Can Film Tax Credits Boost Minnesota's TV And Film Industry?

Table of Contents

Film tax credits are financial incentives offered by governments to film production companies to encourage them to shoot their movies or TV shows within their jurisdiction. These credits essentially reduce the overall cost of production, making a location more attractive compared to others. This article argues that such incentives could be transformative for Minnesota.

The Economic Impact of Film Tax Credits

Film tax credits don't just benefit the production companies; their positive ripples extend throughout the local economy.

Job Creation and Local Hiring

Film productions are labor-intensive. They require a vast array of skilled and unskilled workers, creating jobs far beyond just actors and directors. Local crews, including camera operators, gaffers, grips, sound technicians, and editors, are in high demand. Furthermore, productions rely on local caterers, transportation services, construction workers (for set building), and many other support staff. States with robust film incentive programs have seen impressive job creation numbers. For example, [insert statistic if available, e.g., "Georgia's film tax credit program has been credited with creating X number of jobs since its inception"].

- Increased employment: Across various sectors, from construction and catering to transportation and hospitality.

- Opportunities for all skill levels: From entry-level positions to highly specialized roles, offering valuable experience and training.

- Development of a local film workforce: A thriving film industry fosters a skilled workforce, ensuring long-term sustainability.

Revenue Generation for the State

The economic benefits extend beyond direct employment. Film crews and cast members spend money locally on hotels, restaurants, transportation, and entertainment, significantly boosting revenue for local businesses. Moreover, filming locations often become tourist attractions, drawing visitors who want to experience the places featured in their favorite shows or movies. This results in further economic activity and increased tax revenue for the state.

- Increased tax revenue: From increased spending by production crews and tourists.

- Tourism revenue: From filming locations becoming popular tourist attractions, generating additional income.

- Positive Multiplier Effect: The initial spending by the production stimulates further spending within the local economy, amplifying the overall impact.

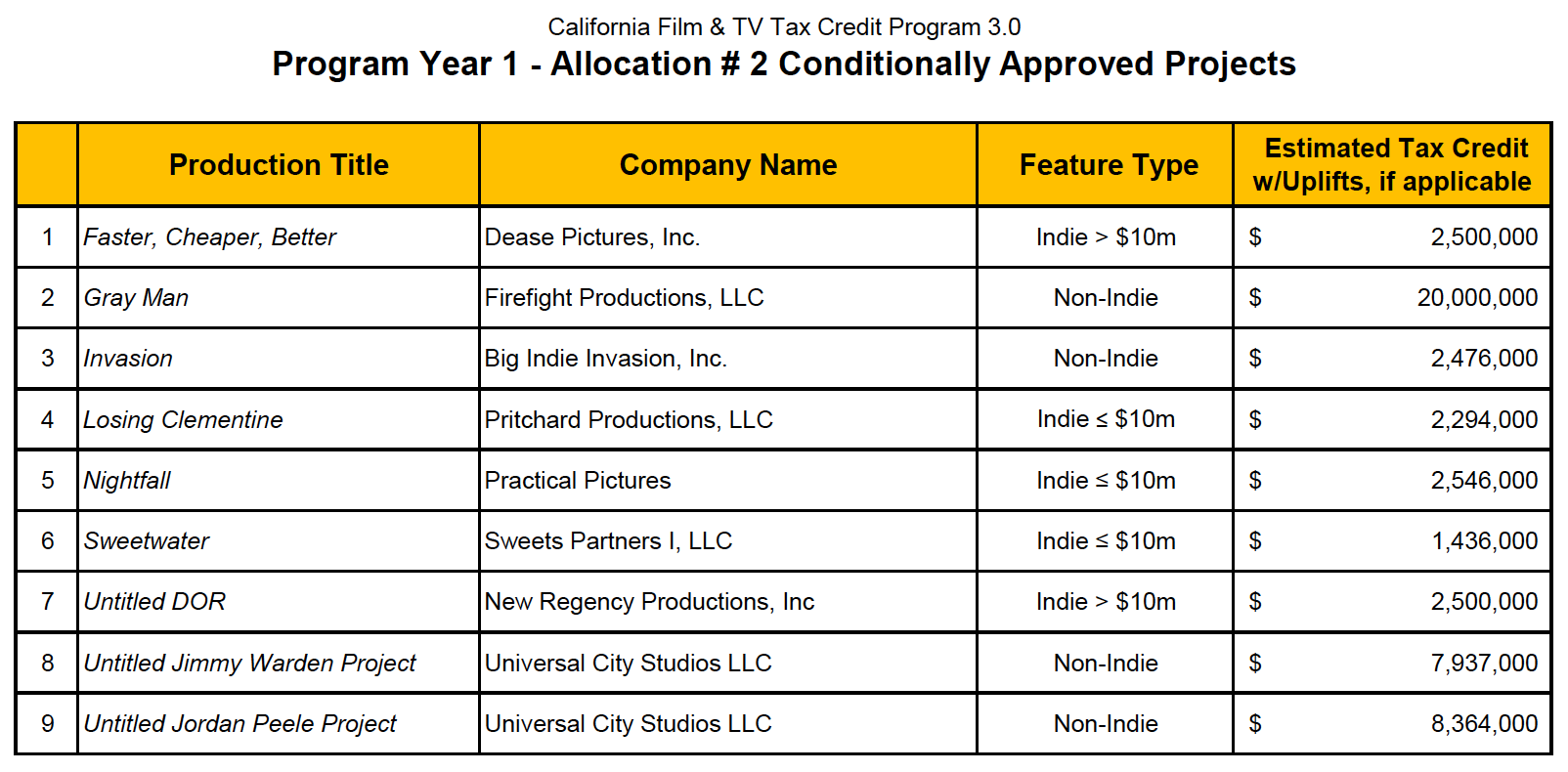

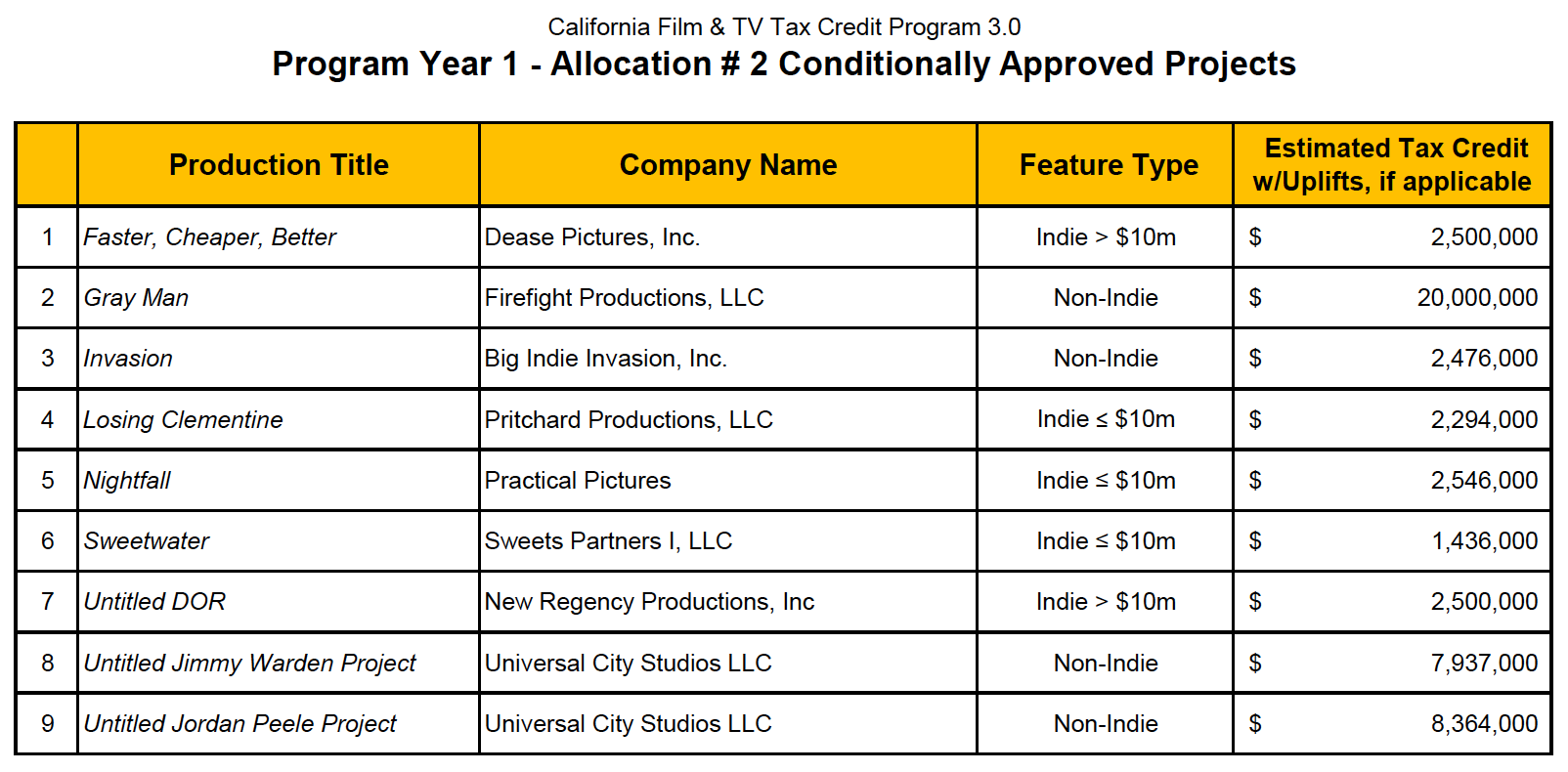

Comparison with Other States' Successful Film Incentive Programs

Analyzing successful film incentive programs in other states provides valuable insights into the potential benefits for Minnesota.

Case Studies of Successful Film Tax Credit Programs

States like Georgia and New Mexico have experienced significant economic growth thanks to their generous film tax credit programs. These programs attracted major productions, leading to substantial job creation and revenue generation. [Insert specific data and examples comparing job creation and economic impact before and after implementation of film tax credit programs in Georgia and New Mexico. Cite sources].

- Examples of Success: Highlight states that have successfully leveraged film tax credits to revitalize their economies.

- Quantifiable Data: Present concrete evidence of job growth and economic impact from other states' programs.

- Best Practices: Learn from the successes and challenges encountered in other states to optimize a Minnesota program.

Addressing Potential Drawbacks and Concerns

While film tax credits offer significant potential, concerns exist regarding their cost to taxpayers and the potential for abuse. However, these concerns can be mitigated through careful planning and implementation.

- Fraud Prevention: Implementing strict guidelines, rigorous audits, and transparent accountability measures can minimize fraud and ensure responsible spending.

- Cost-Effectiveness: Strategies can be employed to maximize economic benefits while minimizing costs, focusing on projects that generate significant local spending and job creation.

- Equity and Inclusion: Program design should prioritize inclusivity and equity within the film industry, ensuring opportunities for underrepresented groups.

Potential for Growth in Minnesota's TV and Film Industry

Minnesota possesses significant untapped potential in the film industry.

Minnesota's Unique Filmmaking Assets

Minnesota offers diverse and visually stunning locations perfect for filming. From its picturesque lakes and forests to its vibrant cities, the state provides a unique backdrop for a wide range of productions. Moreover, there's an existing, albeit underdeveloped, film infrastructure with potential for expansion. Local educational institutions also support the development of a skilled film workforce.

- Diverse Filming Locations: Showcase the variety of landscapes available, attracting a diverse range of productions.

- Existing Infrastructure: Highlight existing studio spaces and the potential for further development.

- Skilled Workforce Pipeline: Emphasize the educational institutions producing skilled professionals for the industry.

Attracting Productions and Investment

Film tax credits act as powerful magnets, attracting major productions to Minnesota. This increased competition for film projects elevates Minnesota's reputation as a film-friendly state, opening doors to both large-scale and independent productions. This influx of productions creates opportunities for local businesses and filmmakers, fostering a more vibrant and self-sustaining industry.

- Increased Competition: Attract more productions by becoming a more competitive filming location.

- Enhanced Reputation: Become known as a film-friendly state, attracting further investment and talent.

- Opportunities for Locals: Provide opportunities for local filmmakers, crews, and businesses to thrive.

The Future of Film in Minnesota and the Role of Film Tax Credits

In summary, film tax credits offer a powerful mechanism to revitalize Minnesota's TV and film industry. The potential economic benefits—job creation, revenue generation, and tourism—are substantial. While potential drawbacks exist, careful planning and implementation can minimize these risks. By implementing effective Minnesota film tax incentives, boosting Minnesota's film industry through film production tax credits in Minnesota, we can create a thriving industry that benefits the entire state. Let's support the implementation of effective film tax credit programs to unlock the full potential of Minnesota's film industry and contribute to its future success.

Featured Posts

-

Nba Player Anthony Edwards Receives 50 000 Fine

Apr 29, 2025

Nba Player Anthony Edwards Receives 50 000 Fine

Apr 29, 2025 -

Anthony Edwards Availability Timberwolves Lakers Game Preview

Apr 29, 2025

Anthony Edwards Availability Timberwolves Lakers Game Preview

Apr 29, 2025 -

Paternity Case Resolved Ayesha Howard Awarded Child Custody From Anthony Edwards

Apr 29, 2025

Paternity Case Resolved Ayesha Howard Awarded Child Custody From Anthony Edwards

Apr 29, 2025 -

Will Tax Credits Revitalize Minnesotas Film And Television Sector

Apr 29, 2025

Will Tax Credits Revitalize Minnesotas Film And Television Sector

Apr 29, 2025 -

Whats Behind Tylor Megills Strong Performance For The New York Mets

Apr 29, 2025

Whats Behind Tylor Megills Strong Performance For The New York Mets

Apr 29, 2025