Grim Retail Sales: Are Rate Cuts Coming From The Bank Of Canada?

Table of Contents

Declining Retail Sales: A Deeper Dive into the Data

The July 2024 retail sales figures paint a concerning picture for the Canadian economy. The 1.5% drop represents a significant contraction, exceeding economists' predictions and indicating weakening consumer spending. This decline wasn't evenly distributed across sectors.

- High inflation impacting consumer spending power: Persistent inflation, currently hovering around 4%, continues to erode purchasing power, forcing consumers to cut back on discretionary spending.

- Decreased consumer confidence due to economic uncertainty: Growing concerns about a potential recession have dampened consumer confidence, leading to a more cautious approach to spending.

- Impact of global economic slowdown on Canadian retail: The global economic slowdown is impacting Canadian exports and influencing consumer sentiment negatively, further impacting retail sales.

- Specific examples of struggling retail sectors: The automotive sector saw a particularly sharp decline, alongside furniture and home improvement retailers, suggesting consumers are delaying major purchases.

Geographic variations are also evident. While Ontario and British Columbia experienced relatively milder declines, the Prairie provinces saw more significant drops, highlighting regional disparities in economic performance. This uneven performance underlines the complexity of the situation and makes a uniform policy response more challenging.

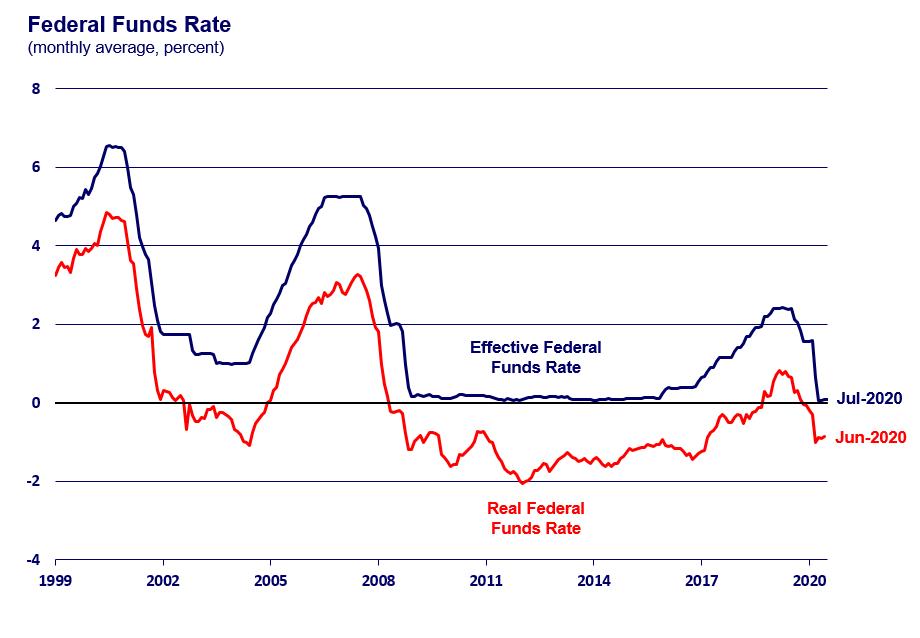

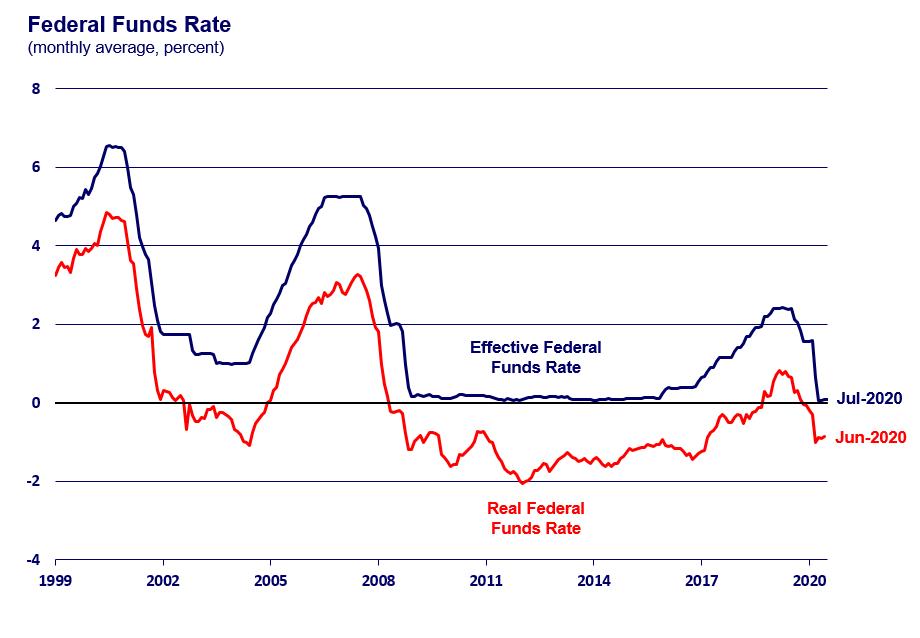

The Bank of Canada's Current Monetary Policy Stance

The Bank of Canada currently maintains an interest rate of 5%, a level set to combat persistent inflation. Their stated objective remains to bring inflation down to their 2% target. Recent statements from the Bank Governor have emphasized a data-dependent approach, suggesting future rate adjustments will depend on incoming economic indicators. While acknowledging the recent softening in economic activity, they have also pointed to persistent inflationary pressures.

The Bank of Canada's mandate considers factors beyond retail sales data. They carefully assess:

- Employment figures: The current unemployment rate, while relatively low, is being closely monitored for any signs of significant weakening.

- Inflation expectations: The Bank is vigilant about ensuring inflation expectations remain anchored to the 2% target. Any sign of rising inflation expectations could deter them from easing monetary policy.

Economic Indicators Beyond Retail Sales

Beyond retail sales, several other key economic indicators influence the Bank of Canada's decisions.

- GDP growth: Recent GDP growth figures have shown some slowing, adding to concerns about the overall economic health.

- Inflation: While trending downward, core inflation remains stubbornly above the Bank's target, making a rate cut less likely.

- Housing market: The housing market is experiencing a slowdown, but its effect on overall economic health is still being assessed.

Predicting the Bank of Canada's Next Move: Rate Cut Probability

Given the grim retail sales figures and the mixed signals from other economic indicators, predicting the Bank of Canada's next move is challenging. Several scenarios are possible:

- Scenario 1 (Most Likely): The Bank holds interest rates steady at 5% in the short term, observing further economic data before making any significant adjustments. This approach allows them to gauge the true impact of previous rate hikes and assess whether inflationary pressures are truly easing.

- Scenario 2 (Less Likely): A small rate cut (0.25%) is implemented if inflation shows a consistent and significant decline while other economic indicators remain relatively stable.

- Scenario 3 (Least Likely): A larger rate cut or a continuation of the current rate is dependent on a more dramatic improvement in inflation and a significant strengthening in other indicators, offsetting concerns related to retail sales.

Expert opinions are divided. Some economists believe a rate cut is warranted given the weakening retail sales and other signs of economic slowdown. Others believe the Bank will remain cautious given persistent inflationary pressures.

Conclusion: Grim Retail Sales and the Outlook for Bank of Canada Rate Cuts

The significant decline in Canadian retail sales raises serious concerns about the economy's health. While the Bank of Canada considers various economic indicators beyond retail sales, the recent data points toward a weakening consumer spending environment. While a rate cut is possible, the likelihood remains low in the short term given persistent inflationary pressures. The Bank will likely maintain a cautious approach, closely monitoring economic data before making any significant adjustments to its monetary policy. Stay tuned for updates on grim retail sales and the Bank of Canada's response. Regularly check our website for the latest analysis on potential interest rate cuts and their impact on the Canadian economy.

Featured Posts

-

Shedeur Sanders Cleveland Browns Draft Pick

Apr 28, 2025

Shedeur Sanders Cleveland Browns Draft Pick

Apr 28, 2025 -

Us China Trade War Partial Tariff Relief For American Products

Apr 28, 2025

Us China Trade War Partial Tariff Relief For American Products

Apr 28, 2025 -

160 Game Hit Streak Ends Orioles Announcers Jinx Finally Broken

Apr 28, 2025

160 Game Hit Streak Ends Orioles Announcers Jinx Finally Broken

Apr 28, 2025 -

Is This Red Sox Outfielder The Next Jarren Duran A Breakout Season Prediction

Apr 28, 2025

Is This Red Sox Outfielder The Next Jarren Duran A Breakout Season Prediction

Apr 28, 2025 -

Car Dealers Renew Fight Against Ev Mandates

Apr 28, 2025

Car Dealers Renew Fight Against Ev Mandates

Apr 28, 2025

Latest Posts

-

Oppo Find X8 Ultra

Apr 28, 2025

Oppo Find X8 Ultra

Apr 28, 2025 -

Espn Predicts A Surprising Red Sox Outfield For 2025

Apr 28, 2025

Espn Predicts A Surprising Red Sox Outfield For 2025

Apr 28, 2025 -

Red Sox 2025 Outfield Espns Unexpected Projection

Apr 28, 2025

Red Sox 2025 Outfield Espns Unexpected Projection

Apr 28, 2025 -

Espns Bold 2025 Red Sox Outfield Prediction Is It Realistic

Apr 28, 2025

Espns Bold 2025 Red Sox Outfield Prediction Is It Realistic

Apr 28, 2025 -

Red Sox Doubleheader Coras Lineup And Game 1 Strategy

Apr 28, 2025

Red Sox Doubleheader Coras Lineup And Game 1 Strategy

Apr 28, 2025