Canadian Travel Boycott: A Posthaste Economic Assessment For The US

Table of Contents

Main Points: Assessing the Economic Fallout

2.1 Direct Economic Losses for the US

A Canadian Travel Boycott, even a partial one, would inflict significant direct economic losses on the United States.

-

Tourism Revenue: Canadians are major contributors to the US tourism sector. In 2022, Canadian tourists spent an estimated X billion dollars in the US (replace X with actual data if available), boosting revenues for hotels, restaurants, theme parks, and other entertainment venues. A boycott would directly impact these businesses, leading to revenue shortfalls and potential job losses. This is particularly true in border states and cities heavily reliant on Canadian tourism.

-

Cross-Border Trade: The impact extends beyond tourism. A Canadian Travel Boycott would disrupt cross-border shopping, impacting retail sales, particularly in border towns. Reduced cross-border traffic would also affect other trade activities, leading to further economic losses. Data on the annual value of cross-border shopping and trade between the US and Canada should be included here for quantification (replace with actual data).

-

Airline Industry Impact: US airlines heavily reliant on Canadian routes would face substantial challenges. Reduced passenger numbers could lead to decreased flight frequencies, job losses for pilots, flight attendants, and ground staff, and potentially even route cancellations. The financial impact on these airlines would be considerable.

-

Real Estate & Property Market: Border towns and states heavily reliant on Canadian tourism could see a downturn in their real estate and property markets. Reduced demand for accommodation and other services could lead to lower property values and reduced investment.

2.2 Indirect Economic Consequences

The economic fallout from a Canadian Travel Boycott wouldn't be limited to direct impacts. Ripple effects would be felt across numerous sectors.

-

Reduced Consumer Spending: The decline in tourism revenue would lead to reduced consumer spending in related industries. Suppliers, manufacturers, and other businesses that cater to the tourism sector would experience a decrease in demand, potentially leading to further job losses and economic contraction.

-

Job Losses: The job losses would not be confined to the tourism sector alone. The ripple effect could lead to significant job losses in related industries, further exacerbating the economic downturn. Specific figures and sectoral analysis are needed for a complete assessment (replace with data).

-

Impact on US Businesses with Canadian Investments: US companies with significant investments or operations in Canada could also face negative consequences. A strained relationship between the two countries, potentially stemming from a boycott, could negatively affect these investments and business operations.

-

Political and Diplomatic Ramifications: Beyond the economic consequences, a Canadian Travel Boycott would have significant political and diplomatic ramifications, potentially further damaging the already strained relationship between the two countries.

2.3 Potential Mitigation Strategies

While a Canadian Travel Boycott would present considerable challenges, several mitigation strategies could be employed.

-

Government Intervention: Government intervention, including financial aid packages or tax breaks for affected businesses, could help cushion the economic blow. Stimulus programs targeting border communities could also be considered.

-

Industry Response: The US tourism and travel industry would need to adapt by focusing on attracting tourists from other countries. Marketing campaigns targeting alternative markets would be crucial.

-

Promoting Alternative Tourist Markets: Diversifying tourism strategies to attract visitors from other countries is crucial. This would involve focusing on different markets and promoting unique aspects of the US travel experience.

-

Strengthening US-Canada Relations: Ultimately, preventing a Canadian Travel Boycott requires strengthening US-Canada relations through diplomatic engagement and addressing the underlying issues causing the tension.

2.4 Case Studies

Examining past travel boycotts, such as [insert examples of past travel boycotts and their economic impacts], provides valuable insights. While the scale and specific circumstances may differ, these case studies offer valuable lessons in understanding the potential economic consequences of a Canadian Travel Boycott. Analyzing these cases, alongside relevant academic research on the economic effects of travel boycotts, will provide a more robust assessment.

Conclusion: Understanding the Stakes of a Canadian Travel Boycott

This assessment highlights the potentially severe economic consequences of a Canadian Travel Boycott for the United States. Both the direct and indirect impacts, ranging from job losses in the tourism sector to reduced consumer spending across multiple industries, underscore the interconnectedness of the US and Canadian economies. Ignoring the potential ramifications of a Canadian Travel Boycott would be a grave mistake. We urge you to engage in informed discussions about this issue and contact your representatives to advocate for policies that foster strong US-Canada relations and prevent such a damaging scenario. Preventing a Canadian travel boycott should be a priority for maintaining economic stability and strong bilateral ties.

Featured Posts

-

Investigation Reveals Fraud Pfc Transfers Eo W From Gensol Promoters

Apr 27, 2025

Investigation Reveals Fraud Pfc Transfers Eo W From Gensol Promoters

Apr 27, 2025 -

Nebraska Jeweler Aids Nfl Players Second Acts A Local Success Story

Apr 27, 2025

Nebraska Jeweler Aids Nfl Players Second Acts A Local Success Story

Apr 27, 2025 -

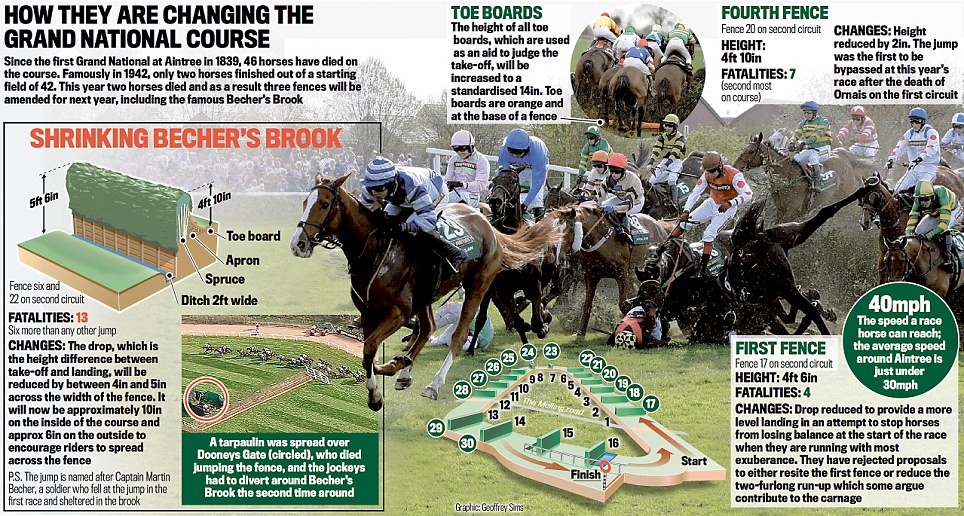

Grand National 2025 Examining The History Of Horse Fatalities

Apr 27, 2025

Grand National 2025 Examining The History Of Horse Fatalities

Apr 27, 2025 -

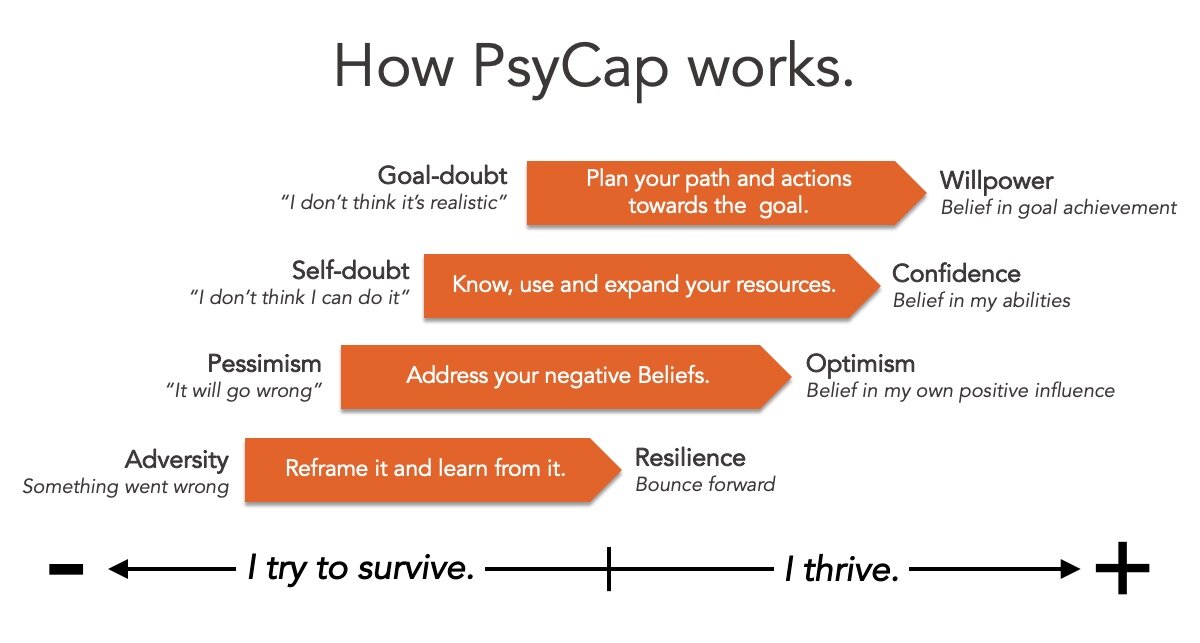

The Crucial Role Of Middle Managers In Employee Development And Company Growth

Apr 27, 2025

The Crucial Role Of Middle Managers In Employee Development And Company Growth

Apr 27, 2025 -

Ariana Grandes Hair Transformation And Tattoo Debut A Look At Professional Styling

Apr 27, 2025

Ariana Grandes Hair Transformation And Tattoo Debut A Look At Professional Styling

Apr 27, 2025