High Stock Market Valuations: BofA's Analysis And Why Investors Shouldn't Panic

Table of Contents

BofA's Key Findings on High Stock Market Valuations

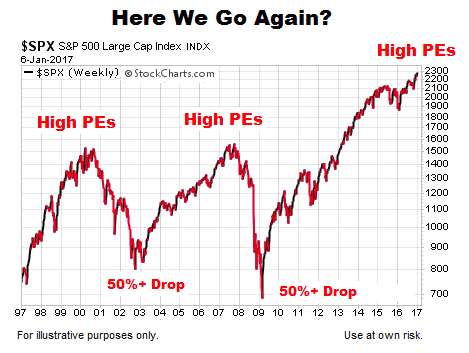

BofA's stock market valuation report offers a detailed assessment of current market multiples. Their analysis utilizes various valuation metrics, including the widely followed price-to-earnings ratio (P/E) and the cyclically adjusted price-to-earnings ratio (Shiller P/E), to gauge equity market valuation.

-

BofA's Assessment: BofA's recent reports (you'll need to insert the specific report and date here for accuracy) generally indicate that current valuations are elevated compared to historical averages. The exact figures and their interpretations vary depending on the specific report, so refer to BofA's official publications for the most up-to-date information. However, expect to see discussions of elevated P/E ratios and other valuation metrics.

-

Sector-Specific Valuations: The report likely highlights specific sectors or asset classes that are deemed overvalued or undervalued. For example, certain technology stocks might be flagged as potentially overvalued, while sectors perceived as more defensive might be seen as relatively undervalued. Again, you will need to insert specifics from BofA's reports.

-

Identified Risks: BofA typically identifies key risks influencing market valuations. These often include inflation, interest rate hikes by central banks (like the Federal Reserve), and geopolitical uncertainty. These factors can significantly impact investor sentiment and market performance.

-

Overall Outlook: BofA's overall outlook will be crucial to understanding their stance. This could range from cautiously optimistic (bullish) to more reserved (neutral or even slightly bearish) depending on their assessment of the prevailing economic conditions and market trends. Refer to their latest reports for their current outlook.

Understanding the Nuances of High Valuations

While high stock market valuations can be unsettling, it's crucial to understand that they aren't always a precursor to an immediate market crash. Understanding stock market cycles is paramount.

-

Historical Context: Examining historical data reveals periods of similarly high valuations that weren't followed by immediate or significant corrections. The length of time valuations remain elevated, the rate of economic growth, and other macroeconomic factors all play a crucial role.

-

Factors Supporting High Valuations: Several factors can justify high valuations. These include periods of low interest rates, which make borrowing cheaper for companies and increase investment, strong corporate earnings fueled by economic growth, and groundbreaking technological innovations that drive future expectations.

-

Short-Term vs. Long-Term: It's vital to differentiate between short-term market fluctuations and long-term trends. Short-term volatility is normal and often driven by factors unrelated to the underlying economic fundamentals.

Strategies for Investors in a High-Valuation Market

Navigating a market with high stock market valuations requires a strategic approach.

-

Diversification: Diversifying your portfolio across different asset classes – stocks, bonds, real estate, and potentially alternative investments – is a cornerstone of risk management. This reduces your exposure to any single asset class.

-

Risk Tolerance and Investment Strategy: Before making any investment decisions, clearly define your risk tolerance. This will guide your asset allocation strategy and help you make informed choices that align with your personal financial goals and risk appetite.

-

Portfolio Rebalancing: Regularly rebalance your portfolio to maintain your desired asset allocation. This involves selling some assets that have performed well and buying others that have underperformed, bringing your portfolio back to your target allocation.

-

Defensive Investments: Consider incorporating defensive investments, such as high-quality bonds or dividend-paying stocks, into your portfolio. These can provide a degree of stability during periods of market uncertainty.

Why Panic Selling is Usually Counterproductive

Panic selling, driven by fear and emotion, is often counterproductive.

-

Psychological Impact: Panic selling leads to poor investment decisions based on fear rather than rational analysis. This can result in significant losses, especially if the market recovers quickly.

-

Market Timing Difficulty: Successfully timing the market – buying low and selling high – is exceptionally difficult, even for experienced professionals. Trying to predict market bottoms or tops consistently leads to underperformance.

-

Buy and Hold Strategy: A long-term, buy-and-hold strategy, focused on consistently investing in high-quality assets, historically outperforms attempts to time the market.

Conclusion

BofA's analysis highlights elevated stock market valuations, but this doesn't automatically signal an impending crash. Understanding the nuances of market cycles, diversifying your investments, and adopting a long-term perspective are crucial. While high stock market valuations warrant careful attention, they shouldn't trigger impulsive decisions. By understanding BofA's assessment and adopting a sound long-term investment strategy, you can navigate this market environment effectively. Don't let high stock market valuations trigger impulsive decisions – develop a robust plan and stay focused on your long-term financial goals.

Featured Posts

-

Tesla Faces Optimus Robot Production Delays Amidst Chinas Rare Earth Crackdown

Apr 24, 2025

Tesla Faces Optimus Robot Production Delays Amidst Chinas Rare Earth Crackdown

Apr 24, 2025 -

Blue Origins Launch Cancelled A Vehicle Subsystem Issue Investigation

Apr 24, 2025

Blue Origins Launch Cancelled A Vehicle Subsystem Issue Investigation

Apr 24, 2025 -

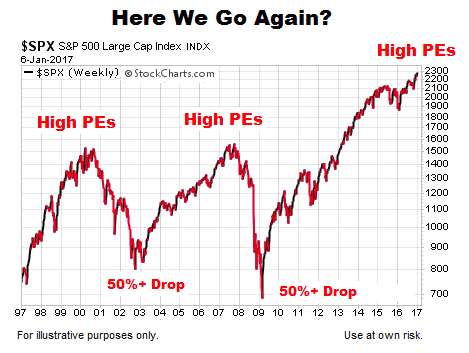

John Travoltas Heartfelt Tribute A Moving Photo Marks Jett Travoltas 33rd Birthday

Apr 24, 2025

John Travoltas Heartfelt Tribute A Moving Photo Marks Jett Travoltas 33rd Birthday

Apr 24, 2025 -

John Travolta Honors Late Son Jett On His Birthday With A Shared Photo

Apr 24, 2025

John Travolta Honors Late Son Jett On His Birthday With A Shared Photo

Apr 24, 2025 -

John Travolta Addresses Concerns After Sharing Intimate Family Home Photo

Apr 24, 2025

John Travolta Addresses Concerns After Sharing Intimate Family Home Photo

Apr 24, 2025