Bundestag Elections And Their Economic Ripple Effects On The Dax

Table of Contents

Pre-Election Volatility and Market Uncertainty

The period leading up to a Bundestag election is often characterized by heightened market uncertainty. This volatility stems from several factors:

-

Policy Uncertainty: Competing political parties often present vastly different economic platforms. Uncertainty about which party or coalition will ultimately govern creates anxiety among investors, leading to cautious trading and potential price fluctuations in the DAX. The debate over tax policies, social welfare programs, and environmental regulations all contribute to this pre-election unease.

-

Investor Sentiment: Poll results and political debates significantly impact investor sentiment. A close race can fuel uncertainty, while a clear lead for a particular party might bring some stability, depending on the party's perceived economic policies. News coverage and expert analysis further shape investor perceptions and influence trading decisions.

-

Geopolitical Factors: International events and global economic trends can exacerbate pre-election volatility. A global economic slowdown, an international crisis, or even significant shifts in the Eurozone can amplify existing anxieties related to the upcoming elections and increase the impact on the DAX. For example, the ongoing war in Ukraine has significantly influenced investor sentiment during recent election cycles.

Examples from past Bundestag elections illustrate this pre-election jitters. The 2017 election, marked by a close race and uncertainty about the future coalition, saw increased volatility in the DAX in the weeks leading up to the vote.

Immediate Post-Election Reactions in the DAX

The announcement of election results typically triggers an immediate market reaction in the DAX. Several key factors influence this response:

-

Coalition Negotiations: The time it takes to form a stable government after the election can significantly affect market stability. Prolonged negotiations introduce uncertainty and can lead to temporary market dips. Conversely, a swift and decisive coalition formation often calms investor nerves.

-

Clear Mandate vs. Coalition Government: A party winning a clear majority generally brings greater certainty and stability than a coalition government. Coalition governments, while representing broader political consensus, often require compromises which may lead to slower decision-making and uncertainty about the ultimate policy direction. This can translate to either positive or negative short-term fluctuations in the DAX, depending on the nature of the compromises and the market’s perception of them.

-

Market Reaction to Specific Winning Party: Historically, the DAX has shown varied reactions to different ruling parties. Investor confidence can be boosted if a party known for pro-business policies wins, leading to a positive market response. Conversely, a victory for a party with more interventionist or protectionist policies might lead to a more cautious or negative market reaction.

Charts and graphs depicting the DAX's performance immediately following past Bundestag elections would visually demonstrate these immediate post-election impacts.

Long-Term Economic Policies and Their Influence on the DAX

The long-term economic policies implemented by the new government significantly impact the DAX. Key policy areas include:

-

Fiscal Policy: Government spending, taxation, and budget deficits directly influence economic growth and investor confidence. Expansionary fiscal policies, including increased government spending or tax cuts, can stimulate economic activity but might also increase the national debt. Conversely, austerity measures may lead to short-term economic contraction but can help to improve the long-term fiscal outlook.

-

Monetary Policy: While the European Central Bank (ECB) sets monetary policy for the Eurozone, the German government's fiscal policies interact with and can influence the ECB's actions. The interplay between fiscal and monetary policy significantly shapes the overall economic environment and the DAX's long-term performance.

-

Regulatory Changes: New laws and regulations in various sectors, like environmental standards or banking regulations, directly affect specific companies listed on the DAX. For instance, stricter environmental regulations might benefit the renewable energy sector while potentially impacting the automotive industry.

Sector-Specific Impacts on the DAX

Bundestag election outcomes differentially impact sectors within the DAX:

-

Automotive Industry: This sector is particularly sensitive to trade policies, environmental regulations, and government incentives related to electric vehicles. Changes in these areas can significantly influence the performance of automotive companies listed on the DAX.

-

Renewable Energy Sector: Government support for green technologies profoundly influences the performance of companies in this sector. Increased investments in renewable energy infrastructure and supportive policies can lead to significant growth.

-

Financial Services: Changes in banking regulations and financial market supervision directly affect the performance of financial institutions listed on the DAX. More stringent regulations might impact profitability, while deregulation might boost growth but increase risk.

Conclusion: Understanding the Bundestag Elections and DAX Interplay

Bundestag elections exert significant influence on the DAX, impacting both short-term volatility and long-term performance. Understanding the interplay between political developments and economic outcomes is crucial for navigating the German stock market. Investors must analyze the economic platforms of competing parties, assess potential policy changes, and understand the historical relationship between different governments and the DAX. Following future Bundestag elections and their impact on the DAX is crucial for informed investing and managing political risk. Further research into specific policy proposals and their potential effects on individual DAX-listed companies is recommended for a comprehensive understanding. Stay informed about the upcoming Bundestag elections and their potential impact on your investments.

Featured Posts

-

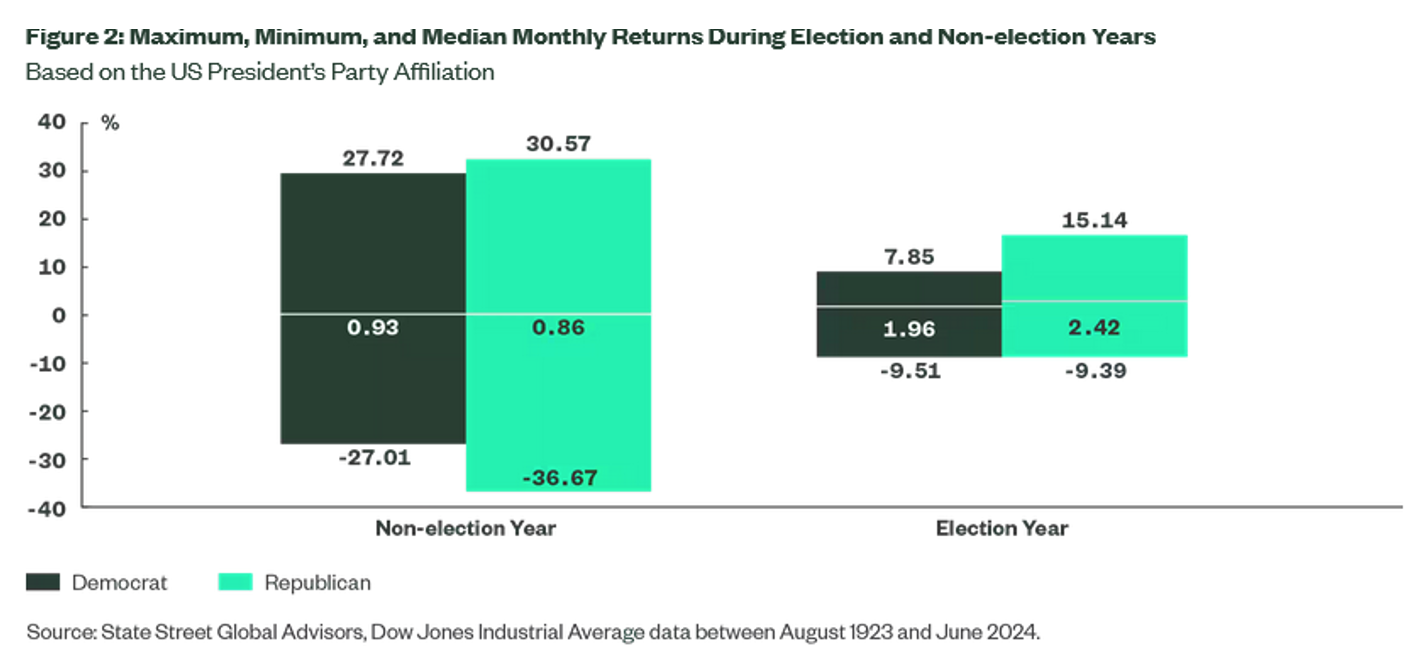

Grand National 2025 Examining The History Of Horse Fatalities

Apr 27, 2025

Grand National 2025 Examining The History Of Horse Fatalities

Apr 27, 2025 -

Jabeur Falls To Rybakina In Hard Fought Mubadala Open Match

Apr 27, 2025

Jabeur Falls To Rybakina In Hard Fought Mubadala Open Match

Apr 27, 2025 -

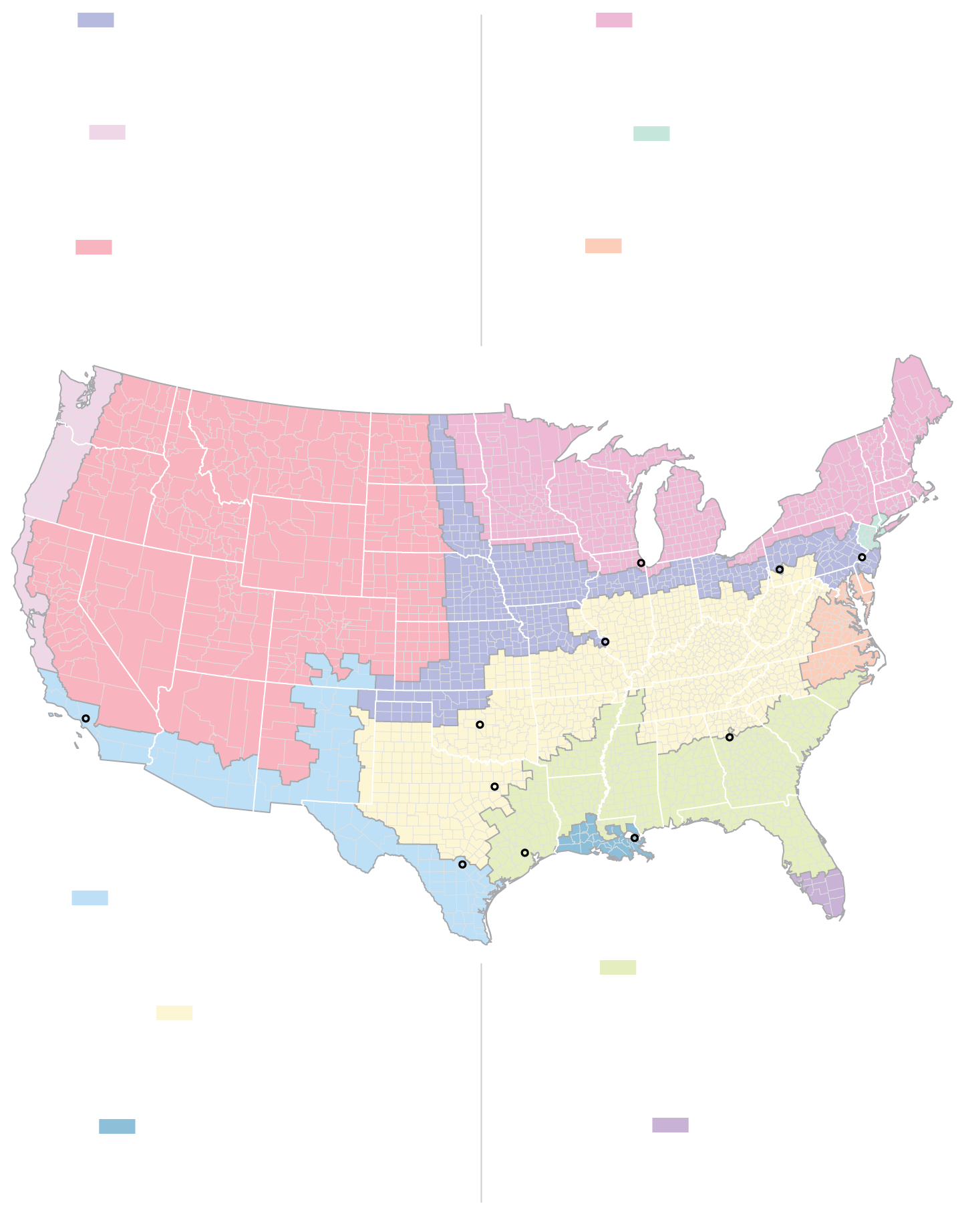

The Political Fault Line How Trumps Presidency Affected Canada

Apr 27, 2025

The Political Fault Line How Trumps Presidency Affected Canada

Apr 27, 2025 -

Packers International Game 2025 Possibilities Unveiled

Apr 27, 2025

Packers International Game 2025 Possibilities Unveiled

Apr 27, 2025 -

The Cdcs Vaccine Study Hire A Case Of Misinformation

Apr 27, 2025

The Cdcs Vaccine Study Hire A Case Of Misinformation

Apr 27, 2025