AbbVie's Q[Quarter] Earnings Beat Expectations: Increased Profit Guidance

![AbbVie's Q[Quarter] Earnings Beat Expectations: Increased Profit Guidance AbbVie's Q[Quarter] Earnings Beat Expectations: Increased Profit Guidance](https://bussehalberschmidt.de/image/abb-vies-q-quarter-earnings-beat-expectations-increased-profit-guidance.jpeg)

Table of Contents

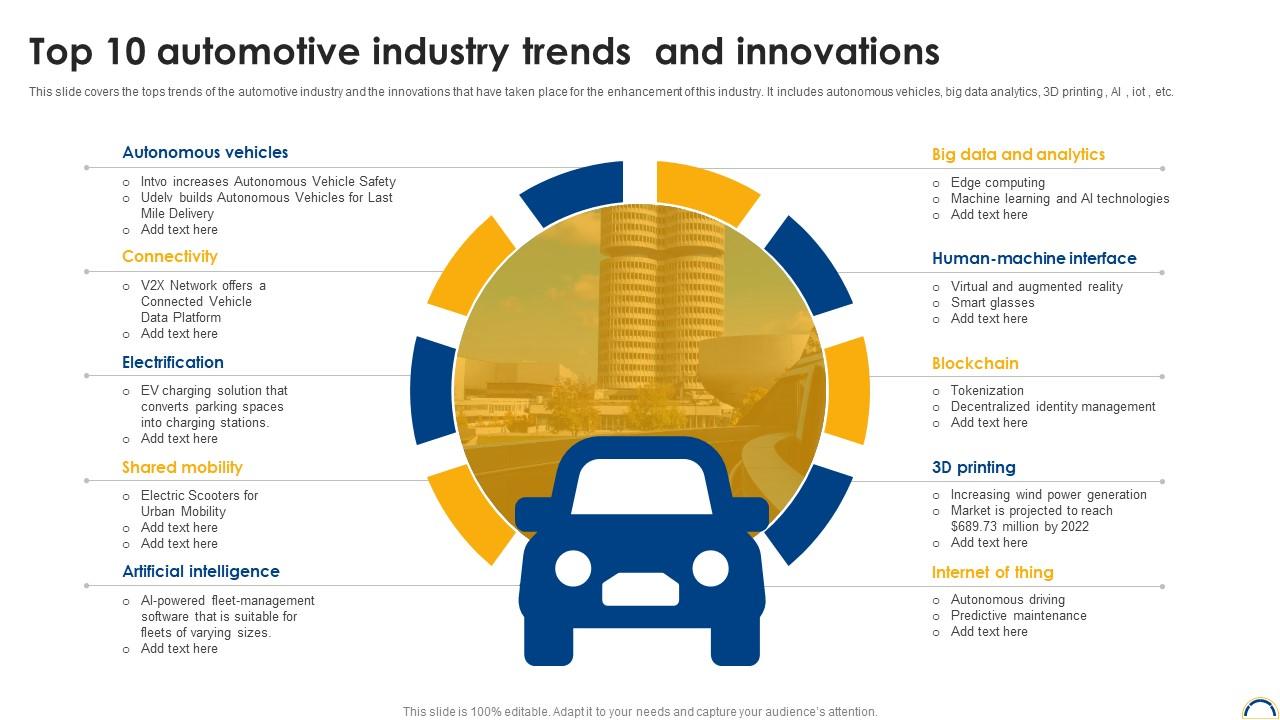

Strong Revenue Growth Across Key Products

AbbVie's Q3 revenue growth demonstrated the strength and diversification of its product portfolio. Several key factors contributed to this success:

-

Humira's Resilience: Despite facing increasing biosimilar competition, Humira continues to generate substantial revenue. While sales are declining year-over-year as expected, AbbVie's strategic initiatives, discussed below, are effectively mitigating the impact of biosimilars. Specific sales figures for Humira will be available in the detailed earnings report. The company exceeded analyst expectations for Humira sales, proving their strategies are bearing fruit.

-

Skyrizi and Rinvoq's Impressive Performance: AbbVie's newer immunology drugs, Skyrizi and Rinvoq, are demonstrating exceptional growth and market share gains. Both drugs showed significant year-over-year revenue increases, highlighting their potential to become major revenue drivers for AbbVie in the coming years. Their strong performance indicates effective market penetration and successful targeting of key patient populations. Further details on precise revenue figures are found within the full earnings release.

-

Broad Portfolio Contribution: Beyond Humira, Skyrizi, and Rinvoq, AbbVie's diverse portfolio of products contributed to the overall revenue growth. Strong performance across various therapeutic areas underscores the company's overall market strength and strategic diversification.

Exceeding Profitability Expectations and Increased Profit Guidance

AbbVie not only exceeded revenue expectations but also significantly outperformed predictions in terms of profitability.

-

EPS Surpasses Forecasts: The reported earnings per share (EPS) for Q3 significantly exceeded analyst consensus estimates, demonstrating strong operational efficiency and cost management. Precise figures are available in the official press release.

-

Increased Profit Guidance for the Year: AbbVie raised its full-year profit guidance by a significant percentage, reflecting the company's confidence in its future performance. This optimistic outlook is based on the robust Q3 results and continued expectations for strong product sales and operational efficiency.

-

Strategic Investments: The increased profit guidance allows AbbVie to strategically invest further in research and development, bolstering its pipeline of innovative therapies and solidifying its position as a leader in the pharmaceutical industry. This is expected to drive further growth and shareholder value in the long term.

Impact on AbbVie Stock and Investor Sentiment

The positive Q3 earnings announcement had an immediate and positive impact on AbbVie's stock price and investor sentiment.

-

Positive Market Reaction: AbbVie's stock price experienced a significant increase following the release of the earnings report, reflecting investor confidence in the company's future prospects.

-

Strengthened Investor Confidence: The exceeding expectations boosted investor confidence, suggesting a positive outlook for future investment and increased shareholder value.

-

Analyst Upgrades: Several investment analysts upgraded their ratings on AbbVie's stock following the positive Q3 results, further reinforcing the positive market sentiment.

-

Short-Term and Long-Term Outlook: The strong Q3 results point towards a positive short-term outlook for AbbVie's stock. The increased profit guidance and ongoing success of key products suggest a robust long-term outlook as well.

Addressing Biosimilar Competition for Humira

The successful navigation of biosimilar competition for Humira is a key factor in AbbVie's Q3 success.

-

Mitigation Strategies: AbbVie is actively implementing strategies to mitigate the impact of biosimilars on Humira sales, including focusing on new product launches like Skyrizi and Rinvoq, and expanding market share in different geographic regions. This diversified approach protects against over-reliance on any single product.

-

Maintaining Market Position: Despite the inevitable decline in Humira sales due to biosimilars, AbbVie has demonstrated its ability to maintain a strong market position and offset revenue losses through the success of its newer products.

Conclusion

AbbVie's Q3 earnings report exceeded expectations, showcasing strong revenue growth, increased profitability, and a robust outlook for the future. The successful launch and market penetration of Skyrizi and Rinvoq, coupled with effective strategies to mitigate the impact of Humira biosimilars, contributed significantly to this positive outcome. The increased profit guidance signals confidence in continued success, promising strong returns for investors. Stay tuned for updates on AbbVie's future earnings and follow AbbVie's progress in navigating the dynamic pharmaceutical market. Learn more about AbbVie's Q3 earnings report and future financial guidance on their investor relations website: [Insert Link Here].

![AbbVie's Q[Quarter] Earnings Beat Expectations: Increased Profit Guidance AbbVie's Q[Quarter] Earnings Beat Expectations: Increased Profit Guidance](https://bussehalberschmidt.de/image/abb-vies-q-quarter-earnings-beat-expectations-increased-profit-guidance.jpeg)

Featured Posts

-

Bmw And Porsches China Challenges A Growing Trend In The Automotive Industry

Apr 26, 2025

Bmw And Porsches China Challenges A Growing Trend In The Automotive Industry

Apr 26, 2025 -

Crack The Code 5 Dos And Don Ts For Private Credit Jobs

Apr 26, 2025

Crack The Code 5 Dos And Don Ts For Private Credit Jobs

Apr 26, 2025 -

Open Ai Facing Ftc Investigation Concerns And Potential Outcomes

Apr 26, 2025

Open Ai Facing Ftc Investigation Concerns And Potential Outcomes

Apr 26, 2025 -

Post Roe America How Over The Counter Birth Control Reshapes Reproductive Healthcare

Apr 26, 2025

Post Roe America How Over The Counter Birth Control Reshapes Reproductive Healthcare

Apr 26, 2025 -

Secret Service Investigation Ends Cocaine Found At White House

Apr 26, 2025

Secret Service Investigation Ends Cocaine Found At White House

Apr 26, 2025