Dax Index: Election Cycles And Economic Growth In Germany

Table of Contents

Historical Analysis of Dax Index Performance During Election Years

Pre-Election Volatility

The period leading up to German federal elections typically witnesses increased volatility in the Dax Index. This heightened uncertainty stems from the inherent unpredictability of election outcomes and the potential for significant policy shifts under different governing coalitions. Investors often react to pre-election polling data and campaign promises, leading to speculation and increased trading volume. This can result in substantial price fluctuations, with the potential for both significant gains and losses depending on prevailing investor sentiment.

- Increased trading volume: The anticipation of potential policy changes drives increased trading activity as investors adjust their portfolios.

- Price fluctuations driven by speculation: Market participants react to news and opinions, often leading to exaggerated price swings.

- Potential for both gains and losses: The direction of the Dax Index movement depends heavily on the perceived impact of potential future policies on various sectors. For example, industries sensitive to environmental regulations may experience volatility depending on the environmental stances of competing parties.

Post-Election Market Reactions

The market's response to election results is equally dynamic. A decisive victory for a party with a clear policy platform can lead to a relatively swift and predictable market reaction, either positive or negative depending on investor perceptions of the proposed policies. However, coalition negotiations, which often follow closely contested elections, introduce a period of extended uncertainty, potentially prolonging market volatility.

- Examples of significant policy changes impacting the Dax: The introduction of significant tax reforms or changes to labor laws can significantly impact listed companies and the Dax Index.

- Analysis of market response times (short-term vs. long-term): Initial reactions are often short-term and driven by sentiment. The long-term impact depends on the actual implementation and effectiveness of the new policies.

- Discussion on investor confidence and its relation to election outcomes: A stable and predictable government typically boosts investor confidence, while prolonged coalition negotiations or unexpected outcomes can lead to uncertainty and potentially trigger a sell-off.

The Influence of Government Policies on the Dax Index

Fiscal Policy and Economic Growth

Government spending and taxation policies significantly impact economic growth, directly influencing the Dax Index. Expansionary fiscal policies, characterized by increased government spending or tax cuts, aim to stimulate economic activity, potentially leading to higher corporate profits and a rising Dax. Conversely, contractionary policies, such as austerity measures, may dampen economic growth and put downward pressure on the Dax.

- Examples of expansionary and contractionary fiscal policies and their impacts: The German government's response to the 2008 financial crisis involved expansionary fiscal measures. Conversely, periods of fiscal consolidation have sometimes led to slower Dax growth.

- Relationship between government debt and Dax performance: High levels of government debt can raise concerns among investors, potentially impacting market confidence and the Dax.

- Analysis of investor response to fiscal policy announcements: The market closely scrutinizes government budget announcements, often reacting positively to pro-growth measures and negatively to austerity measures.

Regulatory Changes and their Impact

Regulatory changes, particularly those impacting specific sectors, can significantly influence listed companies and the overall Dax Index performance. Labor market reforms, for example, can affect productivity and corporate profitability. Environmental regulations can impact energy companies and manufacturers, while changes in financial regulations affect banks and insurance firms.

- Examples of regulatory changes that have influenced the Dax: Reforms in the energy sector, changes to banking regulations, or modifications to environmental protection laws have all had noticeable effects on specific Dax components.

- Analysis of the long-term effects of regulatory changes: The impact of regulatory changes is often not immediately apparent and can unfold over several years.

- Discussion of sector-specific impacts of regulations: Different sectors exhibit varying levels of sensitivity to regulatory changes.

Investor Sentiment and the Dax Index During Election Cycles

Uncertainty and Risk Aversion

Political uncertainty is a major driver of investor sentiment. During election cycles, investors often exhibit risk aversion, preferring safer assets such as government bonds. This "flight to safety" can lead to capital outflows from the equity market, resulting in a decline in the Dax Index.

- Examples of how investors react to election-related news: Negative news about the economy or political instability can trigger a sell-off.

- Analysis of capital flows during election periods: Monitoring capital flows can provide insights into investor confidence and risk appetite.

- Discussion of the role of international investors in influencing the Dax: International investors play a significant role in the Dax, and their reactions to election-related uncertainty can significantly influence the index's performance.

Predicting Dax Performance Based on Election Outcomes (limitations)

While election outcomes provide valuable information, it's crucial to acknowledge the limitations of using them as the sole predictor of Dax performance. Numerous other factors, including global economic conditions, technological advancements, and unforeseen events, exert a significant influence. Over-reliance on election predictions risks overlooking other crucial economic indicators.

- Limitations of using election outcomes as the sole predictor: Economic cycles, interest rate changes, and global market trends can all significantly impact the Dax independently of election results.

- Importance of considering global economic conditions: Global events and economic trends significantly influence the German economy and the Dax.

- The role of technological advancements and other market forces: Technological disruptions and other market forces can have profound and unpredictable impacts on specific sectors and the Dax as a whole.

Conclusion

The Dax Index’s performance is intricately linked to German election cycles, with pre-election volatility and post-election reactions significantly impacting its trajectory. Government policies, both fiscal and regulatory, play a crucial role in shaping economic growth and investor sentiment, further influencing the Dax. While predicting the precise impact of elections on the Dax is challenging, understanding the historical trends and the interplay between political developments and economic factors provides valuable insights for investors. By carefully considering these factors, investors can develop more informed strategies when navigating the complexities of the Dax Index during and after German federal elections. Continue your research and stay informed about the Dax Index and its underlying drivers to make well-informed investment decisions.

Featured Posts

-

Power Finance Corporations 4th Dividend For Fy 25 Announcement Date March 12 2025

Apr 27, 2025

Power Finance Corporations 4th Dividend For Fy 25 Announcement Date March 12 2025

Apr 27, 2025 -

Blue Origins New Shepard Launch Abruptly Cancelled

Apr 27, 2025

Blue Origins New Shepard Launch Abruptly Cancelled

Apr 27, 2025 -

Pne Ag Aktuelle Meldung Nach Deutschem Aktienrecht 40 Abs 1 Wp Hg

Apr 27, 2025

Pne Ag Aktuelle Meldung Nach Deutschem Aktienrecht 40 Abs 1 Wp Hg

Apr 27, 2025 -

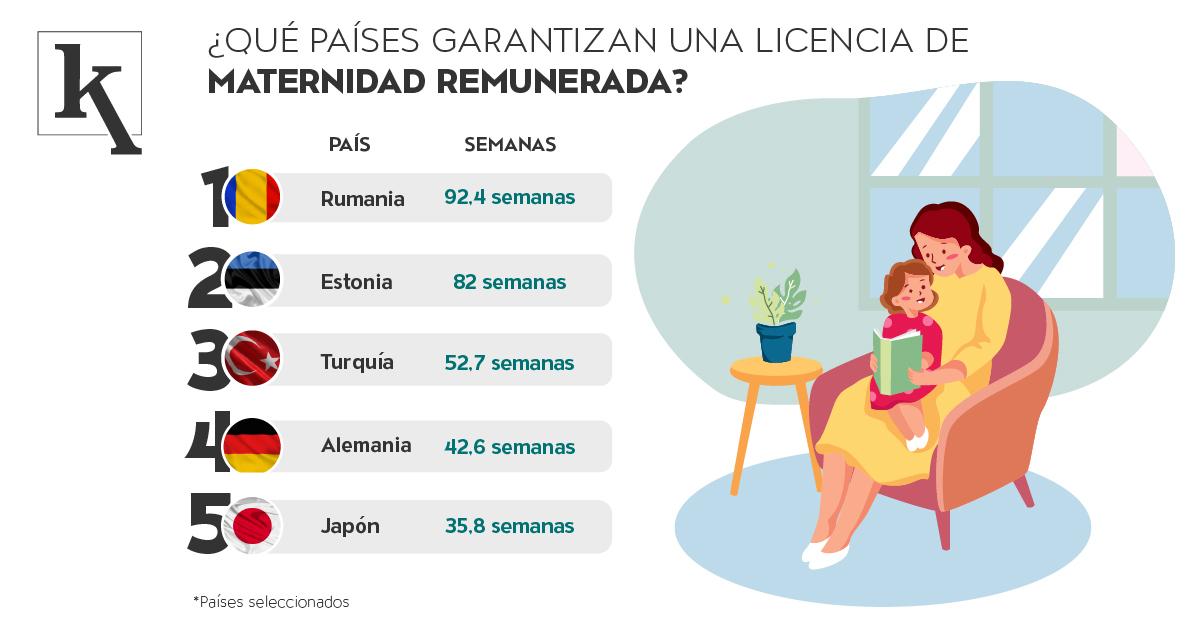

Revolucionario Wta Ofrece Licencia De Maternidad Remunerada A Sus Tenistas

Apr 27, 2025

Revolucionario Wta Ofrece Licencia De Maternidad Remunerada A Sus Tenistas

Apr 27, 2025 -

Sorpresiva Eliminacion En Indian Wells Quien Fue

Apr 27, 2025

Sorpresiva Eliminacion En Indian Wells Quien Fue

Apr 27, 2025