BofA's Take: Why Stretched Stock Market Valuations Shouldn't Worry Investors

Table of Contents

The Limitations of Traditional Valuation Metrics in a Low-Interest-Rate Environment

Traditional valuation metrics, while useful, can be misleading in today's unique economic climate. Low interest rates fundamentally alter the landscape, impacting how we assess the true value of stocks.

Why P/E Ratios Might Be Misleading

The Price-to-Earnings (P/E) ratio, a widely used valuation metric, is significantly affected by interest rates. Low interest rates influence discounted cash flow (DCF) models, the bedrock of many P/E ratio calculations. When interest rates are low, the present value of future earnings is higher, resulting in potentially inflated P/E ratios. This effect is amplified by quantitative easing (QE) and readily available credit, which can boost company profitability and, consequently, valuations.

- Examples: Many technology companies and growth stocks boast high P/E ratios, yet their strong growth prospects justify these valuations in many analysts' eyes. Consider companies like Tesla or Shopify – their high P/E ratios reflect expectations for significant future earnings growth.

- Alternative Metrics: It's crucial to consider alternative valuation metrics like the Price/Earnings to Growth (PEG) ratio, which accounts for growth rates, and Enterprise Value to EBITDA (EV/EBITDA), which is less sensitive to accounting variations.

The Impact of Technological Disruption on Valuation

Rapid technological advancements introduce further challenges to traditional valuation models. Disruptive tech companies often defy conventional earnings projections, making it difficult to accurately assess their future value using traditional metrics.

- Examples: Companies leading technological revolutions, such as those developing artificial intelligence or innovative pharmaceuticals, frequently exhibit high valuations. Predicting their future earnings requires considering exponential growth potential, a factor often missed by simple P/E ratio analysis.

BofA's Positive Economic Outlook and its Effect on Stock Prices

BofA's optimistic economic forecast significantly influences their positive view of the stock market. This outlook directly affects their assessment of stretched stock market valuations.

Projected Economic Growth and its Influence on Corporate Earnings

BofA's projections for moderate economic growth, coupled with controlled inflation and stable interest rates, provide a supportive backdrop for higher stock valuations.

- Key Indicators: BofA likely points to positive indicators like continued consumer spending, strong corporate investment, and ongoing innovation as key components of their positive outlook.

The Role of Corporate Earnings Growth in Justifying Valuations

BofA's predictions for continued, albeit moderated, corporate earnings growth are crucial in justifying current valuations. Strong earnings growth can neutralize concerns about high P/E ratios.

- Growth Sectors: BofA's analysis may highlight specific sectors, such as technology, healthcare, and renewable energy, as significant drivers of future earnings growth.

Addressing Market Volatility and Investor Sentiment

Market volatility is inherent, especially when valuations appear stretched. However, investors shouldn't let short-term fluctuations derail their long-term strategies.

Why Short-Term Fluctuations Shouldn't Deter Long-Term Investors

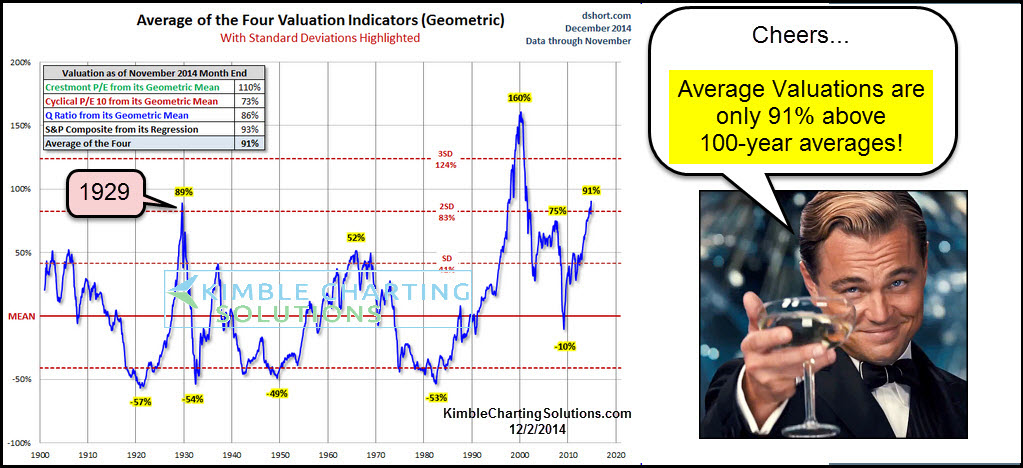

A long-term investment horizon is critical for weathering market volatility. Historically, the stock market has consistently delivered positive returns despite periodic corrections and periods of high valuations.

- Historical Context: Numerous examples illustrate market rebounds following periods of perceived overvaluation. Patience and a well-defined investment plan are key to success.

Managing Risk in a High-Valuation Environment

Even in a seemingly overvalued market, risk management strategies are crucial. Diversification across different asset classes and the use of dollar-cost averaging help mitigate risk. Identifying undervalued companies within specific sectors can further enhance returns.

- Risk Mitigation: Practical steps include regular portfolio reviews, rebalancing, and considering alternative investment options to manage the risk associated with stretched stock market valuations.

Conclusion

In conclusion, while stretched stock market valuations are a valid concern, BofA's analysis suggests that several mitigating factors reduce the risks for long-term investors. The limitations of traditional valuation metrics in a low-interest-rate environment, BofA's positive economic outlook, and the importance of a long-term investment strategy all contribute to a more nuanced perspective. Don't let stretched stock market valuations deter you. Learn more about BofA's investment strategies and plan your long-term investments today! [Link to BofA investment resources]

Featured Posts

-

Trumps Proposed Ban On Congressional Stock Trading A Time Magazine Interview

Apr 26, 2025

Trumps Proposed Ban On Congressional Stock Trading A Time Magazine Interview

Apr 26, 2025 -

Dismissing High Stock Market Valuations Insights From Bof A For Investors

Apr 26, 2025

Dismissing High Stock Market Valuations Insights From Bof A For Investors

Apr 26, 2025 -

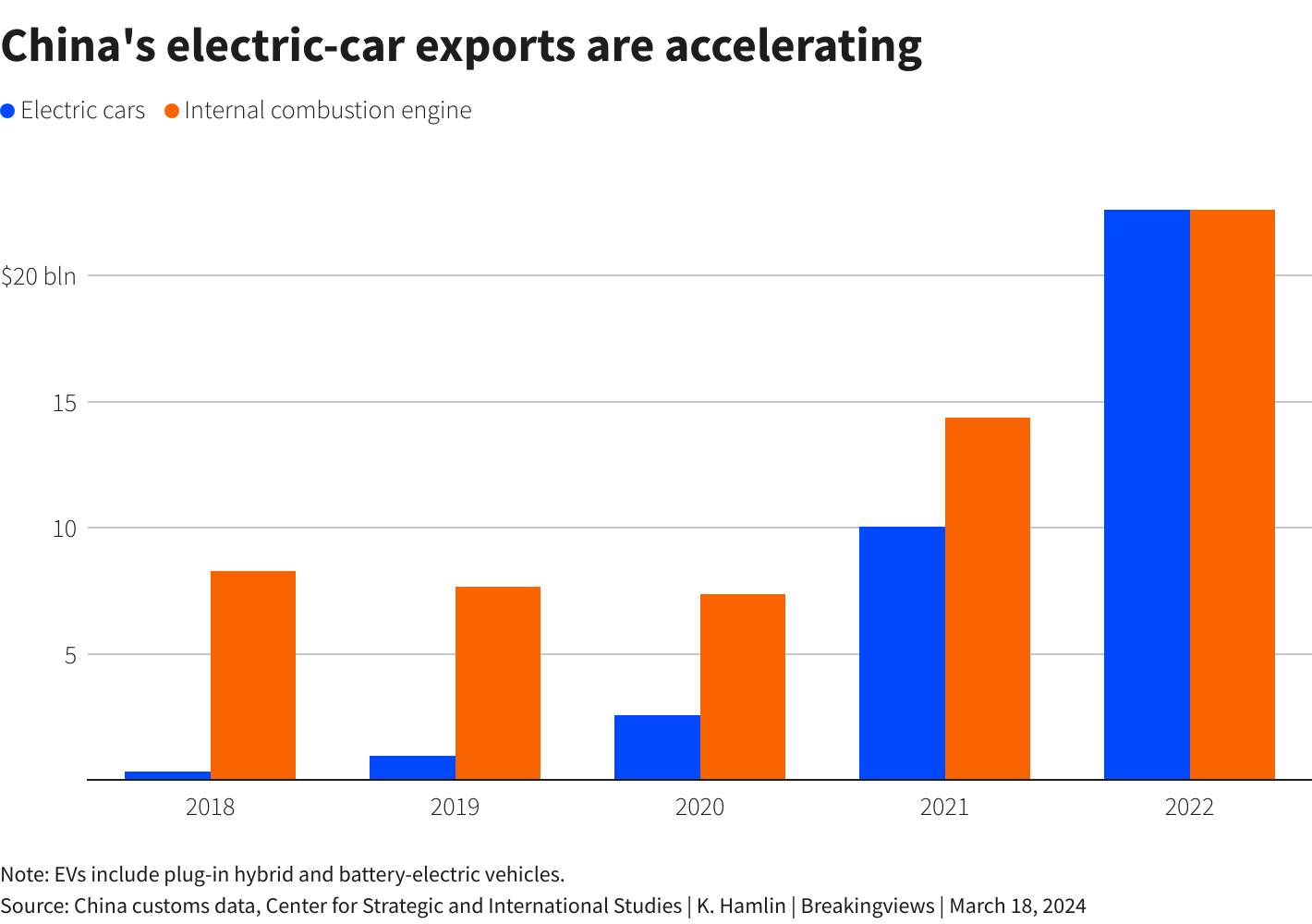

The Growing Influence Of Chinese Automakers On The World Stage

Apr 26, 2025

The Growing Influence Of Chinese Automakers On The World Stage

Apr 26, 2025 -

American Battleground A David Vs Goliath Showdown

Apr 26, 2025

American Battleground A David Vs Goliath Showdown

Apr 26, 2025 -

American Battleground Confronting The Worlds Richest Man

Apr 26, 2025

American Battleground Confronting The Worlds Richest Man

Apr 26, 2025