ECB's New Initiative: Simplifying Banking Regulations

Table of Contents

The European Central Bank (ECB) has launched a groundbreaking initiative aimed at simplifying banking regulations across the Eurozone. This move promises to reduce compliance burdens, boost efficiency, and foster innovation within the European banking sector. This article delves into the key aspects of this significant change, focusing on the implications of ECB banking regulation simplification.

Reducing Regulatory Complexity

The new initiative directly addresses the overwhelming complexity of existing banking regulations. A key focus is streamlining reporting requirements, significantly reducing the administrative burden on banks. This involves:

- Reduction in the number of forms and reports required: The ECB aims to drastically cut the number of regulatory reports banks must submit, freeing up valuable time and resources. This simplification of banking regulations will alleviate the pressure on compliance departments.

- Improved data standardization for easier reporting: Harmonizing data formats across different reporting requirements will make the process more efficient and reduce errors. This improved data standardization is a cornerstone of ECB banking regulation simplification.

- Use of technology (e.g., APIs) for automated reporting: The ECB encourages the adoption of technology solutions to automate data collection and reporting, further reducing manual workload and the potential for human error. This leverages technology to streamline the complexities of banking regulations.

The expected impact on administrative costs for banks is substantial, freeing up resources for core business activities and strategic investments. This is particularly beneficial for smaller banks, which often struggle with the disproportionate compliance costs associated with complex regulations. The simplification of banking regulations will level the playing field for businesses of all sizes. The ECB is simultaneously consolidating existing regulations, merging or eliminating overlapping rules to create a more coherent and understandable framework. This includes:

- Identifying specific regulations that are being simplified or merged: The ECB has publicly committed to a transparent process, outlining which specific regulations are being targeted for simplification or merging.

- Highlighting the rationale behind the consolidation (e.g., removing inconsistencies): The goal is to create a unified, logical, and consistent regulatory environment, eliminating redundancies and conflicting requirements.

- Explaining the process of implementing the changes: A phased approach is being implemented to minimize disruption to banks' operations while ensuring a smooth transition.

Improving Regulatory Clarity and Transparency

Improving communication and guidance is crucial for the success of this initiative. The ECB is committed to enhancing transparency and ensuring clear communication with banks to clarify expectations and facilitate compliance. This involves:

- Increased availability of explanatory materials: The ECB is developing comprehensive and readily accessible explanatory materials, including detailed guidelines and FAQs, to aid banks in navigating the new regulatory landscape.

- More frequent consultations with industry stakeholders: The ECB is actively engaging with banking industry representatives to gather feedback and ensure that the regulations are practical and effective.

- Development of user-friendly guides and FAQs: This increased engagement and accessibility aims to bridge the communication gap between regulators and regulated entities.

Clear communication minimizes errors and disputes, resulting in a smoother and more efficient regulatory process. The initiative also aims to create a consistent regulatory framework across different EU member states. This includes:

- Highlighting the importance of a level playing field for all banks in the Eurozone: The ECB is striving to create a harmonized regulatory environment that ensures fair competition among banks, regardless of their location within the Eurozone.

- Discussing challenges in harmonizing regulations across diverse national contexts: The ECB recognizes the challenges involved in harmonizing regulations across different national legal systems and is working to address these complexities.

- Describing the mechanisms used to ensure consistent implementation: The ECB is implementing robust oversight and monitoring mechanisms to ensure the consistent and effective implementation of the simplified regulations across all member states.

Promoting Innovation and Growth in the Banking Sector

Simplified regulations are intended to stimulate competition and innovation within the banking sector. The initiative's impact includes:

- Lower compliance costs, making it easier for start-ups to enter the market: This reduced barrier to entry encourages competition and fosters innovation, benefiting both established banks and new entrants.

- Fostering FinTech innovation and digital transformation in banking: Simplified regulations create an environment conducive to the adoption of innovative technologies and business models, particularly in the rapidly evolving FinTech sector.

- Increased access to capital for new and smaller banks: Reduced regulatory burdens make it easier for smaller banks and startups to secure funding, promoting competition and growth.

A more competitive banking sector benefits consumers through greater choice, improved services, and more competitive pricing. The ECB is also integrating sustainable finance considerations into the simplified framework:

- Incorporation of ESG (Environmental, Social, and Governance) factors into reporting: This encourages banks to incorporate ESG factors into their operations and reporting, promoting responsible business practices and sustainable finance.

- Incentivizing banks to invest in green initiatives: This initiative promotes environmentally friendly investments and facilitates the transition to a sustainable economy.

- Promotion of responsible lending practices: The new framework encourages responsible lending practices to minimize risks and support sustainable economic growth.

Conclusion

The ECB's initiative to simplify banking regulations offers significant benefits: reduced complexity, improved clarity, and enhanced innovation. This streamlined approach will positively impact banks, consumers, and the overall Eurozone economy, leading to a more efficient, competitive, and sustainable financial sector. Stay informed about the ECB's Banking Regulation Simplification initiative to ensure your bank is prepared for this significant regulatory shift and take advantage of the opportunities presented by this streamlined approach to ECB banking regulation.

Featured Posts

-

Top Seed Pegula Claims Charleston Title After Collins Match

Apr 27, 2025

Top Seed Pegula Claims Charleston Title After Collins Match

Apr 27, 2025 -

The Daxs Reaction To Bundestag Elections A Historical Perspective

Apr 27, 2025

The Daxs Reaction To Bundestag Elections A Historical Perspective

Apr 27, 2025 -

Pne Ag Unternehmensmeldung Eqs Pvr Veroeffentlichung Gemaess Wp Hg

Apr 27, 2025

Pne Ag Unternehmensmeldung Eqs Pvr Veroeffentlichung Gemaess Wp Hg

Apr 27, 2025 -

Canadas Tourism Boom Outpacing The Us As A Travel Destination

Apr 27, 2025

Canadas Tourism Boom Outpacing The Us As A Travel Destination

Apr 27, 2025 -

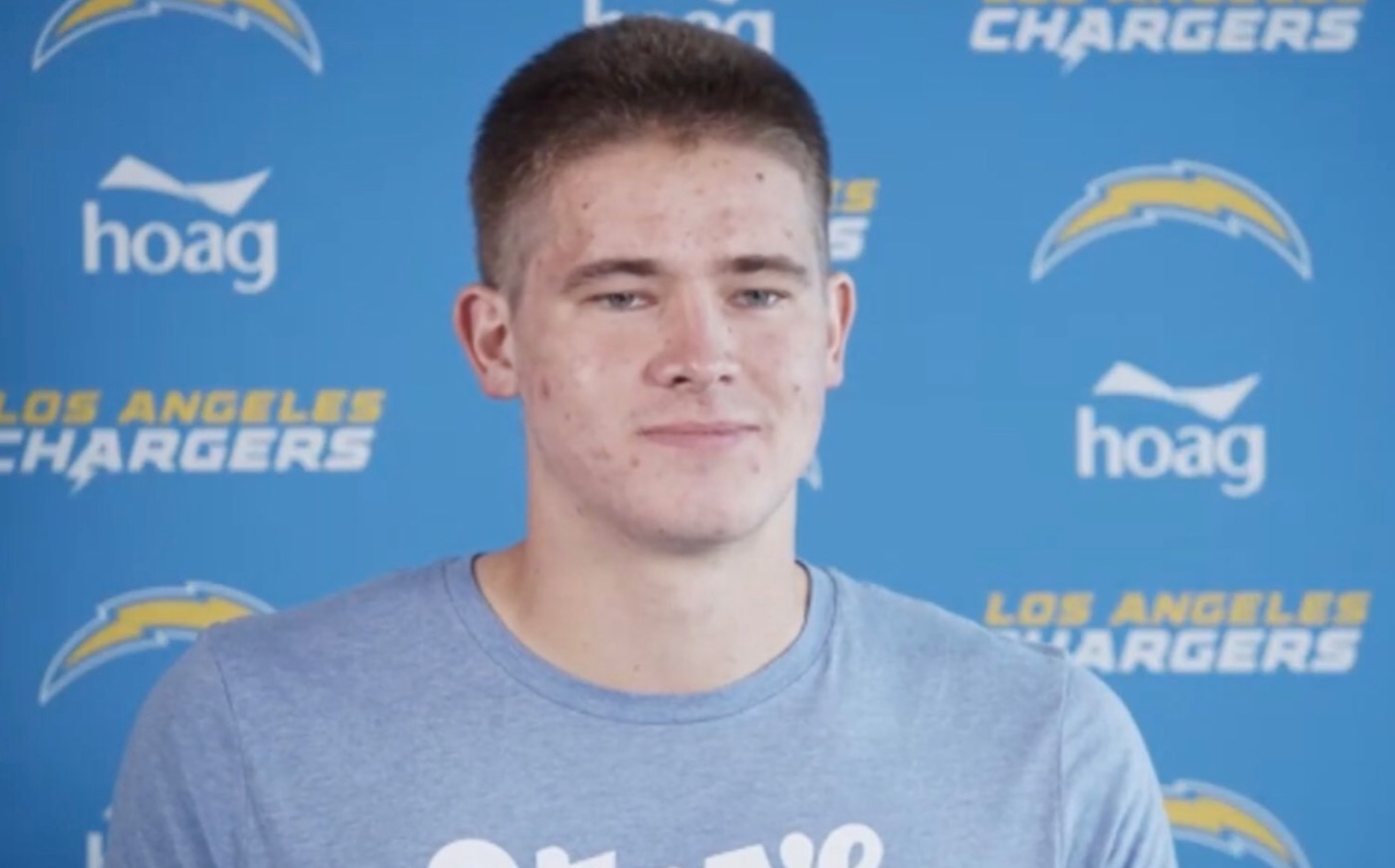

2025 Nfl Season Justin Herbert And The Chargers Head To Brazil

Apr 27, 2025

2025 Nfl Season Justin Herbert And The Chargers Head To Brazil

Apr 27, 2025