trust. Examining past payouts helps gauge expectations for the upcoming FY25 dividend. The company's commitment to returning value to shareholders is evident in its track record.

- FY22 Dividend details: [Insert FY22 Dividend Amount and Details Here]

- FY23 Dividend details: [Insert FY23 Dividend Amount and Details Here]

- FY24 Dividend details: [Insert FY24 Dividend Amount and Details Here]

- Comparison of dividend yields with peers: [Insert comparison data and analysis here. Compare PFC's dividend yield to similar companies in the Indian financial sector]. This comparison provides valuable context and helps assess the attractiveness of the PFC dividend relative to its competitors.

Factors Influencing the FY25 PFC Dividend

Several crucial factors will influence the final amount of the FY25 PFC dividend. Analyzing these factors provides a clearer picture of what investors can expect.

- PFC's financial health and profitability: The company's overall financial performance in FY24, including profitability, revenue growth, and debt levels, will significantly impact the dividend decision. Strong financial results typically lead to higher dividend payouts.

- Government regulations and policies: Government policies and regulations pertaining to the power sector and dividend distribution can influence the PFC's decision. Any changes in these areas could affect the final dividend amount.

- Market conditions and investor sentiment: Prevailing market conditions and investor sentiment play a role. A positive market outlook might encourage a higher dividend, while uncertainty could lead to a more conservative approach.

- Any planned investments or capital expenditures: Significant planned investments or capital expenditures could reduce the amount available for dividend distribution, as the company might prioritize reinvestment for future growth.

Expected Dividend Amount and Implications for Investors

Predicting the exact FY25 PFC dividend amount is challenging without official announcements. However, based on the company's past performance and current market conditions, a range can be estimated. [Insert estimated dividend amount or range here, citing sources and analysis if available].

- Potential dividend yield: [Calculate and state the potential dividend yield based on the estimated dividend amount and current share price].

- Tax implications for different tax brackets: Investors should be aware of the tax implications of receiving dividends. Tax rates vary depending on the investor's tax bracket. [Provide a brief overview of the tax implications].

- Impact on share price – pre and post-dividend: The announcement and payout of the dividend usually impact the share price. Often, the share price drops slightly on the ex-dividend date, reflecting the value of the dividend paid out.

- Investment strategies considering the dividend: Long-term investors might view the dividend as passive income, while short-term investors may focus on the impact on the share price.

How to Receive Your Power Finance Corporation Dividend

Receiving your Power Finance Corporation dividend depends on how you hold your shares.

- Steps for receiving dividends in demat account: If you hold your PFC shares in a dematerialized (demat) account, the dividend will be automatically credited to your account. [Provide additional details as needed].

- Steps for receiving dividends for physical shares: If you hold physical share certificates, you'll need to follow the process outlined by your registrar and transfer agent. [Provide additional details as needed].

- Contact information for inquiries: [Provide relevant contact information for shareholders with questions or concerns].

- Important dates and deadlines: [Mention any important dates and deadlines related to receiving the dividend].

Conclusion

The Power Finance Corporation FY25 dividend, expected on March 12th, is a significant event for investors. While the precise amount remains to be officially announced, analysis of past performance and current market conditions allows for a reasonable estimation [reiterate estimated amount or range]. Several factors, including PFC's financial health, government policies, and market sentiment, will ultimately shape the final dividend payout. To receive your dividend, ensure your shareholding details are up-to-date. Stay informed about the PFC dividend news and upcoming Power Finance Corporation dividend updates. Remember to consult with a financial advisor before making any investment decisions related to the Power Finance Corporation dividend or PFC share investment.

Featured Posts

-

Hair And Tattoo Trends Inspired By Ariana Grandes Recent Transformation

Apr 27, 2025

Hair And Tattoo Trends Inspired By Ariana Grandes Recent Transformation

Apr 27, 2025 -

Hhs Appoints Anti Vaccine Activist To Review Autism Vaccine Link Sources

Apr 27, 2025

Hhs Appoints Anti Vaccine Activist To Review Autism Vaccine Link Sources

Apr 27, 2025 -

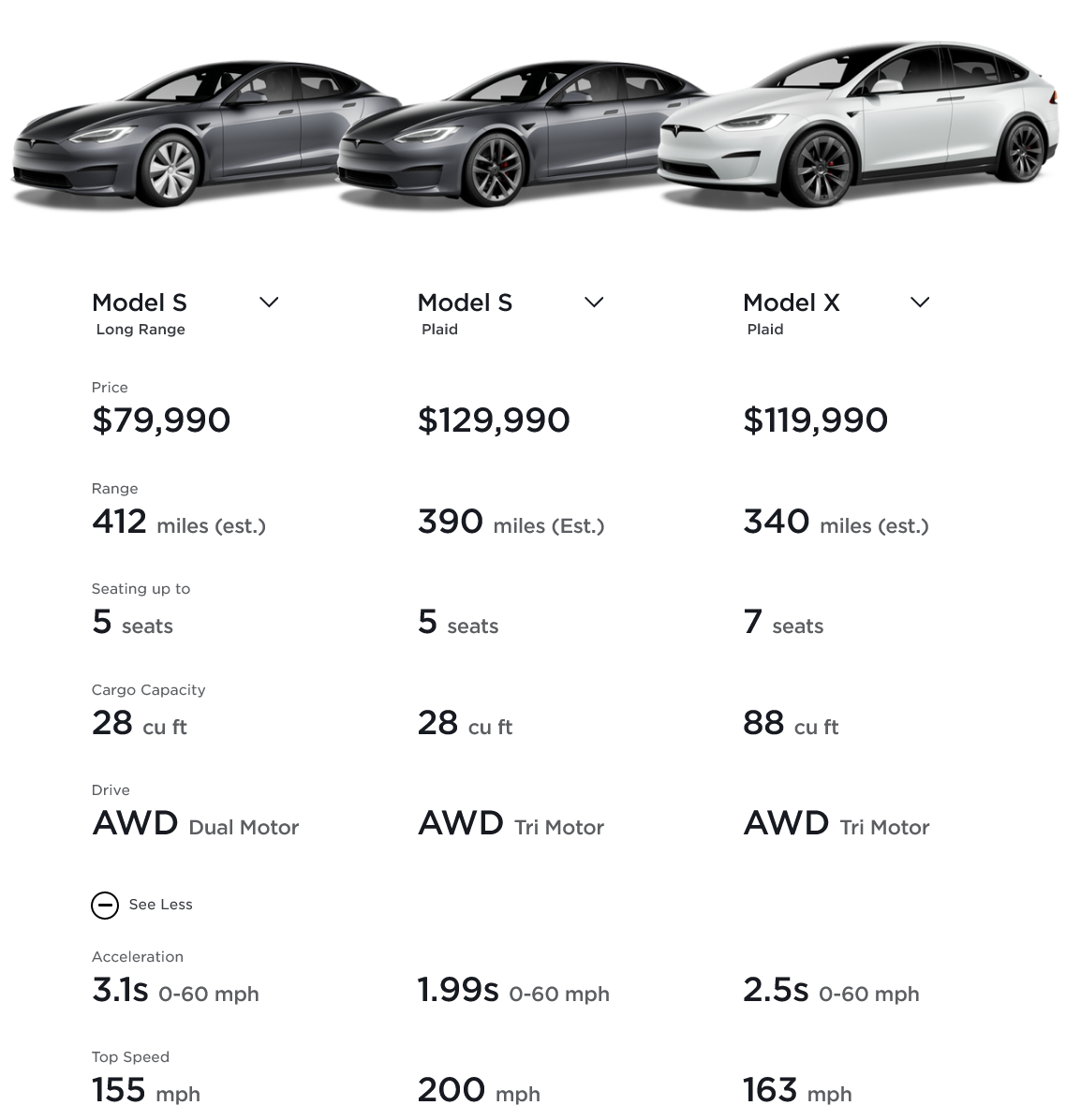

Tesla Canada Price Increase Pre Tariff Inventory Push

Apr 27, 2025

Tesla Canada Price Increase Pre Tariff Inventory Push

Apr 27, 2025 -

Concerns Raised Over Cdc Vaccine Study Hires Misinformation Past

Apr 27, 2025

Concerns Raised Over Cdc Vaccine Study Hires Misinformation Past

Apr 27, 2025 -

Survey Shows Drop In Canadian Interest In Electric Vehicle Purchases

Apr 27, 2025

Survey Shows Drop In Canadian Interest In Electric Vehicle Purchases

Apr 27, 2025