Extreme VMware Price Increase: AT&T Highlights Broadcom's Proposed Hike

Table of Contents

The Broadcom-VMware Merger and its Price Implications

The Broadcom acquisition of VMware, finalized in late 2022, has sent ripples through the IT industry. This merger unites a leading infrastructure software provider with a major semiconductor company, creating a behemoth with significant influence over enterprise IT. The immediate consequence, however, has been a significant price increase for many VMware products and services, leaving businesses scrambling to understand the full implications.

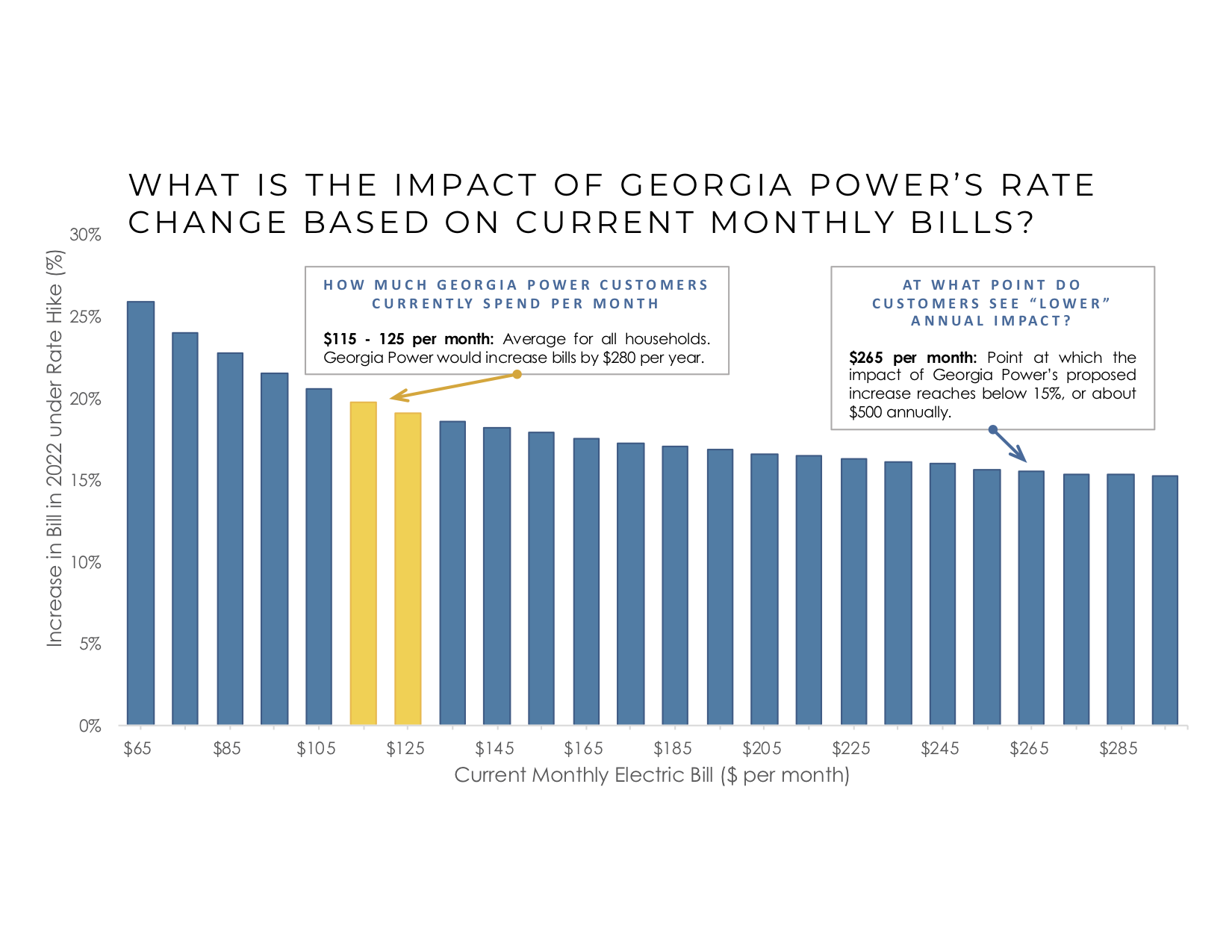

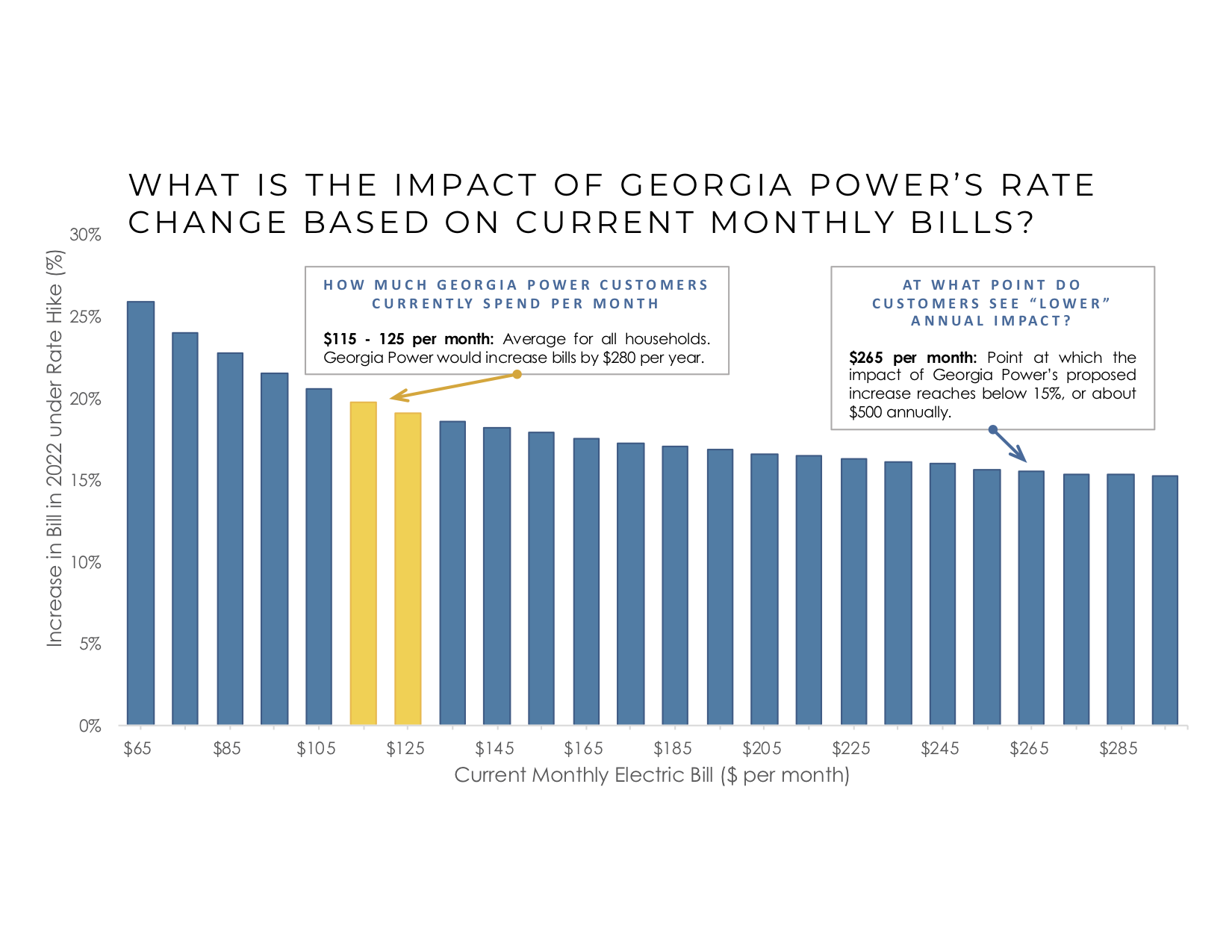

Broadcom's proposed price hikes affect a wide range of VMware's core offerings. While specific percentages haven't been universally disclosed, reports indicate substantial increases across the board. Key products like vSphere, vSAN (VMware vSAN), and NSX are among those experiencing the most significant price jumps.

- Specific price increase percentages for key VMware products: While exact figures remain somewhat opaque, industry reports suggest increases ranging from 20% to over 50% for certain products and licenses.

- Impact on existing contracts and licensing agreements: The impact on existing contracts is a major concern. Many businesses are unsure how these price increases will affect their current agreements and renewal terms. Clarity on this is urgently needed.

- Analysis of Broadcom's rationale for the price hikes: Broadcom justifies the increases by citing increased development costs and the overall value proposition of the combined entity. However, critics argue that these increases are excessive and could stifle innovation within the market.

AT&T's Public Concerns and Industry Reaction

AT&T's vocal opposition to the VMware price increases signals a growing unease among major corporations. Their public statement highlighted the significant financial burden this will place on businesses already grappling with economic uncertainty. This public dissent is noteworthy, as it represents a powerful voice within the telecommunications sector and a significant VMware customer.

The reaction from other corporations and industry analysts has been mixed, ranging from apprehension to outright criticism. Many express concern over the potential for this acquisition to create a monopoly and stifle competition.

- Quotes from AT&T executives expressing concern: Statements from AT&T executives emphasize the need for transparency and fairness in pricing policies. They also highlight the potential negative impact on innovation.

- Statements from other industry leaders: Several other major corporations have expressed similar concerns, albeit often behind closed doors, fearing potential repercussions from Broadcom.

- Summary of analyst opinions on the price increase: Industry analysts are largely critical of the price hikes, predicting potential negative consequences for competition and innovation in the virtualization space.

Strategies for Businesses Facing VMware Price Hikes

The extreme VMware price increase necessitates proactive strategies to mitigate the financial impact. Businesses need to explore several avenues to minimize expenditure and potentially find alternative solutions.

- Options for negotiating lower prices with VMware: Direct negotiation with VMware or Broadcom may yield some success, particularly for large enterprise clients with significant purchasing power.

- Exploration of alternative virtualization technologies (e.g., open-source options): Open-source solutions like Proxmox VE or oVirt offer viable alternatives, although they may require additional expertise and internal resources.

- Strategies for optimizing VMware usage and reducing costs: Analyzing VMware usage patterns can reveal opportunities for consolidation and optimization, reducing the overall licensing requirements.

- Importance of long-term planning for IT infrastructure costs: This situation highlights the critical need for long-term IT infrastructure planning to ensure flexibility and cost-effectiveness in the face of unexpected price changes.

The Long-Term Impact of the VMware Price Increase on the Market

The extreme VMware price increase will undoubtedly reshape the virtualization market landscape. This could lead to increased market share for competitors, accelerating the adoption of open-source alternatives.

- Potential for increased market share for VMware competitors: Competitors like Nutanix, Red Hat, and others are well-positioned to capitalize on the dissatisfaction among VMware customers.

- Impact on the development of open-source virtualization alternatives: The increased costs associated with VMware will likely fuel further investment in and development of open-source alternatives.

- Potential antitrust concerns and regulatory investigations: The significant price increase may attract regulatory scrutiny, particularly regarding potential antitrust violations and the stifling of competition.

Conclusion: Navigating the Extreme VMware Price Increase

Broadcom's price increase for VMware products is a significant event with far-reaching implications for businesses. The potential financial burden and strategic challenges are considerable. Proactive planning is crucial. Explore alternative virtualization solutions, negotiate pricing aggressively, and seek expert advice to mitigate the impact. Understanding the extreme VMware price increase is crucial for your business’s future. Don't let the extreme VMware price increase cripple your budget – act now!

Featured Posts

-

Turning Poop Into Profit An Ai Powered Podcast Revolution

Apr 28, 2025

Turning Poop Into Profit An Ai Powered Podcast Revolution

Apr 28, 2025 -

Virginia Giuffres Death Key Facts And Reactions

Apr 28, 2025

Virginia Giuffres Death Key Facts And Reactions

Apr 28, 2025 -

Brake Problems Cause Bubba Wallace To Crash At Nascar Phoenix Race

Apr 28, 2025

Brake Problems Cause Bubba Wallace To Crash At Nascar Phoenix Race

Apr 28, 2025 -

Death Of Virginia Giuffre Epstein Case Fallout And Implications

Apr 28, 2025

Death Of Virginia Giuffre Epstein Case Fallout And Implications

Apr 28, 2025 -

Marv Albert Mike Breens Pick For Top Basketball Announcer

Apr 28, 2025

Marv Albert Mike Breens Pick For Top Basketball Announcer

Apr 28, 2025