Falling Retail Sales Signal Potential Bank Of Canada Rate Cuts

Table of Contents

Weakening Consumer Spending: A Key Indicator

The softening of consumer spending is a significant indicator of economic health, and recent data paints a concerning picture.

Retail Sales Data Analysis

Statistics Canada's latest reports reveal a persistent downturn in retail sales. For instance, [insert link to Statistics Canada data], retail sales fell by X% in [Month, Year] and Y% in [Month, Year], marking a concerning trend.

- Significant declines were observed in the clothing sector (-Z%), furniture (-A%), and electronics (-B%) categories.

- Regional variations exist, with [Region] experiencing a sharper decline than [Region]. Further investigation is needed to pinpoint the causes of these discrepancies.

Impact of Inflation on Consumer Confidence

Persistent inflation continues to erode consumer purchasing power, significantly impacting consumer confidence. High inflation reduces the real value of wages, leaving less disposable income for discretionary spending.

- The Consumer Price Index (CPI) remains stubbornly high, exceeding the Bank of Canada's inflation target.

- Consumer sentiment surveys, such as the [Name of Survey], reveal declining confidence levels, directly impacting spending habits.

The Bank of Canada's Response to Economic Slowdown

The Bank of Canada's primary mandate is to maintain price stability and promote sustainable economic growth. To achieve this, it employs several monetary policy tools.

Monetary Policy Tools

The Bank of Canada primarily uses interest rate adjustments to influence inflation and economic activity. Raising interest rates typically cools down the economy, while lowering them stimulates growth.

- Interest rate: The target overnight rate is the rate at which banks lend to each other overnight. Changes to this rate ripple through the entire economy.

- Monetary policy: This refers to the actions undertaken by the central bank to manage the money supply and credit conditions to achieve macroeconomic objectives.

- Inflation target: The Bank of Canada aims to keep inflation around 2%, as measured by the CPI.

Historical Precedents

The Bank of Canada has historically responded to economic slowdowns by lowering interest rates. For example, during the [Year] recession, the Bank of Canada implemented several interest rate cuts to stimulate economic activity. [Insert link to relevant historical data].

- [Specific example 1 of historical rate cuts and their context].

- [Specific example 2 of historical rate cuts and their context].

Current Economic Outlook

The current economic climate is characterized by [briefly describe current economic state, e.g., slowing GDP growth, rising unemployment]. This complex situation requires a careful assessment by the Bank of Canada to determine the appropriate policy response.

- Economists at [Financial Institution] predict [GDP growth projection].

- The unemployment rate currently stands at [Unemployment rate], indicating [interpretation of the unemployment rate].

Potential Implications of Bank of Canada Rate Cuts

A potential series of Bank of Canada rate cuts could have significant implications for the Canadian economy.

Impact on Borrowing Costs

Lower interest rates directly translate to lower borrowing costs for consumers and businesses.

- Mortgages and other consumer loans become more affordable, potentially stimulating demand.

- Businesses find it cheaper to access credit for expansion and investment, boosting job creation.

Stimulus to the Economy

Rate cuts aim to stimulate economic activity by encouraging borrowing and spending. Lower borrowing costs incentivize consumers to make larger purchases and businesses to invest.

- Increased consumer spending boosts demand for goods and services, leading to higher production.

- Business investment creates jobs and stimulates economic growth.

Risks and Considerations

While rate cuts can stimulate the economy, they also carry potential risks.

- Fueling inflation: Lower interest rates could inadvertently increase inflation if demand grows too quickly.

- Weakening the Canadian dollar: Lower rates can make the Canadian dollar less attractive to foreign investors, potentially leading to a weaker exchange rate.

Conclusion

Falling retail sales and weakening consumer spending point towards a potential need for action by the Bank of Canada. The historical precedent, current economic outlook, and the potential implications of rate cuts all suggest that Bank of Canada rate cuts are a possibility. However, the Bank must carefully weigh the benefits against the potential risks of such a move. Monitoring key economic indicators such as inflation, GDP growth, and consumer confidence will be crucial in assessing the likelihood and timing of future Bank of Canada interest rate decisions. Stay informed about future interest rate changes by subscribing to our newsletter, following us on social media, or regularly checking our website for updates. Understanding the implications of Bank of Canada Rate Cuts is vital for navigating personal finances and understanding the direction of the Canadian economy.

Featured Posts

-

Fn Abwzby Hdth Thqafy Barz Fy Alimarat

Apr 28, 2025

Fn Abwzby Hdth Thqafy Barz Fy Alimarat

Apr 28, 2025 -

Aaron Judges Wife Gives Birth Couple Welcomes First Baby

Apr 28, 2025

Aaron Judges Wife Gives Birth Couple Welcomes First Baby

Apr 28, 2025 -

From Scatological Documents To Podcast Gold The Power Of Ai

Apr 28, 2025

From Scatological Documents To Podcast Gold The Power Of Ai

Apr 28, 2025 -

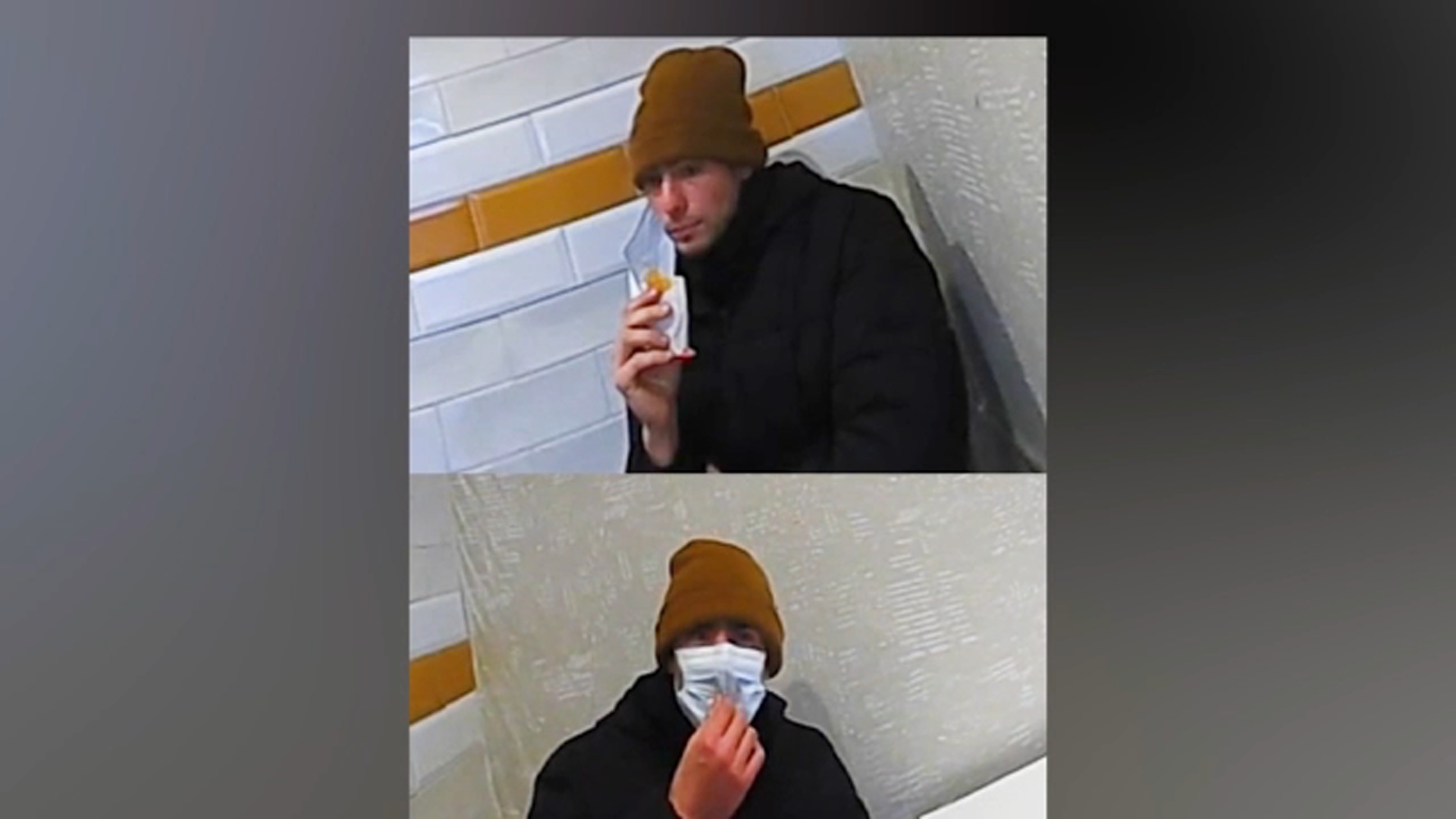

Luigi Mangione A Voice For His Supporters

Apr 28, 2025

Luigi Mangione A Voice For His Supporters

Apr 28, 2025 -

Alberta Economy Hit Dow Project Delay Highlights Tariff Damage

Apr 28, 2025

Alberta Economy Hit Dow Project Delay Highlights Tariff Damage

Apr 28, 2025