India Market Update: Tailwinds Driving Nifty's Strong Performance

Table of Contents

Robust Domestic Demand Fuels Nifty's Growth

A significant driver of the Nifty 50's impressive performance is the robust growth in domestic demand. This surge in consumer spending is underpinning the expansion of various sectors, contributing significantly to the overall market performance.

Rising Consumer Spending

Increased consumer spending across multiple sectors is a key indicator of a healthy Indian economy. This positive trend is evident in the growth witnessed in several key areas.

- Growth in rural consumption: Government initiatives aimed at boosting rural incomes and improved agricultural yields have led to a significant increase in rural spending.

- Rising disposable incomes: Steady economic growth and job creation have resulted in higher disposable incomes, empowering consumers to spend more on discretionary items.

- Positive consumer sentiment: Growing confidence in the economy and future prospects is fueling increased consumer spending and investment.

This strong domestic consumption, reflected in the growth of Nifty sectoral indices like the Nifty FMCG index and the Nifty Auto index, is a crucial factor supporting the overall Nifty 50 performance. Analyzing the Consumer Confidence Index and retail sales growth data provides further insights into this trend.

Government Spending and Infrastructure Development

The Indian government's significant investments in infrastructure development are acting as a powerful catalyst for economic growth. These initiatives are creating a multiplier effect, boosting various sectors and supporting the overall Nifty 50 performance.

- Impact of government schemes: Government schemes aimed at improving infrastructure, including roads, railways, and digital connectivity, are generating employment and stimulating economic activity.

- Infrastructure projects: Large-scale infrastructure projects are creating a significant demand for construction materials, machinery, and related services.

- Boost to construction and related sectors: The construction sector and associated industries are experiencing a significant upswing, contributing positively to the Nifty Infrastructure index and overall market sentiment.

Government expenditure and public investment in infrastructure are vital components of India's economic strategy, creating a positive feedback loop that benefits the broader economy and positively impacts the Nifty 50's trajectory.

Foreign Institutional Investor (FII) Inflows

Significant foreign institutional investor (FII) inflows have played a crucial role in driving the Nifty's upward trajectory. The positive sentiment towards the Indian market is attracting considerable foreign investment.

Positive Sentiment Towards India

Several factors are contributing to the positive sentiment among FIIs towards the Indian market.

- Strong economic fundamentals: India's strong macroeconomic fundamentals, including a young and growing population and a large domestic market, are attracting substantial foreign investment.

- Comparatively higher growth prospects compared to other economies: Compared to many other global economies, India offers comparatively higher growth prospects, making it an attractive investment destination.

- Positive reforms: The government's ongoing efforts to implement economic reforms and improve the business environment are further enhancing investor confidence.

These factors combined are driving substantial FII investments, directly impacting the Nifty index performance and overall market capitalization.

Impact of Global Macroeconomic Conditions

While global macroeconomic conditions can influence FII inflows, India's robust domestic fundamentals offer a degree of insulation.

- Comparison with other markets: Compared to other emerging and developed markets, India's growth story continues to attract investment despite global uncertainties.

- Global risk appetite: While global risk appetite can fluctuate, India's relative stability and growth potential often make it a preferred investment destination.

- Impact of interest rate hikes in other countries: Interest rate hikes in other countries can influence capital flows, but India's relatively independent monetary policy offers some resilience.

Analyzing the global economic outlook and the interplay between US interest rates and market volatility is crucial to understanding the influence of global factors on FII investments and the Nifty's performance.

Managing Inflation and Interest Rates

The Reserve Bank of India's (RBI) management of inflation and interest rates plays a significant role in shaping the market's trajectory. Balancing economic growth with price stability is a key challenge.

Inflation Management

The RBI's proactive measures are crucial in keeping inflation under control, supporting a stable economic environment.

- CPI and WPI data: Monitoring the Consumer Price Index (CPI) and Wholesale Price Index (WPI) data provides insights into inflationary pressures.

- RBI's monetary policy: The RBI's monetary policy decisions, including interest rate adjustments, are crucial in managing inflation and maintaining price stability.

- Impact of inflation on consumer spending: High inflation can dampen consumer spending, potentially affecting the Nifty's performance. Therefore, effective inflation management is critical for sustained market growth.

Analyzing the inflation rate and the RBI's monetary policy decisions is critical for understanding their impact on the Nifty valuation and overall market sentiment.

Interest Rate Scenarios and Their Implications

Interest rate changes significantly impact borrowing costs and corporate earnings, influencing the Nifty's performance.

- RBI's policy stance: The RBI's policy stance on interest rates reflects its assessment of the economic situation and its goals for inflation and growth.

- Impact on borrowing costs: Changes in interest rates directly impact borrowing costs for businesses, influencing investment decisions and corporate profitability.

- Effect on corporate earnings: Interest rate changes can impact corporate earnings, influencing stock valuations and the overall Nifty 50 performance.

Understanding the repo rate, reverse repo rate, and their impact on credit growth are crucial for predicting the future direction of the Nifty.

Conclusion

The Nifty 50's robust performance is a result of the confluence of several positive factors, including robust domestic demand, significant FII inflows, and the effective management of inflation and interest rates by the RBI. While challenges undoubtedly remain, the overall outlook for the Indian economy and the Nifty 50 appears positive. Understanding these tailwinds is essential for investors seeking to capitalize on the significant investment opportunities in the Indian stock market. Stay informed about upcoming Nifty 50 updates and continue analyzing the various factors influencing its performance to make well-informed investment decisions. Further analysis of the Indian market and the Nifty 50 is crucial for long-term success in this dynamic market.

Featured Posts

-

Ray Epps Sues Fox News For Defamation Jan 6th Allegations And The Case Details

Apr 24, 2025

Ray Epps Sues Fox News For Defamation Jan 6th Allegations And The Case Details

Apr 24, 2025 -

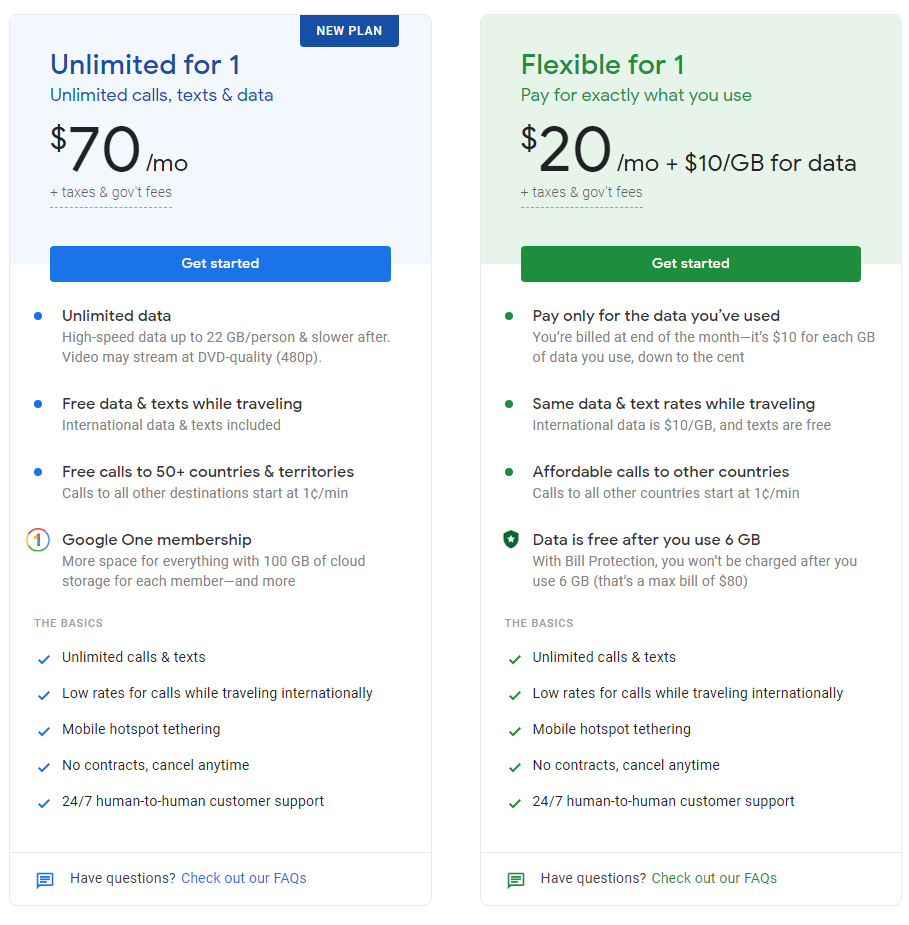

Is Google Fis 35 Unlimited Plan Worth It

Apr 24, 2025

Is Google Fis 35 Unlimited Plan Worth It

Apr 24, 2025 -

Before You Vote Liberal William Watsons Platform Analysis

Apr 24, 2025

Before You Vote Liberal William Watsons Platform Analysis

Apr 24, 2025 -

16 Million Fine For T Mobile Details Of Three Years Of Data Security Lapses

Apr 24, 2025

16 Million Fine For T Mobile Details Of Three Years Of Data Security Lapses

Apr 24, 2025 -

Viral Whataburger Video Propels Hisd Mariachi To Uil State Competition

Apr 24, 2025

Viral Whataburger Video Propels Hisd Mariachi To Uil State Competition

Apr 24, 2025