Gensol Promoters Face PFC Action: EoW Transfer Following Fake Document Submission

Table of Contents

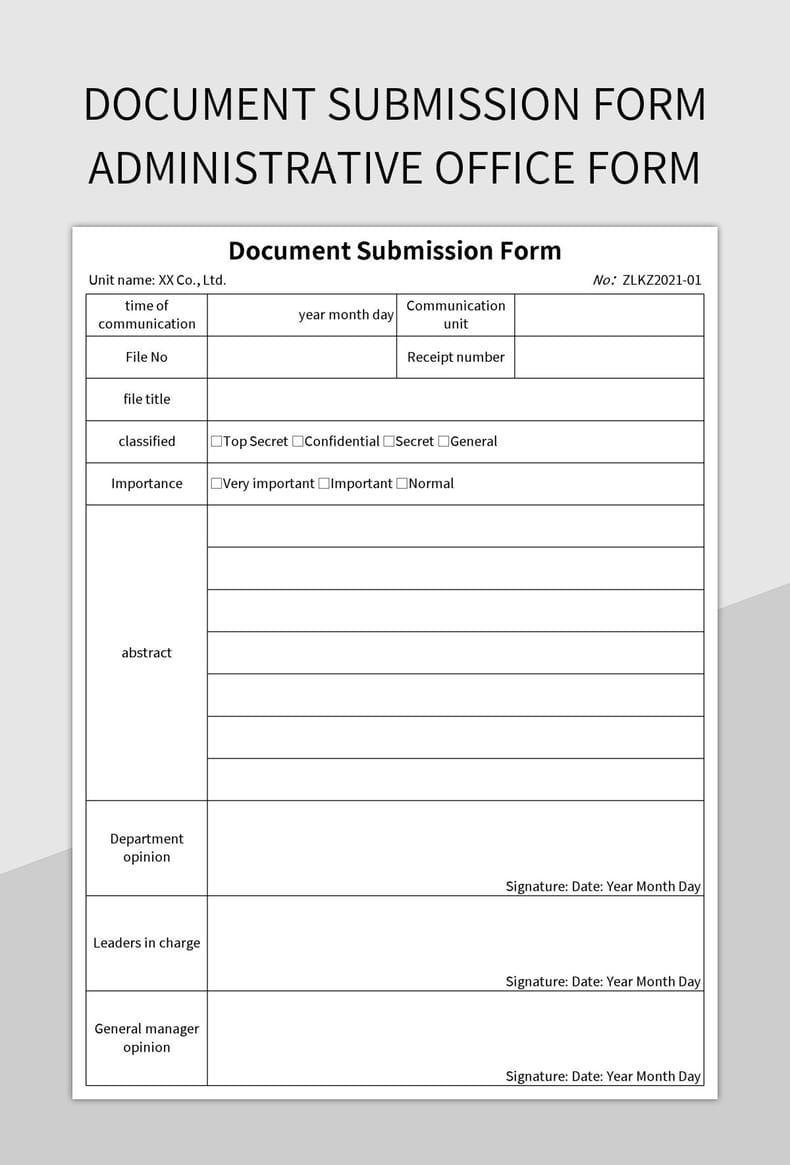

The Alleged Fake Document Submission

The core of the PFC investigation revolves around the alleged submission of forged documents related to the EoW transfer. The nature of these documents remains unclear, but reports suggest they may include falsified financial statements, ownership transfer agreements, or other crucial company records intended to mislead the PFC and facilitate the transaction. The PFC's investigation is focused on determining the extent of the forgery and identifying those responsible. The potential penalties for submitting fraudulent documents are severe, ranging from substantial fines to criminal charges.

- Type of documents allegedly forged: The exact types of documents remain undisclosed pending the ongoing investigation, but reports suggest they pertain to ownership and financial aspects of the EoW transfer.

- Specific inaccuracies or forgeries identified: Details regarding specific inaccuracies and forgeries are currently unavailable to the public due to the ongoing investigation's confidential nature. However, the PFC's actions indicate a significant level of evidence suggesting fraudulent activity.

- Evidence presented by the investigating authorities: The evidence presented by the PFC remains confidential, but the initiation of legal action implies a substantial body of incriminating evidence.

- Potential penalties for submitting fraudulent documents: Depending on the specifics of the case and the jurisdiction, the penalties could include hefty fines, imprisonment, and a permanent ban from participating in financial markets.

The Suspicious EoW Transfer

The EoW transfer itself is under intense scrutiny. While the exact percentage of ownership transferred and the identity of the recipient(s) haven't been officially disclosed, the timing and circumstances surrounding the transfer raise significant red flags. The stated rationale for the transfer is also being questioned, with allegations suggesting that it may have been used to improperly benefit the promoters. Inconsistencies in the valuation of the transferred ownership and a lack of transparency surrounding the transaction fuel suspicions of financial irregularities.

- Percentage of ownership transferred: This information is currently unavailable publicly, pending further details from the ongoing PFC investigation.

- Identity of the recipient(s) of the transferred ownership: The identity of those who received ownership through this transfer hasn't yet been officially released by authorities.

- Timeline of the EoW transfer: The precise timeline is being investigated to determine if the timing coincided with any other suspicious activities or financial events within the company.

- Valuation discrepancies or inconsistencies: The PFC is likely investigating potential discrepancies between the declared value of the transferred ownership and its actual market value.

- Any benefits accrued by the promoters through this transfer: This is a key area of the PFC investigation—determining if the promoters gained any undue financial advantage from the EoW transfer.

The PFC Action and Potential Consequences

The PFC action against Gensol's promoters represents a significant escalation of the situation. The exact nature of the action remains unclear, but it likely involves legal proceedings, potentially including civil and criminal charges. The consequences for the promoters could be severe, potentially resulting in substantial fines, imprisonment, and reputational damage. The impact on Gensol's stock price and overall market standing is already evident, with investors exhibiting caution and uncertainty. The ongoing investigations will ultimately determine the full extent of the penalties and the long-term repercussions for Gensol.

- Specific actions taken by the PFC: The specific actions are currently under wraps, but the launch of an investigation and the resulting PFC action suggest a serious breach of financial regulations.

- Potential fines or penalties faced by the promoters: The penalties could be substantial, ranging from financial penalties to imprisonment depending on the findings of the investigation.

- Potential legal ramifications for Gensol as a company: Gensol itself could face legal ramifications, including regulatory fines and reputational damage, even if it wasn't directly involved in the fraudulent activity.

- Impact on investor confidence and the company's share price: The scandal has undoubtedly eroded investor confidence, leading to market volatility and a likely negative impact on Gensol's share price.

- Ongoing investigations and their potential outcomes: The outcome of the ongoing investigation will have far-reaching implications for Gensol's future and the promoters' careers.

Impact on Gensol Investors

The Gensol scandal highlights the importance of investor due diligence. Investors should carefully consider their options and seek professional financial advice. The current situation underscores the potential for significant losses and the unpredictable nature of market volatility in response to regulatory actions and allegations of financial misconduct. Investors should carefully monitor news sources and official statements from Gensol and the PFC for updates on the ongoing investigation. Proactive monitoring and well-informed decision-making are essential during periods of market uncertainty.

- Monitor news sources: Stay informed about the investigation's progress through reliable news outlets and official statements.

- Diversify investments: Reduce risk by spreading investments across various assets.

- Consult financial advisors: Seek professional guidance before making any rash investment decisions.

Conclusion

The alleged submission of fake documents related to a suspicious EoW transfer at Gensol has resulted in a significant PFC action against the company's promoters. This situation highlights the importance of transparency and accountability in financial dealings. The potential consequences for the promoters are severe, ranging from substantial fines to imprisonment, while Gensol faces reputational damage and market volatility. Investors should remain vigilant, conduct thorough due diligence before making any investment decisions related to Gensol or companies facing similar scrutiny, and consult with financial advisors for guidance. Stay informed about the ongoing investigation into the Gensol promoters and the suspicious EoW transfer to protect your investments. Understanding the risks associated with Gensol and similar situations is crucial. Monitor news sources and official statements for updates on the Gensol PFC action.

Featured Posts

-

Por Primera Vez Tenistas Wta Recibiran Salario Durante Su Licencia De Maternidad

Apr 27, 2025

Por Primera Vez Tenistas Wta Recibiran Salario Durante Su Licencia De Maternidad

Apr 27, 2025 -

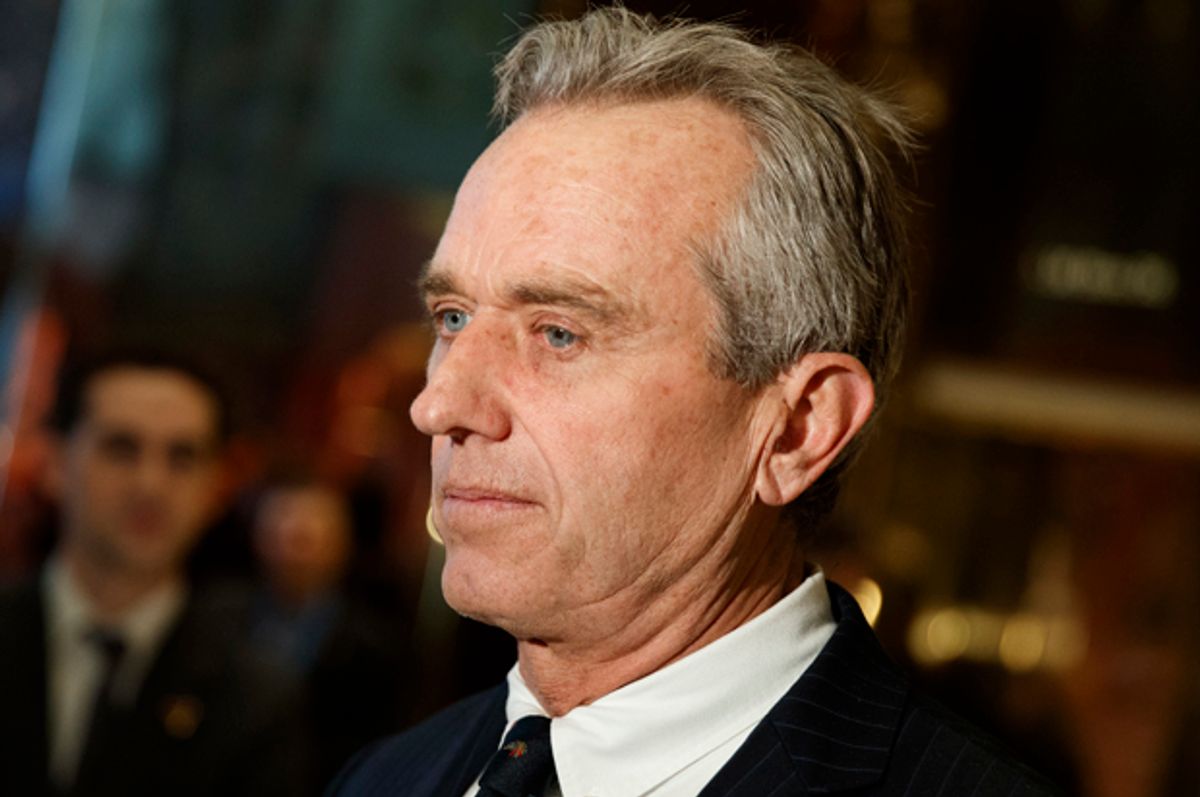

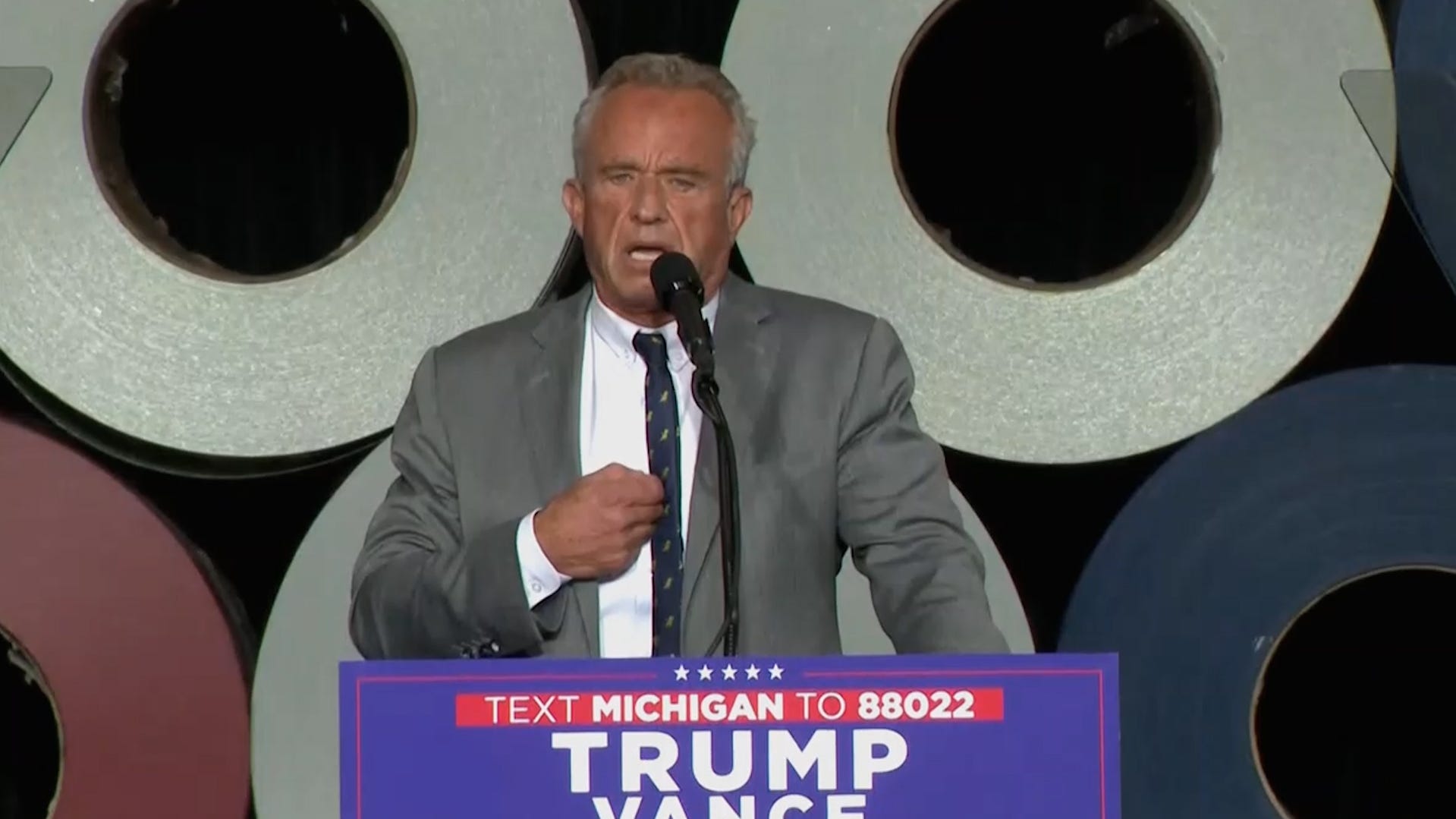

Controversy Erupts Vaccine Skeptic Appointed To Head Immunization Autism Research

Apr 27, 2025

Controversy Erupts Vaccine Skeptic Appointed To Head Immunization Autism Research

Apr 27, 2025 -

Is Betting On The Los Angeles Wildfires A Sign Of The Times A Critical Analysis

Apr 27, 2025

Is Betting On The Los Angeles Wildfires A Sign Of The Times A Critical Analysis

Apr 27, 2025 -

Controversial Hhs Decision Anti Vaxxer To Examine Disproven Autism Vaccine Claims

Apr 27, 2025

Controversial Hhs Decision Anti Vaxxer To Examine Disproven Autism Vaccine Claims

Apr 27, 2025 -

Pegulas Charleston Open Comeback Stunning Victory Over Collins

Apr 27, 2025

Pegulas Charleston Open Comeback Stunning Victory Over Collins

Apr 27, 2025