Analyzing The Effectiveness Of Minnesota's Film Tax Credit Program

Table of Contents

Minnesota's film tax credit program is designed to stimulate the state's film industry, fostering job creation and economic growth. This analysis delves into the program's effectiveness, evaluating its impact on job creation, economic expansion, and overall return on investment (ROI). We will explore whether the program achieves its intended objectives and propose potential improvements to ensure its future success. This in-depth look at the Minnesota film tax credit will assess its contribution to the state's economy and the film industry's vitality.

Economic Impact Assessment of the Minnesota Film Tax Credit

Keywords: economic impact, job creation, revenue generation, film production spending, direct spending, indirect spending, induced spending.

The economic impact of the Minnesota film tax credit program is multifaceted and requires a comprehensive assessment. To accurately gauge its effectiveness, we need to analyze various economic effects:

-

Direct Spending: This encompasses the immediate spending by film productions within Minnesota, including salaries for actors and crew, equipment rentals, location fees, and other production costs. This direct injection of capital into the local economy is a key benefit of the program.

-

Indirect Spending: The program also generates indirect spending. Film crew members, for example, spend their wages at local restaurants, hotels, and shops. This ripple effect boosts the local economy beyond the immediate film production.

-

Induced Spending: The increased economic activity due to the creation of jobs through the film tax credit further expands the economic impact. New employment leads to increased consumer spending, boosting various sectors of the economy.

-

Job Creation: A crucial metric is the number of jobs created – both directly (on-set positions, post-production roles) and indirectly (support services, local businesses). Analyzing job creation figures is essential for understanding the program's impact on employment in Minnesota.

-

Revenue Generation: While the program provides tax credits, it also generates increased tax revenue from the boosted economic activity. This includes sales taxes, income taxes, and other revenue streams resulting from the increased film production and related spending.

Data Sources and Methodology

To accurately measure the economic impact, we must rely on robust data sources and a rigorous methodology. This analysis utilizes data from government reports, industry surveys like those conducted by the Minnesota Film Office, and economic modeling to estimate the program's overall effect. However, it’s important to acknowledge limitations in data availability and the complexities of attributing specific economic gains solely to the film tax credit program.

Job Creation and Skill Development within Minnesota's Film Industry

Keywords: job creation, skilled labor, workforce development, training programs, industry growth, film crew, production jobs, talent retention.

Beyond the economic impact, the Minnesota film tax credit’s effect on job creation and skill development within the state's film industry is critical.

-

Job Type Analysis: Examining the types of jobs created—from on-set crew positions (camera operators, gaffers, sound technicians) to post-production roles (editors, VFX artists) and administrative support—provides a detailed picture of the program's impact on employment.

-

Skill Development: The program's success is linked to its capacity to cultivate a skilled workforce. This includes analyzing whether the influx of film productions fosters training opportunities and apprenticeships, leading to enhanced skills within the Minnesota film community.

-

Talent Retention: Does the program encourage the retention of skilled film professionals within the state, preventing the outflow of talent to other film hubs?

-

Attracting Out-of-State Talent: The program's effectiveness in attracting skilled professionals from other states to Minnesota is a significant indicator of its success in strengthening the state's film industry.

-

Workforce Development Initiatives: Analyzing the synergy between the tax credit program and any related workforce development initiatives provides a comprehensive view of its contribution to building a sustainable film industry in Minnesota.

Return on Investment (ROI) and Program Sustainability

Keywords: return on investment, ROI, cost-benefit analysis, program efficiency, budget allocation, long-term sustainability, program evaluation.

Assessing the ROI of the Minnesota film tax credit program is essential to evaluating its long-term sustainability.

-

Cost-Benefit Analysis: A thorough cost-benefit analysis compares the tax revenue foregone due to the credits against the economic benefits generated (job creation, increased spending, etc.).

-

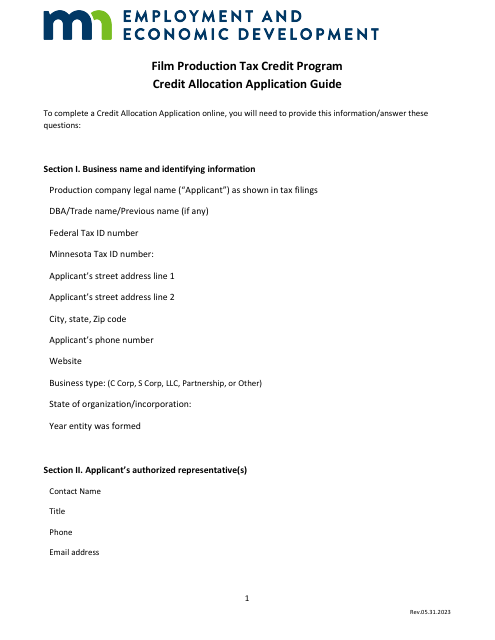

Program Efficiency: Identifying areas for improvement in program efficiency is crucial for maximizing the ROI. This might include streamlining application processes or targeting specific industry segments for greater impact.

-

Long-Term Sustainability: The program's design must ensure its long-term viability. Regular evaluation and adjustments are necessary to address changing economic conditions and maintain its effectiveness.

-

Impact on Related Industries: The program's influence extends beyond the film industry itself. Analyzing its effect on related sectors (tourism, hospitality, etc.) provides a holistic perspective on its overall economic impact.

Comparison with Other States' Film Tax Incentive Programs

Keywords: comparative analysis, best practices, benchmark, film tax credits, other states, incentive programs, policy comparison.

To gain further insights, a comparative analysis of Minnesota's program against similar initiatives in other states is beneficial.

-

Benchmarking: Comparing Minnesota's film tax credit program with successful programs in other states helps identify best practices and areas for potential improvement.

-

Effectiveness of Different Approaches: Analyzing the effectiveness of various approaches to film tax incentives (refundable vs. non-refundable credits, for example) provides valuable data for optimizing Minnesota's program.

-

Policy Recommendations: Insights from the comparative analysis can inform policy recommendations to enhance the effectiveness of Minnesota's film tax credit program.

Conclusion

This analysis of Minnesota's film tax credit program highlights the importance of a comprehensive evaluation encompassing economic impact, job creation, and return on investment. While the program contributes to the state's economy and film industry, further analysis and potential adjustments are warranted to maximize its effectiveness. Improved data collection, a more targeted approach to incentivizing specific film sectors, and stronger integration with workforce development initiatives could significantly improve the program's long-term success. We encourage further research and exploration of the Minnesota film tax credit program and its potential for continued growth within the state's film industry. Let's work together to optimize the Minnesota film tax credit and unlock its full potential for economic growth.

Featured Posts

-

Minnesota Film Production The Impact Of Tax Credits

Apr 29, 2025

Minnesota Film Production The Impact Of Tax Credits

Apr 29, 2025 -

Trumps Transgender Athlete Ban Us Attorney General Targets Minnesota

Apr 29, 2025

Trumps Transgender Athlete Ban Us Attorney General Targets Minnesota

Apr 29, 2025 -

Unmasking The Ccp United Front Activities In Minnesota

Apr 29, 2025

Unmasking The Ccp United Front Activities In Minnesota

Apr 29, 2025 -

Minnesota Department Of Transportation Reveals Snow Plow Names

Apr 29, 2025

Minnesota Department Of Transportation Reveals Snow Plow Names

Apr 29, 2025 -

Arson Investigation Georgian Man Arrested In Germany After Wifes Fire Attack

Apr 29, 2025

Arson Investigation Georgian Man Arrested In Germany After Wifes Fire Attack

Apr 29, 2025