Analyzing The U.S. Dollar's Performance: A 100-Day Comparison To The Nixon Presidency

Table of Contents

The Nixon Shock and its Immediate Aftermath (1971): A Historical Context

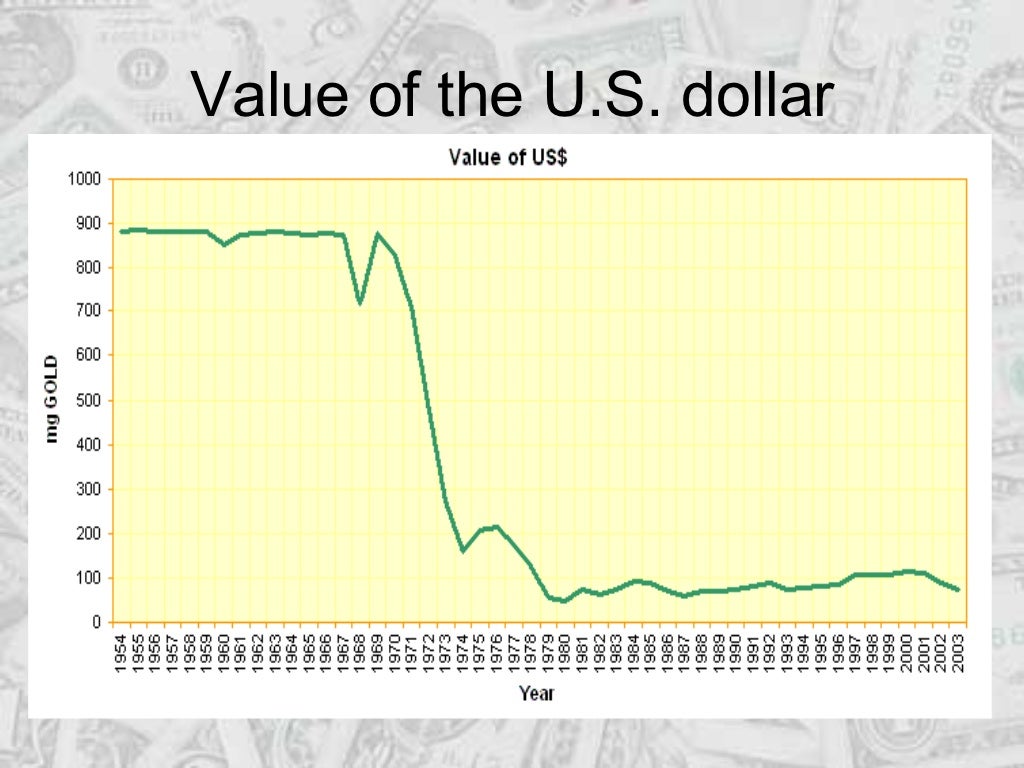

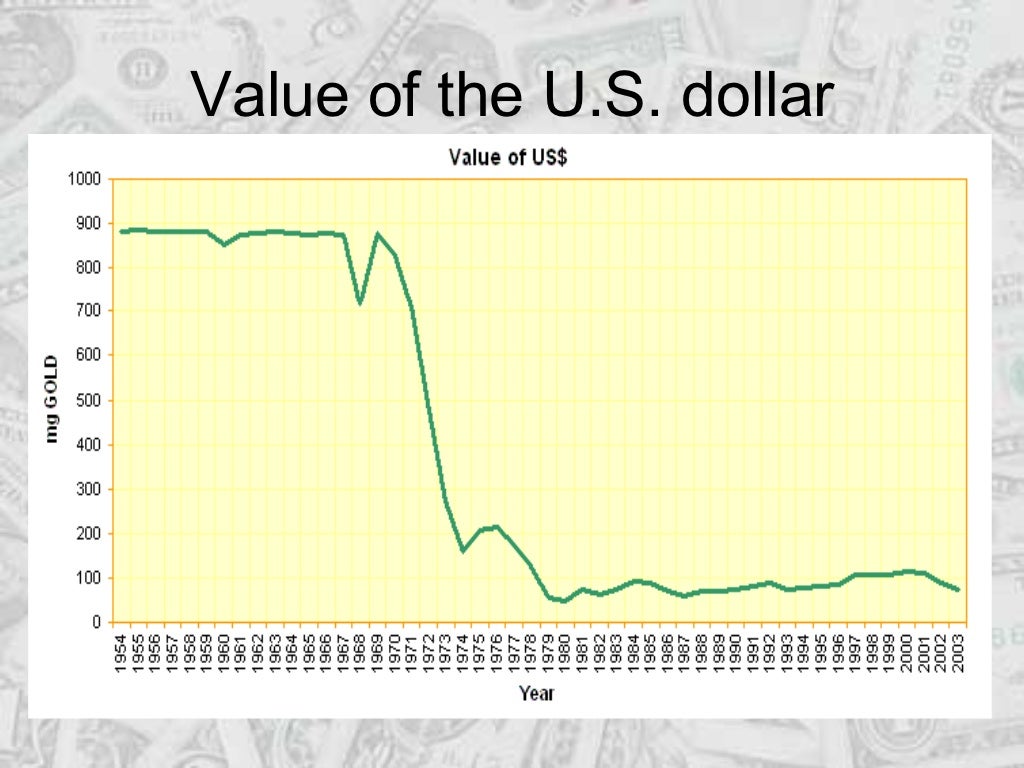

The Gold Standard and its Abandonment:

The Bretton Woods system, established after World War II, pegged major currencies to the U.S. dollar, which was in turn convertible to gold at a fixed rate. This system, however, faced increasing strain in the late 1960s and early 1970s due to:

- Growing U.S. trade deficits: The U.S. was importing more than it was exporting, leading to a decline in its gold reserves.

- Increased demand for gold: Foreign governments and central banks were increasingly demanding gold in exchange for their dollar holdings.

- Inflationary pressures: Rising inflation in the U.S. eroded the value of the dollar.

On August 15, 1971, President Nixon announced the closure of the gold window, effectively ending the Bretton Woods system and allowing the dollar to float freely against other currencies.

Early Indicators of Dollar Performance Post-Nixon Shock:

The initial 100 days following the Nixon shock witnessed significant volatility in the dollar's value.

- The dollar depreciated against many major currencies, reflecting a loss of confidence in the U.S. economy.

- Inflation continued to rise, adding further pressure on the dollar.

- Interest rates were initially increased in an attempt to stabilize the dollar but this had mixed effects.

Charts and graphs illustrating the exchange rates against major currencies like the British Pound (GBP), Japanese Yen (JPY), and Deutsche Mark (DEM - predecessor to the Euro) during this period would clearly show the dramatic shifts in the value of the dollar.

Current U.S. Dollar Performance (100-Day Analysis): A Modern Comparison

Defining the 100-Day Period:

For this analysis, let's consider a specific 100-day period, for example, from October 26, 2023, to February 3, 2024 (adjust these dates to reflect the most current data available at the time of publication).

Key Economic Indicators:

Analyzing this 100-day period requires a close look at several key economic indicators:

- Exchange rates: The dollar's performance against major currencies like the Euro (EUR), Japanese Yen (JPY), British Pound (GBP), and Chinese Yuan (CNY) needs to be tracked and presented graphically.

- Inflation: The Consumer Price Index (CPI) and Producer Price Index (PPI) provide insights into inflationary pressures.

- Interest rates: The Federal Reserve's interest rate decisions significantly impact the dollar's value.

- Other factors such as trade balances and economic growth metrics should be included.

Geopolitical Factors:

Geopolitical events significantly influence currency markets. In this 100-day period, factors such as:

- The ongoing war in Ukraine

- Tensions between the U.S. and China

- Global energy prices

- Other significant global political events

These factors could have influenced the dollar's performance during the selected period.

Comparative Analysis: Similarities and Differences

Parallel Trends:

Comparing the 100-day period after the Nixon shock with the chosen current 100-day period, we might find similarities in:

- Initial market uncertainty leading to volatility.

- Influence of global economic events on currency values.

- Government policy responses attempting to stabilize the currency.

Divergent Factors:

Key differences might include:

- The globalized nature of the current economy compared to 1971.

- Technological advancements in financial markets.

- Different policy responses from central banks and governments.

Predicting Future U.S. Dollar Trends

Based on Historical Precedents:

The historical comparison can offer insights into potential future scenarios. For example, if similar economic pressures emerge as those seen after the Nixon shock, we might anticipate similar volatility in the dollar's value.

Consideration of Unforeseen Events:

However, it's crucial to acknowledge that unforeseen events, such as:

- A major global recession

- A significant geopolitical crisis

- Unexpected technological disruptions

Could significantly alter the trajectory of the U.S. dollar, making accurate predictions challenging.

Conclusion: Key Takeaways and Call to Action

Analyzing the U.S. dollar's performance across both 100-day periods reveals important similarities and differences, primarily driven by economic and geopolitical factors. The historical context provided by the Nixon shock emphasizes the importance of considering these factors for meaningful dollar performance analysis. While historical precedent offers valuable insights, the complexities of the global economy and the potential for unforeseen events necessitate ongoing monitoring. Continue analyzing the U.S. dollar's performance by following reputable financial news sources and subscribing to economic newsletters for informed decision-making. Understanding the intricacies of U.S. dollar strength and fluctuations is key to navigating the complexities of the global financial landscape.

Featured Posts

-

Red Sox Doubleheader Coras Lineup And Game 1 Strategy

Apr 28, 2025

Red Sox Doubleheader Coras Lineup And Game 1 Strategy

Apr 28, 2025 -

Uae Vacation 10 Gb Data Sim And Discounted Abu Dhabi Attractions

Apr 28, 2025

Uae Vacation 10 Gb Data Sim And Discounted Abu Dhabi Attractions

Apr 28, 2025 -

Unstoppable Mets Rivals Starting Pitcher Shines

Apr 28, 2025

Unstoppable Mets Rivals Starting Pitcher Shines

Apr 28, 2025 -

Pandemic Fraud Lab Owner Convicted For False Covid Test Reports

Apr 28, 2025

Pandemic Fraud Lab Owner Convicted For False Covid Test Reports

Apr 28, 2025 -

Tylor Megill And The Mets Analyzing His Effective Pitching Techniques

Apr 28, 2025

Tylor Megill And The Mets Analyzing His Effective Pitching Techniques

Apr 28, 2025