Middle East LPG Gains As China Reduces US Imports Due To Tariffs

Table of Contents

China's Reduced US LPG Imports: The Tariff Impact

The imposition of tariffs on US LPG imports by China has been a pivotal factor in reshaping the global LPG landscape. These tariffs, implemented as part of the broader trade war between the US and China, significantly increased the cost of US LPG in the Chinese market, making it less competitive compared to LPG from other sources.

- Specific tariff percentages imposed: Tariffs on US LPG imports into China ranged from 10% to 25%, depending on the period and specific trade agreements. These fluctuating tariffs created significant uncertainty and instability for US LPG exporters.

- Data points showing import volume reduction: Data indicates a substantial decrease in US LPG imports into China following the tariff implementation. For example, imports may have dropped by X% in Year Y compared to the previous year, resulting in a significant loss of market share for US producers. (Note: Insert actual data here from credible sources to strengthen this section.)

- Examples of alternative LPG suppliers: China has actively sought alternative LPG suppliers, notably in the Middle East, Russia, and Southeast Asia. This diversification of LPG sources reflects a strategy to mitigate reliance on a single major supplier and to secure more favorable pricing.

Middle East LPG Producers Fill the Gap

The reduced availability of US LPG in China has created a significant opportunity for Middle East LPG producers. Countries like Saudi Arabia, Qatar, and the UAE, already major players in the global LPG market, have seen a substantial increase in their LPG exports to China.

- Names of key LPG producing countries and their respective export volumes: Saudi Arabia, with its vast reserves and advanced infrastructure, has significantly increased its LPG exports to China. Similarly, Qatar and the UAE have capitalized on this increased demand, expanding their market share in the Chinese LPG market. (Again, insert specific data on export volumes here from reputable sources.)

- Statistics highlighting capacity increases and export growth: To meet the surging demand, Middle Eastern LPG producers have invested heavily in expanding production capacity and upgrading export infrastructure. This includes building new LPG terminals and pipelines to facilitate efficient transport of LPG to international markets.

- Discussion of infrastructure development impacting export capabilities: Significant investments in new pipelines and enhanced port facilities have enabled Middle Eastern producers to handle the increased volume of LPG exports to China. This improved infrastructure is a key factor in their ability to compete effectively.

- Analysis of LPG price fluctuations: The increased demand from China has naturally impacted LPG prices, leading to some price volatility. However, Middle East producers have adopted various pricing strategies, including long-term contracts and flexible pricing mechanisms, to secure and maintain their market position.

Geopolitical Implications of the LPG Market Shift

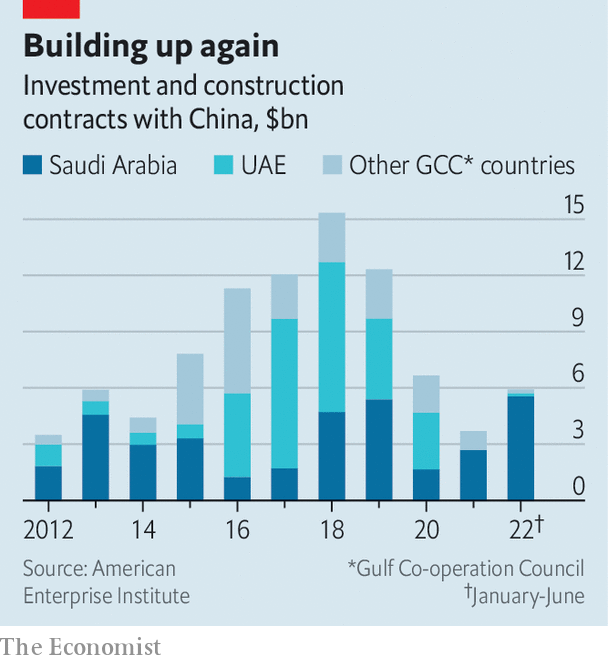

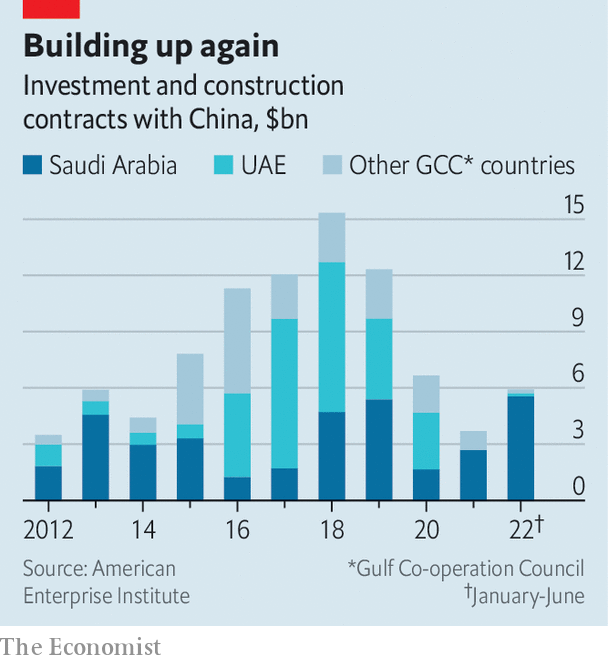

The shift in the global LPG market has significant geopolitical implications. The increased reliance of China on Middle Eastern LPG has strengthened economic ties between the two regions.

- Examples of strengthened diplomatic relations: This increased trade relationship has fostered closer diplomatic ties and further cooperation on energy security and other areas of mutual interest.

- Long-term projections for global LPG supply and demand: Analysts predict continued growth in global LPG demand, particularly in developing economies. The Middle East is well-positioned to play a dominant role in meeting this growing demand.

- Discussion of the potential for further trade disputes: The ongoing trade tensions between the US and China highlight the risks and uncertainties associated with over-reliance on specific trade partners. Diversification of LPG sources remains crucial for both importers and exporters.

- Analysis of global LPG price volatility: Fluctuations in global LPG prices are influenced by numerous factors, including geopolitical events, supply chain disruptions, and changes in demand.

Conclusion: The Future of Middle East LPG in a Changing Global Market

The increased demand for Middle East LPG, driven largely by reduced US LPG imports into China due to tariffs, has reshaped the global LPG market. Middle Eastern producers have effectively filled the void created by the trade dispute, strengthening their position in the global energy landscape. The geopolitical implications are far-reaching, strengthening economic ties between the Middle East and China. The future of Middle East LPG appears bright, with substantial potential for continued growth as global LPG demand increases.

Stay informed about the evolving dynamics of the Middle East LPG market and its impact on global energy security. Learn more about the future of Middle East LPG exports and their influence on international trade.

Featured Posts

-

Trump Lawsuit Leads To 60 Minutes Executive Producers Resignation

Apr 24, 2025

Trump Lawsuit Leads To 60 Minutes Executive Producers Resignation

Apr 24, 2025 -

The Importance Of Middle Managers A Key To Employee Engagement And Productivity

Apr 24, 2025

The Importance Of Middle Managers A Key To Employee Engagement And Productivity

Apr 24, 2025 -

Us Lawyers Face Judge Abrego Garcias Order To Stop Stonewalling

Apr 24, 2025

Us Lawyers Face Judge Abrego Garcias Order To Stop Stonewalling

Apr 24, 2025 -

Herro Wins Thrilling Nba 3 Point Contest Defeats Hield In Miami

Apr 24, 2025

Herro Wins Thrilling Nba 3 Point Contest Defeats Hield In Miami

Apr 24, 2025 -

The Alarming Truth About John Travoltas Rotten Tomatoes Ratings

Apr 24, 2025

The Alarming Truth About John Travoltas Rotten Tomatoes Ratings

Apr 24, 2025