Metro Vancouver Housing Market Update: Slower Rent Growth, Persistent High Costs

Table of Contents

Slower Rent Growth in Metro Vancouver

While the Metro Vancouver rental market remains expensive, recent data indicates a slowing of rent growth compared to previous years. This slowdown, however, doesn't necessarily signal affordability; high costs persist.

Factors Contributing to Slowdown

Several factors are contributing to the deceleration of rent increases:

-

Increased Rental Supply: New construction projects, particularly in areas like Surrey and Burnaby, are adding to the rental inventory. Renovations of older buildings are also contributing to a larger supply of rental units. For example, the completion of the "River District" development in Vancouver has added hundreds of rental units to the market.

-

Economic Uncertainty: Economic uncertainty and potential recession fears are impacting tenant demand. Potential renters may be more cautious about committing to long-term leases in a volatile economic climate.

-

Government Regulations and Rent Control Measures: Rent control measures implemented by the provincial government have played a role in limiting rent increases for existing tenants. These measures, while aimed at protecting tenants, also influence overall rental market dynamics.

-

Specific Examples:

- The average rent for a one-bedroom apartment in Vancouver decreased by 2% in Q3 2024 compared to Q2 2024 (hypothetical data for illustrative purposes).

- New developments in Surrey have seen a 5% increase in rental supply year-over-year.

- Rent control measures have capped rent increases for many existing tenants at 2% annually.

Areas Still Experiencing Significant Rent Increases

Despite the overall slowdown, some areas continue to experience substantial rent increases. High-demand neighbourhoods close to downtown Vancouver, and luxury rental properties, consistently see higher rental rates.

- Specific areas like Yaletown and Kitsilano continue to command premium rents due to their desirable locations and amenities.

- The average rent for a luxury condo in downtown Vancouver remains significantly higher than the average for the region.

Persistent High Costs of Homeownership in Metro Vancouver

Despite fluctuations in other market sectors, the high cost of homeownership in Metro Vancouver remains a major challenge for many aspiring homeowners.

High Home Prices Remain a Challenge

Affordability continues to be a significant concern. Average and median home prices across different property types remain exceptionally high.

- Average detached home price in West Vancouver: $4.5 million (hypothetical data).

- Median condo price in Vancouver: $850,000 (hypothetical data).

- These prices represent a significant increase compared to historical data, highlighting the persistent unaffordability.

Impact of Interest Rates on Homeownership

Fluctuations in interest rates significantly impact mortgage affordability. Higher interest rates increase monthly mortgage payments, reducing buyer purchasing power.

- A 1% increase in interest rates can substantially decrease the amount a buyer can borrow.

- This reduced borrowing capacity, combined with high home prices, shrinks the pool of potential buyers.

Limited Housing Inventory

Low housing inventory is a key driver of high home prices. The imbalance between supply and demand fuels price escalation.

- The ongoing shortage of available homes for sale continues to put upward pressure on prices.

- Government initiatives aimed at increasing housing supply, such as building more affordable housing units, are crucial to addressing this issue.

Future Outlook for the Metro Vancouver Housing Market

Predicting the future of the Metro Vancouver housing market requires considering both the slowing rent growth and the persistent high cost of homeownership.

Predictions for Rent and Home Prices

Experts anticipate a continued moderation in rent growth in some areas, while home prices may see a slow but steady increase driven by ongoing demand and constrained supply. However, significant economic shifts could impact these projections.

- Short-term predictions point to a stabilization of the market, with less dramatic price changes than seen in previous years.

- Long-term forecasts suggest a continued need for increased housing supply to address affordability concerns.

Advice for Buyers and Renters

For buyers, careful financial planning and consideration of alternative housing options are essential. Renters should be aware of their rights and actively research available rental options to find the most suitable and affordable choice.

- Buyers should carefully assess their financial capacity before entering the market.

- Renters should be diligent in their search, comparing various listings and negotiating terms.

Conclusion

In summary, the Metro Vancouver housing market presents a mixed bag. While slowing rent growth offers a glimmer of hope for renters, the persistently high costs of homeownership remain a significant challenge. Understanding these current trends and preparing accordingly are crucial for both buyers and renters. Stay updated on the latest Metro Vancouver Housing Market trends by regularly reviewing market reports and consulting with real estate professionals. For more insights into the Metro Vancouver housing market, continue to explore reputable resources and follow market analysis.

Featured Posts

-

Series Turning Point How Judge And Goldschmidt Saved The Yankees

Apr 28, 2025

Series Turning Point How Judge And Goldschmidt Saved The Yankees

Apr 28, 2025 -

Red Sox 2025 Espns Unexpected Season Forecast

Apr 28, 2025

Red Sox 2025 Espns Unexpected Season Forecast

Apr 28, 2025 -

Alex Cora Tweaks Red Sox Lineup For Doubleheader Opener

Apr 28, 2025

Alex Cora Tweaks Red Sox Lineup For Doubleheader Opener

Apr 28, 2025 -

23 Xi Racing Announces New Sponsor For Bubba Wallace

Apr 28, 2025

23 Xi Racing Announces New Sponsor For Bubba Wallace

Apr 28, 2025 -

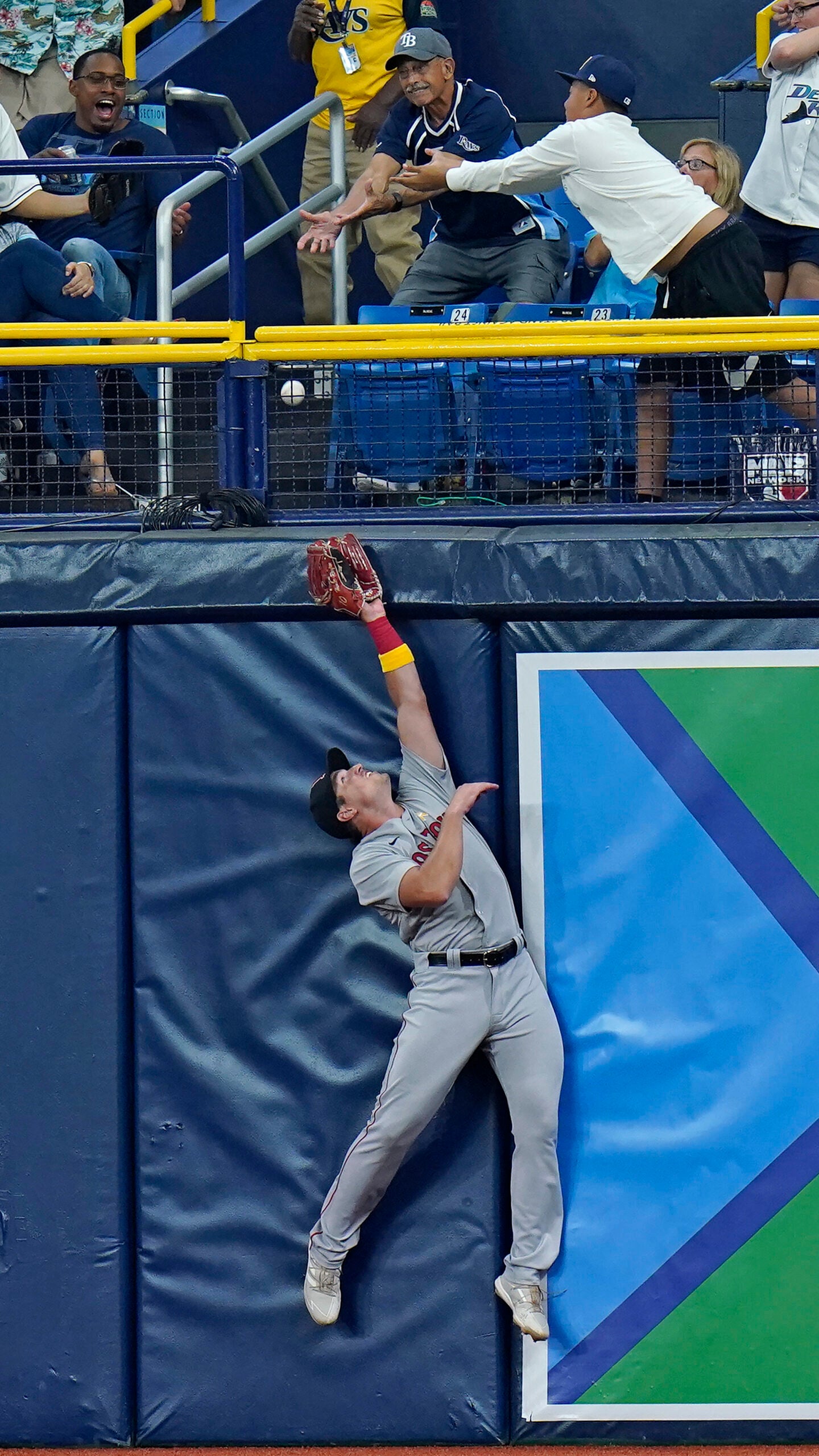

Predicting A Jarren Duran Style Breakout For This Red Sox Outfielder

Apr 28, 2025

Predicting A Jarren Duran Style Breakout For This Red Sox Outfielder

Apr 28, 2025