Dax Performance: Analyzing The Influence Of German Politics And Economics

Table of Contents

The German Economy's Influence on DAX Performance

The German economy is the powerhouse of Europe, and its health directly impacts the DAX. Several key economic indicators provide crucial insights into potential DAX performance.

Key Economic Indicators and their Impact

-

GDP Growth: Germany's Gross Domestic Product (GDP) growth is a primary driver of DAX performance. Strong GDP growth, signifying a booming economy, typically translates to increased investor confidence and higher DAX values. Conversely, slowing GDP growth or contraction can negatively affect the DAX. Analyzing recent GDP growth data, alongside historical DAX performance, reveals a strong positive correlation.

-

Inflation Rates: High inflation erodes purchasing power and can negatively impact consumer spending and business investment. This uncertainty can lead to decreased investor confidence and a subsequent decline in DAX performance. Monitoring inflation rates, particularly in relation to the European Central Bank's (ECB) target, is crucial for predicting DAX trends.

-

Unemployment Rates: Low unemployment rates signify a healthy labor market and strong consumer demand, which generally supports economic growth and positively influences the DAX. High unemployment, on the other hand, can signal economic weakness and negatively impact investor sentiment.

-

Export Performance: Germany is a global export leader. The strength of its export sector is heavily reliant on global trade dynamics and international demand. A decline in global trade or weakening international demand can directly impact German exports and negatively influence DAX performance. Conversely, strong export performance boosts the German economy and typically supports DAX growth.

-

Bullet Points:

- Historical DAX data shows a clear correlation between periods of strong economic growth and significant DAX gains.

- Analyzing leading economic indicators, such as the Purchasing Managers' Index (PMI), can offer valuable insights into future DAX performance.

- Reputable economic forecasting models provide predictions for German GDP growth, inflation, and unemployment, which can inform DAX investment strategies.

The Impact of German Politics on DAX Performance

German politics plays a significant role in shaping the country's economic landscape and consequently, DAX performance. Government policies, political stability, and geopolitical events all contribute to the overall investment climate.

Government Policies and Regulations

-

Fiscal Policy: The German government's fiscal policies, encompassing spending and taxation, directly affect business activity and investor sentiment. Expansionary fiscal policies, such as increased government spending or tax cuts, can stimulate economic growth and positively impact the DAX. Conversely, contractionary fiscal policies may dampen economic activity.

-

Monetary Policy: The European Central Bank (ECB) significantly influences interest rates within the Eurozone, impacting borrowing costs for businesses and consumers. The ECB's monetary policy decisions, aimed at controlling inflation and stimulating economic growth, have a direct effect on the DAX. Low interest rates, for instance, often encourage investment and support DAX growth.

-

Regulatory Changes: Changes in regulations impacting German businesses can significantly influence investor confidence. New environmental regulations, labor laws, or tax reforms can create uncertainty and potentially lead to DAX volatility.

Political Stability and Uncertainty

-

Coalition Governments: Germany frequently operates under coalition governments. The stability of these coalitions directly affects policymaking and investor confidence. Periods of political instability can lead to uncertainty and negatively impact DAX performance.

-

Election Cycles: Election cycles can introduce uncertainty into the market. The potential for policy changes following an election can impact investor sentiment and create volatility in the DAX.

-

Geopolitical Events: Global geopolitical events, such as international conflicts or trade wars, can significantly impact the German economy and consequently the DAX. These events often introduce uncertainty and increase market volatility.

-

Bullet Points:

- The political risk premium associated with investing in the DAX can be higher during periods of political instability.

- Analyzing investor sentiment surveys related to German political stability provides valuable insight into potential market movements.

- Historical analysis shows that major political events have often led to short-term DAX volatility.

Analyzing DAX Performance: Tools and Strategies

Successful DAX investing requires a multifaceted approach, combining technical and fundamental analysis.

Technical Analysis

-

Chart Patterns: Identifying chart patterns, such as head and shoulders or double tops/bottoms, can help predict potential future DAX movements.

-

Moving Averages: Using moving averages, such as 50-day or 200-day averages, helps smooth out price fluctuations and identify potential trend reversals.

-

Technical Indicators: Technical indicators, like RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence), provide signals about overbought or oversold conditions and potential momentum changes.

Fundamental Analysis

-

Company Valuations: Fundamental analysis involves assessing the intrinsic value of DAX-listed companies through methods like discounted cash flow (DCF) analysis.

-

Financial Ratios: Analyzing financial ratios, such as price-to-earnings (P/E) ratios, helps determine the relative valuation of DAX companies.

-

Economic Forecasts: Integrating economic forecasts into investment decisions is crucial. Understanding the expected growth rate of the German economy helps assess the potential performance of the DAX.

-

Bullet Points:

- Several reputable financial websites and platforms provide resources for DAX technical and fundamental analysis.

- Diversification across different DAX sectors reduces investment risk.

- Implementing robust risk management strategies, such as stop-loss orders, is essential when investing in the DAX.

Conclusion

DAX performance is inextricably linked to the German economy's health and the stability of its political landscape. Understanding the interplay of economic indicators, government policies, and political stability is paramount for effective DAX investment strategies. By combining technical and fundamental analysis, investors can make informed decisions and potentially capitalize on market opportunities. Continue your research into the German economic outlook and political environment to further refine your understanding of DAX performance and develop robust investment strategies for this important market index. Regularly monitor key economic indicators and political developments to optimize your approach to DAX investment.

Featured Posts

-

Svitolina Cruises Past Kalinskaya In Dubai Opening Match

Apr 27, 2025

Svitolina Cruises Past Kalinskaya In Dubai Opening Match

Apr 27, 2025 -

Bencic Triumphs First Wta Tournament Win Since Becoming A Mother

Apr 27, 2025

Bencic Triumphs First Wta Tournament Win Since Becoming A Mother

Apr 27, 2025 -

Open Thread February 16 2025 Discussion

Apr 27, 2025

Open Thread February 16 2025 Discussion

Apr 27, 2025 -

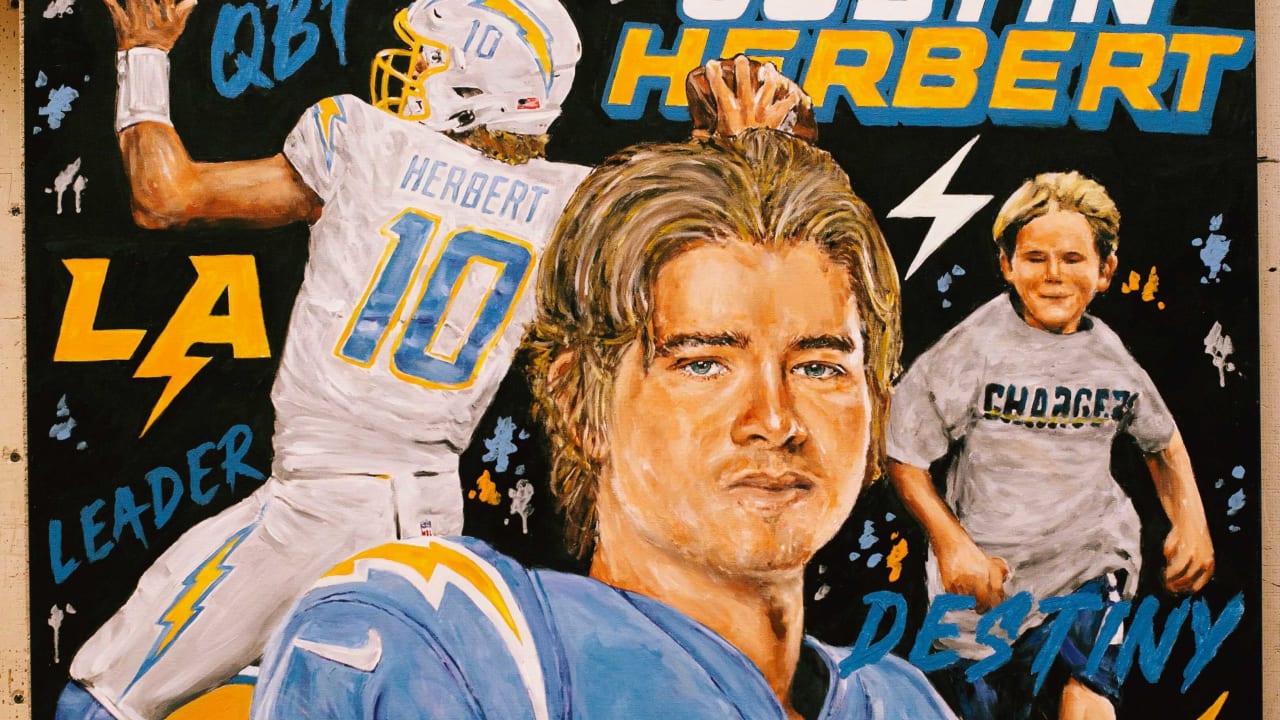

Chargers To Kick Off 2025 Season In Brazil Justin Herberts Reaction

Apr 27, 2025

Chargers To Kick Off 2025 Season In Brazil Justin Herberts Reaction

Apr 27, 2025 -

Anti Vaccine Activist Review Of Autism Vaccine Link Sparks Outrage Nbc 5 Dallas Fort Worth

Apr 27, 2025

Anti Vaccine Activist Review Of Autism Vaccine Link Sparks Outrage Nbc 5 Dallas Fort Worth

Apr 27, 2025