New ECB Task Force To Tackle Banking Regulatory Complexity

Table of Contents

The Genesis of the ECB Task Force

The creation of the ECB Task Force is a direct response to the escalating complexities within the European banking regulatory framework. The current system suffers from several key weaknesses: a rising regulatory burden, fragmentation of rules across member states, and a lack of harmonization leading to inconsistencies in application and interpretation. These factors contribute to significant challenges for banks operating within the EU.

- Rising compliance costs for banks: Meeting the diverse and often overlapping regulatory requirements across different EU countries places a heavy financial strain on financial institutions, particularly smaller banks.

- Increased administrative burden: The complexity of navigating numerous regulations necessitates significant investment in compliance infrastructure and personnel, diverting resources from core banking activities.

- Inconsistent application of regulations across the EU: Differences in interpretation and enforcement of regulations across member states create an uneven playing field and hinder the efficient functioning of the single market.

- Need for improved supervisory efficiency: Streamlining regulations is crucial for improving the efficiency and effectiveness of banking supervision across the EU.

- Enhancement of financial stability: A clearer and more consistent regulatory framework contributes to a more stable and resilient European banking system.

Key Objectives of the Task Force

The primary objectives of the ECB Task Force are to simplify, harmonize, and clarify existing banking regulations. This ambitious undertaking aims to create a more efficient and level playing field for banks operating within the EU.

- Streamlining existing banking regulations: The task force will analyze existing regulations to identify overlaps, inconsistencies, and areas for simplification, aiming to reduce unnecessary bureaucracy.

- Identifying and removing inconsistencies across member states: The task force will work to harmonize regulatory approaches across the EU, ensuring a consistent application of rules and minimizing regulatory arbitrage.

- Developing clearer and more easily understandable guidelines: The task force will focus on improving the clarity and accessibility of regulatory guidance, making it easier for banks to comply with the rules.

- Improving the efficiency of supervisory processes: By streamlining regulations, the task force will contribute to more efficient and effective banking supervision.

- Promoting a level playing field for banks across the EU: This will ensure fair competition and prevent regulatory disadvantages for banks in certain member states.

- Reducing regulatory burden for smaller banks: The task force recognizes the disproportionate impact of complex regulations on smaller banks and aims to alleviate this burden.

Composition and Methodology of the Task Force

The ECB Task Force comprises a diverse group of experts, including representatives from the ECB, national central banks, and potentially external banking industry experts. This multi-stakeholder approach ensures a comprehensive understanding of the challenges and potential solutions. Their methodology will likely involve:

- Expertise represented within the task force: A combination of legal, economic, and banking expertise is crucial for navigating the intricacies of the regulatory landscape.

- Consultation process with stakeholders (banks, supervisors, etc.): Open communication and collaboration with relevant stakeholders are essential for ensuring the task force’s recommendations are practical and effective.

- Methodology for identifying areas for simplification: This might involve quantitative analysis of regulatory burden, qualitative assessments of regulatory clarity, and benchmarking against best practices in other jurisdictions.

- Timeline for delivering recommendations: A clearly defined timeline will ensure accountability and timely implementation of the task force’s findings.

- Transparency of the task force’s work: Openness and transparency in the task force’s processes will foster trust and confidence in its recommendations.

Potential Impact on the European Banking Sector

The successful implementation of the ECB Task Force's recommendations holds the potential to significantly benefit the European banking sector.

- Reduced compliance costs for banks: Simplification and harmonization of regulations will lead to lower compliance costs, freeing up resources for investment and innovation.

- Increased operational efficiency: Clearer and more streamlined regulations will allow banks to operate more efficiently, reducing administrative burden and improving productivity.

- Improved competitiveness of European banks: A more efficient and less burdensome regulatory environment will enhance the competitiveness of European banks in the global financial market.

- Potential for fostering innovation in the financial sector: Reduced regulatory complexity can create an environment conducive to innovation in financial products and services.

- Challenges in achieving full harmonization across diverse national contexts: Differences in national legal systems and traditions may present challenges in achieving complete harmonization of regulations.

Conclusion

The new ECB Task Force represents a significant step towards tackling the escalating complexity of banking regulations within the European Union. By streamlining processes, harmonizing rules, and clarifying guidelines, the task force aims to create a more efficient, stable, and competitive banking sector. The success of this initiative will depend on effective collaboration, transparent communication, and a pragmatic approach to resolving existing regulatory challenges. Stay informed about the progress of the ECB Task Force and its impact on the future of European banking. Following the work of this ECB task force will be crucial for all stakeholders in the European financial system.

Featured Posts

-

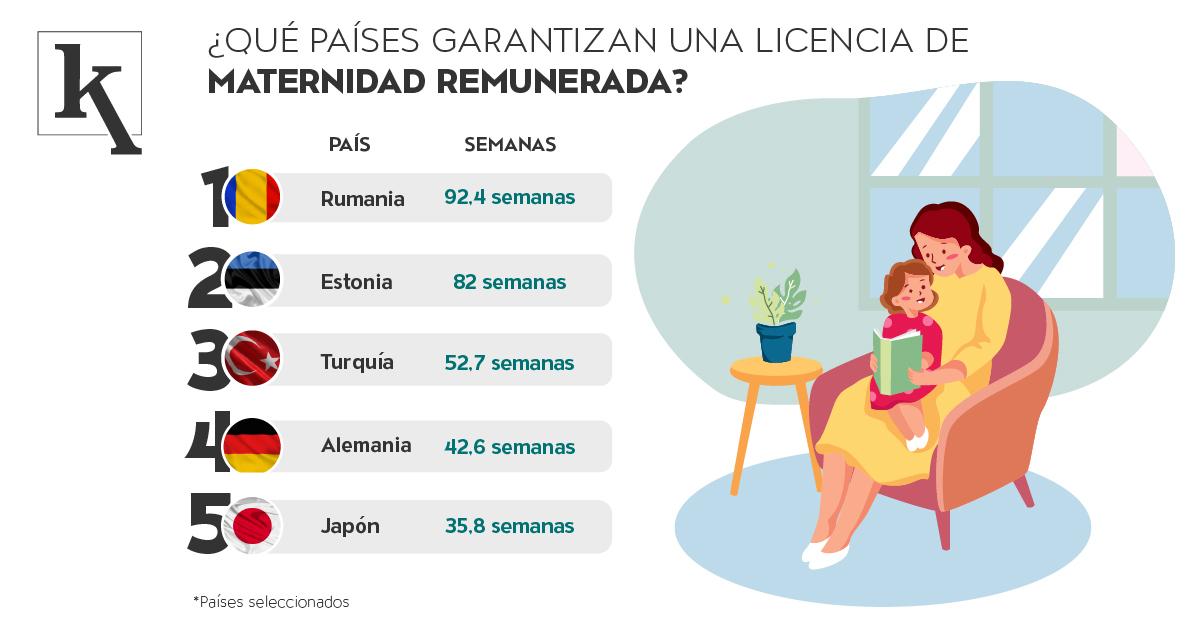

Revolucionario Wta Ofrece Licencia De Maternidad Remunerada A Sus Tenistas

Apr 27, 2025

Revolucionario Wta Ofrece Licencia De Maternidad Remunerada A Sus Tenistas

Apr 27, 2025 -

Mafs Star Sam Carraros Five Minute Love Triangle On Stan

Apr 27, 2025

Mafs Star Sam Carraros Five Minute Love Triangle On Stan

Apr 27, 2025 -

The Cdcs Vaccine Study Hire A Case Of Misinformation

Apr 27, 2025

The Cdcs Vaccine Study Hire A Case Of Misinformation

Apr 27, 2025 -

Professional Help For Hair And Tattoo Decisions Inspired By Ariana Grandes Style

Apr 27, 2025

Professional Help For Hair And Tattoo Decisions Inspired By Ariana Grandes Style

Apr 27, 2025 -

2025 Nfl Season Justin Herbert And The Chargers Head To Brazil

Apr 27, 2025

2025 Nfl Season Justin Herbert And The Chargers Head To Brazil

Apr 27, 2025