Extreme Price Hike: Broadcom's VMware Proposal Faces AT&T Backlash

Table of Contents

The Details of Broadcom's VMware Offer and its Price Point

Broadcom's Acquisition Strategy

Broadcom has a history of aggressive acquisitions, often integrating purchased companies to bolster its existing product lines and expand into new markets. This VMware acquisition follows a similar pattern, aiming to consolidate its position in the enterprise software sector.

- Financial Aspects: Broadcom offered a significant premium over VMware's pre-offer market value, representing a substantial acquisition price. The total deal valuation is in the tens of billions of dollars, making it one of the largest tech acquisitions in recent years. The per-share price offered significantly exceeded VMware's trading price before the announcement.

- Deal Valuation and Premium: The premium offered by Broadcom signifies their confidence in VMware's future profitability and their willingness to pay a high price to secure the acquisition. This valuation has drawn criticism from some investors and analysts, who believe the price is inflated.

Market Reaction to the Proposed Price

The initial market response to Broadcom's offer was mixed. While some investors welcomed the premium valuation, others expressed concerns about the potential impact on competition and the long-term sustainability of the deal.

- Analyst Reactions: Financial analysts offered diverse opinions, with some praising the strategic fit between Broadcom and VMware, while others cautioned about the high price and potential integration challenges. Investment firms also displayed a range of responses, reflecting varying assessments of the deal's risks and rewards.

- Stock Price Volatility: The announcement caused significant stock price volatility for both Broadcom and VMware. While Broadcom's stock initially saw a slight dip, VMware's stock price experienced a significant jump due to the premium offered. Market capitalization fluctuations reflect the uncertainty surrounding the deal's ultimate success.

AT&T's Opposition and its Concerns

AT&T's Arguments Against the Acquisition

AT&T's opposition stems from concerns about potential anti-competitive practices and significant price increases for VMware's products and services. AT&T, a major user of VMware's technology, fears the acquisition could leave them with less negotiating power and expose them to potentially crippling price hikes.

- Negative Business Impacts: AT&T argues that Broadcom's control over VMware could lead to unfavorable contract negotiations, limiting AT&T's ability to leverage competitive pricing. Their reliance on VMware's infrastructure makes them particularly vulnerable to such price increases. This concern highlights the potential for reduced innovation and competition within the market.

- Monopoly Power Concerns: The acquisition could lead to a monopolistic situation in certain segments of the market, reducing consumer choice and driving up prices.

Potential Regulatory Scrutiny

Given AT&T's strong opposition and the potential for increased prices, regulatory scrutiny is highly likely. Antitrust laws designed to prevent anti-competitive mergers could derail the deal.

- Antitrust Investigations: Regulatory bodies like the Federal Trade Commission (FTC) and the Department of Justice (DOJ) in the US, as well as equivalent bodies in other countries, may launch antitrust investigations. Past regulatory challenges faced by Broadcom or VMware could influence the current investigation.

- Regulatory Hurdles: The regulatory hurdles are significant. The acquisition will likely face intense scrutiny and may require substantial concessions from Broadcom to proceed.

Broadcom's Response to the Backlash

Broadcom's Defense of its Offer

Broadcom has defended its offer by highlighting the synergies between the two companies and the potential for cost savings and increased innovation. They emphasize the long-term benefits of the acquisition, including expanded market reach and enhanced product offerings.

- Acquisition Strategy Justification: Broadcom's justification centers on creating a stronger, more competitive entity, arguing that the combined forces of Broadcom and VMware will lead to greater innovation and efficiency.

- Synergies and Cost Savings: They point to potential cost savings through streamlined operations and the elimination of redundancies, and they suggest that the integration will unlock new market opportunities.

Potential Negotiation and Compromise

Given the significant backlash, particularly from AT&T, negotiations and potential compromises may be necessary to ensure the deal's success.

- Negotiation Outcomes: Broadcom may need to offer concessions, such as price reductions for existing VMware clients or commitments to maintain competitive pricing, to appease regulators and key customers like AT&T.

- Modified Acquisition Agreement: The original acquisition agreement might be renegotiated, leading to a modified acquisition with stricter conditions imposed to address antitrust concerns and mitigate price hike fears. This includes the possibility of divesting certain assets.

Conclusion: The Future of the Broadcom-VMware Deal Amidst the AT&T Backlash

The Broadcom-VMware acquisition presents a complex scenario. While Broadcom argues for synergies and cost savings, AT&T's vocal opposition, driven by concerns about extreme price hikes and reduced competition, highlights significant regulatory and market challenges. The potential for regulatory intervention and the possibility of renegotiation remain key uncertainties.

Key takeaways include the exceptionally high acquisition price, the substantial AT&T backlash, the looming threat of regulatory scrutiny, and the uncertainty surrounding the deal's final outcome. The potential impact on the competitive landscape and pricing of vital enterprise software solutions is substantial.

The Broadcom VMware acquisition, characterized by an extreme price hike and significant AT&T backlash, remains a developing story. Stay tuned for updates on this crucial deal as it unfolds, and its implications for the tech industry.

Featured Posts

-

5 1 Loss Tigers Drop Second Series Of The Year Against Brewers

Apr 23, 2025

5 1 Loss Tigers Drop Second Series Of The Year Against Brewers

Apr 23, 2025 -

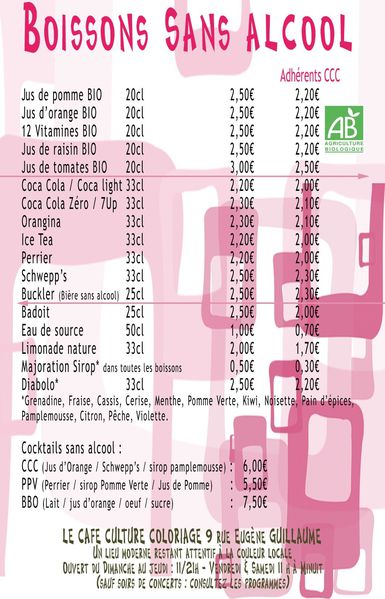

Dry January Tournee Minerale L Essor Du Marche Des Boissons Sans Alcool

Apr 23, 2025

Dry January Tournee Minerale L Essor Du Marche Des Boissons Sans Alcool

Apr 23, 2025 -

Broadcoms Proposed V Mware Price Hike A 1 050 Cost Surge For At And T

Apr 23, 2025

Broadcoms Proposed V Mware Price Hike A 1 050 Cost Surge For At And T

Apr 23, 2025 -

Brewers Experiment With Lineup A Search For Offensive Consistency

Apr 23, 2025

Brewers Experiment With Lineup A Search For Offensive Consistency

Apr 23, 2025 -

Netflix A Wall Street Safe Haven In The Tech Slump

Apr 23, 2025

Netflix A Wall Street Safe Haven In The Tech Slump

Apr 23, 2025