Easing Trade Tensions Boost Chinese Stocks In Hong Kong

Table of Contents

Reduced Trade Uncertainty Fuels Market Confidence

The prolonged trade war between the US and China created considerable uncertainty, impacting businesses and investor sentiment. However, recent de-escalation efforts, including tariff reductions and improved dialogue, have significantly reduced this uncertainty. This newfound stability is a key driver behind the increased confidence in the Chinese economy and its associated assets.

- Decreased tariffs and improved trade relations: Reduced trade barriers directly benefit Chinese companies, allowing them to access global markets more easily and boosting their profitability. This positive impact trickles down to investors, who perceive less risk associated with investing in Chinese stocks.

- Increased investor confidence and willingness to invest: The reduction in trade war anxieties has led to a significant rise in investor confidence. Investors, previously hesitant due to political and economic uncertainty, are now more willing to allocate capital to Chinese assets.

- Positive economic forecasts for China: Positive economic projections for China further reinforce this bullish sentiment. Analysts predict continued economic growth, making Chinese stocks an attractive investment proposition for both short-term and long-term gains.

- Reduced market volatility: The easing of trade tensions has also led to a decrease in market volatility, creating a more stable and predictable investment environment. This reduced risk profile is particularly appealing to investors seeking long-term growth.

Hong Kong's Role as a Key Hub for Chinese Stocks

Hong Kong's position as a leading financial center plays a pivotal role in the surge of Chinese stocks. Its robust regulatory framework, coupled with its strategic location, makes it a preferred listing destination for numerous Chinese companies.

- Hong Kong Stock Exchange (HKEX): The HKEX offers a well-established and internationally recognized platform for trading Chinese stocks, attracting significant global investment.

- Stock Connect programs: Initiatives like the Stock Connect programs facilitate easier access for international investors to participate in the mainland Chinese stock market, significantly increasing liquidity and trading volume in Hong Kong.

- Increased market liquidity: The high liquidity in the Hong Kong market ensures smoother trading and efficient price discovery, making it an attractive environment for both large and small investors.

- Diverse investment products: The HKEX offers a variety of investment products, catering to different risk profiles and investment strategies, further enhancing its attractiveness to a global investor base.

Identifying Promising Sectors for Investment

While the overall market shows promise, certain sectors within the Chinese economy present particularly attractive investment opportunities.

- Technology stocks: China's government is heavily investing in technological advancement, creating significant growth potential in this sector. Companies involved in artificial intelligence, 5G technology, and e-commerce are particularly promising.

- Consumer goods: China's burgeoning middle class fuels strong growth in the consumer goods sector. Companies producing and distributing consumer goods are well-positioned to benefit from this rising consumption.

- Healthcare: An aging population in China is driving substantial growth in the healthcare sector. Companies focusing on pharmaceuticals, medical equipment, and healthcare services are likely to experience significant expansion.

- Renewable energy: China's commitment to environmental sustainability is boosting investments in renewable energy companies. Solar, wind, and other green energy sectors are poised for considerable growth.

- Disclaimer: It's crucial to conduct thorough due diligence before investing in any sector. Understanding the specific risks and opportunities associated with each company is essential for making informed investment decisions.

Navigating the Risks and Opportunities

While the outlook for Chinese stocks in Hong Kong is generally positive, investors must remain aware of potential risks.

- Geopolitical risks: Geopolitical tensions, both between the US and China and within the region, can still impact market sentiment and create volatility.

- Regulatory changes: Changes in Chinese government regulations can significantly affect specific companies and sectors.

- Market corrections: Market corrections are a natural part of the investment cycle. Investors should be prepared for potential short-term downturns.

- Diversification: Diversifying investment portfolios across different sectors and asset classes is a crucial risk management strategy.

- Risk management: Employing a sound risk management strategy, including setting stop-loss orders and monitoring investments regularly, is crucial for mitigating potential losses.

- Professional financial advice: Seeking advice from a qualified financial advisor can provide valuable insights and guidance in navigating the complexities of this market.

Conclusion

The easing of US-China trade tensions has undeniably created a positive environment for Chinese stocks listed in Hong Kong. This presents substantial investment opportunities across diverse sectors, from technology to healthcare and renewable energy. However, understanding the potential risks and conducting thorough due diligence are crucial for maximizing returns and minimizing potential losses. Capitalize on the potential of easing trade tensions by exploring the promising landscape of Chinese stocks in Hong Kong. Conduct thorough research and consider consulting with a financial advisor before making any investment decisions related to this dynamic market. Remember to always conduct your own thorough research before investing in any market.

Featured Posts

-

Herros Hot Shooting 3 Point Contest Victory And Skills Challenge Highlights

Apr 24, 2025

Herros Hot Shooting 3 Point Contest Victory And Skills Challenge Highlights

Apr 24, 2025 -

Why This Startup Airline Uses Deportation Flights

Apr 24, 2025

Why This Startup Airline Uses Deportation Flights

Apr 24, 2025 -

Sk Hynix Now Leading Dram Market Ai Driven Growth Fuels Success

Apr 24, 2025

Sk Hynix Now Leading Dram Market Ai Driven Growth Fuels Success

Apr 24, 2025 -

South Carolina Voter Confronts Rep Nancy Mace A Heated Exchange

Apr 24, 2025

South Carolina Voter Confronts Rep Nancy Mace A Heated Exchange

Apr 24, 2025 -

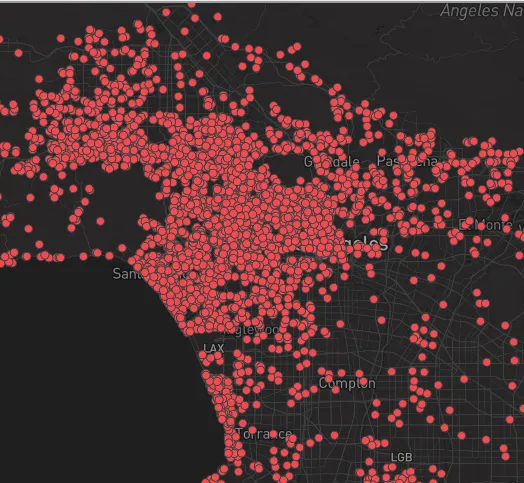

Are La Landlords Price Gouging After The Fires A Selling Sunset Perspective

Apr 24, 2025

Are La Landlords Price Gouging After The Fires A Selling Sunset Perspective

Apr 24, 2025