Dow Rallies 1000 Points: Stock Market Update & Analysis

Table of Contents

Causes of the 1000-Point Dow Rally

Several interconnected factors likely contributed to this significant Dow rally. Let's delve into the key drivers:

Positive Economic Indicators

Stronger-than-expected economic data often fuels market optimism. The recent rally may be attributed to:

- Robust Jobs Report: A surprisingly high number of jobs created in [Month, Year] significantly boosted investor confidence, indicating a healthy and growing economy. This positive employment data suggests increased consumer spending and overall economic strength, directly impacting stock valuations.

- Exceeding GDP Growth Expectations: GDP growth surpassing analysts' forecasts for [Quarter, Year] further fueled the positive market sentiment. This suggests a robust and resilient economy capable of withstanding potential challenges. For example, a [Percentage]% growth in GDP, exceeding the projected [Percentage]%, significantly impacted market optimism.

Easing Inflation Concerns

Decreasing inflation or positive signs of inflation control can significantly impact market performance.

- Cooling Inflation Rates: A slowdown in inflation, as evidenced by the [Month, Year] Consumer Price Index (CPI) report showing a [Percentage]% increase (down from [Previous Percentage]% in the previous month), eased concerns about aggressive interest rate hikes by central banks. This reduced the perceived risk to economic growth.

- Impact on Interest Rate Expectations: The easing inflation spurred expectations that central banks might adopt a less hawkish monetary policy, potentially leading to lower interest rates in the future. Lower interest rates generally stimulate borrowing and investment, boosting economic activity and stock prices.

Geopolitical Developments

Positive shifts in the geopolitical landscape can significantly influence investor sentiment and market stability.

- Reduced Geopolitical Uncertainty: A de-escalation of tensions in [Geopolitical Region] or a breakthrough in international negotiations might have contributed to the rally by reducing market uncertainty and risk aversion.

- Positive Trade Agreements: The announcement or progress on beneficial trade agreements could inject confidence into the market, leading to increased investment and a positive stock market reaction. For instance, progress in [Specific Trade Agreement] could have played a significant role.

Corporate Earnings Reports

Strong corporate earnings often serve as a catalyst for market rallies.

- Strong Earnings Season: A series of better-than-expected earnings reports from major Dow components, such as [Company A] and [Company B], injected renewed confidence into the market. Their positive results signaled robust corporate health and future growth potential.

- Positive Profit Trends: The overall trend of increased corporate profits across various sectors reinforces the positive narrative, signaling a healthy and expanding economy.

Impact of the 1000-Point Dow Rally

The 1000-point Dow rally had a widespread impact on the market and investor behavior.

Investor Sentiment and Confidence

The rally dramatically improved investor sentiment and confidence levels.

- Increased Investment Activity: The surge in the Dow led to a notable increase in investment activity, as investors rushed to participate in the upward trend.

- VIX Decline: The VIX volatility index, often referred to as the "fear gauge," likely experienced a significant decline, reflecting reduced market uncertainty and increased investor confidence. Anecdotal evidence from investor surveys also points towards a marked improvement in market sentiment.

Short-Term and Long-Term Implications

The rally has both short-term and long-term implications for the economy and the stock market.

- Potential for Further Growth: The rally might signal further potential for growth, depending on the persistence of positive economic indicators and geopolitical stability. However, it's crucial to acknowledge the possibility of a correction.

- Risks of Correction: Sharp market gains often precede periods of consolidation or correction. Investors need to be aware of the possibility of a pullback and manage their risk accordingly. Long-term economic prospects remain dependent on various factors, including inflation control, geopolitical stability, and sustained economic growth.

Sector-Specific Performance

The rally's impact varied across different market sectors.

- Outperforming Sectors: Sectors such as [Sector A] and [Sector B] might have outperformed the market due to their inherent resilience or positive industry-specific trends.

- Underperforming Sectors: Conversely, sectors like [Sector C] might have lagged behind, potentially due to specific industry challenges or headwinds.

Investment Strategies Following the Dow Rally

Following a significant market movement like this 1000-point rally, careful consideration of investment strategies is crucial.

Risk Assessment and Portfolio Diversification

Assessing risk and diversifying investments is paramount after any substantial market shift.

- Mitigating Risk: Diversifying across different asset classes (stocks, bonds, real estate) and sectors is essential to mitigate risk and protect your portfolio from market volatility.

- Rebalancing: Rebalancing your portfolio to align with your risk tolerance and investment goals is recommended after such significant market changes.

Long-Term Investing vs. Short-Term Trading

The choice between long-term investing and short-term trading depends on individual risk tolerance and investment goals.

- Long-Term Investing: A long-term investment strategy, focusing on consistent growth over time, often provides better returns and minimizes the impact of short-term market fluctuations.

- Short-Term Trading: Short-term trading involves more frequent buying and selling, aiming to profit from short-term price movements. This strategy carries higher risk but could potentially offer higher returns (and losses).

Seeking Professional Financial Advice

Consulting a financial advisor is highly recommended before making any significant investment decisions.

- Personalized Guidance: A financial advisor can provide personalized guidance tailored to your individual financial situation, risk tolerance, and investment goals.

- Informed Decisions: Professional advice ensures you make informed investment choices, mitigating risks and optimizing returns.

Conclusion

The 1000-point Dow rally resulted from a confluence of factors, including positive economic indicators, easing inflation concerns, favorable geopolitical developments, and strong corporate earnings. This market surge impacted investor sentiment, leading to increased confidence and investment activity. However, understanding the potential for corrections and diversifying investments is crucial. Moving forward, investors should focus on risk assessment, portfolio diversification, and potentially seek professional financial advice. Remember to stay updated on future Dow Jones Industrial Average movements and market analyses to make informed investment decisions. For further insights, consult reputable financial news sources and investment tools.

Featured Posts

-

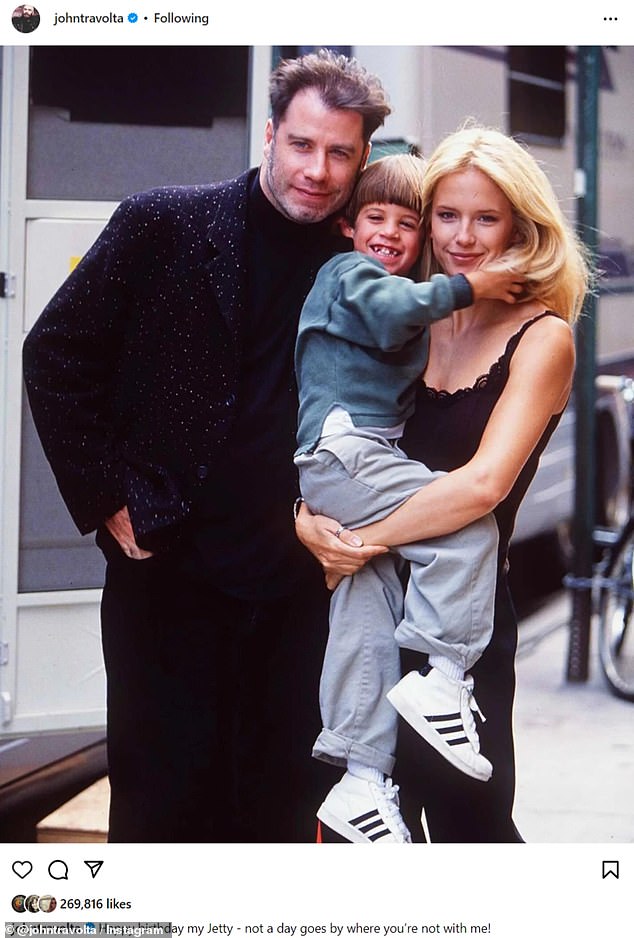

John Travoltas Heartfelt Tribute A Moving Photo Marks Jett Travoltas 33rd Birthday

Apr 24, 2025

John Travoltas Heartfelt Tribute A Moving Photo Marks Jett Travoltas 33rd Birthday

Apr 24, 2025 -

The End Of Ryujinx Nintendo Intervention And Project Closure

Apr 24, 2025

The End Of Ryujinx Nintendo Intervention And Project Closure

Apr 24, 2025 -

Future Of Microsoft Activision Deal Uncertain After Ftc Appeal

Apr 24, 2025

Future Of Microsoft Activision Deal Uncertain After Ftc Appeal

Apr 24, 2025 -

Gambling On Natural Disasters The Los Angeles Wildfire Example

Apr 24, 2025

Gambling On Natural Disasters The Los Angeles Wildfire Example

Apr 24, 2025 -

Bold And The Beautiful Spoilers For Thursday February 20th Liam Steffy And Finn

Apr 24, 2025

Bold And The Beautiful Spoilers For Thursday February 20th Liam Steffy And Finn

Apr 24, 2025