Colgate (CL) Stock: How Tariffs Affected Q[Quarter] Results

![Colgate (CL) Stock: How Tariffs Affected Q[Quarter] Results Colgate (CL) Stock: How Tariffs Affected Q[Quarter] Results](https://bussehalberschmidt.de/image/colgate-cl-stock-how-tariffs-affected-q-quarter-results.jpeg)

Table of Contents

Impact of Tariffs on Colgate's Raw Material Costs

Increased Costs of Imported Ingredients

The rise in global tariffs directly impacted Colgate's cost of goods sold. Key ingredients sourced internationally, such as certain specialty chemicals used in toothpaste formulations and packaging materials like plastics and resins, experienced significant price increases.

- Specific examples: The cost of titanium dioxide, a whitening agent used in many Colgate toothpastes, increased by approximately 15% due to tariffs imposed on imports from China. Similarly, certain resins used in packaging saw a 10% price hike due to tariffs originating from Mexico.

- Percentage increase in costs: The overall impact on Colgate's raw material costs is estimated to be around 8%, significantly impacting profit margins.

- Regions most affected: China and Mexico were the two primary regions where tariffs had the most significant effect on Colgate's supply chain. This highlights the vulnerability of globally integrated businesses to trade disputes.

- Keyword integration: Colgate tariffs, raw material costs, import tariffs, supply chain disruptions, Colgate-Palmolive supply chain.

Strategies Implemented to Mitigate Cost Increases

Colgate-Palmolive actively implemented several strategies to mitigate the impact of increased raw material costs.

- Cost-cutting measures: The company streamlined its manufacturing processes, optimized its logistics network, and implemented stricter cost controls across various departments.

- Price adjustments: Colgate strategically adjusted prices on certain products in specific regions to offset some of the increased costs. However, they carefully considered price elasticity of demand to avoid losing market share.

- Sourcing alternative suppliers: The company actively sought alternative suppliers in regions less affected by tariffs, diversifying its sourcing strategy to reduce its reliance on high-tariff areas.

- Supply chain optimization: Improvements to the supply chain, including better inventory management and enhanced forecasting, helped minimize waste and reduce overall costs.

- Hedging strategies: Colgate employed various hedging strategies, such as forward contracts, to lock in prices for certain raw materials and protect against future price volatility.

- Keyword integration: Cost mitigation strategies, price increases, supply chain management, risk management, Colgate-Palmolive cost control.

Effect on Colgate's Sales and Market Share

Changes in Consumer Demand

While Colgate implemented price adjustments, the increased costs did have some impact on consumer demand.

- Sales figures comparison: Q3 sales showed a slight decrease compared to Q2, particularly in regions most affected by price increases. This suggests that consumer demand was slightly sensitive to price changes for certain products.

- Regional performance variations: Regions with higher tariff impacts showed a more pronounced decrease in sales volume compared to regions less affected by tariffs.

- Impact on different product categories: The impact varied across product categories. Higher-priced products experienced more significant sales volume drops than lower-priced items. The price elasticity of demand varied depending on consumer perception of value and competitive offerings.

- Keyword integration: Consumer spending, market share analysis, sales volume, price elasticity, Colgate-Palmolive sales.

Competitive Landscape and Tariff Advantages/Disadvantages

The impact of tariffs varied across Colgate's competitors, creating a shifting competitive landscape.

- Comparison with key competitors: Competitors with more diversified sourcing strategies or stronger presence in regions less affected by tariffs were less impacted.

- Tariff advantages/disadvantages: For Colgate, the tariffs presented a disadvantage, increasing costs and potentially affecting market share. Companies with domestic sourcing or alternative supply chains gained a competitive edge.

- Keyword integration: Competitive advantage, market competition, industry analysis, Colgate-Palmolive competitors.

Colgate's Q3 Financial Performance and Forward Guidance

Analysis of Key Financial Metrics

Colgate's Q3 financial performance clearly reflected the impact of tariffs.

- Revenue: Overall revenue was slightly lower than projected, directly influenced by the reduced sales volume and increased costs.

- Net income: Net income also decreased compared to Q2, reflecting the pressure on profit margins caused by increased raw material costs.

- Operating margin: The operating margin contracted due to the combined effect of reduced sales volume and higher raw material costs.

- Earnings per share (EPS): Earnings per share were negatively affected, reflecting the overall impact on profitability.

- Keyword integration: Financial performance, earnings per share (EPS), revenue growth, net income, operating margin, Colgate-Palmolive financial results.

Management's Outlook and Future Expectations

Colgate's management acknowledged the impact of tariffs but expressed confidence in their ability to navigate the challenges.

- Future projections: While specific forecasts were cautious, management indicated a belief in their ability to offset some of the tariff impacts through ongoing cost-cutting measures and strategic pricing adjustments.

- Expected impact of tariffs on future earnings: The company anticipates the impact of tariffs to continue into Q4, but at a potentially reduced level.

- Potential changes in strategy: Colgate emphasized a continued focus on supply chain diversification and innovation to mitigate future risks associated with global trade uncertainties.

- Keyword integration: Forward guidance, future outlook, earnings forecast, strategic planning, Colgate-Palmolive strategy.

Conclusion

Colgate (CL) stock's performance in Q3 was undeniably affected by the impact of global tariffs, primarily impacting raw material costs and potentially influencing sales. While Colgate implemented strategies to mitigate the negative consequences, the full extent of these effects will continue to unfold. Investors need to carefully monitor Colgate's ongoing response to trade tensions and assess the company's ability to adapt to the evolving global trade landscape. Further analysis of Colgate (CL) stock and its future performance in light of tariff fluctuations is essential for making informed investment decisions. Stay tuned for further updates on how tariffs continue to affect Colgate (CL) stock performance.

![Colgate (CL) Stock: How Tariffs Affected Q[Quarter] Results Colgate (CL) Stock: How Tariffs Affected Q[Quarter] Results](https://bussehalberschmidt.de/image/colgate-cl-stock-how-tariffs-affected-q-quarter-results.jpeg)

Featured Posts

-

Construction Of Worlds Tallest Abandoned Skyscraper To Resume After A Decade

Apr 26, 2025

Construction Of Worlds Tallest Abandoned Skyscraper To Resume After A Decade

Apr 26, 2025 -

The Human Element An Interview With Microsofts Head Of Design On Ai

Apr 26, 2025

The Human Element An Interview With Microsofts Head Of Design On Ai

Apr 26, 2025 -

Green Bays Nfl Draft First Round Preview And Predictions

Apr 26, 2025

Green Bays Nfl Draft First Round Preview And Predictions

Apr 26, 2025 -

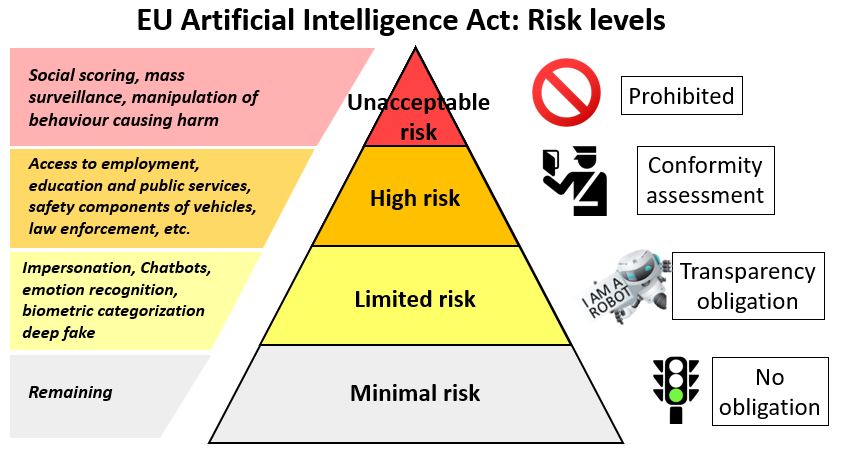

Ai Regulation In Europe The Impact Of Trump Administration Pressure

Apr 26, 2025

Ai Regulation In Europe The Impact Of Trump Administration Pressure

Apr 26, 2025 -

Nintendo Switch 2 Preorder My Game Stop Line Experience

Apr 26, 2025

Nintendo Switch 2 Preorder My Game Stop Line Experience

Apr 26, 2025