Gold Price Record Rally: Bullion As A Safe Haven During Trade Wars

Table of Contents

Understanding the Safe Haven Appeal of Gold

Gold's allure as a safe haven asset stems from its inherent value and its long history as a store of wealth. Unlike fiat currencies, which are subject to inflation and government policies, gold holds intrinsic value. This makes it a desirable asset during times of economic uncertainty. Several factors contribute to gold's appeal as a safe haven:

- Inflation Hedging: Gold historically performs well during inflationary periods, acting as a hedge against the erosion of purchasing power. As inflation rises, the value of fiat currencies decreases, while the value of gold tends to increase.

- Currency Devaluation Concerns: When a currency weakens, investors often seek refuge in gold, viewing it as a more stable store of value. This is especially true during periods of geopolitical instability or economic crisis.

- Geopolitical Instability: Global events such as wars, political upheavals, and terrorist attacks often trigger a flight to safety, driving investors towards gold.

- Market Volatility: During periods of high market volatility, gold's relative stability makes it an attractive investment for risk-averse investors seeking to protect their portfolios.

The diversification benefits of including gold in a portfolio are substantial. It offers a negative correlation with many traditional asset classes, meaning that when stocks or bonds decline, gold often rises, mitigating overall portfolio risk. Effective portfolio diversification strategies often incorporate gold investment to reduce risk and enhance stability.

Trade Wars and Their Impact on Gold Prices

Trade wars introduce significant uncertainty and volatility into global markets. The imposition of tariffs and trade restrictions erodes investor confidence, leading to market corrections and increased risk aversion. This uncertainty fuels demand for safe haven assets, and gold often benefits from this increased demand, leading to a gold price surge.

Historically, periods of heightened trade tensions have been correlated with increases in gold prices. [Cite specific historical examples, e.g., the impact of specific trade disputes on gold prices]. The increased market volatility and uncertainty caused by trade wars directly translate into increased demand for gold, pushing its price upwards. The keywords trade war, global uncertainty, and market volatility are intrinsically linked to the resulting increase in gold prices.

Investing in Gold During a Record Rally

Investing in gold offers various options, each with its own set of advantages and disadvantages:

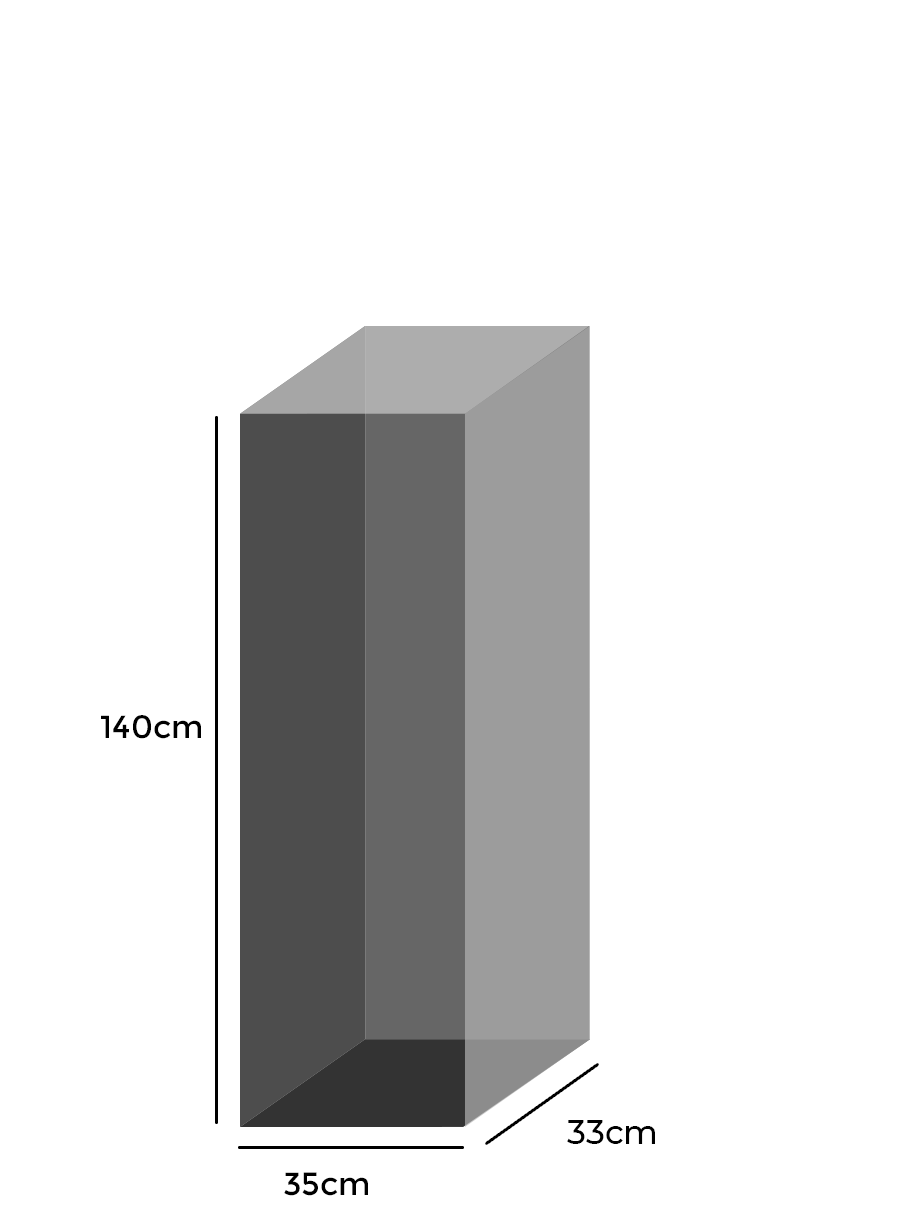

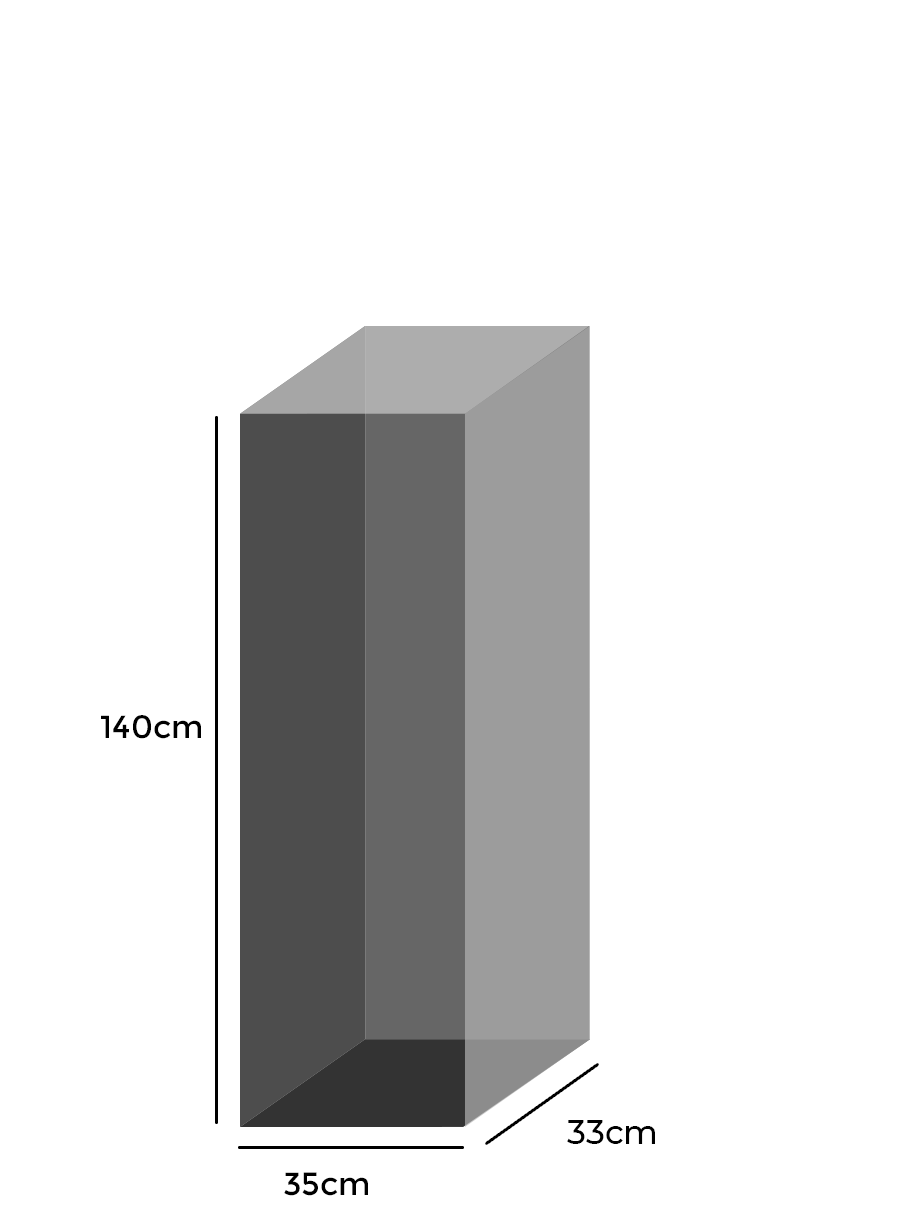

- Physical Gold: Purchasing physical gold in the form of bullion bars or coins provides tangible ownership and is generally considered a relatively straightforward investment strategy. However, it involves storage and security considerations.

- Gold ETFs (Exchange-Traded Funds): Gold ETFs offer convenient and cost-effective access to gold without the need for physical storage. They track the price of gold, providing a liquid and easily tradable investment option.

- Gold Mining Stocks: Investing in gold mining stocks offers leveraged exposure to gold prices, meaning that price increases in gold can lead to even greater returns (but also greater losses). However, these investments are subject to the risks associated with individual companies.

- Gold Futures and Options: These derivatives provide leveraged exposure to gold price movements. They offer sophisticated investment strategies but are generally considered higher risk.

Regardless of your chosen gold investment strategies, thorough research, careful consideration of your risk tolerance, and a well-diversified portfolio are crucial for successful gold investment. Risk management is paramount in any investment strategy, especially concerning assets like gold which can experience significant price swings.

The Future of Gold Prices and Trade Relations

Predicting future gold prices is inherently challenging. However, current geopolitical and economic factors suggest several potential scenarios:

- Continued trade tensions could support higher gold prices.

- Resolution of trade disputes could lead to lower gold prices, as investor confidence and market stability return.

- Global economic slowdown or recession could drive increased demand for gold.

- Inflationary pressures could also boost gold's appeal as a hedge.

Analyzing the evolving global landscape—the geopolitical risk and the economic outlook—provides crucial insights. However, definitive gold price prediction is impossible. A cautious and diversified approach remains essential for any investor.

Conclusion: Capitalizing on the Gold Price Record Rally

The current gold price record rally highlights gold's enduring role as a safe haven asset, particularly during periods of global uncertainty and trade wars. Strategic investment in gold, as part of a diversified portfolio, can offer protection against market volatility and the potential for substantial returns. Don't miss out on the potential of gold as a safe haven during future trade disputes and economic uncertainty. Learn more about various gold investment strategies and consider adding gold to your portfolio to benefit from this compelling investment opportunity. Learn how to capitalize on the current gold price record rally and secure your financial future.

Featured Posts

-

Full List Celebrities Affected By The Palisades Fires In Los Angeles

Apr 26, 2025

Full List Celebrities Affected By The Palisades Fires In Los Angeles

Apr 26, 2025 -

Trumps First 100 Days A Rural Schools Perspective From 2700 Miles Away

Apr 26, 2025

Trumps First 100 Days A Rural Schools Perspective From 2700 Miles Away

Apr 26, 2025 -

Green Bays Nfl Draft First Round Preview And Predictions

Apr 26, 2025

Green Bays Nfl Draft First Round Preview And Predictions

Apr 26, 2025 -

The Closing Of Anchor Brewing Company What Happens Next

Apr 26, 2025

The Closing Of Anchor Brewing Company What Happens Next

Apr 26, 2025 -

16 Million Fine For T Mobile Details Of Three Year Data Breach Settlement

Apr 26, 2025

16 Million Fine For T Mobile Details Of Three Year Data Breach Settlement

Apr 26, 2025